Introduction to Finance: Core Principles & Financial Decisions

advertisement

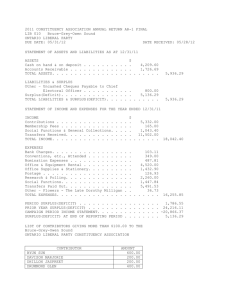

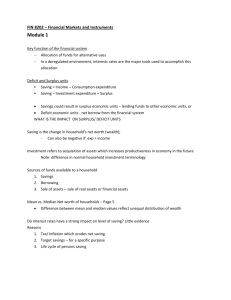

Chapter 1: Introduction to Finance OUTLINE 1. Defining Finance 2. Five core principles of finance 3. Financial Decisions - Households 4. Financial Decisions - Firms 5. The Financial System 1. Defining Finance Finance is the study of how people allocate scarce resources over time (Bodie and Merton) 2. The Financial System 2.1. What is the Financial System? A Financial System is comprised of markets, intermediaries, service firms and other institutions used to carry out the financial decisions of households, business firms, and governments Market Participants Spending Sectors Household • SURPLUS SPENDING UNITS • DEFICIT SPENDING UNITS Business Firms Government Foreign Sector The household is the primary provider of funds to businesses and government. Households must accumulate financial resources throughout their working life times to have enough savings (pension) to live on in their retirement years a. Surplus Spending Unit • Has more cash income flow than expenditure on consumption and real investments in a period of time. The surplus is then allocated to the financial sector. • Other terms for surplus unit are saver, lender, buyer of financial assets, financial investor, supplier of loanable funds, buyer of securities. a. Surplus Spending Unit • The surplus unit may buy financial assets, hold more money, or pay off financial liabilities issued earlier when in a deficit situation • The household and foreign sectors are usually a surplus sector b. Deficit Spending Unit • Has more expenditures on consumption and real goods (investment) in the real sector than income during a period of time • The deficit unit must participate (borrow) in the financial sector to balance cash inflows with outflows b. Deficit Spending Unit • Other terms for deficit expending unit are borrower, demander of loanable funds, and seller of securities. • The deficit spending unit may issue financial liabilities, reduce money balances, and sell financial assets acquired previously when in a surplus situation c. Other Participants Financial intermediaries transform the nature of the securities they issue and invest in Banks, trust companies, credit unions, insurance firms, mutual funds Market intermediaries simply help make markets work Investment dealers Brokers 2.2 Financial Transaction • Spread out through space and over time • Risk – Return trade off • Assets used for the transactions is either cash or financial assets Real Assets versus Financial Assets Asset: any possession that has value in an exchange A real asset is used to produce goods and services and thereby generate cash flow E.g: machine, building, equipment, land/real estate A financial asset is a claim against a firm, government or individual for future expected cash flows. E.g: bonds, preferred stocks and common stocks. Financial assets Main properties: Rate of Return : expected return Risk: credit risk, market risk Liquidity: Easy convertibility into cash with little or no loss of value The Liquidity Spectrum •2-15 Financial Assets Three broad types of financial assets: Fixed-income securities Equity securities Derivative securities 2.3 The Flow of Funds Funds may flow from the surplus unit to the deficit unit in three ways: Directly meet Through market intermediaries (or markets) Through intermediaries The Flow of Funds Diagram Markets Surplus Units Deficit Units Intermediaries The Flow of Funds Diagram We shall examine various pathways from the surplus unit to the deficit unit Direct Meet Funds Funds •Deficit Spending Unit (DSU) Surplus Spending Unit (SSU) • Financial Claims Fund Flows via Markets Markets Surplus Units Deficit Units Intermediaries Fund Flows via Markets A household with surplus funds invests them in government bonds Fund Flows via Intermediaries Markets Surplus Units Deficit Units Intermediaries Fund Flows via Intermediaries Holders of surplus funds may use an intermediary, such as a bank, to invest them. The bank receives the surplus funds, say as 90-day deposits, and adds them to the bank’s assets (creating a bank liability). Money is fungible, so the corresponding loan can not be identified Fund Flows via Intermediaries and Markets Markets Surplus Units Deficit Units Intermediaries Fund Flows via Intermediaries and Markets Sometimes the intermediary itself has surplus funds, and invests them in the market or another intermediary A bank that borrows and invests in the money market can increase its flexibility, reduce its risks, and turn a profit Eventually, the surplus funds are consumed by a deficit unit Fund Flow via Markets and Intermediaries Intermediaries such as General Motors Acceptance Corporation issue commercial paper to finance car loans and leases made to households needing a car In this case, the paper has a shorter maturity than the loan, leading to a risk Funds Flow via Markets and Intermediaries Markets Surplus Units Deficit Units Intermediaries 3. Five Core Principles of Finance - Time has value - Risk requires compensation - Information is the basis for decisions - Markets determine prices and allocate resources - Stability improves welfare 4. Financial Decisions of Households Consumption and savings decisions How to allocate wealth over time? Investment decisions How to grow wealth? How should they invest to get benefit? Financing decisions How to finance consumption and investment? Risk management decisions How to reduce financial uncertainties and when should increase risk? Cash flow and financial decisions of households Cash raised by selling financial assets Cash invested in real assets Cash consumed Cash invested in financial assets 5. Financial Decisions of Firms Business Firms entities whose primary function is to produce goods and services they vary widely in size from part-time businesses run from a spare room, to giant corporations (e.g. Mitsubishi or General Motors) with hundreds of thousands of employees, and an even larger ownership Forms of business organization Three major forms in the U.S 1. Sole proprietorship 2. Partnership 3. Corporation Financial Decisions of Firms When you start your own business, what financial decisions do you have to take? 1. What long-term investments should we take on? 2. What are the sources of long-term financing? (equity, loans) 3. How should we manage everyday financial activities – managing working capital? (collecting receivables, paying suppliers etc.) Financial decisions Investment decision – how much to invest and in what assets? Financing decision – where is money from in order to finance long-term investments? Working capital decision Financial Decisions of Firms The Capital Budgeting Process – Investment Decision The preparation of a plan for acquiring factories, machinery, research laboratories, show rooms, warehouses, and human assets to implement the strategic plan The basic unit of analysis is the investment project. Investment projects are identified, triaged, and implemented in the capital budgeting process Financial Decisions of Firms The Financing Process Once a new set of approved projects has been identified, it must be financed with retained earnings, stock, bonds, et cetera Capital structure is the amount of the firm’s market value allocated to each category of issued securities. It determines ownership and risk level of the firms future cash flows Capital structure’s unit of analysis is the firm as a whole (not an investment project ) Financial Decisions of Firms Working Capital all firms (including highly profitable ones) that do not pay sufficient attention to working capital management may be seriously damaged by the resulting loss of investor and creditor confidence delayed in investment schedules sub-optimal temporary finance unscheduled sale of the firms assets