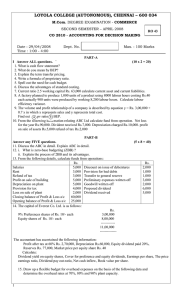

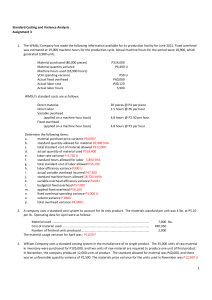

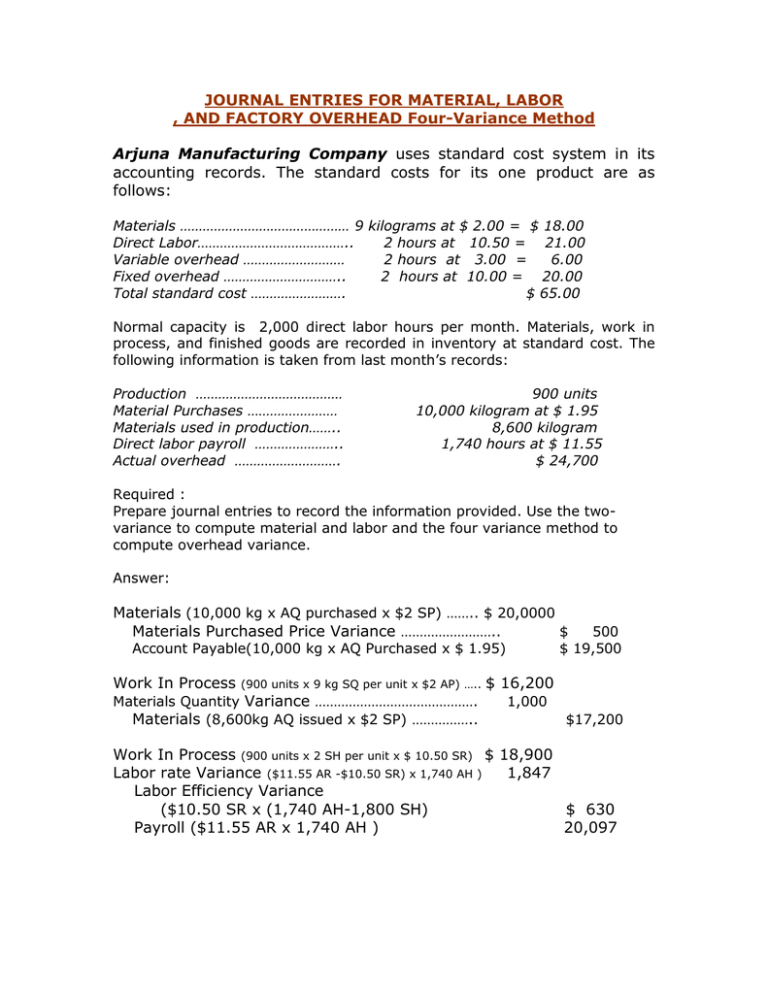

JOURNAL ENTRIES FOR MATERIAL, LABOR , AND FACTORY OVERHEAD Four-Variance Method

advertisement

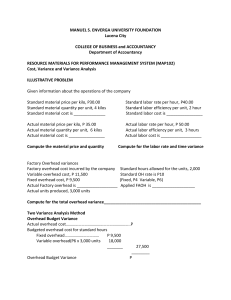

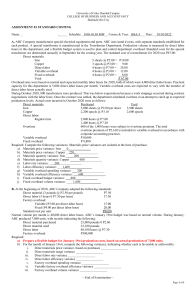

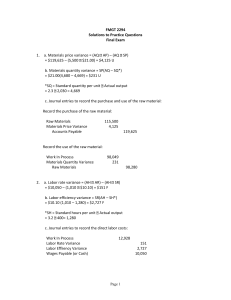

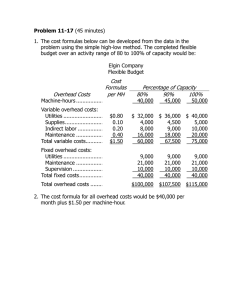

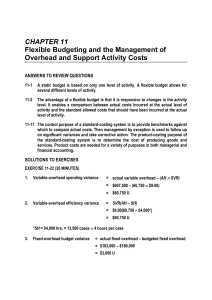

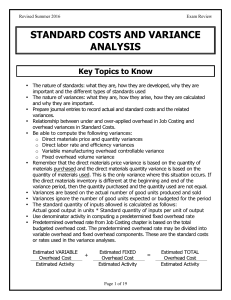

JOURNAL ENTRIES FOR MATERIAL, LABOR , AND FACTORY OVERHEAD Four-Variance Method Arjuna Manufacturing Company uses standard cost system in its accounting records. The standard costs for its one product are as follows: Materials ……………………………………… 9 kilograms at $ 2.00 = $ 18.00 Direct Labor………………………………….. 2 hours at 10.50 = 21.00 Variable overhead ……………………… 2 hours at 3.00 = 6.00 Fixed overhead ………………………….. 2 hours at 10.00 = 20.00 Total standard cost ……………………. $ 65.00 Normal capacity is 2,000 direct labor hours per month. Materials, work in process, and finished goods are recorded in inventory at standard cost. The following information is taken from last month’s records: Production ………………………………… Material Purchases …………………… Materials used in production…….. Direct labor payroll ………………….. Actual overhead ………………………. 900 units 10,000 kilogram at $ 1.95 8,600 kilogram 1,740 hours at $ 11.55 $ 24,700 Required : Prepare journal entries to record the information provided. Use the twovariance to compute material and labor and the four variance method to compute overhead variance. Answer: Materials (10,000 kg x AQ purchased x $2 SP) …….. $ 20,0000 Materials Purchased Price Variance …………………….. $ 500 $ 19,500 Account Payable(10,000 kg x AQ Purchased x $ 1.95) Work In Process (900 units x 9 kg SQ per unit x $2 AP) ….. Materials Quantity Variance ……………………………………. Materials (8,600kg AQ issued x $2 SP) …………….. $ 16,200 1,000 $17,200 Work In Process (900 units x 2 SH per unit x $ 10.50 SR) $ 18,900 Labor rate Variance ($11.55 AR -$10.50 SR) x 1,740 AH ) 1,847 Labor Efficiency Variance ($10.50 SR x (1,740 AH-1,800 SH) $ 630 Payroll ($11.55 AR x 1,740 AH ) 20,097