29-May-09 PRELIMINARY RESULTS Less than 10 10-20

advertisement

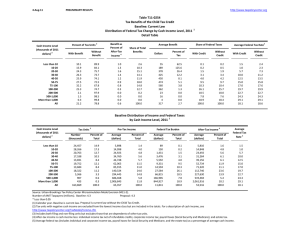

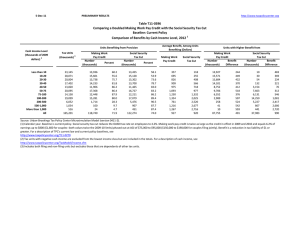

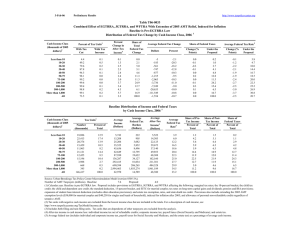

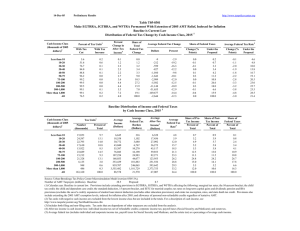

29-May-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Click on PDF or Excel link above for additional tables containing more detail and breakdowns by filing status and demographic groups. Table T09-0302 Administration's Fiscal Year 2010 Budget Proposals Extend the Making Work Pay Credit, Earned Income Tax Credit Expansion, Expand Refundability of Child Tax Credit Create Automatic IRAs and 401(k)s, Expand the Saver's Credit, Provide American Opportunity Tax Credit Baseline: Administration Baseline Distribution of Federal Tax Change by Cash Income Level, 2012 1 Summary Table Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut 66.9 65.7 75.3 82.2 84.8 87.2 89.0 80.1 35.4 19.4 14.5 75.8 With Tax Increase 0.0 0.2 0.2 0.2 0.0 0.1 0.3 0.3 0.0 0.0 0.0 0.2 Percent Change in After-Tax Income 4 5.8 3.6 2.5 2.0 1.6 1.3 1.0 0.7 0.1 0.0 0.0 1.0 Share of Total Federal Tax Change 5.7 14.0 13.5 11.1 8.9 17.0 11.2 16.5 1.5 0.2 0.1 100.0 Average Federal Tax Change ($) -312 -534 -591 -634 -639 -691 -716 -731 -233 -215 -240 -586 Average Federal Tax Rate 5 Change (% Points) -5.5 -3.5 -2.3 -1.8 -1.4 -1.1 -0.8 -0.5 -0.1 0.0 0.0 -0.8 Under the Proposal -0.1 1.1 6.5 11.1 14.0 16.4 18.4 21.1 24.1 25.4 29.6 19.9 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-1). Number of AMT Taxpayers (millions). Baseline: 5.1 Proposal: 5.0 (1) Calendar year. Administration baseline extends the 2009 AMT patch and indexes the AMT exemption, rate bracket threshold, and phaseout exemption threshold for inflation; makes the 2001 and 2003 individual income tax cuts permanent and makes 2009 estate tax law permanent. Proposal would: (a) extend the Making Work Pay Credit, reduce the phase-out rate to 1.6 percent, and index the phase-out thesholds for inflation after 2010; (b) extend the higher EITC credit value for families with 3 children and higher phase-out threshold for married couples; (c) modify the saver's credit making it equal to 50% of the first $500 of retirement savings ($1,000 for couples) and fully refundable; (d) create automatic 401(k)s and IRAs; (e) extend the American Opportunity Tax Credit; (f) extend the $3,000 child tax credit refundability threshold. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 29-May-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0302 Administration's Fiscal Year 2010 Budget Proposals Extend the Making Work Pay Credit, Earned Income Tax Credit Expansion, Expand Refundability of Child Tax Credit Create Automatic IRAs and 401(k)s, Expand the Saver's Credit, Provide American Opportunity Tax Credit Baseline: Administration Baseline 1 Distribution of Federal Tax Change by Cash Income Level, 2012 Detail Table Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units With Tax Cut 3 With Tax Increase 66.9 65.7 75.3 82.2 84.8 87.2 89.0 80.1 35.4 19.4 14.5 75.8 0.0 0.2 0.2 0.2 0.0 0.1 0.3 0.3 0.0 0.0 0.0 0.2 Percent Change in After-Tax