13-Mar-09 PRELIMINARY RESULTS

advertisement

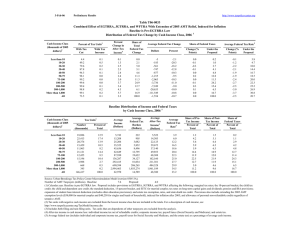

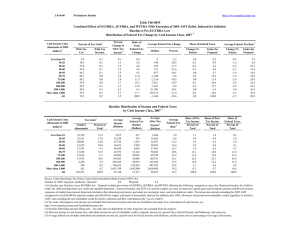

13-Mar-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Click on PDF or Excel link above for additional tables containing more detail and breakdowns by filing status and demographic groups. Table T09-0141 Administration's Fiscal Year 2010 Budget Proposals Extend the Making Work Pay Credit, Earned Income Tax Credit Expansion, Expand Refundability of Child Tax Credit Create Automatic IRAs and 401(k)s, Expand the Saver's Credit, Provide American Opportunity Tax Credit Baseline: Administration Baseline Distribution of Federal Tax Change by Cash Income Level, 2012 1 Summary Table Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut 71.9 71.1 74.8 82.9 86.7 87.1 85.7 76.1 26.0 18.7 13.8 76.2 With Tax Increase 0.0 0.2 0.2 0.1 0.1 0.0 0.3 0.3 0.1 0.1 0.0 0.2 Percent Change in After-Tax Income 4 6.4 3.9 2.5 2.0 1.6 1.3 0.9 0.6 0.1 0.0 0.0 1.0 Share of Total Federal Tax Change 6.0 14.6 14.1 11.1 8.7 16.8 11.2 15.7 1.2 0.2 0.1 100.0 Average Federal Tax Change ($) -348 -589 -599 -645 -651 -691 -685 -686 -196 -211 -234 -594 Average Federal Tax Rate 5 Change (% Points) -6.1 -3.7 -2.3 -1.8 -1.4 -1.1 -0.8 -0.5 -0.1 0.0 0.0 -0.8 Under the Proposal -0.5 1.2 6.5 11.2 14.2 16.6 18.0 20.8 24.0 25.8 29.7 19.8 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0309-1). Number of AMT Taxpayers (millions). Baseline: 4.9 Proposal: 4.9 (1) Calendar year. Baseline is the Administration's baseline (extends all of the individual income tax provisions included in 2001 EGTRRA and 2003 JGTRRA; maintains the estate tax at its 2009 parameters; extends the 2009 AMT Patch and indexes the AMT exemption, rate bracket threshold, and phase-out exemption threshold for inflation). Proposal extends the Making Work Pay Credit (not indexed for inflation), the Earned Income Tax Credit expansion and the Saver's credit expansion. It creates automatic 401(k)s and IRAs and extends the American Opportunity Tax Credit. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 13-Mar-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0141 Administration's Fiscal Year 2010 Budget Proposals Extend the Making Work Pay Credit, Earned Income Tax Credit Expansion, Expand Refundability of Child Tax Credit Create Automatic IRAs and 401(k)s, Expand the Saver's Credit, Provide American Opportunity Tax Credit Baseline: Administration Baseline Distribution of Federal Tax Change by Cash Income Level, 2012 1 Detail Table Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 71.9 71.1 74.8 82.9 86.7 87.1 85.7 76.1 26.0 18.7 13.8 76.2 0.0 0.2 0.2 0.1 0.1 0.0 0.3 0.3 0.1 0.1 0.0 0.2 Percent Change in After-Tax Income 4 6.4 3.9 2.5 2.0 1.6 1.3 0.9 0.6 0.1 0.0 0.0 1.0 Share of Total Federal Tax Change 6.0 14.6 14.1 11.1 8.7 16.8 11.2 15.7 1.2 0.2 0.1 100.0 Average Federal Tax Change Dollars -348 -589 -599 -645 -651 -691 -685 -686 -196 -211 -234 -594 Percent -109.6 -76.0 -26.0 -13.6 -8.9 -6.0 -4.0 -2.3 -0.3 -0.1 0.0 -3.7 Share of Federal Taxes Change (% Points) -0.2 -0.5 -0.5 -0.3 -0.2 -0.3 0.0 0.4 0.6 0.3 0.7 0.0 Under the Proposal 0.0 0.2 1.6 2.7 3.5 10.1 10.4 26.1 17.5 7.8 20.1 100.0 Average Federal Tax Rate5 Change (% Points) -6.1 -3.7 -2.3 -1.8 -1.4 -1.1 -0.8 -0.5 -0.1 0.0 0.0 -0.8 Under the Proposal -0.5 1.2 6.5 11.2 14.2 16.6 18.0 20.8 24.0 25.8 29.7 19.8 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2012 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) 16,013 23,194 22,014 16,088 12,539 22,724 15,284 21,316 5,894 1,021 519 157,316 Percent of Total 10.2 14.7 14.0 10.2 8.0 14.4 9.7 13.6 3.8 0.7 0.3 100.0 Average Income (Dollars) 5,740 15,900 26,173 36,651 47,251 65,018 91,616 142,730 300,152 714,940 3,165,609 77,851 Average Federal Tax Burden (Dollars) 318 775 2,306 4,737 7,342 11,465 17,198 30,345 72,309 184,521 941,514 16,014 Average AfterTax Income 4 (Dollars) 5,423 15,125 23,866 31,914 39,908 53,553 74,417 112,385 227,843 530,418 2,224,095 61,837 Average Federal Tax Rate 5 5.5 4.9 8.8 12.9 15.5 17.6 18.8 21.3 24.1 25.8 29.7 20.6 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 0.8 3.0 4.7 4.8 4.8 12.1 11.4 24.8 14.5 6.0 13.4 100.0 0.9 3.6 5.4 5.3 5.1 12.5 11.7 24.6 13.8 5.6 11.9 100.0 0.2 0.7 2.0 3.0 3.7 10.3 10.4 25.7 16.9 7.5 19.4 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0309-1). Number of AMT Taxpayers (millions). Baseline: 4.9 Proposal: 4.9 (1) Calendar year. Baseline is the Administration's baseline (extends all of the individual income tax provisions included in 2001 EGTRRA and 2003 JGTRRA; maintains the estate tax at its 2009 parameters; extends the 2009 AMT Patch and indexes the AMT exemption, rate bracket threshold, and phase-out exemption threshold for inflation). Proposal extends the Making Work Pay Credit (not indexed for inflation), the Earned Income Tax Credit expansion and the Saver's credit expansion. It creates automatic 401(k)s and IRAs and extends the American Opportunity Tax Credit. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 13-Mar-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0141 Administration's Fiscal Year 2010 Budget Proposals Extend the Making Work Pay Credit, Earned Income Tax Credit Expansion, Expand Refundability of Child Tax Credit Create Automatic IRAs and 401(k)s, Expand the Saver's Credit, Provide American Opportunity Tax Credit Baseline: Administration Baseline Distribution of Federal Tax Change by Cash Income Level, 2012 1 Detail Table - Single Tax Units Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 71.5 63.2 68.1 80.5 86.3 83.3 75.4 21.0 7.1 10.1 4.8 69.7 0.0 0.3 0.1 0.1 0.0 0.0 0.0 0.0 0.0 0.2 0.0 0.1 Percent Change in After-Tax Income 4 5.6 2.5 1.7 1.5 1.2 0.9 0.5 0.1 0.0 0.0 0.0 1.0 Share of Total Federal Tax Change 13.3 20.1 18.7 14.7 10.5 16.0 4.9 1.3 0.2 0.0 0.0 100.0 Average Federal Tax Change Dollars -288 -353 -381 -465 -437 -431 -316 -96 -71 -73 -67 -358 Percent -55.1 -24.4 -11.3 -7.5 -4.8 -3.2 -1.5 -0.3 -0.1 0.0 0.0 -3.8 Share of Federal Taxes Change (% Points) -0.5 -0.7 -0.5 -0.3 -0.1 0.1 0.3 0.6 0.4 0.2 0.4 0.0 Under the Proposal 0.4 2.5 5.8 7.2 8.2 19.5 12.5 18.1 9.7 4.3 11.7 100.0 Average Federal Tax Rate5 Change (% Points) -5.1 -2.2 -1.5 -1.3 -0.9 -0.7 -0.4 -0.1 0.0 0.0 0.0 -0.8 Under the Proposal 4.1 6.9 11.4 15.7 18.3 20.5 22.7 23.8 25.3 27.9 32.9 20.0 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2012 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 11,322 13,927 12,005 7,758 5,890 9,119 3,769 3,371 777 136 72 68,506 16.5 20.3 17.5 11.3 8.6 13.3 5.5 