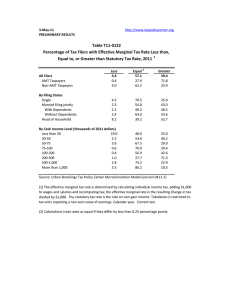

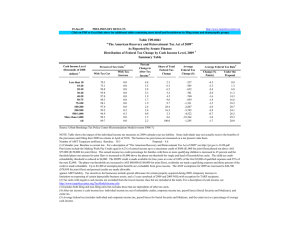

3-Jun-08 PRELIMINARY RESULTS Group 2007

advertisement

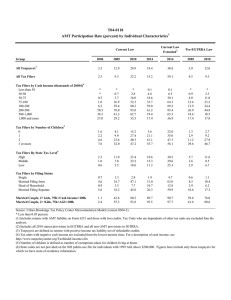

3-Jun-08 http://www.taxpolicycenter.org PRELIMINARY RESULTS T08-0096 AMT Participation Rate (percent) by Individual Characteristics Current Law Extended2 Current Law Group 1 Pre-EGTRRA Law 2007 2008 2009 2010 2018 2018 2008 2010 All Taxpayers 3 4.5 33.8 32.1 34.8 38.0 51.8 13.5 17.8 All Tax Filers 3.2 20.8 23.1 25.3 30.3 39.6 10.3 13.7 Tax Filers by Cash Income (thousands of 2008$) 4 Less than 30 30-50 50-75 75-100 100-200 200-500 500-1,000 1,000 and more 0.0 0.0 0.2 0.6 3.6 47.0 57.2 37.3 0.0 1.4 10.1 35.5 71.0 91.4 69.6 43.7 0.0 1.8 12.6 41.8 75.2 93.1 70.3 43.2 0.0 2.4 15.2 45.9 78.2 94.2 76.9 47.3 0.1 11.4 29.4 52.5 67.6 81.3 29.6 21.4 0.1 12.3 38.1 67.6 92.0 97.0 77.7 43.4 0.0 1.6 7.8 21.0 28.0 48.0 26.9 21.9 0.0 2.4 11.7 26.5 35.3 58.8 27.3 22.1 Tax Filers by Number of Children 5 0 1 2 3 or more 2.2 3.4 5.5 8.2 13.2 28.5 38.6 42.8 15.3 31.3 40.8 45.7 17.3 34.3 43.5 48.5 19.0 43.7 56.5 65.7 31.4 50.4 58.0 63.7 3.2 11.7 28.4 43.6 4.6 19.1 36.7 50.0 Tax Filers By State Tax Level High Middle Low 5.0 2.9 1.8 24.5 21.2 17.2 26.6 23.6 19.4 28.8 25.9 21.5 34.2 31.5 25.8 43.0 40.7 35.7 14.0 10.1 7.1 17.9 13.7 10.1 Tax Filers by Filing Status Single Married Filing Joint Head of Household Married Filing Separate 1.1 5.7 1.6 5.2 2.8 40.3 12.6 40.0 3.3 44.1 15.2 43.4 3.9 47.8 17.8 46.9 5.7 51.2 34.0 51.9 12.3 66.1 36.0 66.3 1.4 18.4 10.6 15.7 1.9 24.2 15.3 19.8 Married Couple, 2+ Kids, 75k<Cash Income<100k Married Couple, 2+ Kids, 75k<AGI<100k 0.0 0.3 57.4 77.5 63.5 82.7 67.8 87.3 90.8 98.2 90.1 97.9 57.8 74.2 68.4 85.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0308-5). * Less than 0.05 percent. (1) Includes returns with AMT liability on Form 6251, with lost credits, and with reduced deductions. Tax Units who are dependents of other tax units are excluded fom the analysis. (2) Includes all 2010 sunset provisions in current law. (3) Taxpayers are defined as returns with positive income tax liability net of refundable credits. (4) Tax units with negative cash income are excluded from the lowest income class. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (5) Number of children is defined as number of exemptions taken for children living at home.