Income 4 Share of Total Federal Tax Change 5.8 3.6 2.5 2.0 1.6 1.3 1.0 0.7 0.1 0.0 0.0 1.0 5.7 14.0 13.5 11.1 8.9 17.0 11.2 16.5 1.5 0.2 0.1 100.0 Average Federal Tax Change Dollars -312 -534 -591 -634 -639 -691 -716 -731 -233 -215 -240 -586 Percent -102.5 -75.1 -26.3 -13.7 -9.0 -6.2 -4.2 -2.4 -0.3 -0.1 0.0 -3.7 Share of Federal Taxes Change (% Points) -0.2 -0.5 -0.5 -0.3 -0.2 -0.3 -0.1 0.4 0.6 0.3 0.8 0.0 Under the Proposal 0.0 0.2 1.5 2.7 3.5 10.0 10.0 25.8 17.8 7.9 20.5 100.0 Average Federal Tax Rate 5 Change (% Points) -5.5 -3.5 -2.3 -1.8 -1.4 -1.1 -0.8 -0.5 -0.1 0.0 0.0 -0.8 Under the Proposal -0.1 1.1 6.5 11.1 14.0 16.4 18.4 21.1 24.1 25.4 29.6 19.9 Baseline Distribution of Income and Federal Taxes 1 by Cash Income Level, 2012 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) 16,867 24,202 21,129 16,119 12,811 22,730 14,433 20,762 5,989 1,052 533 157,348 Percent of Total 10.7 15.4 13.4 10.2 8.1 14.5 9.2 13.2 3.8 0.7 0.3 100.0 Average Income (Dollars) 5,698 15,471 25,711 36,076 46,449 63,828 89,794 140,646 294,838 703,124 3,105,866 76,169 Average Federal Tax Burden (Dollars) 305 710 2,250 4,637 7,131 11,176 17,198 30,389 71,232 178,856 919,118 15,744 Average AfterTax Income 4 (Dollars) 5,393 14,761 23,461 31,438 39,319 52,652 72,596 110,257 223,607 524,267 2,186,748 60,424 Average Federal Tax Rate 5 5.4 4.6 8.8 12.9 15.4 17.5 19.2 21.6 24.2 25.4 29.6 20.7 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 0.8 3.1 4.5 4.9 5.0 12.1 10.8 24.4 14.7 6.2 13.8 100.0 1.0 3.8 5.2 5.3 5.3 12.6 11.0 24.1 14.1 5.8 12.3 100.0 0.2 0.7 1.9 3.0 3.7 10.3 10.0 25.5 17.2 7.6 19.8 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-1). Number of AMT Taxpayers (millions). Baseline: 5.1 Proposal: 5.0 (1) Calendar year. Administration baseline extends the 2009 AMT patch and indexes the AMT exemption, rate bracket threshold, and phaseout exemption threshold for inflation; makes the 2001 and 2003 individual income tax cuts permanent and makes 2009 estate tax law permanent. Proposal would: (a) extend the Making Work Pay Credit, reduce the phase-out rate to 1.6 percent, and index the phase-out thesholds for inflation after 2010; (b) extend the higher EITC credit value for families with 3 children and higher phase-out threshold for married couples; (c) modify the saver's credit making it equal to 50% of the first $500 of retirement savings ($1,000 for couples) and fully refundable; (d) create automatic 401(k)s and IRAs; (e) extend the American Opportunity Tax Credit; (f) extend the $3,000 child tax credit refundability threshold. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 29-May-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0302 Administration's Fiscal Year 2010 Budget Proposals Extend the Making Work Pay Credit, Earned Income Tax Credit Expansion, Expand Refundability of Child Tax Credit Create Automatic IRAs and 401(k)s, Expand the Saver's Credit, Provide American Opportunity Tax Credit Baseline: Administration Baseline Distribution of Federal Tax Change by Cash Income Level, 2012 1 Detail Table - Single Tax Units Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Increase