14-Aug-08 PRELIMINARY RESULTS

advertisement

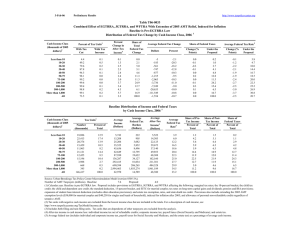

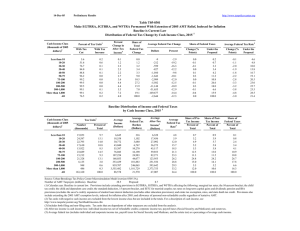

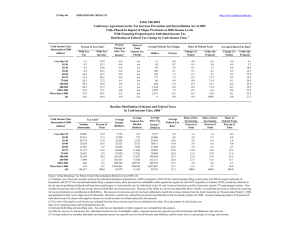

14-Aug-08 PRELIMINARY RESULTS http://www.taxpolicycenter.org Click on PDF or Excel link above for additional tables containing more detail and breakdowns by filing status and demographic groups. Table T08-0200 Make 2001-06 Tax Cuts Permanent and Extend AMT Patch Distribution of Federal Tax Change by Cash Income Level, 2012 Summary Table Cash Income Level (thousands of 2008 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut 2.7 44.4 77.4 89.1 93.6 97.5 99.0 99.5 99.6 99.1 99.6 75.6 With Tax Increase 1.1 1.5 0.8 0.3 0.2 0.2 0.1 0.1 0.1 0.1 0.0 0.6 Percent Change in After-Tax Income 4 0.1 1.0 2.4 2.6 2.5 2.8 3.4 4.4 4.9 5.3 7.8 4.2 Share of Total Federal Tax Change 0.0 0.9 2.8 3.1 3.0 8.1 9.0 26.4 17.1 7.3 22.4 100.0 1 Average Federal Tax Change ($) -5 -147 -568 -842 -1,007 -1,506 -2,527 -4,898 -10,816 -27,517 -169,090 -2,643 Average Federal Tax Rate 5 Change (% Points) -0.1 -0.9 -2.1 -2.2 -2.1 -2.2 -2.7 -3.3 -3.5 -3.7 -5.1 -3.2 Under the Proposal 5.3 4.6 9.1 13.2 16.1 18.1 19.4 21.7 24.4 25.7 29.2 21.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0308-6). Number of AMT Taxpayers (millions). Baseline: 22.7 Proposal: 6.1 (1) Calendar year. Baseline is pre-EGTRRA law. Proposal: (1) makes permanent the individual income and estate tax provisions in the 2001-06 tax cuts currently set to expire at the end of 2010; (2) makes permanent the retirement savings provisions in EGTRRA; (3) extends the 2007 AMT patch and indexes the AMT exemption for inflation. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 14-Aug-08 PRELIMINARY RESULTS Click on PDF or Excel link above for additional tables containing more detail and breakdowns by filing status and demographic groups. http://www.taxpolicycenter.org Table T08-0200 Make 2001-06 Tax Cuts Permanent and Extend AMT Patch Distribution of Federal Tax Change by Cash Income Level, 2012 1 Detail Table Cash Income Level (thousands of 2008 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 2.7 44.4 77.4 89.1 93.6 97.5 99.0 99.5 99.6 99.1 99.6 75.6 1.1 1.5 0.8 0.3 0.2 0.2 0.1 0.1 0.1 0.1 0.0 0.6 Percent Change in After-Tax Income 4 0.1 1.0 2.4 2.6 2.5 2.8 3.4 4.4 4.9 5.3 7.8 4.2 Share of Total Federal Tax Change 0.0 0.9 2.8 3.1 3.0 8.1 9.0 26.4 17.1 7.3 22.4 100.0 Average Federal Tax Change Dollars -5 -147 -568 -842 -1,007 -1,506 -2,527 -4,898 -10,816 -27,517 -169,090 -2,643 Percent -1.5 -16.4 -18.7 -14.4 -11.3 -11.0 -12.1 -13.2 -12.5 -12.7 -15.0 -13.1 Share of Federal Taxes Change (% Points) 0.0 0.0 -0.1 0.0 0.1 0.2 0.1 0.0 0.1 0.0 -0.4 0.0 Under the Proposal 0.2 0.7 1.8 2.8 3.5 9.9 9.9 26.3 18.0 7.6 19.2 100.0 Average Federal Tax Rate 5 Change (% Points) Under the Proposal -0.1 -0.9 -2.1 -2.2 -2.1 -2.2 -2.7 -3.3 -3.5 -3.7 -5.1 -3.2 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2012 1 Cash Income Level (thousands of 2008 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) 