Type III Banking Executive Summary

advertisement

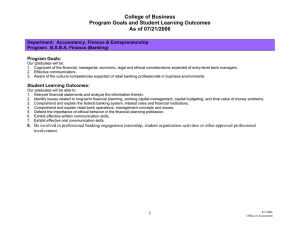

Type III Banking Executive Summary This paper outlines the evolution of retail banking towards an emerging service oriented culture which we call ‘Type III’. Type III banking involves the adoption of customer centric multi channel model which creates competitive advantage for those who learn, apply and adapt to the changes it requires. Opportunities from adopting this model arise for the following reasons: • • • Currently successful (Type II) banks have not configured themselves around this new model and are struggling (some of them terminally) to do so. This process of industry restructuring is already in place (the longest upswing in the banking cycle since the 19th century has just come to an end, globally). There are a number of current strategic opportunities for those banks who are less adapted to the current structure, either because they are new to the industry or they have smaller scale and thus are less embedded in the existing approach than their current dominant rivals. The competitive (evolutionary) process – how one type replaces another, and how the industry evolves Over the last thirty years each epoch has produced a dominant model of what a successful retail bank looks like. Epoch/Dates 1/1973-1986 II/1986-2006 III/2006+ Name Banking as a club Banking as manufacturing (mass production) Customer centric banking (customised services) Environmental condition Regulation of access to market – low level competition (zero entry for instance in product or capital markets: you couldn’t become a bank nor could you buy one) Emerging pan European competition, increased regulatory oversight of customer proposition. Successful banks characteristics Conservative centralised control driven, transparent Deregulation of access in product and capital markets: building societies become banks and banks become takeover targets, scale driven contested takeover – intracountry (not intercountry), increasing competition, but customer inertia. Opportunity to create scale economies by consolidation. Reason for existence Regulatory response (BofE) secondary banking collapse of early 1970s Cost focussed, IT competent, acquisitive (of customers and businesses), back office efficiency driven Use of risk data to improve customer proposition in multi product. Beating slow market growth, delivering customer returns and reducing inertia End of epoch Deregulation and globalisation 1980s Poor risk management at customer level, lack of organic growth, shareholder ? Innovative, organic growth, strong retail brnad, strategically focused. dissatisfaction. Type I banks were removed in the 90s by the process of competitive entry into either the product market (Type 1 banks lost customers to new entrants) or more usually by entry into the capital market. But more usually it is entry into the capital markets. This is a shareholder driven shift, since they are the main beneficiaries. The current epoch in European retail banking is characterised by consolidation of banking models into a single dominant type (type II). A type II bank is characterised by excellence in manufacturing, leading to cost efficiency. However a Type III bank is beginning to emerge, because evolutionary processes are restless and epoch II will give way to epoch III. Currently there is evidence that a type III bank will be different to a type II bank in that it will be much more focussed on the consumer experience and on service (it will be a customer centric bank) it may operate effectively in a broader range of businesses and it may be more innovative. The Emerging Competitive Landscape in UK Retail banking The first epoch in retail banking is the period before financial deregulation (1980), but after the secondary banking crisis of the early 1970s we characterise this epoch as Type I banking or banking as a club. ‘Excessive’ competition in the UK was implicitly discouraged by the Bank of England (as regulator – a role it appears to be keen to resurrect) in order to prevent a repetition of the disasters of the 1970s. This scenario may return to haunt us, currently there is a strong ‘consumer protection’, agenda which is beginning to appear in the form of regulatory oversight and in the popular press. Deregulation in 1986 changed type I and transformed UK retail financial services into a vigorously competitive and highly profitable industry. Strategies changed radically and profits rose dramatically. This second epoch , which we define as Type II banking, is the period which is currently coming to an end (banking as manufacturing). There is an emerging third epoch, a period which begins about now. There are examples of banks which have developed type III strategies – but they are few and generally highly successful in the markets they operate in. This period or epoch characterised by shareholder dissatisfaction with poor organic revenue growth, especially in large retail focussed banks. It is further motivated by vocal customer dissatisfaction. Another feature is attempts by the senior management of those banks to use an efficient manufacturing business, configured around mass production of products and highly geared sales machines, to generate a customer centric service proposition. A type II bank cannot act like a type III bank: it has to stop being a type II bank first. A type III bank does not manufacture products but provides a service, and service can only be provided for and with a customer in mind. Such a bank, a type III bank also moves away from a sales and acquisition mindset to a service and customer retention mindset, with a set of technologies which allow such a shift in the basic interface between a bank and its customers. Type III banking is customer centric banking rather than product and scale focused. Strategic Implications of Type III banking for Current Players There are two main implications of this shift in the banking market for bank strategies. First, how does a bank begin the process of making this vision effective? How will the industry create type III banking? Second the industry needs to envision is a Type III bank looks like, since there are clear implications for the manufacturing strategies research in the last 15 years in order to make it fit for purpose in a type III banking environment. The Move from Type II to III: how