Forward Cash, Basis and Minimum Price Contracts Cash and MPC

Cash and MPC

Forward Cash, Basis and Minimum Price Contracts

A producer has several marketing alternatives for selling his production. He can sell the crops at several stages of crop production i.e. pre-harvest, harvest and post harvest time periods using variety of marketing tools. Forward contracts allow farmers to lock in a price or basis for grain they plan to deliver some time in the future.

If a producer does not lock in a price he will be speculating in the cash market and exposes him to the associated price risks due to changes. Hedging in the futures markets can avoid the price risk but still leaves the basis risk. There are few other alternatives that eliminate either the price risk or basis risk or both. Following we discuss three popular contracts that are available at the local grain elevator along with the merits and drawbacks of each contract.

Forward Cash Contracts

‘allow producers to lock in a flat price for grain they plan to deliver some time in the future’

Many elevator operators offer forward contracts to the local grain producers. These contracts can be signed by the growers even prior to planting at the beginning of the spring for the delivery of grain at harvest time, at a pre-arranged price. Many producers prefer these contracts due to simple and easy to understand nature as well as to reduce the price risk and to assure an outlet for their production.

A cash forward contract may be defined as; “an agreement which specifies that the producer will deliver a certain quantity of a specific grade of a commodity on a certain date.”

As the price is locked in advance these contracts eliminate both the price and basis risk and there will be no need to enter into the futures market transactions. Actually, when an elevator operator offers a forward contract to a producer, as soon as the contract is signed he places pre-harvest hedge to protect his position using the futures markets. So the forward price that is offered by an elevator operator will also reflects the charges for this service. It is always better for the producer to evaluate several forward contract offers before deciding to sign one. Once it was signed there will not be much flexibility except meeting the contract terms.

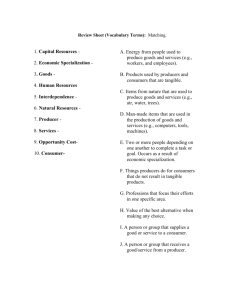

Advantages

1) Lock in a price in advance and thus eliminate both price and basis risk.

2) These contracts are simple, flexible and easy to understand.

3) These will enable the producer to deliver the crop upon harvest and eliminate the need to store the commodities.

4) Cash contracts could be written for any quantity unlike futures contracts where the size of the contract is fixed.

5) A producer may receive a portion of the contract value prior to delivering the actual commodity that will help to meet other costs.

Grain Marketing Page 1

Cash and MPC

Disadvantages

1) There is production risk. If the yield is low and if the contract obligations can not be met it will prove costly for the producer to secure additional grain in the open market to deliver.

2) Because of the locked in nature of the price, a producer cannot take advantage of rising prices.

3) Producer will have less flexibility using forward contracts compared to hedges. Producer must deliver the stated amount, regardless of the cash price.

4) Most contracts are quite specific with regard to the quantity, quality, place and time of delivery of the products. A thorough understanding of the terms of the contract is necessary before signing one.

For example, let us assume that December corn futures are trading at $2.70 per bushel and the best bid on a forward contract is $2.45 per bushel, or 25 cents under the December futures contract. Your estimated cost of production is $2.10 per bushel. Therefore, you could lock in a profit of 35 cents per bushel through this forward contract. Before entering into the contract, your review of historical basis during mid November reveals that basis is usually in the range of

25-35 cents under the December. In this case the producer had the risk that the basis may weaken at the time of actual sale. He wants to avoid the price as well as basis risk. So he can enter into this forward agreement that gives him a profit of 35 cents. In future if the prices rise above $2.45 in the cash market the producer has to deliver the product as specified in the forward contract i.e.

$2.45 and can't take advantage of rising prices subsequently.

