2013 and 2014 Income and Estate Tax Issues January 14, 2014

advertisement

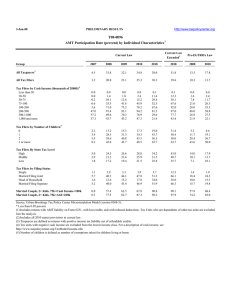

2013 and 2014 Income and Estate Tax Issues January 14, 2014 J C. Hobbs - Assistant Extension Specialist OSU Department of Agricultural Economics 2013 & 2014 Income Tax Rates • 2013 and the future rates are to be: 10, 15, 25, 28, 33, 35, and 39.6 percent. • 39.6% rate applies to: – Single Filers with TI > $400,000 ($406,750) – Married Filers with TI > $450,000 ($457,600) – Head of Household Filers with TI > $425,000 – Married Filing Separate with TI > $225,000 Tax Rates: Single Filers Rate 2013 2014 10% 0 to 8,925 0 to 9,075 15% 8,926 to 36,250 9,076 to 36,900 25% 36,251 to 87,850 36,901 to 89,350 28% 87,851 to 183,250 89,351 to 186,350 33% 183,251 to 398,350 186,351 to 405,100 35% 398,351 to 400,000 405,101 to 406,750 39.6% 400,001 and over 406,751 and over Tax Rates: Married Filing Joint Rate 2013 2014 10% 0 to 17,850 0 to 18,150 15% 17,851 to 72,500 18,151 to 73,800 25% 72,501 to 146,400 73,801 to 148,850 28% 146,401 to 223,050 148,851 to 226,850 33% 223,051 to 398,350 226,851 to 405,100 35% 398,351 to 450,000 405,101 to 457,600 39.6% 450,001 and over 457,601 and over Net Investment Income Tax beginning in 2013 • Net Investment Income Tax on unearned income at a 3.8% rate if modified adjusted gross income exceeds $250,000 for married filing joint or $200,000 all others. • Net investment income - applies to interest, dividends, annuities, royalties and rent (unless it is from business activities). • Net income from the sale of capital investments including stock and real estate (unless it is from the sale of business property). Net Investment Income Tax after Dec. 31, 2012 • Does not include wages, social security, self-employment income, alimony, unemployment, tax exempt interest, distributions from qualified retirement plans, etc. • Does not apply to the exclusion allowed on the sale of a principal residence of $250,000 for individuals or $500,000 on a joint return. Additional Medicare Tax after Dec. 31, 2012 • New Medicare Tax on earned income at 0.9% on wages and self-employment exceeding $250,000 for joint returns and surviving spouses or $200,000 single filers and all others. • Applies only to the employees share of the Medicare tax ( not the employers) and to self-employment income. Itemized Deductions • Up to 80% of itemized deductions for higher income taxpayers will be subject to a 3% phase out (“Pease limitations”) • Reduction does not affect deduction of medical expenses, investment interest, casualty losses, and gambling losses Phaseout Ranges Filing Status Single Married filing joint Married filing sep. Head of household Start $250,000 $300,000 $150,000 $275,000 End $327,501 $422,501 $211.501 $397,501 Provisions Taking Effect in 2013 • Itemized deduction floor for medical expense will rise to 10% of AGI for taxpayers under age 65 • During 2013 through 2016, the floor remains at 7.5% for taxpayers who are 65 years of age or older. Capital Gain Rates • Capital gains for 2013 and 2014 – Net capital gain is taxed at the 0% rate for taxpayers in the 10% and 15% income tax brackets. – Net capital gain is taxed at the 15% rate for taxpayers in the 25%, 28%, 33%, and 35% income tax brackets. – Net capital gain is taxed at the 20% rate for taxpayers in the 39.6% income tax bracket. Dividends • Qualified dividend rates for 2013 and 2014 – Qualified dividends are taxed at the 0% rate for taxpayers in the 10% and 15% income tax brackets. – Qualified dividends are taxed at the 15% rate for taxpayers in the 25%, 28%, 33%, and 35% income tax brackets. – Qualified dividends are taxed at the 20% rate for taxpayers in the 39.6% income tax bracket. Self Employment and Social Security Taxes • For 2013 and 2014: FICA has reverted back to 12.4% for selfemployed individuals and 6.2% for employees. Alternative Minimum Tax • Finally Fixed the Exemption issue (no need for an annual AMT patch to be passed by Congress). • 2013 and beyond the exemption amount will be indexed for inflation. Credits • Adoption credit has been made permanent • The $1,000 child tax credit for children under 17 has been made permanent • Dependent care credit has been made permanent • The simplified Earned Income credit has been made permanent • American Opportunity (education) credit has been extended through 2018 Estate Taxes • Rates: – 2013 & 2014 maximum rate is 40 percent • Exemption amount: – 2013 exemption amount is $5.25 million – 2014 exemption amount is $5.34 million • The exemption amount is indexed for annual inflation. Estate Taxes • Portability between spouses made permanent – Husband and wife can transfer $10.68 million of assets free of estate taxation. – The unused estate tax exemption ($5.34 million) can be transferred from the deceased spouse and thus can be used by the surviving spouse when he/she passes. Gift Taxes • Federal Gift Tax Exclusion (annual) – 2013 & 2014 exclusion is $14,000 per person ($28,000 husband & wife using gift splitting) • Gift Tax Rates: – 2013 & 2014 maximum rate is 40 percent • Exemption Amount (lifetime) – 2013 exemption amount is $5.25 million – 2014 exemption amount is $5.34 million • Indexed for inflation annually Section 179 Expensing • Purchased capital assets that are depreciable (new or used). • 2013 was $250,000 with a $500,000 investment limit • 2014 reverted back to $25,000 with a $200,000 investment limit. (Will Congress enact new legislation to modify this?) Additional First-Year Depreciation • 2013: 50% Additional First-Year Depreciation is allowed for qualifying property placed in service through 12/31/2013. • Expired effective January 1, 2014 Contact Information J C. Hobbs jc.hobbs@okstate.edu 580-237-7677 Oklahoma Cooperative Extension Service Oklahoma State University