Chapter Performance Evaluation Using Variances from Standard Costs Financial and Managerial Accounting

advertisement

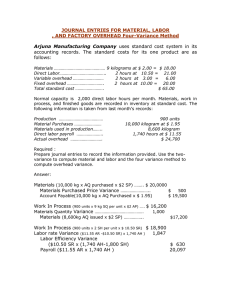

Chapter 21 Performance Evaluation Using Variances from Standard Costs Financial and Managerial Accounting 8th Edition Warren Reeve Fess PowerPoint Presentation by Douglas Cloud Professor Emeritus of Accounting Pepperdine University © Copyright 2004 South-Western, a division of Thomson Learning. All rights reserved. Task Force Image Gallery clip art included in this electronic presentation is used with the permission of NVTech Inc. Some of the action has been automated, so click the mouse when you see this lightning bolt in the lower right-hand corner of the screen. You can point and click anywhere on the screen. Objectives 1. Describe the types of standards and After studying this how they are established for chapter, you should businesses. be able to: 2. Explain and illustrate how standards are used in budgeting. 3. Calculate and interpret direct materials price and quantity variances. 4. Calculate and interpret direct labor rate and time variances. Objectives 5. Calculate and interpret factory overhead controllable and volume variances. 6. Journalize the entries for recording standards in the accounts and prepare an income statement that includes variances from standards. 7. Explain how standards may be used for nonmanufacturing expenses. 8. Explain and provide examples of nonfinancial performance measures. Standards—Performance Benchmarks Setting Standards Requires joint efforts of accountants, engineers, and other management personnel Types of Standards Theoretical or ideal (world record) standards Currently attainable standards (normal standards) Reviewing and Revising Standards Should be revised when they no longer reflect operating conditions they intended to measure Western Rider Inc., a manufacturer of blue jeans, uses standard manufacturing costs in its budgets. Western Rider Inc. Standard Cost per Pair of XL Jeans Direct materials: $5.00 per square yard x 1.5 square yards = Direct labor: $9.00 per hour x 0.80 hour per pair = Factory overhead: $6.00 per hour x 0.80 hour per pair = Total standard cost per pair $ 7.50 7.20 4.80 $19.50 Western Rider Inc. Budget Performance Report For the Month Ended June 30, 2006 Manufacturing Costs Direct materials Direct labor Factory overhead Total mfg. costs Actual Costs $ 40,150 38,500 22,400 $101,050 Standard Cost Cost at Actual Variance Volume (favorable) (5,000 units) Unfavorable 5,000 $37,500 36,000 24,000 $97,500 x $2,650 $7.50 per 2,500 pair (1,600) $3,550 Direct Materials Cost Variance Total Manufacturing Cost Variance Direct Labor Cost Variance Factory Overhead Cost Variance Direct Materials Price Variance Direct Materials Price Variance Direct Labor Rate Variance Direct Labor Time Variance Variable Factory Overhead Controllable Variance Fixed Factory Overhead Volume Variance Direct Materials Price Variance Actual price per unit Standard price per unit Price variance (unfavorable) $5.50 per sq. yd. 5.00 per sq. yd. $0.50 per sq. yd. $0.50 times the actual quantity of 7,300 sq. yds. = $3,650 unfavorable Direct Materials Quantity Variance Actual quantity used Standard quantity at actual production Quantity variance (favorable) 7,300 sq. yds. 7,500 (200) sq. yds. (200) square yards times the standard price of $5.00 = ($1,000) favorable Direct Materials Variance Relationships Actual quantity x Actual price 7,300 x $5.50 = $40,150 Actual quantity x Standard price 7,300 x $5.00 = $36,500 Standard quantity x Standard price 7,500 x $5.00 = $37,500 Material Price Variance Material Quantity Variance $3,650 U ($1,000) F Direct Materials Variance