Forward Basis Contracts

‘allow producers to lock in a basis but leaves the future price open’

A forward basis contract allows a producer to lock in a basis but leaves it open to take advantage of rising prices. The contracts can be arranged for spot or deferred delivery but establishes a day by which the grain must be delivered or priced. Once delivered, the title passes to the elevator, who can resell the grain immediately, whether or not the farmer has priced the contract. Usually most of the elevators will pay an advance on the grain after it is delivered. Typically it amounts to 80 percent of current value of the commodity. Sometimes elevators don’t charge storage fees or interest on the advance. Producers like basis contracts due to several advantages these contracts offer. They can take advantage of higher prices if prices rise while they were locked in the basis. This exposes them to price risk but not basis risk. If the futures prices fall before the contract is priced out, they could get hurt.

Advantages

1) Allow the producer to take advantage of rising prices.

2) Will protect the producer from weakening basis.

Grain Marketing Page 2

Cash and MPC

3) Producer can deliver the crop upon harvest and do not need to worry about storage or storage related problems.

4) Producer can get paid an advance at the time of entering the contract depending upon the value of commodities. This advance payment will help in meeting some costs and also managing cash flow.

Disadvantages

1) The selling price will be low if the futures price fall before grain is priced.

2) Because of locked in nature of the basis, producer can not benefit from the strengthening basis.

3) Must meet the delivery terms and obligations. Quantities delivered may be restricted to the size of futures contracts.

4) Title transfer of the products happens at the time of delivery. Could lose money if elevator goes bankrupt.

For example, a producer enters a basis contract in the spring to sell 5,000 bushels of corn for harvest delivery at 20 cents under December futures. Shortly after the corn is delivered Corn futures are at $3.02. Now, the producer can choose to price the basis contract, resulting in a cash price of $2.82 per bushel ($3.02-$0.20). If the producer thinks that the prices will go further high he can wait further to call the elevator and price the grain when the prices are up.

Minimum Price Contracts (MPC)

‘allow producers to establish a minimum price for their grain and take advantage of higher price’

Minimum Price Contracts (MPC) had several advantages and the interest to use them as marketing tools among the grain producers, grain dealers and brokerage firms is very high. The primary feature of MPC’s allow the producer to set a floor price for his crop and take advantage of increase in the futures price. These are one among the several marketing alternatives a grain elevator offers to the producers.

If a grain dealer is going to offer producers an opportunity to sell their grain through MPC, he has to offset his price risks. Essentially the grain elevators or dealers will offset their price risks by hedging using the futures and options positions. This relieves the producer to enter into these markets directly but indirectly they are participating through the grain dealers hedging programs.

If the prices in the future goes up then the producer will get the benefit of raising prices. If the prices go low in the future he is assured of the minimum price spelled in the contract.

There are a number of ways to combine positions (combinations strategies) in cash, futures and options markets to establish a minimum price. Producers should understand about the contracts that the local grain elevator offers to them in order to successfully use them in their marketing program. There are several advantages and disadvantages in using the MPC’s.

Grain Marketing Page 3

Cash and MPC

Advantages

1) Establishes a minimum price but leaves the upside price potential if the prices move up later in the season.

2) No need to worry about the storage costs or additional interest charges. This benefit is appealing to bank lenders who have a vested interest in their client’s cash flow and debt status.

3) Limited risk. There is no need to directly enter into the futures and options markets.

There are no margin account requirements and thus completely avoids the unpleasant margin calls.

4) The grain can be delivered to the grain elevator upon harvest, under most contracts, and avoid any shrinkage losses or changes in grade which could occur in farm storage.

5) Sometimes the total quantity that is going to be contracted could be less than the desirable. (i.e., can contract less than the size of one futures contact, less than 5,000 bushels in the case of corn).

Disadvantages

1) Grain should be transported to a specific elevator. An important feature of these contracts is that all producers are required to make delivery and all grain elevators must accept delivery.

2) Must pay the premiums and any transaction costs. The cash basis, administrative expenses and the option premiums are all used to establish the minimum price guarantee.

So the farmer is charged a fee if he wants to take advantage of several flexible options that come during entering the contract.

3) The producer needs to understand all the contract terms and leaves significant risk in fulfilling his side of the obligations.

4) Knowledge about futures and options is essential to know and select the right contract options that will set the floor price higher. Producer should also posses the knowledge how to arrive at the minimum price or understand the formula used to compute the minimum price.