With Tax Cut 66.6 57.2 70.4 80.7 83.9 84.5 83.4 31.1 9.7 10.1 4.8 68.7 0.0 0.3 0.1 0.0 0.0 0.0 0.0 0.0 0.0 0.1 0.0 0.1 Percent Change in After-Tax Income 4 5.1 2.2 1.7 1.6 1.1 0.9 0.6 0.1 0.0 0.0 0.0 1.0 Share of Total Federal Tax Change 13.3 19.4 18.0 14.8 10.6 16.0 5.7 1.7 0.3 0.0 0.0 100.0 Average Federal Tax Change Dollars -265 -313 -386 -468 -426 -434 -378 -120 -80 -76 -69 -348 Percent -54.9 -24.4 -11.5 -7.5 -4.8 -3.2 -1.8 -0.4 -0.1 0.0 0.0 -3.8 Share of Federal Taxes Change (% Points) -0.5 -0.7 -0.5 -0.3 -0.1 0.1 0.3 0.7 0.4 0.2 0.5 0.0 Under the Proposal 0.4 2.4 5.5 7.2 8.3 19.0 12.3 18.7 9.8 4.4 11.9 100.0 Average Federal Tax Rate5 Change (% Points) -4.7 -2.0 -1.5 -1.3 -0.9 -0.7 -0.4 -0.1 0.0 0.0 0.0 -0.8 Under the Proposal 3.8 6.4 11.7 16.0 18.2 20.8 23.2 24.2 25.1 27.5 32.4 20.1 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2012 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 12,093 14,849 11,214 7,581 5,967 8,814 3,630 3,425 789 138 75 68,932 17.5 21.5 16.3 11.0 8.7 12.8 5.3 5.0 1.1 0.2 0.1 100.0 Average Income (Dollars) 5,684 15,322 25,573 36,006 46,386 62,955 88,784 136,925 299,674 695,858 2,961,621 43,878 Average Federal Tax Burden (Dollars) 482 1,286 3,371 6,225 8,879 13,521 20,931 33,201 75,425 191,298 958,491 9,146 Average AfterTax Income 4 (Dollars) 5,203 14,036 22,202 29,781 37,507 49,433 67,854 103,724 224,249 504,560 2,003,130 34,731 Average Federal Tax Rate 5 8.5 8.4 13.2 17.3 19.1 21.5 23.6 24.3 25.2 27.5 32.4 20.8 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 2.3 7.5 9.5 9.0 9.2 18.4 10.7 15.5 7.8 3.2 7.4 100.0 2.6 8.7 10.4 9.4 9.4 18.2 10.3 14.8 7.4 2.9 6.3 100.0 0.9 3.0 6.0 7.5 8.4 18.9 12.1 18.0 9.4 4.2 11.4 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-1). (1) Calendar year. Administration baseline extends the 2009 AMT patch and indexes the AMT exemption, rate bracket threshold, and phaseout exemption threshold for inflation; makes the 2001 and 2003 individual income tax cuts permanent and makes 2009 estate tax law permanent. Proposal would: (a) extend the Making Work Pay Credit, reduce the phase-out rate to 1.6 percent, and index the phase-out thesholds for inflation after 2010; (b) extend the higher EITC credit value for families with 3 children and higher phase-out threshold for married couples; (c) modify the saver's credit making it equal to 50% of the first $500 of retirement savings ($1,000 for couples) and fully refundable; (d) create automatic 401(k)s and IRAs; (e) extend the American Opportunity Tax Credit; (f) extend the $3,000 child tax credit refundability threshold. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 29-May-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0302 Administration's Fiscal Year 2010 Budget Proposals Extend the Making Work Pay Credit, Earned Income Tax Credit Expansion, Expand Refundability of Child Tax Credit Create Automatic IRAs and 401(k)s, Expand the Saver's Credit, Provide American Opportunity Tax Credit Baseline: Administration Baseline Distribution of Federal Tax Change by Cash Income Level, 2012 1 Detail Table - Married Tax Units Filing