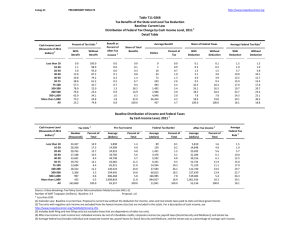

5-Dec-11 PRELIMINARY RESULTS Less than 10 10-20

advertisement

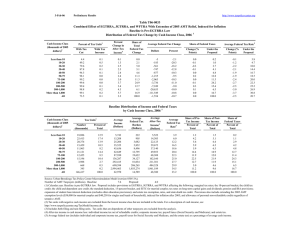

5-Dec-11 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T11-0396 Comparing a Doubled Making Work Pay Credit with the Social Security Tax Cut Baseline: Current Policy Comparison of Benefits by Cash Income Level, 2012 1 Average Benefit, Among Units Benefiting (Dollars) Units Benefiting from Provision Cash Income Level (thousands of 2009 dollars) 2 Tax Units (thousands) 3 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All 23,145 28,071 20,804 17,402 13,820 20,095 14,158 19,099 6,052 1,034 516 165,201 Making Work Pay Credit Number Percent (thousands) 13,936 15,601 15,738 14,233 11,906 17,368 12,448 15,281 1,714 100 24 118,740 60.2 55.6 75.7 81.8 86.2 86.4 87.9 80.0 28.3 9.7 4.7 71.9 Social Security Tax Cut Number Percent (thousands) 13,455 15,128 15,302 13,700 11,465 16,727 12,211 17,079 5,476 907 451 122,274 58.1 53.9 73.6 78.7 83.0 83.2 86.2 89.4 90.5 87.7 87.4 74.0 Making Work Pay Credit 357 695 826 909 975 1,093 1,230 1,354 761 1,216 1,267 927 Social Security Tax Cut 118 255 408 566 718 977 1,332 2,025 2,520 2,677 2,716 920 Units with Higher Benefit from Making Work Pay Credit Number Benefit (thousands) Difference 13,927 15,571 15,684 14,101 8,752 9,706 6,352 2,989 258 41 10 87,755 244 449 432 370 412 518 376 507 524 542 503 401 Social Security Tax Cut Number Benefit (thousands) Difference 10 30 54 132 3,154 7,663 6,131 14,250 5,227 867 441 37,983 483 369 234 221 76 312 546 1,081 2,417 2,686 2,720 990 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0411-2). (1) Calendar year. Baseline is current policy. Social security tax cut reduces the OASDI tax rate on employees to 4.2%. Making work pay credit is twice as large as the credit in effect in 2009 and 2010 and equals 6.2% of earnings up to $800 ($1,600 for couples--both values twice the 2009-10 limits) phased out at AGI of $75,000 to $95,000 ($150,000 to $190,000 for couples filing jointly). Benefit is a reduction in tax liability of $1 or greater. For a description of TPC's current law and current policy baselines, see http://www.taxpolicycenter.org/T11-0270 (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units.