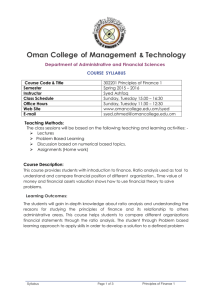

FINA 363 Finance Fundamentals March 27, 2006

advertisement

FINA 363 Finance Fundamentals March 27, 2006 Instructor: Mr. Dale Manke Office Phone 865-2815 ext. 8123 Home Phone 725-5744 E-mail manked@evangel.edu Course Description: Learners study principles and problems involved in the finance function of the firm, including taxes, cash flow, capital management, budgets, reorganization, and investments. Course Objectives: At the completion of this course the student will: Prior to and during session one 1. Categorize key participants in financial transactions and the basic activities of financial institutions. 2. Identify different measures of performance that can be used to evaluate a business firm. 3. Appreciate that cash is the lifeblood of a business enterprise. 4. Create cash budgets for the short-term. Prior to and during session two 1. Define the concept of time-value of money. 2. Realize the meaning and fundamentals of risk and return. 3. Apply the basic valuation model to all types of cash flows. 4. Value the concept of market efficiency related to valuation. Prior to and during session three 1. Calculate, interpret, and evaluate capital budgeting techniques. 2. Determine the short-term and long-term cost of capital. 3. Differentiate between debt and equity capital. Prior to and during session four 1. Recognize the financial planning process, including the role and interrelationship between long-term and short-term plans. 2. Analyze credit terms offered by suppliers. 3. Calculate effective interest rates. 4. Evaluate the lease vs. purchase decision Required Materials: Text: Principles of Managerial Finance Gitman, Lawrence, J. Eleventh edition 2006, Pearson/Addison Wesley. Calculator: Texas Instruments BA-II Plus Grade Determination Grades will be assigned according to the new scale found on page 38 in the 2004-2006 Evangel University Catalog. Grades will be determined according to the following point distribution: Point Value Chapter problems and questions 280 Attendance/Participation 80 (20 per night must be present) Course Exams 400 Total 760 Please use the grid provided to track your grade Assignment Chapter problems and questions Participation Course Exam Chapter problems and questions Participation Course Exam Chapter problems and questions Participation Course Exam Chapter problems and questions Participation Course Exam Total Points Week 1 1 1 2 2 2 3 3 3 4 4 4 Points Possible 60 20 100 80 20 100 60 20 100 80 20 100 760 Points Earned Assignments The assignments for this module are designed to enable you to continue your personal professional development. The practical nature of the Evangel University degree completion program is designed for learners to apply text theory to real-life situations. Accordingly, please be prepared to share examples with your colleagues during class time. All written homework should be presented in a professional manner. Always include appropriate headings to your papers and include your name and school number. While problem-solving work should be done on a spreadsheet program when possible, hand-written work for problems will be accepted. Finish assignments for each chapter separately for easier grading. You must show all of your work don’t just right down an answer and expect to receive credit. Late homework will be graded for half credit. In-class activities may be handwritten and informal. Please be prepared to discuss the objectives contained in the assigned readings. You may call or e-mail me with any questions you may have while completing the assignments. Homework will be collected each week. There will be an exam each night over the chapters and what we discuss in class. Week 1 To be completed prior to and submitted on the first night of class. Read Gitman, Chapter 1 THE ROLE AND ENVIRONMENT OF MANAGERIAL FINANCE Demonstrate the discipline’s importance to students of all majors and the usefulness of the topic to individuals in their roles as consumers, investors, employees, and citizens. Establish the goal of the corporation: shareholder wealth maximization. Familiarize students with concepts that will recur throughout the text, including fixed and residual claims, bonds and stocks, markets, agency problems, forms of organizations and economic considerations. Discuss the fundamentals of business taxation of ordinary income and capital gains, and explain the treatment of tax losses. Write Page 39-40 Problems 1-6, 1-8, 1-11. 20 points “SHOW ALL OF YOUR WORK” Read Gitman, Chapter 2 FINANCIAL STATEMENTS AND ANALYSIS Appreciate financial analysis more broadly than the mechanical evaluation of standard financial ratios. Evaluate the standard techniques of trend and common size analysis of financial statements and demonstrate the importance of comparing ratios and stock returns to benchmarks. Discuss the relationship between debt and financial leverage and the ratios used to analyze a firm’s debt. Analyze a firm’s profitability and its market value using ratios. Write Page 84 problem 2-3 & page 93 problem 2-20 (All the ratios from #20 will be on the exam but I will provide formulas). 20 points “SHOW ALL OF YOUR WORK” Read Gitman, Chapter 3 CASH FLOW AND FINANCIAL PLANNING Grasp the importance of cash flow. Understand why net income is not an accurate measure of cash flow. Identify several ways to estimate future cash flows. Construct a pro forma income statement. Explain the financial planning process, including long-term and short-term financial plans. Write Page 137 problem 3-3(tax rate 34%), & page 140 problem 3-10 on a spreadsheet. 20 points “SHOW ALL OF YOUR WORK” Week 2 To be completed prior to and submitted on the second night of class. Read Gitman, Chapter 4 TIME VALUE OF MONEY Distinguish between simple and compound interest and have an appreciation for the effect of compounding on either the present value or the future value of cash flows. Solve for the present value or the future value of A single cash flow using simple, or compounded interest. Solve for either the number of periods or the interest rate for a single cash flow problem where all other variables are known. Solve a multiple cash flow problem by continuously applying the single cash flow technique. Solve for annuities and perpetuities. Understand and solve loan amortization problems as being an application of the annuity problem. Write Page 204-215 problems 1, 4, 7, 11, 16, 18a(1), 19a(1), 21a.b.c, 25b, 30, & 46 (a loan amortization schedule is on page 194 table 4.8). 