8-Feb-10 PRELIMINARY RESULTS Average Average Federal Tax Rate

advertisement

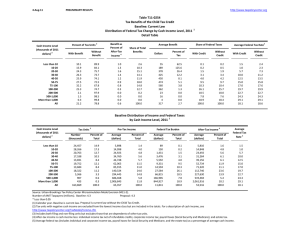

8-Feb-10 PRELIMINARY RESULTS Click on PDF or Excel link above for an additional table containing more detail. http://www.taxpolicycenter.org Table T10-0074 Child Tax Credit (CTC) Distribution of Federal Tax Benefits for Tax Units with Eligible Children Only, by Cash Income Level, 2010 Summary Table Cash Income Level (thousands of 2009 2 dollars) Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units with Eligible Children 3 With Tax Without Tax Benefit Benefit 61.1 83.0 94.4 98.2 99.1 99.5 99.3 66.9 6.1 5.0 0.7 82.2 38.9 17.0 5.6 1.8 0.9 0.5 0.7 33.1 93.9 95.1 99.3 17.8 Benefit as Percent of After-Tax 4 Income 4.9 5.9 5.8 4.8 4.2 3.2 2.4 0.9 0.0 0.0 0.0 1.9 1 5 Share of Total Federal Tax Benefits Average Federal Tax Benefit ($) Without Credit 2.9 11.0 14.3 13.2 10.8 18.5 16.1 12.7 0.2 0.0 0.0 100.0 -347 -994 -1,450 -1,549 -1,669 -1,699 -1,715 -981 -67 -60 -12 -1,217 -13.6 -9.4 0.5 8.8 13.3 16.9 19.2 23.2 26.5 26.0 28.5 20.4 Average Federal Tax Rate With Credit -19.1 -15.8 -5.3 4.4 9.6 14.2 17.3 22.6 26.5 26.0 28.5 18.9 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-4). Number of AMT Taxpayers (millions). Baseline: 28.3 Proposal: 28.1 (1) Calendar year. Benefits of the credit are calculated under current law. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 8-Feb-10 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T10-0074 Child Tax Credit (CTC) Distribution of Federal Tax Benefits for Tax Units with Eligible Children Only, by Cash Income Level, 2010 1 Detail Table Cash Income Level (thousands of 2009 2 dollars) Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units with Eligible 3 Children With Tax Without Tax Benefit Benefit 61.1 83.0 94.4 98.2 99.1 99.5 99.3 66.9 6.1 5.0 0.7 82.2 38.9 17.0 5.6 1.8 0.9 0.5 0.7 33.1 93.9 95.1 99.3 17.8 Benefit as Percent of After-Tax 4 Income 4.9 5.9 5.8 4.8 4.2 3.2 2.4 0.9 0.0 0.0 0.0 1.9 Share of Total Federal Tax Benefits 2.9 11.0 14.3 13.2 10.8 18.5 16.1 12.7 0.2 0.0 0.0 100.0 Average Federal Tax Benefit Dollars -347 -994 -1,450 -1,549 -1,669 -1,699 -1,715 -981 -67 -60 -12 -1,217 Share of Federal Taxes 5 Average Federal Tax Rate Without Credit With Credit Without Credit With Credit -0.5 -1.2 0.1 1.9 2.9 8.6 11.7 31.8 21.0 7.8 15.8 100.0 -0.8 -2.2 -1.0 1.0 2.3 7.8 11.4 33.4 22.6 8.4 17.0 100.0 -13.6 -9.4 0.5 8.8 13.3 16.9 19.2 23.2 26.5 26.0 28.5 20.4 -19.1 -15.8 -5.3 4.4 9.6 14.2 17.3 22.6 26.5 26.0 28.5 18.9 Average Federal Tax 5 Rate Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total -13.6 -9.4 0.5 8.8 13.3 16.9 19.2 23.2 26.5 26.0 28.5 20.4 0.8 2.6 3.8 4.5 4.4 10.4 12.4 27.9 16.1 6.1 11.3 100.0 1.1 3.5 4.7 5.2 4.8 10.9 12.6 26.9 14.9 5.7 10.1 100.0 -0.5 -1.2 0.1 1.9 2.9 8.6 11.7 31.8 21.0 7.8 15.8 100.0 Percent 40.6 68.6 -1,175.1 -50.2 -27.7 -15.8 -10.1 -2.9 -0.1 0.0 0.0 -7.4 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2010 1 Cash Income Level (thousands of 2009 2 dollars) Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) 4,246 5,728 5,112 4,401 3,356 5,644 4,863 6,700 1,862 300 125 42,548 Percent of Total 10.0 13.5 12.0 10.3 7.9 13.3 11.4 15.8 4.4 0.7 0.3 100.0 Average Income (Dollars) 6,304 15,480 25,279 35,182 45,382 63,551 87,993 143,772 298,671 701,680 3,110,440 81,035 Average Federal Tax Burden (Dollars) -855 -1,451 123 3,085 6,031 10,745 16,920 33,413 79,211 182,133 885,264 16,527 Average After4 Tax Income (Dollars) 7,158 16,930 25,156 32,097 39,351 52,806 71,072 110,359 219,460 519,547 2,225,177 64,508 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-4). Number of AMT Taxpayers (millions). Baseline: 28.3 Proposal: 28.1 (1) Calendar year. Benefits of the credit are calculated under current law. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income.