4.9 1.1 0.2 0.1 100.0 Average Income (Dollars) 5,679 15,797 26,047 36,609 47,203 64,298 90,691 139,363 304,627 706,682 3,061,513 45,237 Average Federal Tax Burden (Dollars) 523 1,450 3,359 6,204 9,084 13,616 20,886 33,253 77,078 197,454 1,007,756 9,381 Average AfterTax Income 4 (Dollars) 5,156 14,347 22,688 30,405 38,119 50,682 69,805 106,110 227,549 509,228 2,053,757 35,856 Average Federal Tax Rate 5 9.2 9.2 12.9 17.0 19.2 21.2 23.0 23.9 25.3 27.9 32.9 20.7 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 2.1 7.1 10.1 9.2 9.0 18.9 11.0 15.2 7.6 3.1 7.1 100.0 2.4 8.1 11.1 9.6 9.1 18.8 10.7 14.6 7.2 2.8 6.0 100.0 0.9 3.1 6.3 7.5 8.3 19.3 12.3 17.4 9.3 4.2 11.2 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0309-1). (1) Calendar year. Baseline is the Administration's baseline (extends all of the individual income tax provisions included in 2001 EGTRRA and 2003 JGTRRA; maintains the estate tax at its 2009 parameters; extends the 2009 AMT Patch and indexes the AMT exemption, rate bracket threshold, and phase-out exemption threshold for inflation). Proposal extends the Making Work Pay Credit (not indexed for inflation), the Earned Income Tax Credit expansion and the Saver's credit expansion. It creates automatic 401(k)s and IRAs and extends the American Opportunity Tax Credit. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 13-Mar-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0141 Administration's Fiscal Year 2010 Budget Proposals Extend the Making Work Pay Credit, Earned Income Tax Credit Expansion, Expand Refundability of Child Tax Credit Create Automatic IRAs and 401(k)s, Expand the Saver's Credit, Provide American Opportunity Tax Credit Baseline: Administration Baseline Distribution of Federal Tax Change by Cash Income Level, 2012 1 Detail Table - Married Tax Units Filing Jointly Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 54.9 73.4 71.7 73.6 80.5 87.3 88.7 89.9 29.6 20.3 15.7 77.6 0.0 0.0 0.1 0.3 0.1 0.1 0.5 0.4 0.1 0.1 0.1 0.2 Percent Change in After-Tax Income 4 6.6 5.5 3.7 2.8 2.5 1.8 1.1 0.7 0.1 0.0 0.0 0.8 Share of Total Federal Tax Change 1.3 6.5 8.9 7.9 8.2 18.8 17.0 28.3 2.2 0.4 0.2 100.0 Average Federal Tax Change Dollars Percent -310 -866 -931 -955 -1,058 -989 -856 -835 -217 -236 -269 -813 -126.2 -180.3 -72.0 -32.3 -20.9 -10.4 -5.5 -2.8 -0.3 -0.1 0.0 -3.0 Share of Federal Taxes Change (% Points) 0.0 -0.2 -0.3 -0.2 -0.2 -0.4 -0.2 0.1 0.6 0.3 0.7 0.0 Under the Proposal 0.0 -0.1 0.1 0.5 1.0 4.9 8.9 29.9 21.5 9.5 23.7 100.0 Average Federal Tax Rate5 Change (% Points) -6.2 -5.3 -3.5 -2.6 -2.2 -1.5 -0.9 -0.6 -0.1 0.0 0.0 -0.6 Under the Proposal -1.3 -2.4 1.4 5.5 8.5 12.8 16.0 20.1 23.8 25.4 29.2 20.7 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2012 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,080 3,744 4,757 4,142 3,865 9,499 9,889 16,942 4,932 852 427 61,400 3.4 6.1 7.8 6.8 6.3 15.5 16.1 27.6 8.0 1.4 0.7 100.0 Average Income (Dollars) 4,968 16,339 26,344 36,758 47,359 66,123 92,185 143,802 299,285 716,602 3,123,239 128,766 Average Federal Tax Burden (Dollars) 246 480 1,293 2,958 5,067 9,478 15,612 29,714 71,459 182,549 911,766 27,486 Average AfterTax Income 4 (Dollars) 4,723 15,859 25,051 33,800 42,292 56,645 76,572 114,088 227,826 534,053 2,211,473 101,280 Average