SAP Asset Accounting Exercise: Vendor & Fixed Asset Processes

advertisement

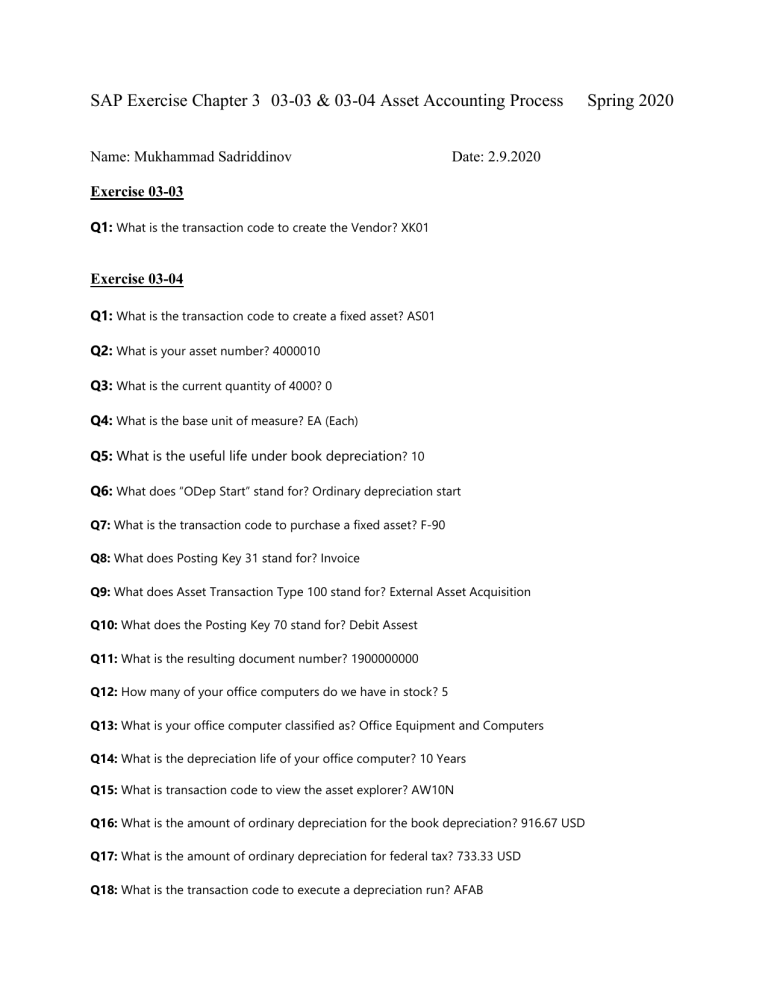

SAP Exercise Chapter 3 03-03 & 03-04 Asset Accounting Process Name: Mukhammad Sadriddinov Date: 2.9.2020 Exercise 03-03 Q1: What is the transaction code to create the Vendor? XK01 Exercise 03-04 Q1: What is the transaction code to create a fixed asset? AS01 Q2: What is your asset number? 4000010 Q3: What is the current quantity of 4000? 0 Q4: What is the base unit of measure? EA (Each) Q5: What is the useful life under book depreciation? 10 Q6: What does “ODep Start” stand for? Ordinary depreciation start Q7: What is the transaction code to purchase a fixed asset? F-90 Q8: What does Posting Key 31 stand for? Invoice Q9: What does Asset Transaction Type 100 stand for? External Asset Acquisition Q10: What does the Posting Key 70 stand for? Debit Assest Q11: What is the resulting document number? 1900000000 Q12: How many of your office computers do we have in stock? 5 Q13: What is your office computer classified as? Office Equipment and Computers Q14: What is the depreciation life of your office computer? 10 Years Q15: What is transaction code to view the asset explorer? AW10N Q16: What is the amount of ordinary depreciation for the book depreciation? 916.67 USD Q17: What is the amount of ordinary depreciation for federal tax? 733.33 USD Q18: What is the transaction code to execute a depreciation run? AFAB Spring 2020 Q19: What is the purpose to execute a depreciation run? Reduce Asset’s Monetary Value Q20: What is the book value in Year 5.? 4,083.33USD Q21: How much is the ordinary depreciation in Year 5? 1,000.00USD Q22: What is the net book value in Year 5? 3,683,33USD Q23: How much is the ordinary depreciation in Year 5? 1,000.00 USD