4‐Aug‐11 PRELIMINARY RESULTS Less than 10 10‐20

advertisement

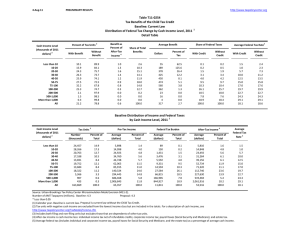

4‐Aug‐11 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T11‐0250 Tax Benefits of the Child and Dependent Care Tax Credit Baseline: Current Law Distribution of Federal Tax Change by Cash Income Level, 2011 1 Detail Table Cash Income Level (thousands of 2011 2 dollars) Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Percent of Tax Units 3 Without Benefit With Benefit 0.0 0.4 2.8 4.9 4.4 6.0 7.6 9.7 6.6 4.1 2.6 4.0 100.0 99.6 97.2 95.1 95.6 94.0 92.4 90.3 93.4 95.9 97.4 96.0 Benefit as Percent of After‐Tax Average Benefit Share of Total Benefits 4 Income 0.0 0.0 0.1 0.1 0.1 0.1 0.1 0.1 0.0 0.0 0.0 0.0 0.0 0.7 6.5 13.0 9.7 19.0 16.4 28.3 5.7 0.6 0.2 100.0 Dollars 0 1 11 26 25 33 42 54 37 25 17 21 Share of Federal Taxes Percent of Tax 0.0 0.5 0.8 0.8 0.4 0.4 0.3 0.2 0.1 0.0 0.0 0.2 With Credit 0.1 0.2 1.5 3.1 4.0 9.5 10.3 26.1 18.5 7.8 18.9 100.0 Without Credit 0.1 0.2 1.5 3.1 4.0 9.5 10.3 26.1 18.5 7.8 18.8 100.0 Average Federal Tax Rate5 With Credit 1.5 1.0 5.7 10.0 12.5 15.0 17.0 19.7 22.7 24.3 29.1 18.1 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2011 1 Cash Income Level (thousands of 2011 2 dollars) Less than 10 10‐20 20‐30 30‐40 40‐50 50‐75 75‐100 100‐200 200‐500 500‐1,000 More than 1,000 All Tax Units 3 Number (thousands) 24,457 28,266 20,763 17,188 13,691 19,752 13,684 18,322 5,366 907 433 163,869 Pre‐Tax Income Percent of Total 14.9 17.3 12.7 10.5 8.4 12.1 8.4 11.2 3.3 0.6 0.3 100.0 Average (dollars) 5,898 14,998 24,923 34,760 44,748 62,065 85,915 140,324 294,445 686,468 2,906,843 65,357 Federal Tax Burden Percent of Total Average (dollars) Percent of Total 1.4 4.0 4.8 5.6 5.7 11.5 11.0 24.0 14.8 5.8 11.8 100.0 89 150 1,431 3,476 5,592 9,331 14,594 27,584 66,815 166,985 844,927 11,841 0.1 0.2 1.5 3.1 4.0 9.5 10.3 26.1 18.5 7.8 18.9 100.0 After‐Tax Income 4 Average (dollars) 5,810 14,848 23,492 31,284 39,156 52,734 71,320 112,740 227,630 519,484 2,061,916 53,516 Percent of Total 1.6 4.8 5.6 6.1 6.1 11.9 11.1 23.6 13.9 5.4 10.2 100.0 Average Federal Tax 5 Rate 1.5 1.0 5.7 10.0 12.5 15.0 17.0 19.7 22.7 24.3 29.1 18.1 Source: Urban‐Brookings Tax Policy Center Microsimulation Model (version 0411‐2). Number of AMT Taxpayers (millions). Baseline: 4.3 Proposal: 4.3 * Less than 0.05 (1) Calendar year. Baseline is current law. Proposal is current law without the Child and Dependent Care Tax Credit. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non‐filing units but excludes those that are dependents of other tax units. (4) After‐tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. Without Credit 1.5 1.0 5.8 10.1 12.6 15.1 17.0 19.7 22.7 24.3 29.1 18.2