Jointly Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Increase With Tax Cut 50.1 66.2 67.3 71.6 78.1 85.9 90.0 92.9 40.5 21.2 16.5 77.6 0.0 0.0 0.0 0.3 0.1 0.1 0.4 0.4 0.0 0.0 0.0 0.2 Percent Change in After-Tax Income 4 5.9 4.9 3.5 2.7 2.3 1.7 1.2 0.8 0.1 0.1 0.0 0.8 Share of Total Federal Tax Change 1.2 6.3 8.4 7.9 8.0 18.9 16.3 29.5 2.6 0.4 0.2 100.0 Average Federal Tax Change Dollars -267 -764 -862 -889 -979 -949 -884 -895 -260 -239 -277 -807 Percent -116.8 -173.3 -73.8 -32.5 -20.4 -10.4 -5.7 -3.0 -0.4 -0.1 0.0 -3.0 Share of Federal Taxes Change (% Points) 0.0 -0.2 -0.3 -0.2 -0.2 -0.4 -0.2 0.0 0.6 0.3 0.7 0.0 Under the Proposal 0.0 -0.1 0.1 0.5 1.0 5.0 8.3 29.3 21.9 9.7 24.3 100.0 Average Federal Tax Rate5 Change (% Points) -5.6 -4.8 -3.3 -2.5 -2.1 -1.5 -1.0 -0.6 -0.1 0.0 0.0 -0.6 Under the Proposal -0.8 -2.0 1.2 5.1 8.2 12.6 16.2 20.3 23.9 25.1 29.1 20.8 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2012 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,164 4,064 4,828 4,406 4,057 9,840 9,114 16,285 4,998 880 437 61,357 3.5 6.6 7.9 7.2 6.6 16.0 14.9 26.5 8.2 1.4 0.7 100.0 Average Income (Dollars) 4,748 15,973 25,857 36,192 46,612 64,984 90,400 141,926 294,061 704,704 3,067,872 126,020 Average Federal Tax Burden (Dollars) 228 441 1,168 2,739 4,804 9,109 15,516 29,768 70,524 177,065 892,687 26,988 Average AfterTax Income 4 (Dollars) 4,520 15,532 24,689 33,453 41,808 55,874 74,885 112,159 223,537 527,638 2,175,185 99,032 Average Federal Tax Rate 5 4.8 2.8 4.5 7.6 10.3 14.0 17.2 21.0 24.0 25.1 29.1 21.4 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 0.1 0.8 1.6 2.1 2.5 8.3 10.7 29.9 19.0 8.0 17.3 100.0 0.2 1.0 2.0 2.4 2.8 9.1 11.2 30.1 18.4 7.6 15.6 100.0 0.0 0.1 0.3 0.7 1.2 5.4 8.5 29.3 21.3 9.4 23.5 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-1). (1) Calendar year. Administration baseline extends the 2009 AMT patch and indexes the AMT exemption, rate bracket threshold, and phaseout exemption threshold for inflation; makes the 2001 and 2003 individual income tax cuts permanent and makes 2009 estate tax law permanent. Proposal would: (a) extend the Making Work Pay Credit, reduce the phase-out rate to 1.6 percent, and index the phase-out thesholds for inflation after 2010; (b) extend the higher EITC credit value for families with 3 children and higher phase-out threshold for married couples; (c) modify the saver's credit making it equal to 50% of the first $500 of retirement savings ($1,000 for couples) and fully refundable; (d) create automatic 401(k)s and IRAs; (e) extend the American Opportunity Tax Credit; (f) extend the $3,000 child tax credit refundability threshold. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 29-May-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0302 Administration's Fiscal Year 2010 Budget Proposals Extend the Making Work Pay Credit, Earned Income Tax Credit Expansion, Expand Refundability of Child Tax Credit Create Automatic IRAs and 401(k)s, Expand the Saver's Credit, Provide American Opportunity Tax Credit Baseline: Administration Baseline Distribution of Federal Tax Change by Cash Income Level, 2012 1 Detail