Federal Tax Rate 5 4.9 2.9 4.9 8.1 10.7 14.3 16.9 20.7 23.9 25.5 29.2 21.4 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 0.1 0.8 1.6 1.9 2.3 7.9 11.5 30.8 18.7 7.7 16.9 100.0 0.2 1.0 1.9 2.3 2.6 8.7 12.2 31.1 18.1 7.3 15.2 100.0 0.0 0.1 0.4 0.7 1.2 5.3 9.2 29.8 20.9 9.2 23.1 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0309-1). (1) Calendar year. Baseline is the Administration's baseline (extends all of the individual income tax provisions included in 2001 EGTRRA and 2003 JGTRRA; maintains the estate tax at its 2009 parameters; extends the 2009 AMT Patch and indexes the AMT exemption, rate bracket threshold, and phase-out exemption threshold for inflation). Proposal extends the Making Work Pay Credit (not indexed for inflation), the Earned Income Tax Credit expansion and the Saver's credit expansion. It creates automatic 401(k)s and IRAs and extends the American Opportunity Tax Credit. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 13-Mar-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0141 Administration's Fiscal Year 2010 Budget Proposals Extend the Making Work Pay Credit, Earned Income Tax Credit Expansion, Expand Refundability of Child Tax Credit Create Automatic IRAs and 401(k)s, Expand the Saver's Credit, Provide American Opportunity Tax Credit Baseline: Administration Baseline Distribution of Federal Tax Change by Cash Income Level, 2012 1 Detail Table - Head of Household Tax Units Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 87.7 89.3 93.0 96.6 96.2 96.1 92.4 27.0 10.2 13.6 5.6 90.1 0.0 0.0 0.3 0.1 0.1 0.1 0.0 0.0 0.0 0.2 0.0 0.1 Percent Change in After-Tax Income 4 9.1 6.1 3.2 2.1 1.4 1.1 0.7 0.2 0.1 0.0 0.0 2.0 Share of Total Federal Tax Change 9.0 29.7 22.3 14.7 7.4 11.9 4.0 0.8 0.2 0.0 0.0 100.0 Average Federal Tax Change Dollars Percent -662 -1,027 -823 -694 -552 -601 -532 -171 -193 -196 -91 -728 112.8 114.7 -147.7 -20.0 -8.5 -5.5 -3.0 -0.6 -0.3 -0.1 0.0 -13.0 Share of Federal Taxes Change (% Points) -1.5 -4.9 -3.0 -0.8 0.6 2.5 2.0 2.7 1.1 0.4 1.0 0.0 Under the Proposal -2.6 -8.3 -1.1 8.8 12.0 30.7 19.5 21.2 8.4 3.2 8.0 100.0 Average Federal Tax Rate5 Change (% Points) -9.9 -6.5 -3.1 -1.9 -1.2 -0.9 -0.6 -0.1 -0.1 0.0 0.0 -1.7 Under the Proposal -18.7 -12.1 -1.0 7.6 12.6 16.2 19.2 22.5 24.0 24.7 30.0 11.7 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2012 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,467 5,224 4,903 3,826 2,437 3,581 1,358 845 139 23 11 24,862 9.9 21.0 19.7 15.4 9.8 14.4 5.5 3.4 0.6 0.1 0.0 100.0 Average Income (Dollars) 6,689 15,879 26,283 36,558 47,271 63,957 90,406 135,286 302,335 696,822 2,985,224 41,756 Average Federal Tax Burden (Dollars) -587 -896 557 3,478 6,511 10,969 17,906 30,599 72,877 172,452 896,501 5,595 Average AfterTax Income 4 (Dollars) 7,276 16,775 25,726 33,080 40,760 52,988 72,501 104,687 229,458 524,370 2,088,723 36,162 Average Federal Tax Rate 5 -8.8 -5.6 2.1 9.5 13.8 17.2 19.8 22.6 24.1 24.8 30.0 13.4 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 1.6 8.0 12.4 13.5 11.1 22.1 11.8 11.0 4.1 1.5 3.1 100.0 2.0 9.8 14.0 14.1 11.1 21.1 11.0 9.8 3.6 1.3 2.5 100.0 -1.0 -3.4 2.0 9.6 11.4 28.2 17.5 18.6 7.3 2.8 7.0 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0309-1). (1) Calendar year. Baseline is the Administration's