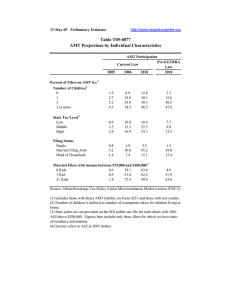

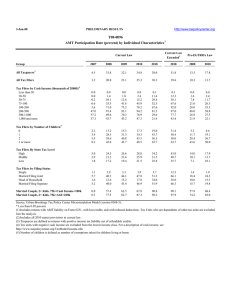

29-Jan-09 PRELIMINARY RESULTS Less than 10 10-20

advertisement

29-Jan-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Click on PDF or Excel link above for additional tables containing more detail and breakdowns by filing status and demographic groups. Table T09-0061 "The American Recovery and Reinvestment Tax Act of 2009" As Reported by Senate Finance Distribution of Federal Tax Change by Cash Income Level, 2009 1 Summary Table Cash Income Level (thousands of 2008 2 dollars) Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut 70.3 75.1 90.8 95.8 97.0 98.3 98.1 97.0 99.2 94.9 98.3 89.7 With Tax Increase 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.2 0.3 0.0 0.0 Percent Change in After-Tax Income 4 4.8 3.5 2.8 2.3 1.9 1.7 1.9 2.6 2.6 0.9 1.5 2.2 Share of Total Federal Tax Change Average Federal Tax Change ($) 2.3 6.3 6.5 5.2 4.5 9.6 9.7 28.4 16.5 2.3 8.6 100.0 -257 -505 -652 -701 -740 -859 -1,331 -2,807 -5,703 -4,522 -32,362 -1,295 Average Federal Tax Rate5 Change (% Points) -4.5 -3.3 -2.6 -2.0 -1.6 -1.4 -1.5 -2.0 -2.0 -0.7 -1.0 -1.7 Under the Proposal 0.8 1.3 6.8 11.3 14.3 16.6 18.2 20.7 24.1 26.2 29.3 20.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0308-7). NOTE: Table shows the impact of the individual income tax measures on 2009 calendar year tax liability. Some individuals may not actually receive the benefits of the provisions until filing their 2009 tax returns in April of 2010. The business tax provisions are measured on a net present value basis. Number of AMT Taxpayers (millions). Baseline: 30.3 Proposal: 4.6 (1) Calendar year. Baseline is current law. For a description of "The American Recovery and Reinvestment Tax Act of 2009" see http://jct.gov/x-12-09.pdf. Provisions include the Making Work Pay Credit equal to 6.2% of earned income up to a maximum credit of $500 ($1,000 for joint filers) phased out above AGI $75,000 ($150,000 for joint filers). The earned income tax credit percentage for families with three or more qualifying children is increased to 45 percent and the threshold phase-out amount for joint filers is increased to $5,000 above the phase-out threshold for single and head of household tax units. The child tax credit refundability threshold is reduced to $6,000. The HOPE credit is made available for four years at a rate of 100% of the first $2,000 of qualified expenses and 25% of the next $2,000. The phase-out thresholds are increased to AGI $80,000 ($160,000 for joint filers), textbooks are made a qualifying expense and thirty percent of the credit is made refundable. Up to $2,400 of unemployment benefits are excludable from gross income. The AMT exemptions for 2009 are increased to $46,700 ($70,950 for joint filers) and personal credits are made allowable against AMT liability. Tax incentives for businesses include special allowance for certain property acquired during 2009, temporary increase in limitation on expensing of certain depreciable business assets, and a 5 year carryback of 2008 and 2009 NOLswith exception for TARP recipients. