htt

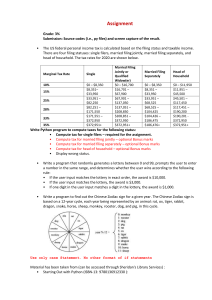

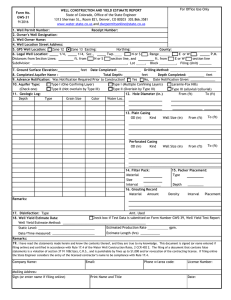

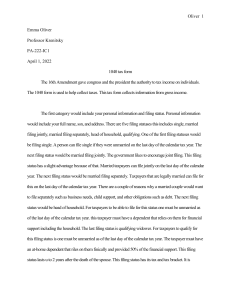

advertisement

13-Jul-11 http://www.taxpolicycenter.org PRELIMINARY RESULTS Table T11-0225 Percentage of Tax Units that Pay No Individual Income Tax by Filing Status and Cash Income Level, Current Law, 2011-20131 Tax Filing Status Elderly Tax Units Tax Units with Children 95.8 34.1 17.8 10.2 11.2 7.3 7.6 9.7 6.6 3.5 3.9 19.9 100.0 99.5 86.9 44.8 44.1 14.0 4.1 2.4 1.9 2.7 0.8 55.9 99.9 99.8 98.4 85.8 59.5 28.6 9.0 2.0 1.3 2.3 1.5 51.3 99.4 80.8 60.9 41.4 30.6 14.5 5.3 2.1 1.5 2.4 1.6 46.5 2012 99.6 96.6 90.2 74.6 34.1 14.1 4.5 2.6 0.5 9.7 1.4 69.9 97.6 35.4 19.8 8.9 9.4 7.2 5.9 9.0 5.7 5.0 4.0 20.1 100.0 99.5 89.0 46.0 44.3 15.1 4.1 2.2 1.7 2.7 0.5 55.6 99.8 99.7 98.2 86.8 57.6 25.9 7.1 1.7 0.9 1.9 1.0 50.6 99.6 80.7 62.0 41.8 29.9 13.9 4.5 1.8 1.3 2.0 1.1 45.8 2013 99.6 96.8 86.9 50.5 15.2 5.7 2.3 1.1 0.2 6.0 0.4 59.1 92.1 18.2 8.3 4.6 6.8 5.4 5.6 5.2 1.4 0.4 1.1 13.7 100.0 99.1 87.3 41.3 37.3 11.0 2.8 1.2 0.8 2.4 0.4 52.0 99.8 99.6 96.4 63.4 26.3 7.8 2.3 0.6 0.4 0.7 0.4 39.3 99.5 78.6 57.5 31.5 17.7 6.1 2.1 0.9 0.7 1.1 0.6 39.1 Cash Income (2011 dollars)2 Single Under $10,000 $10,000 -$20,000 $20,000 -$30,000 $30,000 -$40,000 $40,000 -$50,000 $50,000 -$75,000 $75,000 - $100,000 100,000 - $200,000 $200,000 - $500,000 $500,000 - $1,000,000 Over $1,000,000 All 99.3 74.9 44.4 14.0 5.0 3.6 2.7 3.0 2.6 3.2 1.7 52.4 99.4 97.2 82.2 76.3 59.3 22.2 6.1 1.8 1.3 2.0 1.5 28.7 2011 99.7 96.5 90.7 74.1 37.4 16.0 4.8 2.7 0.8 13.5 3.1 71.2 Under $10,000 $10,000 -$20,000 $20,000 -$30,000 $30,000 -$40,000 $40,000 -$50,000 $50,000 -$75,000 $75,000 - $100,000 100,000 - $200,000 $200,000 - $500,000 $500,000 - $1,000,000 Over $1,000,000 All 99.7 74.6 46.4 15.6 5.1 3.9 2.5 2.7 2.1 2.3 1.5 51.8 99.0 97.3 83.7 76.0 59.6 21.6 5.1 1.6 1.2 1.7 1.0 27.9 Under $10,000 $10,000 -$20,000 $20,000 -$30,000 $30,000 -$40,000 $40,000 -$50,000 $50,000 -$75,000 $75,000 - $100,000 100,000 - $200,000 $200,000 - $500,000 $500,000 - $1,000,000 Over $1,000,000 All 99.6 72.2 42.1 12.4 4.0 2.8 1.6 1.4 1.1 0.9 0.8 47.2 99.1 94.3 79.8 63.0 38.4 9.1 2.1 0.8 0.6 0.9 0.6 20.2 Married Filing Jointly Head of Household Married Filing Separately All Tax Units Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0411-2). (1) Calendar year under current law. "Non-paying tax units" are those with individual income tax liability of $5 or less. Tabulations include both filing and non-filing units but exclude those that are dependents of other tax units. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm