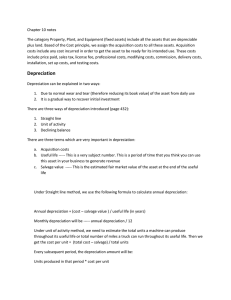

Homework 12 .Depreciation

advertisement

Homework 12 .Depreciation 1. Earth Harvest Nursery paid $152,000 for an asset in 1990 and installed it at a cost of $3000. The asset’s expected life was 10years with a salvage value of 10% of the original purchase price. The asset was sold at the end of 1998 for 43,000 a. Define the values needed to develop an annual depreciation schedule at purchase time b. What are the values for the actual life, the market value in 1998 and the book value at sale time if 75% of the first cost has been removed via an accelerated depreciation model? 2. A $100,000 piece of testing equipment was installed and depreciated for 5 years. Each year the end-of year book value decreased at a rate of 10% of the book value at the beginning of the year. The system was sold for $24,000 at the end of the 5 years. a. Compute the amount of the annual depreciation b. What is the actual depreciation rate for each year c. Plot the book value for each the 5 years d. At the time of sale, what is the difference between the book value and the market value 3. A building cost $320,000 to construct. It has a 30 years life with an estimated sales value of 25% of the construction cost. Calculate and compare the annual depreciatiaon charge for years 4, 18, and 25 using : a. Straight line b. DDB Depreciation