4-May-05 Preliminary Results Less than 10 10-20

advertisement

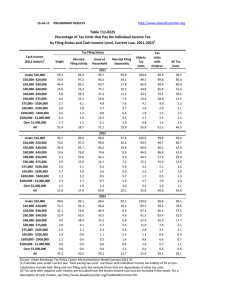

4-May-05 http://www.taxpolicycenter.org Preliminary Results Table T05-0244. Option 2: Increase Point at Which EITC is Phased Out by 10 Percent Number of Returns and Amount Reported Compared to Current Law, 2005 1 Cash Income Class (thousands of 2005 2,3 dollars) Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Returns Number Percent Of (thousands) Total 5,176 6,912 5,734 3,422 422 97 13 4 4 0 0 21,850 23.7 31.6 26.2 15.7 1.9 0.4 0.1 0.0 0.0 0.0 0.0 100.0 Current Law Reported Credit Amount ($ Percent Of millions) Total 6,002.2 19,216.3 12,504.6 3,517.1 423.0 131.7 10.8 3.9 8.3 0.0 0.0 41,908.2 14.3 45.9 29.8 8.4 1.0 0.3 0.0 0.0 0.0 0.0 0.0 100.0 Average Credit ($) 1,160 2,780 2,181 1,028 1,002 1,361 829 1,092 2,220 4,769 2,100 1,918 Returns Number Percent Of Total (thousands) 5,179 7,346 5,758 4,221 1,083 147 14 4 4 0 0 23,826 21.7 30.8 24.2 17.7 4.5 0.6 0.1 0.0 0.0 0.0 0.0 100.0 Proposal Reported Credit Amount ($ Percent Of millions) Total 6,019.4 19,394.6 13,630.1 5,141.6 800.3 179.7 16.3 4.3 8.8 0.0 0.0 45,289.2 13.3 42.8 30.1 11.4 1.8 0.4 0.0 0.0 0.0 0.0 0.0 100.0 Average Credit ($) 1,162 2,640 2,367 1,218 739 1,223 1,151 1,105 2,350 4,769 2,434 1,901 Returns Number Percentage (thousands) 3 434 24 799 661 50 1 0 0 0 0 1,976 0.1 6.3 0.4 23.4 156.6 51.8 9.3 10.2 0.0 0.0 0.0 9.0 Change Due to Proposal Reported Credit Amount ($ Percentage millions) 17.2 178.3 1,125.5 1,624.5 377.3 48.0 5.6 0.4 0.5 0.0 0.0 3,381.0 0.3 0.9 9.0 46.2 89.2 36.4 51.6 11.5 5.8 0.0 15.9 8.1 Average Credit Dollars Percentage 3 -140 186 190 -263 -138 321 13 129 0 334 -17 0.2 -5.0 8.5 18.5 -26.3 -10.1 38.7 1.2 5.8 0.0 15.9 -0.9 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0305-2). (1) Calendar year. Proposal reduces the EITC phasedown rates to ensure the credit is completely phased out at an income level that is 10 percent higher than under current law. For married couples filing a joint return, the rates would be 6.05, 13.34, and 17.87 percent for 0 children, 1 child, and 2 or more children, respectively. For other filing statuses, the rates would be 6.24 percent, 13.47 percent, and 18.02 percent. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units. Tax units that are dependents of other taxpayers are excluded from the analysis.