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 29-Jan-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0061 "The American Recovery and Reinvestment Tax Act of 2009" As Reported by Senate Finance Distribution of Federal Tax Change by Cash Income Level, 2009 Detail Table Cash Income Level (thousands of 2008 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units With Tax Cut 70.3 75.1 90.8 95.8 97.0 98.3 98.1 97.0 99.2 94.9 98.3 89.7 3 With Tax Increase 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.2 0.3 0.0 0.0 Percent Change in After-Tax Income 4 Share of Total Federal Tax Change 4.8 3.5 2.8 2.3 1.9 1.7 1.9 2.6 2.6 0.9 1.5 2.2 2.3 6.3 6.5 5.2 4.5 9.6 9.7 28.4 16.5 2.3 8.6 100.0 Average Federal Tax Change Dollars Percent -257 -505 -652 -701 -740 -859 -1,331 -2,807 -5,703 -4,522 -32,362 -1,295 -84.8 -71.5 -27.6 -14.8 -10.2 -7.6 -7.6 -8.9 -7.5 -2.4 -3.3 -7.9 1 Share of Federal Taxes Change (% Points) -0.2 -0.5 -0.4 -0.2 -0.1 0.0 0.0 -0.3 0.1 0.5 1.0 0.0 Under the Proposal 0.0 0.2 1.5 2.6 3.4 10.0 10.1 25.0 17.5 8.0 21.6 100.0 Average Federal Tax Rate 5 Change (% Points) -4.5 -3.3 -2.6 -2.0 -1.6 -1.4 -1.5 -2.0 -2.0 -0.7 -1.0 -1.7 Under the Proposal 0.8 1.3 6.8 11.3 14.3 16.6 18.2 20.7 24.1 26.2 29.3 20.0 Baseline Distribution of Income and Federal Taxes 1 by Cash Income Level, 2009 Cash Income Level (thousands of 2008 Average Income Tax Units 3 Average Federal Average After Tax Average Federal Share of Pre Tax Number (thousands) 200-500 500-1,000 More than 1,000 All 5,636 989 519 150,241 3.8 0.7 0.4 100.0 291,886 695,069 3,199,967 75,289 75,924 186,351 970,745 16,327 215,962 508,717 2,229,222 58,962 26.0 26.8 30.3 21.7 14.5 6.1 14.7 100.0 Share of PostTax Income Percent of Total 1.1 3.9 5.1 5.0 5.1 12.7 11.4 13.7 5.7 13.1 Share of Federal Taxes Percent of Total 0.2 0.7 1.9 2.8 3.5 10.0 10.1 17.4 7.5 20.6 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0308-07). Number of AMT Taxpayers (millions). Baseline: 30.3 Proposal: 4.6 NOTE: Table shows the impact of the individual income tax measures on 2009 calendar year tax liability. Some individuals may not actually receive the benefits of the provisions until filing their 2009 tax returns in April of 2010. The business tax provisions are measured on a net present value basis. (1) Calendar year. Baseline is current law. For a description of "The American Recovery and Reinvestment Tax Act of 2009" see http://jct.gov/x-12-09.pdf. Provisions include the Making Work Pay Credit equal to 6.2% of earned income up to a maximum credit of $500 ($1,000 for joint filers) phased out above AGI $75,000 ($150,000 for joint filers). The earned income tax credit percentage for families with three or more qualifying children is increased to 45 percent and the threshold phase-out amount for joint filers is increased to $5,000 above the phase-out threshold for single and head of household tax units. The child tax credit refundability threshold is reduced to $6,000. The HOPE credit is made available for four years at a rate of 100% of the first $2,000 of qualified expenses and 25% of the next $2,000. The phase-out thresholds are increased to AGI $80,000 ($160,000 for joint filers), textbooks are made a qualifying expense and thirty percent of the credit is made refundable. Up to $2,400 of unemployment benefits are excludable from gross income. The AMT exemptions for 2009 are increased to $46,700 ($70,950 for joint filers) and personal credits are made allowable against AMT liability. Tax incentives for businesses include special allowance for certain property acquired during 2009, temporary increase in limitation on expens carryback of 2008 and 2009 NOLs with exception for TARP recipients. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 29-Jan-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0061 "The American Recovery and Reinvestment Tax Act of 2009" As Reported by Senate Finance Distribution of Federal Tax Change by Cash Income Level, 2009 Detail Table - Single Tax Units Cash Income Level (thousands of 2008 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units With Tax Cut 69.1 69.2 90.4 96.6 97.3 98.2 94.4 81.5 95.9 95.0 97.9 83.3 3 With Tax Increase 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.3 0.5 0.1 0.0 0.0 Percent Change in After-Tax Income 4 Share of Total Federal Tax Change 4.6 2.4 2.1 1.8 1.4 1.2 0.9 0.9 1.6 1.3 1.9 1.6 8.9 14.3 13.3 10.1 8.3 13.7 5.6 7.9 7.5 2.4 7.8 100.0 Average Federal Tax Change Dollars Percent -240 -325 -457 -527 -519 -572 -587 -913 -3,506 -6,311 -38,681 -524 -53.0 -26.0 -12.6 -8.2 -5.8 -4.2 -2.8 -2.8 -4.5 -3.2 -3.6 -5.8 1 Share of Federal Taxes Change (% Points) -0.5 -0.7 -0.4 -0.2 0.0 0.3 0.4 0.5 0.1 0.1 0.3 0.0 Under the Proposal 0.5 2.5 5.7 7.0 8.3 19.2 12.0 17.3 9.9 4.5 13.0 100.0 Average Federal Tax Rate 5 Change (% Points) -4.2 -2.2 -1.8 -1.5 -1.1 -0.9 -0.7 -0.7 -1.2 -0.9 -1.2 -1.3 Under the Proposal 3.7 6.2 12.6 16.7 18.4 20.8 23.0 23.9 25.3 27.6 32.8 20.1 Baseline Distribution of Income and Federal Taxes 1 by Cash Income Level, 2009 Cash Income Level (thousands of 2008 Average Income Tax Units 3 Average Federal Average After Tax Average Federal Share of Pre Tax Number (thousands) 200-500 500-1,000 More than 1,000 All 730 130 69 64,958 1.1 0.2 0.1 100.0 295,280 694,203 3,156,727 42,053 78,268 197,542 1,074,887 8,992 217,012 496,661 2,081,839 33,060 26.5 28.5 34.1 21.4 7.9 3.3 7.9 100.0 Share of PostTax Income Percent of Total 3.1 9.6 9.9 8.9 9.3 18.5 10.2 7.4 3.0 6.7 Share of Federal Taxes Percent of Total 1.0 3.2 6.1 7.2 8.3 18.9 11.6 9.8 4.4 12.7 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0308-07). NOTE: Table shows the impact of the individual income tax measures on 2009 calendar year tax liability. Some individuals may not actually receive the benefits of the provisions until filing their 2009 tax returns in April of 2010. The business tax provisions are measured on a net present value basis. (1) Calendar year. Baseline is current law. For a description of "The American Recovery and Reinvestment Tax Act of 2009" see http://jct.gov/x-12-09.pdf. Provisions include the Making Work Pay Credit equal to 6.2% of earned income up to a maximum credit of $500 ($1,000 for joint filers) phased out above AGI $75,000 ($150,000 for joint filers). The earned income tax credit percentage for families with three or more qualifying children is increased to 45 percent and the threshold phase-out amount for joint filers is increased to $5,000 above the phase-out threshold for single and head of household tax units. The child tax credit refundability threshold is reduced to $6,000. The HOPE credit is made available for four years at a rate of 100% of the first $2,000 of qualified expenses and 25% of the next $2,000. The phase-out thresholds are increased to AGI $80,000 ($160,000 for joint filers), textbooks are made a qualifying expense and thirty percent of the credit is made refundable. Up to $2,400 of unemployment benefits are excludable from gross income. The AMT exemptions for 2009 are increased to $46,700 ($70,950 for joint filers) and personal credits are made allowable against AMT liability. Tax incentives for businesses include special allowance for certain property acquired during 2009, temporary increase in limitation on expens carryback of 2008 and 2009 NOLs with exception for TARP recipients. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 29-Jan-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0061 "The American Recovery and Reinvestment Tax Act of 2009" As Reported by Senate Finance Distribution of Federal Tax Change by Cash Income Level, 2009 Detail Table - Married Tax Units Filing Jointly Cash Income Level (thousands of 2008 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units With Tax Cut 64.3 76.7 85.6 91.7 95.1 98.0 99.3 99.9 99.8 95.5 98.5 94.6 3 With Tax Increase 0.0 0.0 0.0 0.0 0.0 0.0 0.1 0.0 0.1 0.0 0.0 0.0 Percent Change in After-Tax Income 4 Share of Total Federal Tax Change 4.9 4.7 3.9 3.1 2.7 1.9 2.1 3.0 2.8 0.8 1.4 2.4 0.4 2.1 3.2 2.9 2.9 7.3 10.6 37.0 21.1 2.6 9.6 100.0 Average Federal Tax Change Dollars Percent -229 -719 -931 -1,014 -1,086 -1,032 -1,556 -3,201 -6,111 -4,270 -30,587 -2,298 -87.5 -155.6 -74.7 -35.5 -21.0 -11.0 -9.7 -10.3 -8.1 -2.3 -3.3 -8.1 1 Share of Federal Taxes Change (% Points) 0.0 -0.2 -0.3 -0.2 -0.2 -0.2 -0.2 -0.7 0.0 0.6 1.3 0.0 Under the Proposal 0.0 -0.1 0.1 0.5 1.0 5.2 8.8 28.5 21.2 9.6 25.1 100.0 Average Federal Tax Rate 5 Change (% Points) -4.7 -4.6 -3.7 -2.9 -2.4 -1.6 -1.7 -2.3 -2.1 -0.6 -1.0 -1.8 Under the Proposal 0.7 -1.6 1.3 5.2 8.9 13.1 16.3 20.1 23.9 25.9 28.8 20.8 Baseline Distribution of Income and Federal Taxes 1 by Cash Income Level, 2009 Cash Income Level (thousands of 2008 Average Income Tax Units 3 Average Federal Average After Tax Average Federal Share of Pre Tax Number (thousands) 200-500 500-1,000 More than 1,000 All 4,725 827 430 59,479 7.9 1.4 0.7 100.0 291,151 695,396 3,148,057 125,155 75,559 184,513 936,412 28,353 215,592 510,883 2,211,645 96,802 26.0 26.5 29.8 22.7 18.5 7.7 18.2 100.0 Share of PostTax Income Percent of Total 0.2 1.0 2.0 2.3 2.6 9.2 11.9 17.7 7.3 16.5 Share of Federal Taxes Percent of Total 0.0 0.1 0.4 0.7 1.1 5.4 8.9 21.2 9.1 23.9 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0308-07). NOTE: Table shows the impact of the individual income tax measures on 2009 calendar year tax liability. Some individuals may not actually receive the benefits of the provisions until filing their 2009 tax returns in April of 2010. The business tax provisions are measured on a net present value basis. (1) Calendar year. Baseline is current law. For a description of "The American Recovery and Reinvestment Tax Act of 2009" see http://jct.gov/x-12-09.pdf. Provisions include the Making Work Pay Credit equal to 6.2% of earned income up to a maximum credit of $500 ($1,000 for joint filers) phased out above AGI $75,000 ($150,000 for joint filers). The earned income tax credit percentage for families with three or more qualifying children is increased to 45 percent and the threshold phase-out amount for joint filers is increased to $5,000 above the phase-out threshold for single and head of household tax units. The child tax credit refundability threshold is reduced to $6,000. The HOPE credit is made available for four years at a rate of 100% of the first $2,000 of qualified expenses and 25% of the next $2,000. The phase-out thresholds are increased to AGI $80,000 ($160,000 for joint filers), textbooks are made a qualifying expense and thirty percent of the credit is made refundable. Up to $2,400 of unemployment benefits are excludable from gross income. The AMT exemptions for 2009 are increased to $46,700 ($70,950 for joint filers) and personal credits are made allowable against AMT liability. Tax incentives for businesses include special allowance for certain property acquired during 2009, temporary increase in limitation on expens carryback of 2008 and 2009 NOLs with exception for TARP recipients. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 29-Jan-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0061 "The American Recovery and Reinvestment Tax Act of 2009" As Reported by Senate Finance Distribution of Federal Tax Change by Cash Income Level, 2009 Detail Table - Head of Household Tax Units Cash Income Level (thousands of 2008 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units With Tax Cut 81.1 90.2 96.7 98.6 99.2 99.2 98.4 97.0 98.6 84.6 95.9 94.6 3 With Tax Increase 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Percent Change in After-Tax Income 4 Share of Total Federal Tax Change 5.5 5.5 3.2 2.1 1.8 1.9 2.2 2.0 1.6 0.7 1.4 2.5 4.4 21.3 17.6 11.9 7.8 15.7 9.2 7.7 2.4 0.4 1.6 100.0 Average Federal Tax Change Dollars Percent -375 -877 -798 -685 -688 -973 -1,502 -2,004 -3,652 -3,616 -30,419 -878 82.3 106.7 -132.9 -20.1 -10.6 -8.9 -8.1 -6.4 -4.9 -2.0 -3.3 -15.4 1 Share of Federal Taxes Change (% Points) -1.0 -4.4 -2.8 -0.5 0.6 2.1 1.5 2.0 0.9 0.5 1.1 0.0 Under the Proposal -1.8 -7.5 -0.8 8.6 11.9 29.3 19.0 20.6 8.4 3.3 8.9 100.0 Average Federal Tax Rate 5 Change (% Points) -5.8 -5.8 -3.1 -1.9 -1.5 -1.6 -1.7 -1.5 -1.2 -0.5 -1.0 -2.2 Under the Proposal -13.0 -11.1 -0.8 7.7 12.6 16.2 19.5 22.6 23.8 26.2 29.4 12.0 Baseline Distribution of Income and Federal Taxes 1 by Cash Income Level, 2009 Cash Income Level (thousands of 2008 Average Income Tax Units 3 Average Federal Average After Tax Average Federal Share of Pre Tax Number (thousands) 200-500 500-1,000 More than 1,000 All 132 21 11 23,292 0.6 0.1 0.1 100.0 298,070 683,864 3,070,023 40,351 74,443 182,444 932,848 5,702 223,627 501,421 2,137,175 34,650 25.0 26.7 30.4 14.1 4.2 1.5 3.6 100.0 Share of PostTax Income Percent of Total 2.1 9.9 13.9 14.1 11.3 20.8 10.7 3.7 1.3 2.9 Share of Federal Taxes Percent of Total -0.8 -3.1 2.0 9.1 11.3 27.2 17.5 7.4 2.8 7.8 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0308-07). NOTE: Table shows the impact of the individual income tax measures on 2009 calendar year tax liability. Some individuals may not actually receive the benefits of the provisions until filing their 2009 tax returns in April of 2010. The business tax provisions are measured on a net present value basis. (1) Calendar year. Baseline is current law. For a description of "The American Recovery and Reinvestment Tax Act of 2009" see http://jct.gov/x-12-09.pdf. Provisions include the Making Work Pay Credit equal to 6.2% of earned income up to a maximum credit of $500 ($1,000 for joint filers) phased out above AGI $75,000 ($150,000 for joint filers). The earned income tax credit percentage for families with three or more qualifying children is increased to 45 percent and the threshold phase-out amount for joint filers is increased to $5,000 above the phase-out threshold for single and head of household tax units. The child tax credit refundability threshold is reduced to $6,000. The HOPE credit is made available for four years at a rate of 100% of the first $2,000 of qualified expenses and 25% of the next $2,000. The phase-out thresholds are increased to AGI $80,000 ($160,000 for joint filers), textbooks are made a qualifying expense and thirty percent of the credit is made refundable. Up to $2,400 of unemployment benefits are excludable from gross income. The AMT exemptions for 2009 are increased to $46,700 ($70,950 for joint filers) and personal credits are made allowable against AMT liability. Tax incentives for businesses include special allowance for certain property acquired during 2009, temporary increase in limitation on expens carryback of 2008 and 2009 NOLs with exception for TARP recipients. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 29-Jan-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0061 "The American Recovery and Reinvestment Tax Act of 2009" As Reported by Senate Finance Distribution of Federal Tax Change by Cash Income Level, 2009 Detail Table - Tax Units with Children Cash Income Level (thousands of 2008 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units With Tax Cut 83.0 96.9 99.1 99.5 99.6 99.6 99.6 99.5 99.7 92.9 97.6 98.2 3 With Tax Increase 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.1 0.2 0.0 0.0 Percent Change in After-Tax Income 4 Share of Total Federal Tax Change 6.3 6.5 4.4 3.1 2.7 2.2 2.5 3.6 3.0 0.6 1.2 2.8 1.1 5.9 6.2 4.8 4.0 8.7 10.6 34.8 16.7 1.4 5.8 100.0 Average Federal Tax Change Dollars Percent -421 -1,089 -1,117 -1,028 -1,086 -1,189 -1,830 -3,863 -6,269 -3,095 -27,439 -2,104 61.9 77.7 1,264.5 -36.7 -18.8 -11.8 -10.9 -12.2 -8.2 -1.6 -2.8 -10.3 1 Share of Federal Taxes Change (% Points) -0.2 -0.8 -0.7 -0.4 -0.2 -0.1 -0.1 -0.6 0.5 0.8 1.7 0.0 Under the Proposal -0.3 -1.6 -0.8 1.0 2.0 7.5 9.9 28.8 21.5 9.4 22.6 100.0 Average Federal Tax Rate 5 Change (% Points) -7.0 -7.0 -4.4 -2.9 -2.4 -1.9 -2.1 -2.8 -2.2 -0.5 -0.9 -2.2 Under the Proposal -18.4 -16.1 -4.8 5.0 10.3 14.1 16.8 20.1 24.4 27.0 29.6 19.3 Baseline Distribution of Income and Federal Taxes 1 by Cash Income Level, 2009 Cash Income Level (thousands of 2008 Average Income Tax Units 3 Average Federal Average After Tax Average Federal Share of Pre Tax Number (thousands) 200-500 500-1,000 More than 1,000 All 2,690 442 212 48,094 5.6 0.9 0.4 100.0 288,713 693,043 3,179,388 95,281 76,663 189,988 969,934 20,453 212,050 503,055 2,209,454 74,827 26.6 27.4 30.5 21.5 17.0 6.7 14.7 100.0 Share of PostTax Income Percent of Total 0.5 2.6 4.0 4.3 4.2 10.9 11.7 15.9 6.2 13.0 Share of Federal Taxes Percent of Total -0.2 -0.8 -0.1 1.4 2.2 7.6 10.0 21.0 8.5 20.9 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0308-07). Note: Tax units with children are those claiming an exemption for children at home or away from home. NOTE: Table shows the impact of the individual income tax measures on 2009 calendar year tax liability. Some individuals may not actually receive the benefits of the provisions until filing their 2009 tax returns in April of 2010. The business tax provisions are measured on a net present value basis. (1) Calendar year. Baseline is current law. For a description of "The American Recovery and Reinvestment Tax Act of 2009" see http://jct.gov/x-12-09.pdf. Provisions include the Making Work Pay Credit equal to 6.2% of earned income up to a maximum credit of $500 ($1,000 for joint filers) phased out above AGI $75,000 ($150,000 for joint filers). The earned income tax credit percentage for families with three or more qualifying children is increased to 45 percent and the threshold phase-out amount for joint filers is increased to $5,000 above the phase-out threshold for single and head of household tax units. The child tax credit refundability threshold is reduced to $6,000. The HOPE credit is made available for four years at a rate of 100% of the first $2,000 of qualified expenses and 25% of the next $2,000. The phase-out thresholds are increased to AGI $80,000 ($160,000 for joint filers), textbooks are made a qualifying expense and thirty percent of the credit is made refundable. Up to $2,400 of unemployment benefits are excludable from gross income. The AMT exemptions for 2009 are increased to $46,700 ($70,950 for joint filers) and personal credits are made allowable against AMT liability. Tax incentives for businesses include special allowance for certain property acquired during 2009, temporary increase in limitation on expens carryback of 2008 and 2009 NOLs with exception for TARP recipients. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 29-Jan-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0061 "The American Recovery and Reinvestment Tax Act of 2009" As Reported by Senate Finance Distribution of Federal Tax Change by Cash Income Level, 2009 Detail Table - Elderly Tax Units Cash Income Level (thousands of 2008 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units With Tax Cut 35.4 42.0 69.7 82.2 85.9 93.6 96.5 98.4 99.5 99.2 99.6 72.3 3 With Tax Increase 0.0 0.0 0.0 0.0 0.0 0.0 0.1 0.0 0.1 0.2 0.1 0.0 Percent Change in After-Tax Income 4 Share of Total Federal Tax Change 0.8 0.6 0.8 0.8 0.8 1.0 1.3 1.8 2.6 1.6 2.0 1.6 0.5 2.0 3.0 2.1 2.1 8.1 8.8 23.8 23.3 6.8 19.6 100.0 Average Federal Tax Change Dollars Percent -53 -80 -199 -263 -332 -536 -944 -2,027 -5,864 -8,357 -42,303 -951 -29.5 -20.2 -15.7 -12.5 -9.4 -7.4 -7.3 -7.8 -8.2 -4.4 -4.3 -6.7 1 Share of Federal Taxes Change (% Points) 0.0 -0.1 -0.1 -0.1 0.0 -0.1 -0.1 -0.2 -0.3 0.3 0.8 0.0 Under the Proposal 0.1 0.6 1.1 1.0 1.5 7.3 8.0 20.1 18.8 10.5 31.0 100.0 Average Federal Tax Rate 5 Change (% Points) -0.8 -0.5 -0.8 -0.8 -0.7 -0.9 -1.1 -1.5 -2.0 -1.2 -1.4 -1.3 Under the Proposal 1.9 2.1 4.3 5.2 7.0 10.6 13.5 17.4 22.0 25.8 29.7 17.5 Baseline Distribution of Income and Federal Taxes 1 by Cash Income Level, 2009 Cash Income Level (thousands of 2008 Average Income Tax Units 3 Average Federal Average After Tax Average Federal Share of Pre Tax Number (thousands) 200-500 500-1,000 More than 1,000 All 1,082 221 126 28,639 3.8 0.8 0.4 100.0 298,445 696,175 3,134,426 75,721 71,508 188,052 974,445 14,178 226,937 508,123 2,159,981 61,543 24.0 27.0 31.1 18.7 14.9 7.1 18.2 100.0 Share of PostTax Income Percent of Total 1.0 5.6 5.4 4.0 4.1 13.1 10.9 13.9 6.4 15.5 Share of Federal Taxes Percent of Total 0.1 0.7 1.3 1.1 1.5 7.3 8.1 19.1 10.2 30.3 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0308-07). Note: Elderly tax units are those with either head or spouse (if filing jointly) age 65 or older. NOTE: Table shows the impact of the individual income tax measures on 2009 calendar year tax liability. Some individuals may not actually receive the benefits of the provisions until filing their 2009 tax returns in April of 2010. The business tax provisions are measured on a net present value basis. (1) Calendar year. Baseline is current law. For a description of "The American Recovery and Reinvestment Tax Act of 2009" see http://jct.gov/x-12-09.pdf. Provisions include the Making Work Pay Credit equal to 6.2% of earned income up to a maximum credit of $500 ($1,000 for joint filers) phased out above AGI $75,000 ($150,000 for joint filers). The earned income tax credit percentage for families with three or more qualifying children is increased to 45 percent and the threshold phase-out amount for joint filers is increased to $5,000 above the phase-out threshold for single and head of household tax units. The child tax credit refundability threshold is reduced to $6,000. The HOPE credit is made available for four years at a rate of 100% of the first $2,000 of qualified expenses and 25% of the next $2,000. The phase-out thresholds are increased to AGI $80,000 ($160,000 for joint filers), textbooks are made a qualifying expense and thirty percent of the credit is made refundable. Up to $2,400 of unemployment benefits are excludable from gross income. The AMT exemptions for 2009 are increased to $46,700 ($70,950 for joint filers) and personal credits are made allowable against AMT liability. Tax incentives for businesses include special allowance for certain property acquired during 2009, temporary increase in limitation on expens carryback of 2008 and 2009 NOLs with exception for TARP recipients. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income.