A producer can use these MPC’s to protect his break-even costs of production. He should enter into these contracts if the market is not offering enough profit potential but he wants to cover costs of production and also protection against falling prices. In raising markets also MPC can be used if the producer finds it difficult to sell not knowing how far the market will go. With a

MPC he can lock in a floor price, and still have upside potential if the market rallies. By using these contracts MPC’s will give some producers a discipline to sell into a market that is rallying.

No one knows how far the prices will go up and when it will break. Often the price breaks happen earlier than expected and the price fall will be steeper and often occur before taking the selling action. That leaves the producer with missed opportunity. To prevent this from happening, entering into MPC while the prices are still climbing will allow setting minimum price and allowing taking advantage of price raises at a minimum cost without much risk. Unlike

Grain Marketing Page 4

Cash and MPC forward cash contracts, MPC will allow to contract quantities that could fall below the required contract size. In the face of production risks this will be an advantage.

There are several methods by which a grain dealer can guarantee the floor price in a MPC to the producer. As mentioned earlier they can use combination strategies using cash forward contracts, futures, puts and call options etc., An elevator operator can offer a MPC to a producer where the minimum price will be specified but leaves the upside price potential if the prices become favorable to the producer. Basically he is using the futures and options markets to provide this flexibility. He achieves this by selling futures contract and buying a call option. When he buys the commodity from the producer he will sell the futures contract and buys a call option that gives the upside potential if the prices rise. He will charge the cost of financing the option premiums to the producer. This way, he can ensure that the producer gets a minimum price for his grain, but can take advantage of rising prices. Sometimes a service fee will be charged.

For example, a farmer wants to protect the price of 5,000 bushels of corn but also want to take advantage of a possible market rally. An elevator operator is offering a basis contract at 20 cents under December futures. He guarantees a minimum price of $2.00 for the producer.

When December futures are trading at $2.34 and the producer enters into the basis contract to price his product. The elevator operator will sell the December futures and buys a December call option. The producer also agreed to finance the call option at a strike price of $2.40 for 13 cents per bushel. In addition the elevator operator may charge a service charge of $0.01 per bushel. So these actions will ensure that the minimum price that the producer will receives to be $2.00

(futures price-basis-call premium-service fee = $2.34-$0.20-$0.13-$0.01).

No matter what happens to prices, the lowest price the producer receives will be $2.00. However, if December corn raises producer will receive higher price and falls he will get the minimum price. See the following table:

December corn falls to $1.90 December corn rises to $3.00

Dec futures $1.90 $3.00

Minimum Price Contract

Intrinsic Value of $2.40 call

$2.00

$0.00 (call will expire)

$2.00

+$0.60 ($3 futures - $2.40 strike)

Net price for farmer $2.00 $2.60

Grain Marketing Page 5

Cash and MPC

Exercises

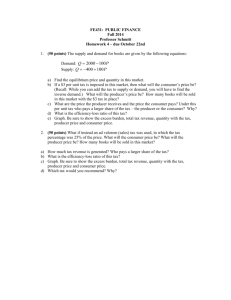

Exercise 1: Basis Contract

Develop an understanding and awareness of basis contracts

You anticipate having 6,000 bushels of soybeans to market. In March you enter into a basis contract for 3,000 bushels with Grainville Elevator, locking in October basis at -$0.41. You sell

6,000 bushels of cash beans in late October. The local basis at that time is

$0.60. The

November CBOT price when you sell is $5.10. Calculate the net price on the 3,000 bushels that were sold under the basis contract and the 3,000 that were not under contract.

Grain Marketing Page 6

Cash and MPC

Exercise 2: Cash Forward Contract

Develop an understanding of how cash forward contracts work

Develop an appreciation for the effects of storage and ownership costs on profitability

You have 10,000 bushels of corn to sell during the month of November. You contract the corn with Grainville Elevator for delivery as follows:

Month Amount Price

November

March

May

5,000 bu

2,000 bu

3,000 bu

$1.96

$2.17

$2.23

Storage and ownership costs are $0.05 per month. What price did you net on each of the three contracts?

Grain Marketing Page 7