20 points “SHOW ALL OF YOUR WORK” Read Gitman, Chapter 5 RISK AND RETURN Review the meaning and fundamentals of risk, return, and risk preferences. Analyze the portfolio effect; the risk of diversified portfolios is reduced to market risk only. Discuss the measurement of return and standard deviation for a portfolio and the various types of correlation Identify the origin and application of beta. Discuss the security market line and the capital asset pricing model and their application to security pricing. Write Page 264 Problem 5-10 using a spreadsheet & page 269 problem 5-22. 20 points. “SHOW ALL OF YOUR WORK” Read Gitman, Chapter 6 INTEREST RATES AND BOND VALUATION Describe interest rate fundamentals, the term structure of interest rates, and risk premiums. Apply the basic valuation model to bonds and describe the impact of required return and time to maturity on bond values. Solve for the price of a bond. Write Page 313-320 problems 6-3, 6-11, 6-16, 6-24, 6-25. 20 points “SHOW ALL OF YOUR WORK” Read Gitman, Chapter 7 STOCK VALUATION Differentiate between debt and equity capital. Discuss the concept of market efficiency and basic common stock valuation under zero growth and constant growth. Solve for the price of a share of preferred stock. Solve for the price of a share of common stock whose dividends are judged to grow at a constant rate. Explain the relationships among financial decisions, return, risk, and the firm’s value. Write Page 361-362 problems 7-5, 7-7, 7-8, 7-9. 20 points “SHOW ALL OF YOUR WORK” Week 3 To be completed prior to and submitted on the third night of class. Read Gitman, Chapter 9 CAPITAL BUDGETING TECHNIQUES Introduce students to the basics of the corporate investment decision. Recognize how markets create investment opportunities. Calculate, interpret, and evaluate three capital budgeting techniques; payback period, net present value and internal rate of return Provide an opportunity to synthesize and reinforce much of the material covered in previous chapters. Write Page 438-442 problems 9-3, 9-5, 9-10, 9-12, 9-16a&c then page 440 problem 9-9 using a spreadsheet. 20 points “SHOW ALL OF YOUR WORK” Read Gitman, Chapter 11 THE COST OF CAPITAL Estimate the after-tax cost of debt, the cost of preferred stock, and the cost of equity using two methods; the CAPM approach and the discounted cash flow approach. Adjust these estimates for the costs of raising capital from outside sources Combine all previous objectives and calculate the WACC. Explain the RADR and when it should be used rather than the WACC. Write Page 526-530 problems 11-6, 11-9, 11-16. 20 points “SHOW ALL OF YOUR WORK” Read Gitman, Chapter 12 LEVERAGE AND CAPITAL STRUCTURE Explain how the “magnifying” effect of debt’s use on both good and bad operating results may increase the expected level of cash flows but also may increase risk. Realize that when corporations are taxed, debt acts as a tax shield and can increase the firms’ value. Recognize that debt forces the firm to pay out a part of its free cash flow, thereby lowering potential agency costs and increasing the value of the firm. Discuss the use of debt as a credible signal that the expected level of future cash flows is high enough to meet fixed obligations. Discover that the optimal capital structure is a trade-off that balances the benefits of leverage against the likelihood and size of potential bankruptcy costs Write Page 576 problem 12-5 & page 583 problem 12-23 using a spreadsheet. 20 points “SHOW ALL OF YOUR WORK” Week 4 To be completed prior to and submitted on the fourth night of class. Read Gitman, Chapter 13 DIVIDEND POLICY Realize that divided policy impacts stockholders’ wealth. Discover that the board of directors of a company is responsible for synthesizing residual dividend policy, the implications of signaling, investor expectations, and agency costs. Combine all of the above into a coherent logical approach to setting dividend policy and come up with the value of the dividend. Explain stock repurchases, stock dividends, and stock splits and why such actions may (or may not) affect stockholders’ wealth. Write Page 614-616 problems 13-3, 13-7 & 13-11. 20 points “SHOW ALL OF YOUR WORK” Read Gitman, Chapter 14 WORKING CAPITAL AND CURRENT ASSETS MANAGEMENT Introduce the concept of working capital and how working capital management adds value to the firm. Present what managers must address in striking a balance in managing cash, inventory and receivables. Describe the cash conversion cycle, its funding requirements, and the key strategies for managing it. Identify with the management of receipts and disbursements, including float, speeding collections, slowing payments, zero balance accounts, and investing in marketable securities. Write Page 660-663 problems 14-1, 14-3 & 14-13. 20 points “SHOW ALL OF YOUR WORK” Read Gitman, Chapter 15 CURRENT LIABILITIES MANAGEMENT Review the key components of a firm’s credit terms and the procedures for analyzing them. Realize the effects of stretching accounts payable with the firms’ suppliers. Describe the interest rates and basic types of unsecured bank sources of shortterm loans. Calculate effective interest rates. Write Page 694-696 problems 15-2, 15-8, 15-9, 15-10, 15-13. 20 points “SHOW ALL OF YOUR WORK” Read Gitman, Chapter 16, pp 708 – 717 (just the part on leasing) LEASING vs. BORROW PURCHASE Review the basic types of leases and leasing arrangements. Evaluate the lease-versus-purchase decision. Describe the effects of leasing on future financing and the advantages and disadvantages of leasing. Write Page 737 problem 16-4. 20 points “SHOW ALL OF YOUR WORK”