16,546 24,280 20,001 15,128 12,063 22,213 14,729 22,218 6,499 1,087 546 156,009 Percent of Total 10.6 15.6 12.8 9.7 7.7 14.2 9.4 14.2 4.2 0.7 0.4 100.0 Average Income (Dollars) 6,019 16,259 27,053 37,907 48,997 67,389 94,738 148,087 309,272 739,526 3,289,961 83,049 Average Federal Tax Burden (Dollars) 325 897 3,031 5,851 8,895 13,687 20,895 37,099 86,377 217,528 1,127,972 20,108 Average AfterTax Income 4 (Dollars) 5,694 15,362 24,022 32,055 40,102 53,702 73,843 110,988 222,895 521,998 2,161,989 62,941 Average Federal Tax Rate 5 5.4 5.5 11.2 15.4 18.2 20.3 22.1 25.1 27.9 29.4 34.3 24.2 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 0.8 3.1 4.2 4.4 4.6 11.6 10.8 25.4 15.5 6.2 13.9 100.0 1.0 3.8 4.9 4.9 4.9 12.2 11.1 25.1 14.8 5.8 12.0 100.0 0.2 0.7 1.9 2.8 3.4 9.7 9.8 26.3 17.9 7.5 19.6 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0308-6). Number of AMT Taxpayers (millions). Baseline: 22.7 Proposal: 6.1 (1) Calendar year. Baseline is pre-EGTRRA law. Proposal: (1) makes permanent the individual income and estate tax provisions in the 2001-06 tax cuts currently set to expire at the end of 2010; (2) makes permanent the retirement savings provisions in EGTRRA; (3) extends the 2007 AMT patch and indexes the AMT exemption for inflation. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 5.3 4.6 9.1 13.2 16.1 18.1 19.4 21.7 24.4 25.7 29.2 21.0 14-Aug-08 PRELIMINARY RESULTS Click on PDF or Excel link above for additional tables containing more detail and breakdowns by filing status and demographic groups. http://www.taxpolicycenter.org Table T08-0200 Make 2001-06 Tax Cuts Permanent and Extend AMT Patch Distribution of Federal Tax Change by Cash Income Level, 2012 1 Detail Table - Single Tax Units Cash Income Level (thousands of 2008 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 2.4 47.7 75.6 92.6 97.2 98.5 98.9 98.6 99.1 99.0 99.1 65.3 1.0 1.2 0.5 0.2 0.1 0.1 0.2 0.1 0.1 0.0 0.0 0.6 Percent Change in After-Tax Income 4 0.0 0.9 1.7 1.7 1.7 2.5 3.5 4.7 8.0 10.6 14.7 3.9 Share of Total Federal Tax Change 0.0 2.2 4.3 3.9 3.8 12.3 9.7 18.4 15.2 7.9 22.1 100.0 Average Federal Tax Change Dollars -1 -134 -384 -523 -642 -1,291 -2,405 -4,882 -17,502 -53,384 -297,690 -1,378 Percent -0.2 -9.3 -9.5 -7.2 -6.2 -8.2 -9.8 -12.3 -18.5 -22.9 -23.5 -12.5 Share of Federal Taxes Change (% Points) 0.1 0.1 0.2 0.4 0.6 0.9 0.4 0.0 -0.7 -0.5 -1.5 0.0 Under the Proposal 0.9 3.0 5.8 7.1 8.3 19.6 12.7 18.7 9.6 3.8 10.3 100.0 Average Federal Tax Rate 5 Change (% Points) Under the Proposal 0.0 -0.8 -1.4 -1.4 -1.3 -1.9 -2.6 -3.4 -5.6 -7.2 -9.1 -3.0 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2012 1 Cash Income Level (thousands of 2008 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 12,033 15,257 10,409 6,929 5,586 8,900 3,777 3,528 811 138 69 67,788 17.8 22.5 15.4 10.2 8.2 13.1 5.6 5.2 1.2 0.2 0.1 100.0 Average Income (Dollars) 6,036 16,104 26,937 37,831 48,999 66,503 93,400 143,053 313,377 737,609 3,290,833 46,595 Average Federal Tax Burden (Dollars) 472 1,438 4,041 7,231 10,320 15,719 24,472 39,636 94,645 233,535 1,269,092 11,029 Average AfterTax Income 4 (Dollars) 5,564 14,666 22,896 30,600 38,679 50,784 68,929 103,417 218,733 504,074 2,021,741 35,566 Average Federal Tax Rate 5 7.8 8.9 15.0 19.1 21.1 23.6 26.2 27.7 30.2 31.7 38.6 23.7 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 2.3 7.8 8.9 8.3 8.7 18.7 11.2 16.0 8.0 3.2 7.2 100.0 2.8 9.3 9.9 8.8 9.0 18.8 10.8 15.1 7.4 2.9 5.8 100.0 0.8 2.9 5.6 6.7 7.7 18.7 12.4 18.7 10.3 4.3 11.8 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0308-6). Number of AMT Taxpayers (millions). Baseline: 22.7 Proposal: 6.1 (1) Calendar year. Baseline is pre-EGTRRA law. Proposal: (1) makes permanent the individual income and estate tax provisions in the 2001-06 tax cuts currently set to expire at the end of 2010; (2) makes permanent the retirement savings provisions in EGTRRA; (3) extends the 2007 AMT patch and indexes the AMT exemption for inflation. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 7.8 8.1 13.6 17.7 19.8 21.7 23.6 24.3 24.6 24.4 29.5 20.7 14-Aug-08 PRELIMINARY RESULTS Click on PDF or Excel link above for additional tables containing more detail and breakdowns by filing status and demographic groups. http://www.taxpolicycenter.org Table T08-0200 Make 2001-06 Tax Cuts Permanent and Extend AMT Patch Distribution of Federal Tax Change by Cash Income Level, 2012 1 Detail Table - Married Tax Units Filing Jointly Cash Income Level (thousands of 2008 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 5.8 33.4 68.6 76.6 85.0 96.1 99.1 99.6 99.7 99.3 99.7 86.7 2.0 1.6 1.4 0.6 0.5 0.2 0.1 0.0 0.0 0.0 0.0 0.4 Percent Change in After-Tax Income 4 0.5 1.0 2.8 3.3 3.1 2.8 3.4 4.4 4.5 4.5 6.9 4.5 Share of Total Federal Tax Change 0.0 0.2 1.1 1.6 1.7 5.1 8.4 31.0 19.3 7.7 23.8 100.0 Average Federal Tax Change Dollars -25 -158 -694 -1,114 -1,316 -1,601 -2,589 -4,991 -9,929 -23,782 -147,489 -4,630 Percent -7.4 -24.5 -33.6 -26.6 -19.1 -13.7 -13.5 -13.6 -11.7 -11.1 -13.6 -13.2 Share of Federal Taxes Change (% Points) 0.0 0.0 -0.1 -0.1 -0.1 0.0 0.0 -0.2 0.4 0.2 -0.1 0.0 Under the Proposal 0.0 0.1 0.3 0.7 1.1 4.9 8.2 29.9 22.2 9.4 23.0 100.0 Average Federal Tax Rate 5 Change (% Points) Under the Proposal -0.5 -0.9 -2.6 -2.9 -2.7 -2.3 -2.7 -3.3 -3.2 -3.2 -4.6 -3.3 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2012 1 Cash Income Level (thousands of 2008 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,059 3,695 4,653 4,125 3,572 9,064 9,144 17,526 5,479 913 455 60,954 3.4 6.1 7.6 6.8 5.9 14.9 15.0 28.8 9.0 1.5 0.8 100.0 Average Income (Dollars) 5,102 16,805 27,081 37,989 49,128 68,660 95,433 149,607 308,576 739,970 3,227,576 138,787 Average Federal Tax Burden (Dollars) 333 643 2,068 4,198 6,894 11,719 19,159 36,630 85,207 215,255 1,085,284 35,070 Average AfterTax Income 4 (Dollars) 4,769 16,163 25,013 33,791 42,234 56,941 76,275 112,977 223,369 524,715 2,142,292 103,717 Average Federal Tax Rate 5 6.5 3.8 7.6 11.1 14.0 17.1 20.1 24.5 27.6 29.1 33.6 25.3 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 0.1 0.7 1.5 1.9 2.1 7.4 10.3 31.0 20.0 8.0 17.4 100.0 0.2 0.9 1.8 2.2 2.4 8.2 11.0 31.3 19.4 7.6 15.4 100.0 0.0 0.1 0.5 0.8 1.2 5.0 8.2 30.0 21.8 9.2 23.1 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0308-6). Number of AMT Taxpayers (millions). Baseline: 22.7 Proposal: 6.1 (1) Calendar year. Baseline is pre-EGTRRA law. Proposal: (1) makes permanent the individual income and estate tax provisions in the 2001-06 tax cuts currently set to expire at the end of 2010; (2) makes permanent the retirement savings provisions in EGTRRA; (3) extends the 2007 AMT patch and indexes the AMT exemption for inflation. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 6.0 2.9 5.1 8.1 11.4 14.7 17.4 21.2 24.4 25.9 29.1 21.9 14-Aug-08 PRELIMINARY RESULTS Click on PDF or Excel link above for additional tables containing more detail and breakdowns by filing status and demographic groups. http://www.taxpolicycenter.org Table T08-0200 Make 2001-06 Tax Cuts Permanent and Extend AMT Patch Distribution of Federal Tax Change by Cash Income Level, 2012 1 Detail Table - Head of Household Tax Units Cash Income Level (thousands of 2008 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 1.1 40.2 88.8 95.5 97.4 98.8 99.2 99.5 98.6 98.0 99.8 75.0 1.1 2.6 0.8 0.3 0.2 0.1 0.0 0.0 0.0 0.1 0.0 0.8 Percent Change in After-Tax Income 4 0.1 1.0 3.3 3.5 3.3 3.2 3.4 3.3 3.4 4.3 7.6 3.2 Share of Total Federal Tax Change 0.1 3.0 13.3 14.5 11.6 21.3 12.6 11.6 4.1 1.9 6.1 100.0 Average Federal Tax Change Dollars -6 -172 -847 -1,141 -1,333 -1,689 -2,435 -3,442 -7,748 -22,213 -159,244 -1,189 Percent 1.4 26.3 -54.5 -23.2 -16.1 -12.8 -11.2 -9.7 -9.4 -10.9 -14.4 -15.5 Share of Federal Taxes Change (% Points) -0.1 -0.9 -1.7 -0.9 -0.1 0.8 0.9 1.3 0.5 0.2 0.1 0.0 Under the Proposal -0.7 -2.6 2.0 8.8 11.0 26.6 18.2 19.8 7.3 2.8 6.7 100.0 Average Federal Tax Rate 5 Change (% Points) Under the Proposal -0.1 -1.1 -3.1 -3.0 -2.7 -2.5 -2.6 -2.5 -2.5 -3.1 -5.0 -2.6 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2012 1 Cash Income Level (thousands of 2008 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,316 5,047 4,615 3,737 2,547 3,703 1,518 988 156 25 11 24,714 9.4 20.4 18.7 15.1 10.3 15.0 6.1 4.0 0.6 0.1 0.1 100.0 Average Income (Dollars) 6,761 16,328 27,243 37,894 48,781 66,425 93,959 139,901 310,610 727,675 3,207,147 45,216 Average Federal Tax Burden (Dollars) -471 -652 1,554 4,925 8,281 13,230 21,719 35,681 82,743 204,646 1,104,387 7,691 Average AfterTax Income 4 (Dollars) 7,232 16,980 25,689 32,969 40,500 53,195 72,240 104,220 227,867 523,029 2,102,760 37,525 Average Federal Tax Rate 5 -7.0 -4.0 5.7 13.0 17.0 19.9 23.1 25.5 26.6 28.1 34.4 17.0 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 1.4 7.4 11.3 12.7 11.1 22.0 12.8 12.4 4.3 1.6 3.3 100.0 1.8 9.2 12.8 13.3 11.1 21.2 11.8 11.1 3.8 1.4 2.6 100.0 -0.6 -1.7 3.8 9.7 11.1 25.8 17.3 18.5 6.8 2.7 6.6 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0308-6). Number of AMT Taxpayers (millions). Baseline: 22.7 Proposal: 6.1 (1) Calendar year. Baseline is pre-EGTRRA law. Proposal: (1) makes permanent the individual income and estate tax provisions in the 2001-06 tax cuts currently set to expire at the end of 2010; (2) makes permanent the retirement savings provisions in EGTRRA; (3) extends the 2007 AMT patch and indexes the AMT exemption for inflation. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. -7.1 -5.0 2.6 10.0 14.2 17.4 20.5 23.0 24.1 25.1 29.5 14.4 14-Aug-08 PRELIMINARY RESULTS Click on PDF or Excel link above for additional tables containing more detail and breakdowns by filing status and demographic groups. http://www.taxpolicycenter.org Table T08-0200 Make 2001-06 Tax Cuts Permanent and Extend AMT Patch Distribution of Federal Tax Change by Cash Income Level, 2012 1 Detail Table - Tax Units with Children Cash Income Level (thousands of 2008 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 1.7 45.5 90.4 97.1 98.1 99.1 99.6 99.9 99.8 99.5 99.8 87.0 1.4 2.8 1.0 0.4 0.2 0.2 0.1 0.0 0.0 0.1 0.0 0.6 Percent Change in After-Tax Income 4 0.3 1.3 4.2 4.4 4.1 3.7 4.1 4.9 4.4 4.8 7.0 4.7 Share of Total Federal Tax Change 0.0 0.7 3.3 3.9 3.6 8.2 9.7 29.8 16.4 6.4 18.1 100.0 Average Federal Tax Change Dollars -19 -237 -1,086 -1,465 -1,671 -2,029 -3,079 -5,445 -9,760 -24,521 -148,457 -3,710 Percent 2.8 19.0 -99.2 -32.0 -20.8 -15.8 -15.0 -14.6 -11.3 -10.9 -13.2 -14.5 Share of Federal Taxes Change (% Points) 0.0 -0.2 -0.5 -0.4 -0.2 -0.1 -0.1 0.0 0.8 0.4 0.3 0.0 Under the Proposal -0.2 -0.7 0.0 1.4 2.3 7.4 9.3 29.5 21.8 8.9 20.1 100.0 Average Federal Tax Rate 5 Change (% Points) -0.3 -1.4 -4.0 -3.9 -3.4 -3.0 -3.2 -3.7 -3.2 -3.3 -4.6 -3.5 Under the Proposal -10.6 -9.0 0.0 8.2 13.0 15.9 18.3 21.3 24.9 27.0 30.1 20.8 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2012 1 Cash Income Level (thousands of 2008 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,594 5,296 5,529 4,775 3,857 7,346 5,684 9,906 3,045 476 220 48,864 5.3 10.8 11.3 9.8 7.9 15.0 11.6 20.3 6.2 1.0 0.5 100.0 Average Income (Dollars) 6,371 16,585 27,153 37,955 49,028 67,754 95,395 149,292 307,399 739,676 3,238,329 105,014 Average Federal Tax Burden (Dollars) -658 -1,250 1,095 4,581 8,030 12,813 20,529 37,310 86,407 224,391 1,124,201 25,577 Average AfterTax Income 4 (Dollars) 7,028 17,835 26,058 33,374 40,998 54,940 74,866 111,982 220,992 515,284 2,114,128 79,438 Average Federal Tax Rate 5 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total -10.3 -7.5 4.0 12.1 16.4 18.9 21.5 25.0 28.1 30.3 34.7 24.4 0.3 1.7 2.9 3.5 3.7 9.7 10.6 28.8 18.2 6.9 13.9 100.0 0.5 2.4 3.7 4.1 4.1 10.4 11.0 28.6 17.3 6.3 12.0 100.0 -0.1 -0.5 0.5 1.8 2.5 7.5 9.3 29.6 21.1 8.5 19.8 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0308-6). Number of AMT Taxpayers (millions). Baseline: 22.7 Proposal: 6.1 Note: Tax units with children are those claiming an exemption for children at home or away from home. (1) Calendar year. Baseline is pre-EGTRRA law. Proposal: (1) makes permanent the individual income and estate tax provisions in the 2001-06 tax cuts currently set to expire at the end of 2010; (2) makes permanent the retirement savings provisions in EGTRRA; (3) extends the 2007 AMT patch and indexes the AMT exemption for inflation. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 14-Aug-08 PRELIMINARY RESULTS Click on PDF or Excel link above for additional tables containing more detail and breakdowns by filing status and demographic groups. http://www.taxpolicycenter.org Table T08-0200 Make 2001-06 Tax Cuts Permanent and Extend AMT Patch Distribution of Federal Tax Change by Cash Income Level, 2012 1 Detail Table - Elderly Tax Units Cash Income Level (thousands of 2008 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 0.5 14.3 41.6 56.7 69.1 92.1 97.9 98.8 99.1 98.2 99.5 56.7 0.4 0.2 0.4 0.4 0.2 0.2 0.1 0.1 0.2 0.0 0.1 0.2 Percent Change in After-Tax Income 4 0.0 0.4 0.9 1.5 1.9 2.9 3.5 4.8 7.0 7.5 10.6 5.0 Share of Total Federal Tax Change 0.0 0.4 1.1 1.3 1.4 7.0 7.9 20.6 20.3 9.6 30.1 100.0 Average Federal Tax Change Dollars -1 -61 -237 -515 -846 -1,707 -2,770 -5,514 -16,022 -39,276 -225,562 -3,250 Percent -0.5 -13.6 -16.0 -18.9 -18.8 -17.9 -17.4 -17.5 -18.9 -18.1 -19.7 -18.5 Share of Federal Taxes Change (% Points) 0.0 0.0 0.0 0.0 0.0 0.1 0.1 0.3 -0.1 0.1 -0.4 0.0 Under the Proposal 0.1 0.6 1.3 1.3 1.4 7.3 8.6 22.0 19.8 9.9 27.8 100.0 Average Federal Tax Rate 5 Change (% Points) Under the Proposal 0.0 -0.4 -0.9 -1.4 -1.7 -2.5 -2.9 -3.8 -5.1 -5.3 -6.9 -3.9 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2012 1 Cash Income Level (thousands of 2008 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,539 6,918 4,634 2,493 1,658 4,080 2,843 3,711 1,258 243 133 30,530 8.3 22.7 15.2 8.2 5.4 13.4 9.3 12.2 4.1 0.8 0.4 100.0 Average Income (Dollars) 6,784 16,273 26,676 37,627 49,112 67,978 94,250 147,138 315,492 740,468 3,269,522 82,817 Average Federal Tax Burden (Dollars) 192 450 1,480 2,723 4,502 9,513 15,945 31,501 84,837 217,395 1,142,678 17,598 Average AfterTax Income 4 (Dollars) 6,591 15,823 25,196 34,904 44,610 58,464 78,305 115,637 230,655 523,073 2,126,844 65,219 Average Federal Tax Rate 5 2.8 2.8 5.6 7.2 9.2 14.0 16.9 21.4 26.9 29.4 35.0 21.3 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 0.7 4.5 4.9 3.7 3.2 11.0 10.6 21.6 15.7 7.1 17.2 100.0 0.8 5.5 5.9 4.4 3.7 12.0 11.2 21.6 14.6 6.4 14.2 100.0 0.1 0.6 1.3 1.3 1.4 7.2 8.4 21.8 19.9 9.9 28.2 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0308-6). Number of AMT Taxpayers (millions). Baseline: 22.7 Proposal: 6.1 Note: Elderly tax units are those with either head or spouse (if filing jointly) age 65 or older. (1) Calendar year. Baseline is pre-EGTRRA law. Proposal: (1) makes permanent the individual income and estate tax provisions in the 2001-06 tax cuts currently set to expire at the end of 2010; (2) makes permanent the retirement savings provisions in EGTRRA; (3) extends the 2007 AMT patch and indexes the AMT exemption for inflation. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 2.8 2.4 4.7 5.9 7.4 11.5 14.0 17.7 21.8 24.1 28.1 17.3