Relationships Actual quantity x Actual price 7,300 x $5.50 = $40,150 Actual quantity x Standard price 7,300 x $5.00 = $36,500 Standard quantity x Standard price 7,500 x $5.00 = $37,500 Total Direct Materials Cost Variance $2,650 U Direct Labor Variances Standard direct labor hours per of XL jeans 0.80 direct labor hour Actual units produced x 5,000 pairs of jeans Standard direct labor hours budgeted for actual production 4,000 direct labor hours Standard rate per DLH x $9.00 Standard direct labor cost at actual production $36,000 Direct Labor Variances Actual direct labor hours used in production 3,850 direct labor hours Actual rate per direct labor hour x $10.00 Total actual direct labor cost $ 38,500 Direct Labor Rate Variance Actual rate $10.00 Standard rate 9.00 Rate variance (unfavorable) $ 1.00 per DLH $1.00 times the actual time of 3,850 hours = $3,850 unfavorable Direct Labor Time Variance Actual hours Standard hours at actual production Time variance 3,850 DLH 4,000 DLH (150) DLH (150) Direct labor hours times the standard rate of $9.00 = ($1,350) favorable Direct Labor Variance Relationships Actual hours x Actual rate 3,850 x $10 = $38,500 Actual hours x Standard rate 3,850 x $9.00 = $34,650 Standard hours x Standard rate 4,000 x $9.00 = $36,000 Direct Labor Rate Variance Direct Labor Time Variance $3,850 U ($1,350) F Direct Labor Variance Relationships Actual hours x Actual rate 3,850 x $10 = $38,500 Actual hours x Standard rate 3,850 x $9.00 = $34,650 Standard hours x Standard rate 4,000 x $9.00 = $36,000 Total Direct Labor Cost Variance $2,500 U Overhead is applied at $6.00 per direct labor hour based on estimated 5,000 total hours. Variances from standard for factory overhead result from: 1. Actual variable factory overhead cost greater or less than budgeted variable factory overhead for actual production. 2. Actual production at a level above or below 100% of normal capacity. Western Rider Inc. produced 5,000 pairs of XL jeans in June. Each pair requires 0.80 standard labor hours for production. The firm operated at 80% of capacity. Direct Labor Hours 4,000 5,000 5,500 Percentage of capacity Total variable costs Actual variable overhead Variable overhead variance—favorable 80% $14,400 10,400 100% 110% $18,000 $19,800 $(4,000)F Level of activity Controllable variance based on variable costs Western Rider Inc. produced 5,000 pairs of XL jeans in June. Each pair requires 0.80 standard labor hours for production. The firm operated at 80% of capacity. Direct Labor Hours 4,000 5,000 5,500 Percentage of capacity Total fixed costs Fixed cost per DLH 80% 12,000 $3.00 100% 12,000 $2.40 Desired Standard hours capacity at actual production 110% 12,000 $2.18 Western Rider Inc. produced 5,000 pairs of XL jeans in June. Each pair requires 0.80 standard labor hours for production. The firm operated at 80% of capacity. Direct Labor Hours 4,000 5,000 5,500 Percentage of capacity Total fixed costs Fixed cost per DLH 80% 12,000 $3.00 100% of normal capacity Standard hours at actual production Capacity not used Standard fixed overhead rate at 100% Fixed overhead volume variance 100% 12,000 $2.40 110% 12,000 $2.18 5,000 4,000 1,000 x $2.40 $ 2,400 DLH DLH DLH U Western Rider Inc. Factory Overhead Cost Variance Report For the Month Ended June 30, 2006 Productive capacity for the month (100% of normal) 5,000 hours Actual production for the month 4,000 hours Budget (at Actual Production) Actual Variable factory overhead costs $14,400 $10,400 Fixed factory overhead costs 12,000 12,000 Total factory overhead costs $26,400 $22,400 Total controllable variances Net controllable variances— favorable Volume variance—unfavorable: Capacity not used at the standard rate for fixed factory overhead—1,000 x $2.40 Total factory overhead cost variance--favorable Variances Favorable Unfavorable $4,000 $4,000 $ 0 $4,000 2,400 $1,600 Fixed Overhead Variances and the Factory Overhead Account Factory Overhead Actual factory overhead Applied factory $22,400 overhead Balance, June 30 $10,400 + $12,000 $24,000 1,600 4,000 hours x $6.00 per hour Fixed Overhead Variances and the Factory Overhead Account Factory Overhead Actual factory overhead Applied factory $22,400 overhead Balance, June 30 Controllable Variance: $4,000 F $22,400 – $26,400 $24,000 1,600 Fixed Overhead Variances and the Factory Overhead Account Factory Overhead Actual factory overhead Applied factory $22,400 overhead $24,000 Balance, June 30 Volume Variance: $2,400 U $26,400 – $24,000 1,600 Fixed Overhead Variances and the Factory Overhead Account Total Factory Overhead Variance Controllable variance Volume variance Total $4,000 F 2,400 U $1,600 F Fixed Overhead Variances and the Factory Overhead Account Budgeted Factory Overhead for Amount Produced Controllable variance Fixed factory overhead Total $14,400 12,000 $26,400 Recording and Reporting Variances from Standards On August 1, Western Rider Inc. purchased, on account, the 7,300 square yards of blue denim at $5.50 per square yard. Recall, the standard price was $5.00. Aug. 1 Materials (7,300 sq. yds. X $5.00) Direct Materials Price Variance Accounts Payable $5.50 $5.00 x x 7,300 7,300 36 500 00 3 650 00 40 150 00 $3,650 U = $40,150 Direct = $36,500 materials price variance Western Rider Inc. used 7,300 square yards of blue denim to produce 5,000 pairs of XL jeans, compared to the standard of 7,500 square yards. Date the entry August 31. Aug. 31 Work in Process (7,500 x $5.00) 37 500 00 Direct Materials Quantity Variance Materials (7,300 x $5.00) Standard quantity $5.00price x Actual7,300 Standard quantity $5.00price x Standard 7,500 1 000 00 36 500 00 $1,000 F = $36,500 Direct = $37,500 Materials quantity variance For the month of August, Western Rider Inc. accrued wages of $38,500 (3,850 hours at $10 per hour) in producing 5,000 XL Jeans. The standard rate is $9 per hour and each pair of jeans had a time standard of 0.8 hr. Aug. 31 Work in Process Direct Labor Rate Variance Direct Labor Time Variance Wages Payable 36 000 00 3 850 00 1 350 00 38 500 00 $10.00 Actual rate x Actual3,850 hours = $38,500 $3,850 U (rate) Standard hours $9.00rate x Actual3,850 = $34,650 $1,350 F (time) Standard rate x Standard quantity $9.00 4,000 = $36,000 This entry is not shown in the textbook. Western Rider Inc. Income Statement For the Month Ended June 30, 2006 Sales…………………………………… Cost of goods sold…………………….. Gross profit--at standard………………. $140,000 97,500 $ 42,500 Favorable Unfavorable Less variances from standard cost: Direct materials price……………….. Direct materials quantity……………. $1,000 Direct labor rate…………………….. Direct labor time……………………. 1,350 Factory overhead controllable………. 4,000 Factory overhead volume…………… Gross profit……………………………. Operating expenses……………………. Income before income tax…………….. $3,650 3,850 2,400 3,550 $38,950 25,725 $13,225 Nonfinancial Performance Measures Inventory turnover On-time delivery Elapsed time between a customer order and product delivery Customer preference rankings compared to competitors Response time to a service call Time to develop new products Employee satisfaction Number of customer complaints Nonfinancial Performance Measures (Fast Food Restaurant) Inputs Employee training Employee experience Number of new menu items Number of employees Fryer reliability Fountain supply availability Activity Counter service Outputs Line wait Percent order accuracy Friendly service score Chapter 21 The End