Table - Head of Household Tax Units Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Increase With Tax Cut 82.8 89.1 93.7 96.4 96.7 96.6 96.5 41.6 11.1 14.8 5.5 90.3 0.0 0.0 0.7 0.2 0.0 0.0 0.0 0.0 0.0 0.2 0.0 0.2 Percent Change in After-Tax Income 4 8.3 6.2 3.2 2.1 1.6 1.3 0.8 0.2 0.1 0.0 0.0 2.0 Share of Total Federal Tax Change 8.2 28.3 21.5 14.6 8.5 13.2 4.5 1.0 0.2 0.0 0.0 100.0 Average Federal Tax Change Dollars Percent -591 -1,008 -807 -688 -620 -655 -573 -191 -217 -176 -87 -726 114.8 116.0 -146.0 -19.9 -9.6 -6.1 -3.2 -0.6 -0.3 -0.1 0.0 -12.7 Share of Federal Taxes Change (% Points) -1.3 -4.5 -2.9 -0.8 0.4 2.1 1.9 2.7 1.1 0.4 1.0 0.0 Under the Proposal -2.2 -7.6 -1.0 8.5 11.6 29.5 19.7 21.9 8.5 3.2 7.9 100.0 Average Federal Tax Rate5 Change (% Points) -8.9 -6.5 -3.1 -1.9 -1.3 -1.0 -0.7 -0.1 -0.1 0.0 0.0 -1.7 Under the Proposal -16.7 -12.1 -1.0 7.7 12.6 16.1 19.5 22.7 23.7 24.1 30.0 12.0 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2012 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,467 4,998 4,757 3,777 2,442 3,577 1,399 895 150 24 11 24,547 10.1 20.4 19.4 15.4 10.0 14.6 5.7 3.7 0.6 0.1 0.0 100.0 Average Income (Dollars) 6,622 15,513 25,869 36,040 46,392 62,829 88,811 132,422 294,067 684,765 2,969,130 41,760 Average Federal Tax Burden (Dollars) -515 -869 552 3,462 6,461 10,781 17,891 30,299 69,939 164,861 891,050 5,737 Average AfterTax Income 4 (Dollars) 7,137 16,382 25,316 32,578 39,932 52,047 70,920 102,123 224,127 519,904 2,078,079 36,023 Average Federal Tax Rate 5 -7.8 -5.6 2.1 9.6 13.9 17.2 20.1 22.9 23.8 24.1 30.0 13.7 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 1.6 7.6 12.0 13.3 11.1 21.9 12.1 11.6 4.3 1.6 3.2 100.0 2.0 9.3 13.6 13.9 11.0 21.1 11.2 10.3 3.8 1.4 2.6 100.0 -0.9 -3.1 1.9 9.3 11.2 27.4 17.8 19.3 7.5 2.8 6.9 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-1). (1) Calendar year. Administration baseline extends the 2009 AMT patch and indexes the AMT exemption, rate bracket threshold, and phaseout exemption threshold for inflation; makes the 2001 and 2003 individual income tax cuts permanent and makes 2009 estate tax law permanent. Proposal would: (a) extend the Making Work Pay Credit, reduce the phase-out rate to 1.6 percent, and index the phase-out thesholds for inflation after 2010; (b) extend the higher EITC credit value for families with 3 children and higher phase-out threshold for married couples; (c) modify the saver's credit making it equal to 50% of the first $500 of retirement savings ($1,000 for couples) and fully refundable; (d) create automatic 401(k)s and IRAs; (e) extend the American Opportunity Tax Credit; (f) extend the $3,000 child tax credit refundability threshold. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 29-May-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0302 Administration's Fiscal Year 2010 Budget Proposals Extend the Making Work Pay Credit, Earned Income Tax Credit Expansion, Expand Refundability of Child Tax Credit Create Automatic IRAs and 401(k)s, Expand the Saver's Credit, Provide American Opportunity Tax Credit Baseline: Administration Baseline 1 Distribution of Federal Tax Change by Cash Income Level, 2012 Detail Table - Tax Units with Children Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units With Tax Cut 3 With Tax Increase 83.1 96.4 97.6 98.7 98.7 98.8 98.3 94.2 39.3 18.6 14.1 92.0 0.0 0.0 0.4 0.0 0.0 0.0 0.6 0.6 0.1 0.0 0.1 0.3 Percent Change in After-Tax Income 4 8.9 7.3 4.3 3.1 2.5 1.9 1.3 0.9 0.1 0.1 0.0 1.3 Share of Total Federal Tax Change 3.9 14.8 13.5 10.5 8.4 15.6 11.6 19.4 1.7 0.2 0.1 100.0 Average Federal Tax Change Dollars Percent -620 -1,255 -1,127 -1,022 -1,036 -1,000 -949 -980 -296 -257 -297 -966 85.9 86.1 656.3 -37.1 -17.9 -10.0 -5.8 -3.3 -0.4 -0.1 0.0 -5.0 Share of Federal Taxes Change (% Points) -0.2 -0.8 -0.7 -0.5 -0.3 -0.4 -0.1 0.5 1.0 0.5 1.1 0.0 Average Federal Tax Rate 5 Under the Proposal Change (% Points) Under the Proposal -0.4 -1.7 -0.8 0.9 2.0 7.4 9.9 29.9 22.0 9.2 21.5 100.0 -10.0 -8.0 -4.4 -2.8 -2.2 -1.6 -1.1 -0.7 -0.1 0.0 0.0 -1.0 -21.6 -17.3 -5.0 4.8 10.2 14.0 17.0 20.4 24.4 26.6 30.3 19.3 Baseline Distribution of Income and Federal Taxes 1 by Cash Income Level, 2012 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,948 5,596 5,687 4,892 3,846 7,413 5,821 9,378 2,778 445 207 49,155 6.0 11.4 11.6 10.0 7.8 15.1 11.8 19.1 5.7 0.9 0.4 100.0 Average Income (Dollars) 6,225 15,695 25,809 36,039 46,542 64,136 90,376 141,540 292,361 702,705 3,097,146 95,419 Average Federal Tax Burden (Dollars) -722 -1,458 -172 2,754 5,774 10,006 16,297 29,821 71,682 187,184 937,935 19,342 Average AfterTax Income 4 (Dollars) 6,947 17,153 25,980 33,285 40,768 54,130 74,078 111,719 220,679 515,521 2,159,211 76,077 Average Federal Tax Rate 5 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total -11.6 -9.3 -0.7 7.6 12.4 15.6 18.0 21.1 24.5 26.6 30.3 20.3 0.4 1.9 3.1 3.8 3.8 10.1 11.2 28.3 17.3 6.7 13.7 100.0 0.6 2.6 4.0 4.4 4.2 10.7 11.5 28.0 16.4 6.1 12.0 100.0 -0.2 -0.9 -0.1 1.4 2.3 7.8 10.0 29.4 20.9 8.8 20.4 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-1). Note: Tax units with children are those claiming an exemption for children at home or away from home. (1) Calendar year. Administration baseline extends the 2009 AMT patch and indexes the AMT exemption, rate bracket threshold, and phaseout exemption threshold for inflation; makes the 2001 and 2003 individual income tax cuts permanent and makes 2009 estate tax law permanent. Proposal would: (a) extend the Making Work Pay Credit, reduce the phase-out rate to 1.6 percent, and index the phase-out thesholds for inflation after 2010; (b) extend the higher EITC credit value for families with 3 children and higher phase-out threshold for married couples; (c) modify the saver's credit making it equal to 50% of the first $500 of retirement savings ($1,000 for couples) and fully refundable; (d) create automatic 401(k)s and IRAs; (e) extend the American Opportunity Tax Credit; (f) extend the $3,000 child tax credit refundability threshold. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 29-May-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0302 Administration's Fiscal Year 2010 Budget Proposals Extend the Making Work Pay Credit, Earned Income Tax Credit Expansion, Expand Refundability of Child Tax Credit Create Automatic IRAs and 401(k)s, Expand the Saver's Credit, Provide American Opportunity Tax Credit Baseline: Administration Baseline 1 Distribution of Federal Tax Change by Cash Income Level, 2012 Detail Table - Elderly Tax Units Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units With Tax Cut 3 With Tax Increase 15.6 14.1 23.3 27.7 29.8 44.3 47.9 43.2 23.5 17.2 12.4 28.6 0.0 0.1 0.0 0.1 0.0 0.1 0.0 0.2 0.0 0.0 0.0 0.1 Percent Change in After-Tax Income 4 0.9 0.4 0.5 0.4 0.4 0.5 0.4 0.3 0.1 0.0 0.0 0.3 Share of Total Federal Tax Change 2.3 8.1 11.4 8.5 7.5 24.9 15.8 17.4 2.8 0.7 0.5 100.0 Average Federal Tax Change Dollars -52 -64 -115 -143 -170 -289 -322 -295 -126 -137 -209 -167 Percent -26.7 -16.6 -10.4 -6.7 -5.6 -4.5 -2.8 -1.2 -0.2 -0.1 0.0 -1.3 Share of Federal Taxes Change (% Points) 0.0 -0.1 -0.1 -0.1 -0.1 -0.2 -0.1 0.0 0.2 0.1 0.4 0.0 Under the Proposal 0.1 0.5 1.3 1.5 1.7 6.9 7.2 19.0 19.4 10.9 31.3 100.0 Average Federal Tax Rate 5 Change (% Points) -0.8 -0.4 -0.5 -0.4 -0.4 -0.5 -0.4 -0.2 0.0 0.0 0.0 -0.2 Under the Proposal 2.3 2.1 3.9 5.6 6.2 9.6 12.8 17.5 22.2 24.5 30.1 17.0 Baseline Distribution of Income and Federal Taxes 1 by Cash Income Level, 2012 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,290 6,436 5,081 3,028 2,243 4,407 2,503 3,022 1,130 246 132 30,543 7.5 21.1 16.6 9.9 7.3 14.4 8.2 9.9 3.7 0.8 0.4 100.0 Average Income (Dollars) 6,340 15,603 25,455 35,926 46,389 64,259 88,731 141,022 303,653 708,629 3,089,249 75,737 Average Federal Tax Burden (Dollars) 196 388 1,101 2,137 3,061 6,438 11,670 25,008 67,620 173,400 928,588 13,011 Average AfterTax Income 4 (Dollars) 6,144 15,216 24,354 33,788 43,328 57,820 77,061 116,014 236,033 535,230 2,160,661 62,726 Average Federal Tax Rate 5 3.1 2.5 4.3 6.0 6.6 10.0 13.2 17.7 22.3 24.5 30.1 17.2 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 0.6 4.3 5.6 4.7 4.5 12.2 9.6 18.4 14.8 7.5 17.7 100.0 0.7 5.1 6.5 5.3 5.1 13.3 10.1 18.3 13.9 6.9 14.9 100.0 0.1 0.6 1.4 1.6 1.7 7.1 7.4 19.0 19.2 10.7 30.9 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-1). Note: Elderly tax units are those with either head or spouse (if filing jointly) age 65 or older. (1) Calendar year. Administration baseline extends the 2009 AMT patch and indexes the AMT exemption, rate bracket threshold, and phaseout exemption threshold for inflation; makes the 2001 and 2003 individual income tax cuts permanent and makes 2009 estate tax law permanent. Proposal would: (a) extend the Making Work Pay Credit, reduce the phase-out rate to 1.6 percent, and index the phase-out thesholds for inflation after 2010; (b) extend the higher EITC credit value for families with 3 children and higher phase-out threshold for married couples; (c) modify the saver's credit making it equal to 50% of the first $500 of retirement savings ($1,000 for couples) and fully refundable; (d) create automatic 401(k)s and IRAs; (e) extend the American Opportunity Tax Credit; (f) extend the $3,000 child tax credit refundability threshold. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income.