baseline (extends all of the individual income tax provisions included in 2001 EGTRRA and 2003 JGTRRA; maintains the estate tax at its 2009 parameters; extends the 2009 AMT Patch and indexes the AMT exemption, rate bracket threshold, and phase-out exemption threshold for inflation). Proposal extends the Making Work Pay Credit (not indexed for inflation), the Earned Income Tax Credit expansion and the Saver's credit expansion. It creates automatic 401(k)s and IRAs and extends the American Opportunity Tax Credit. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 13-Mar-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0141 Administration's Fiscal Year 2010 Budget Proposals Extend the Making Work Pay Credit, Earned Income Tax Credit Expansion, Expand Refundability of Child Tax Credit Create Automatic IRAs and 401(k)s, Expand the Saver's Credit, Provide American Opportunity Tax Credit Baseline: Administration Baseline Distribution of Federal Tax Change by Cash Income Level, 2012 1 Detail Table - Tax Units with Children Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 86.2 97.0 97.7 98.9 98.6 98.8 97.4 92.2 28.5 17.6 13.5 91.4 0.0 0.0 0.1 0.0 0.1 0.0 0.8 0.6 0.1 0.1 0.1 0.2 Percent Change in After-Tax Income 4 9.4 7.3 4.3 3.1 2.5 1.8 1.2 0.8 0.1 0.1 0.0 1.3 Share of Total Federal Tax Change 4.2 15.6 14.1 10.7 8.3 15.5 11.5 18.0 1.4 0.2 0.1 100.0 Average Federal Tax Change Dollars Percent -680 -1,281 -1,148 -1,041 -1,043 -993 -937 -948 -258 -255 -290 -971 85.8 85.0 738.5 -36.7 -17.8 -9.7 -5.7 -3.1 -0.4 -0.1 0.0 -5.1 Share of Federal Taxes Change (% Points) -0.2 -0.9 -0.8 -0.5 -0.3 -0.4 -0.1 0.6 1.0 0.5 1.1 0.0 Average Federal Tax Rate5 Under the Proposal Change (% Points) Under the Proposal -0.5 -1.8 -0.9 1.0 2.1 7.7 10.2 29.7 21.5 9.3 21.6 100.0 -10.6 -8.0 -4.4 -2.8 -2.2 -1.5 -1.0 -0.7 -0.1 0.0 0.0 -1.0 -22.9 -17.4 -5.0 4.9 10.2 14.1 16.9 20.4 24.5 26.9 30.3 19.1 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2012 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,972 5,814 5,867 4,921 3,825 7,471 5,897 9,105 2,642 433 204 49,293 6.0 11.8 11.9 10.0 7.8 15.2 12.0 18.5 5.4 0.9 0.4 100.0 Average Income (Dollars) 6,433 16,048 26,305 36,655 47,340 65,217 91,884 143,825 298,516 715,609 3,148,106 95,214 Average Federal Tax Burden (Dollars) -792 -1,508 -155 2,837 5,867 10,205 16,436 30,227 73,252 192,374 953,277 19,170 Average AfterTax Income 4 (Dollars) 7,225 17,556 26,461 33,817 41,473 55,011 75,447 113,598 225,264 523,235 2,194,829 76,045 Average Federal Tax Rate 5 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total -12.3 -9.4 -0.6 7.7 12.4 15.7 17.9 21.0 24.5 26.9 30.3 20.1 0.4 2.0 3.3 3.8 3.9 10.4 11.5 27.9 16.8 6.6 13.7 100.0 0.6 2.7 4.1 4.4 4.2 11.0 11.9 27.6 15.9 6.0 11.9 100.0 -0.3 -0.9 -0.1 1.5 2.4 8.1 10.3 29.1 20.5 8.8 20.5 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0309-1). Note: Tax units with children are those claiming an exemption for children at home or away from home. (1) Calendar year. Baseline is the Administration's baseline (extends all of the individual income tax provisions included in 2001 EGTRRA and 2003 JGTRRA; maintains the estate tax at its 2009 parameters; extends the 2009 AMT Patch and indexes the AMT exemption, rate bracket threshold, and phase-out exemption threshold for inflation). Proposal extends the Making Work Pay Credit (not indexed for inflation), the Earned Income Tax Credit expansion and the Saver's credit expansion. It creates automatic 401(k)s and IRAs and extends the American Opportunity Tax Credit. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 13-Mar-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0141 Administration's Fiscal Year 2010 Budget Proposals Extend the Making Work Pay Credit, Earned Income Tax Credit Expansion, Expand Refundability of Child Tax Credit Create Automatic IRAs and 401(k)s, Expand the Saver's Credit, Provide American Opportunity Tax Credit Baseline: Administration Baseline Distribution of Federal Tax Change by Cash Income Level, 2012 1 Detail Table - Elderly Tax Units Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 21.2 16.9 20.2 25.1 28.9 40.4 47.9 44.4 19.5 16.9 12.4 29.9 0.0 0.0 0.0 0.1 0.1 0.1 0.1 0.1 0.0 0.0 0.0 0.1 Percent Change in After-Tax Income 4 1.4 0.5 0.4 0.4 0.4 0.4 0.4 0.3 0.1 0.0 0.0 0.3 Share of Total Federal Tax Change 2.7 7.6 10.3 6.7 5.5 19.9 19.7 23.8 2.7 0.6 0.5 100.0 Average Federal Tax Change Dollars -79 -80 -108 -129 -159 -256 -321 -298 -108 -135 -209 -178 Percent -30.2 -16.5 -10.5 -6.9 -5.6 -3.8 -2.7 -1.2 -0.2 -0.1 0.0 -1.2 Share of Federal Taxes Change (% Points) 0.0 -0.1 -0.1 -0.1 -0.1 -0.2 -0.1 0.0 0.2 0.1 0.3 0.0 Under the Proposal 0.1 0.5 1.1 1.1 1.1 6.1 8.7 23.7 20.1 10.0 27.5 100.0 Average Federal Tax Rate5 Change (% Points) -1.3 -0.5 -0.4 -0.4 -0.3 -0.4 -0.4 -0.2 0.0 0.0 0.0 -0.2 Under the Proposal 3.0 2.5 3.6 4.8 5.6 9.9 12.8 17.2 21.9 25.3 30.1 17.1 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2012 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 1,848 5,108 5,158 2,815 1,850 4,184 3,301 4,291 1,343 244 130 30,291 6.1 16.9 17.0 9.3 6.1 13.8 10.9 14.2 4.4 0.8 0.4 100.0 Average Income (Dollars) 5,990 16,184 25,829 36,231 47,206 65,731 91,141 142,313 303,063 717,151 3,111,488 85,420 Average Federal Tax Burden (Dollars) 261 484 1,033 1,856 2,818 6,737 12,014 24,719 66,491 181,694 937,970 14,808 Average AfterTax Income 4 (Dollars) 5,729 15,700 24,797 34,375 44,388 58,994 79,127 117,594 236,572 535,458 2,173,518 70,612 Average Federal Tax Rate 5 4.4 3.0 4.0 5.1 6.0 10.3 13.2 17.4 21.9 25.3 30.2 17.3 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 0.4 3.2 5.2 3.9 3.4 10.6 11.6 23.6 15.7 6.8 15.7 100.0 0.5 3.8 6.0 4.5 3.8 11.5 12.2 23.6 14.9 6.1 13.2 100.0 0.1 0.6 1.2 1.2 1.2 6.3 8.8 23.7 19.9 9.9 27.2 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0309-1). Note: Elderly tax units are those with either head or spouse (if filing jointly) age 65 or older. (1) Calendar year. Baseline is the Administration's baseline (extends all of the individual income tax provisions included in 2001 EGTRRA and 2003 JGTRRA; maintains the estate tax at its 2009 parameters; extends the 2009 AMT Patch and indexes the AMT exemption, rate bracket threshold, and phase-out exemption threshold for inflation). Proposal extends the Making Work Pay Credit (not indexed for inflation), the Earned Income Tax Credit expansion and the Saver's credit expansion. It creates automatic 401(k)s and IRAs and extends the American Opportunity Tax Credit. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income.