will it happen? Our basic approach is evolutionary: industrial systems evolve the way biological systems do. And, just as evolution is the process by which complex biological processes move ahead, it is also an essential tool for bringing coherence to the complexities of industries such as retail banking. It enables us to understand long term shifts in the competitive landscape and the strategic opportunities these shifts create. If we measure the average characteristics of the population of firms in the banking industry in 1980, and then measured them again in 1990, and then again in 2000, on each occasion the characteristics would look very different. And moreover the differences between 1990 and 2000 would be greater than between 1980 and 1990: this is not a cyclical but a progressive and cumulative progress of change. This is just an empirical regularity: things change and they don’t go back. The value of the evolutionary model is that it asserts certain hypotheses about the way things change and the processes underlying change. What we are trying to develop here is a picture of what a bank in 2010 might look like and how different is it from a bank in 2000 In order to successfully thrive (rather than just survive) in one set of environmental conditions an organisation (or organism) has to become specialised in doing what is ideal in those conditions. The organisation becomes predictably good at what it does; consistent in its behaviour and a reliable source of the benefits it creates for its stakeholders because it is in tune with its environment. In retail banking the environment is the industry and in Epoch I the environment in the UK presented little or no competitive threat, it was slow growing. Costs were high, product ranges were narrow, and retail customers paid a lot for a fairly basic service. This is a type 1 bank. Epoch II began with a bang, in 1986, and was characterised at the industry level by entry of type 2 banks. The key stakeholder in this was the shareholder, who selected type II over type one by voting for acquisitions of the latter by the former. The actual stakeholders or the regulator may shift: for instance, the shift to epoch 3 may be initiated by customers rather than shareholders selecting type three banks, and indeed this may be already be happening. The interesting aspect of this for successful type II banks in the UK is that the normal strategy process involves becoming better and better at being what you are. But this strategy process is not what is needed to make a transition from type II to type III. And that is why the most successful banks each year are the ones who are least successful now. For instance, to succeed as a type 1 bank (pre 1986) banks have to be reliable, consistent, predictable and focussed. This tended to cause successful organisation to de select initiatives which were outside the type 1 landscape (efficient execution of a type 1 strategy requires this). So for instance they didn’t look for rapid growth by diversification, they didn’t make significant investments in new technologies, they did not challenge the regulatory structure of the industry. There are certain organisational features of such typically the management style is centralised, top down, controlled and transparent. The people who ran banks in this period were also like this. One phrase for this is “vectored” (a phrase Andy Grove coined to describe how he eradicated unnecessary activities at Intel when he was turning it into a microprocessor company). An organisation which is highly programmed becomes a specialised and ruthlessly efficient species (or ‘type’) and this causes it to struggle as it shifts to Type 1. Such organisations for instance fail to generate any variation in their strategies and this results in lock in, and inertia when the epoch (or market) begins to shift. Thus, the better you are at being a type II bank the less likely you are to make a rapid shift to type III. This means that (generally) the strategy process needs to be devolved and the process of creatively experimenting with new strategies needs to be encouraged alongside the specialisation activities required to succeed in the current environment. The ideally structured organisation ie one which is fully exploiting type II whilst also fully exploring type III. Most banks find this very hard to do. How a successful type II bank could become a type III bank is a legitimate concern for stakeholders (including the management) of such an organisation. Senior management (the main board and the layer reporting into them), have made their careers by creating a type II organisation. This has involved in them being utterly convinced that this is the correct way to run a bank, and convincing everyone around them that this is true as well. It is very hard to be equally convincing that this is now absolutely value destroying and then to move the organisation to a new vector with at least the same level of conviction as before. So frequently the move from one type to another is very painful, time consuming and involves a lot of blood letting at senior management level, nearly always involving the CEO exiting the company. This evolutionary model can be applied to all industries. For instance from 1968-1985 Intel was a Memory company (type 1) and then switched from 1985-1998 to being a Microprocessor company and from 1998-present as an Internet building block company (a fancy term for a technology conglomerate). In each case it was a change in the industry which led Intel to adapt its strategy. As another example, from its foundation in 1986 (as a spin off from Racal) Vodafone was a technology company, until the arrival in 1993 of Chris Gent who turned it into a network company (a netco), which ended in 2000 when it became a services company (a servco). Similar shifts will take place in Retail banking. More or less it asserts that the characteristics (which we call the type) of the average firm change because the firms without these characteristics are forced to exit the industry (eg RBS bought Nat West and HSBC bought Midland, both examples of type II buying type I banks). Acquisitions move us from one epoch to another because that is one process (or strategy) the industry uses to adapt to change and because certain firms, which do possess them, enter the industry (eg HSBC, NAG, Santander, MBNA entering