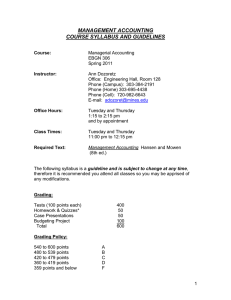

Dr. Mary Bumgarner Economics 4210 BB 319 (770) 423-6341

advertisement

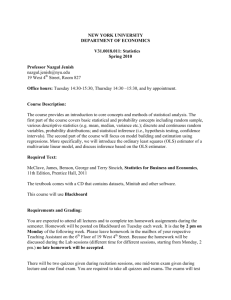

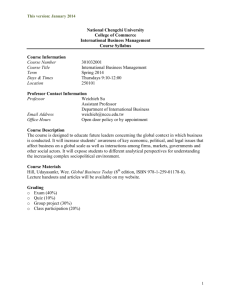

Dr. Mary Bumgarner BB 319 (770) 423-6341 Mary_Bumgarner@coles2.kennesaw.edu Economics 4210 Money and Financial Markets Spring 2005 Course Description: Economics 4210 analyzes the operation, structure, regulation and control of financial markets, emphasizing the effects on the level and term structure of interest rates on economic activity and business decisions. The course also focuses on monetary theory, monetary policy and the various roles played by the Federal Reserve System in the economy. Course Objective: At the end of the course, the successful student will have a deeper, more analytical understanding of how the United States financial system is structured and functions. He or she also will have a better understanding of the role played by the Federal Reserve and the impact it has on financial institutions and markets. Course Prerequisites: Successful completion of Economics 2100 and 2200 as well as Finance 3100 is required. Office Hours: Office hours will be held from 12:15 – 1:30 PM on Tuesday and Thursday or by appointment. Text: Financial Markets and Institutions, 4th edition, Frederic S. Mishkin and Stanley G. Eakins, Addison Wesley Longman, 2003. The Wall Street Journal is required for two of the assignments. Examinations and Quizzes: Two exams are scheduled, a mid-term examination and a final. Anyone who misses the mid-term exam may take a make-up exam, providing he or she notifies the instructor that he or she will not take the test at the scheduled hour and takes the make-up test within one week of the scheduled exam. ONCE AN EXAM HAS BEEN RETURNED TO THE CLASS, A MAKE-UP TEST MAY NOT BE TAKEN AND THE STUDENT WILL RECEIVE A GRADE OF ZERO FOR THAT TEST. Make-up exams are given at the convenience of the instructor and may be scheduled during class time. ALL MAKE-UP EXAMS WILL BE PENALIZED ONE-HALF A LETTER GRADE. Make-up exams are a privilege, not a right; they should be utilized only in emergencies. Exams may not be taken early except in exceptional circumstances. Approximately four to five quizzes will be given. Quizzes MAY NEVER BE MADE UP. If a student misses a quiz, he or she will receive a zero. All quizzes are announced. Exam Schedule: Mid-Term Exam Final Exam February 24, 2005 May 5, 2005 Term Project: The term project is comprised of three assignments to be completed during the term. These assignments must be typed and submitted on time. Late assignments will be penalized five (5) points for every class session beyond the due date. Final Grade: The final grade is determined as follows: Mid- Term Final Project Quizzes 25% 25% 25% 25% Grading Policy: All grades are based on the student’s demonstrated understanding of the concepts taught in the course and his/her effectiveness in applying those concepts to real world problems. Professional and personal circumstances that occur during the semester that preclude the student from performing at a satisfactory level are not considered in the determination of the final course grade. Kindly do not make requests for special projects, papers, extra work, etc. to improve your grade. Class Withdrawal Procedure: If you wish to withdraw from this course after the schedule change period, you must obtain a withdrawal form in the Registrar’s Office, and complete it according to instructions. CEASING TO ATTEND CLASS OR ORAL NOTICE THEREOF DOES NOT CONSTITUTE OFFICIAL WITHDRAWAL AND WILL RESULT IN THE GRADE OF “F.” You are reminded that after the official withdrawal date you many not withdraw without penalty except in cases of extreme hardship as determined by the Registrar of the University. THE LAST DAY FOR WITHDRAWING WITHOUT PENALTY FORM THIS COURSE DURING SPRING SEMESTER 2005 IS MARCH 4, 2005. COURSE OUTLINE TOPICS TEXT CHAPTERS PAGES Introduction Fundamentals of Interest Rates Central Banking Foreign Exchange Market International Financial System The Efficient Market Hypothesis Theory of Financial Structure 1, 2 3, 4, 5 6, 7 12 13 10 14 3-34 37-145 149-211 311-338 339-369 267-290 371-401