Assignment brief

advertisement

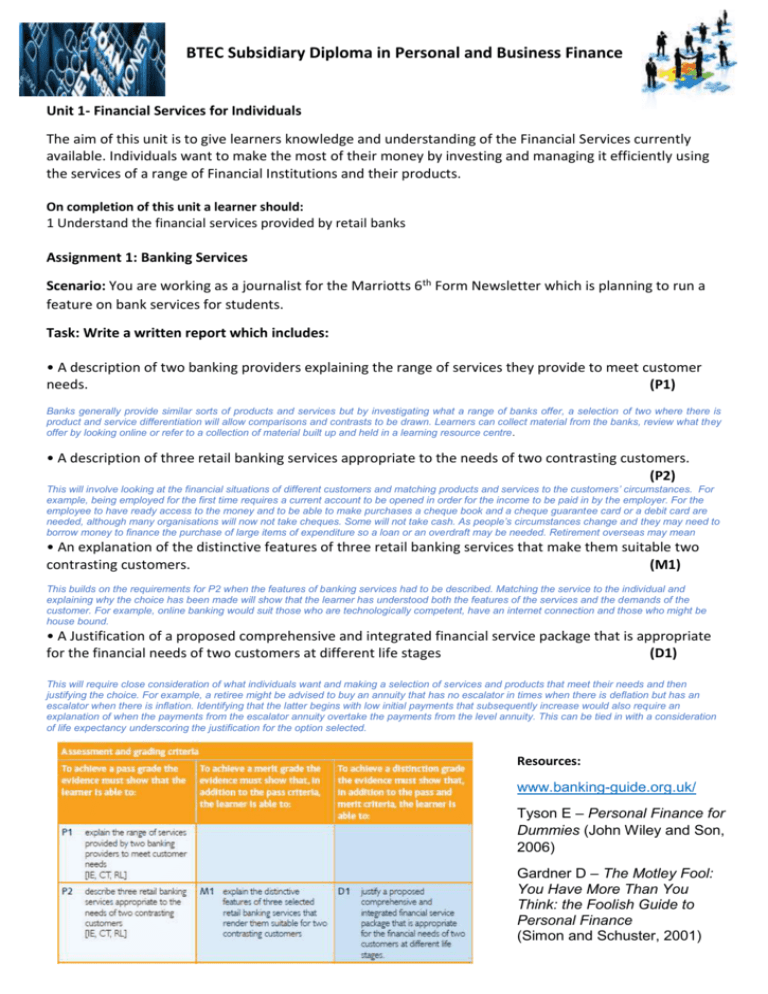

BTEC Subsidiary Diploma in Personal and Business Finance Unit 1- Financial Services for Individuals The aim of this unit is to give learners knowledge and understanding of the Financial Services currently available. Individuals want to make the most of their money by investing and managing it efficiently using the services of a range of Financial Institutions and their products. On completion of this unit a learner should: 1 Understand the financial services provided by retail banks Assignment 1: Banking Services Scenario: You are working as a journalist for the Marriotts 6th Form Newsletter which is planning to run a feature on bank services for students. Task: Write a written report which includes: • A description of two banking providers explaining the range of services they provide to meet customer needs. (P1) Banks generally provide similar sorts of products and services but by investigating what a range of banks offer, a selection of two where there is product and service differentiation will allow comparisons and contrasts to be drawn. Learners can collect material from the banks, review what they offer by looking online or refer to a collection of material built up and held in a learning resource centre. • A description of three retail banking services appropriate to the needs of two contrasting customers. (P2) This will involve looking at the financial situations of different customers and matching products and services to the customers’ circumstances. For example, being employed for the first time requires a current account to be opened in order for the income to be paid in by the employer. For the employee to have ready access to the money and to be able to make purchases a cheque book and a cheque guarantee card or a debit card are needed, although many organisations will now not take cheques. Some will not take cash. As people’s circumstances change and they may need to borrow money to finance the purchase of large items of expenditure so a loan or an overdraft may be needed. Retirement overseas may mean • An explanation of the distinctive features of three retail banking services that make them suitable two contrasting customers. (M1) This builds on the requirements for P2 when the features of banking services had to be described. Matching the service to the individual and explaining why the choice has been made will show that the learner has understood both the features of the services and the demands of the customer. For example, online banking would suit those who are technologically competent, have an internet connection and those who might be house bound. • A Justification of a proposed comprehensive and integrated financial service package that is appropriate for the financial needs of two customers at different life stages (D1) This will require close consideration of what individuals want and making a selection of services and products that meet their needs and then justifying the choice. For example, a retiree might be advised to buy an annuity that has no escalator in times when there is deflation but has an escalator when there is inflation. Identifying that the latter begins with low initial payments that subsequently increase would also require an explanation of when the payments from the escalator annuity overtake the payments from the level annuity. This can be tied in with a consideration of life expectancy underscoring the justification for the option selected. Resources: www.banking-guide.org.uk/ Tyson E – Personal Finance for Dummies (John Wiley and Son, 2006) Gardner D – The Motley Fool: You Have More Than You Think: the Foolish Guide to Personal Finance (Simon and Schuster, 2001)