UK financial services). The power of the argument is this: that the characteristics of the average firm (the industry type) changes not because the incumbents (the previous type) learn or adapt, but because they fail to learn and adapt. Industry Epochs and Firm Types: What does a Type III bank look like? The second outcome is to examine substantively what a type 3 bank might look like: this looks at the content of a type three strategy rather than the management process by which it evolves and is implemented. Generally there are two sources of such evidence: the external stakeholders (eg, customers, shareholders) and the internal stakeholder (eg, staff, senior management) which looks at how the organisation may be developing new routines to respond to this external selection process. Interestingly, Intel did not copy its rivals, it continued with its generic strategy of producing highly R and D intensive products, this led it to Intel producing the first microprocessor, which they sold to IBM who put it inside the first PC and this led to Intel becoming the dominant hardware company in the information age. Applying this logic to predicting a type 3 banking model, we might predict that this could be a customer centric strategy. This would mean that the business should already be finding that the offerings it makes now are becoming less attractive to customers. Low retention for instance implies that retail banks are being deselected for long term financial relationships, that their type II strategies are ‘vectored’ to produce low cost products through a channel configuration which maintains efficiency at the transaction level, but is costly at the customer or relationship level. One would expect such organisations to stick to their generic strategy from type 2 and to create new experiments in the market place which are based on traditional cost effective manufacturing processes and in this way to slowly kill themselves. Banks may seek to develop a competence in how to create a scaleable customer centric service offer, which exploits the manufacturing competence the type II business has. If a type II bank discovers how to add the back end manufacturing systems efficiently in a service system, the may find they have created a powerful new strategic trajectory, not just for themselves but for the industry. Branch Data Call Data Online Data Broker Data Existing CRM systems Product (legacy) integrated data warehouse Customer Planning Software Tools Middleware Current account systems Personal loans systems Mortgage systems Integrated customer centric product strategy Customer strategy - personalised - segmented Channel legacy integrated data warehouse Integrated customer centric channel strategy Middleware Credit card systems Conclusions: Implications of this Research Our view is that the current turmoil in the credit markets are a direct result of the retail distribution models which have served banks well (were very well adapted) to an expanding economy in which credit services were increasingly deregulated, both in terms of access (ie who could buy and who could sell credit) and conduct (ie how lending was done). In fact it was pretty close to unregulated as is now becoming clear, with large financial services firms ( such as Northern Rock, Soc Gen and others we do not know about yet, but who will emerge and which this model will allow us to predict) given a great deal of autonomy over their product portfolios and their distribution of these products. The result was a massive ( but for many years profitable) expansion of retail debt. This includes mortgage debt, and this is where the problems are first being felt, but there are problems down the line in automotive finance, unsecured lending, and SME business lending on almost the same scale. Guess which big automobile company is most exposed to the credit crunch? The outcomes will be 1 A wave of mergers across and between Europe and North America as the more stable banks (ie those who did not expand their retail businesses too fast in the 1990s and early 2000s) buy up the market shares of their less successful rivals. 2 A change in strategy (eventually) of these larger businesses to be significantly more aware of the entire customer relationship with their organisation and a desire to make this relationship more stable. This will have a particular impact on those markets where sales (origination) of products is driven by independent brokers. The role of brokers has been to drive new, lower quality sales towards the less secure lenders (Northern Rock was particularly dependent on mortgage brokers). There will be increasing pressure to look at the data protection act to allow banks to share information with each other (data fusion) in order to continue to expand their lending. A sensible policy would be for regulators to refuse this and to thereby force banks to learn how to talk to their customers. 3 A call (from large established lenders) for regulation of the broker markets by the FSA, and a major new piece of legislation to give the FSA or the Bank of England (or both ) powers over the brokers and the lenders they want to regulate respectively. 4 Significant losses in the retail banking sector in 2008/9 as these “false” positions of excessively poor quality loans are accounted for (currently banks are taking it in turns to write down $2b to $3b each, at the rate of about 1 every 3 days: some are on their second round of this carousel). Many will make three rounds or more at this level. That’s a lot of equity to lose. 5 A very significant proportion of the UK equity market is based on large banks, and this will impact on the value of our shares, our pensions and our overall feeling of financial security. This will have a very significant impact on consumer confidence, as will the decline in house prices as mortgage lending collapses (along with our pensions, the main source of wealth we all hold) and this will increase significantly the downward (ie recessionary) pressure on the main industrialised economies. This will be particularly pronounced in the US and in the UK: in the latter it has hardly begun and in the former there is much, much further to run. Current reductions in US interest rates look rather desperate and are possibly futile, given that the problem is not lack of money book poor asset quality. But expect more of this panic.