Professor Vipin 2015 An Overview Of Capital And Commodities Markets

advertisement

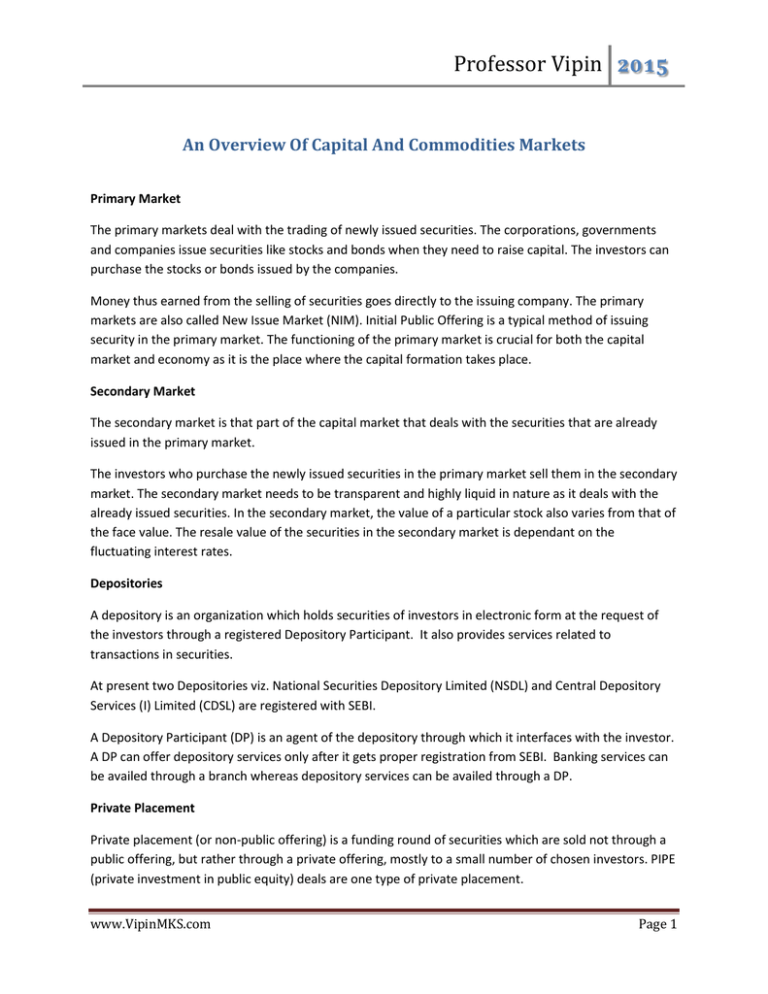

Professor Vipin 2015 An Overview Of Capital And Commodities Markets Primary Market The primary markets deal with the trading of newly issued securities. The corporations, governments and companies issue securities like stocks and bonds when they need to raise capital. The investors can purchase the stocks or bonds issued by the companies. Money thus earned from the selling of securities goes directly to the issuing company. The primary markets are also called New Issue Market (NIM). Initial Public Offering is a typical method of issuing security in the primary market. The functioning of the primary market is crucial for both the capital market and economy as it is the place where the capital formation takes place. Secondary Market The secondary market is that part of the capital market that deals with the securities that are already issued in the primary market. The investors who purchase the newly issued securities in the primary market sell them in the secondary market. The secondary market needs to be transparent and highly liquid in nature as it deals with the already issued securities. In the secondary market, the value of a particular stock also varies from that of the face value. The resale value of the securities in the secondary market is dependant on the fluctuating interest rates. Depositories A depository is an organization which holds securities of investors in electronic form at the request of the investors through a registered Depository Participant. It also provides services related to transactions in securities. At present two Depositories viz. National Securities Depository Limited (NSDL) and Central Depository Services (I) Limited (CDSL) are registered with SEBI. A Depository Participant (DP) is an agent of the depository through which it interfaces with the investor. A DP can offer depository services only after it gets proper registration from SEBI. Banking services can be availed through a branch whereas depository services can be availed through a DP. Private Placement Private placement (or non-public offering) is a funding round of securities which are sold not through a public offering, but rather through a private offering, mostly to a small number of chosen investors. PIPE (private investment in public equity) deals are one type of private placement. www.VipinMKS.com Page 1 Professor Vipin 2015 Buy Back of Shares It is the repurchase of outstanding shares (repurchase) by a company in order to reduce the number of shares on the market. Companies will buy back shares either to increase the value of shares still available (reducing supply), or to eliminate any threats by shareholders who may be looking for a controlling stake. Issue Mechanism Public Issue Through Prospectus Company issue a prospectus which is an invitation for subscription by the investing public. It is a direct offer by the company to the public. Normally the shares of new company are issued at par and shares of existing company can be issued at premium. Prospectus contains all the details of the company and its promoters, prospects and risk associated. Key Features - simple way of issuing shares. - wide distribution of share is possible. - floatation costs, administrative costs, publicity costs and legal costs are high. Offer for Sale The company does not offer shares directly to the public, but through intermediaries, such as, issuing houses or stock broker firms. Sale of securities done in two stages. In the first stage, the issuing company makes an en bloc sale of securities to the issue house at an agreed fixed price. The second stage involves re-issue of securities by issue houses to the ultimate investor at higher price. The difference between the sale and purchase price of issue house is called as turn. All the costs related with the issue like underwriting, advertisement etc. have to meet by issuing houses, out of the turn. Major benefit of the method is issuing company is free of hassles involved in issuing shares. Private Placement Under this method, the securities are acquired by the issuing company at an agreed price and then these are placed only with their investor-clients, both individual and institutional investors, at a higher price and hence earning turn. In this case no underwriting is required. The advantage of this method is no advertisement costs or no underwriting fee is to be paid. Advantages SEs requirement regarding prospectus is also less stringent. On the other hand, the major limitation of this method is – fear of issue getting concentrated in few hands. This method is more common for Government Owned Institutions. www.VipinMKS.com Page 2 Professor Vipin 2015 Right Issue A fresh issue of shares by an existing company to its existing shareholders in proportion to the number of shares already held by them is called as right issue. Only a company whose shares are already listed can make right issue. It is offered on pro-rata basis. Major advantage of this method is – it is economical and do not disturb the existing shareholding pattern. Limitations are – only existing company can issue it, shares may get concentrated in few hands and there may be conflict between the rights of existing shareholders and overall societal considerations of diffusion of share ownership for promoting dispersal of wealth and economic power. Bonus Shares It does not result in raising fresh capital. It is merely a conversion of existing reserves and surpluses into share capital. It represents just a book entry subject to certain rules and regulation. Total resource base of the company does not change nor it results into entry of new shareholders IPOs through Secondary Market In October 1999, SEBI accepted the proposal for marketing IPOs through the secondary market, i.e. using existing infrastructure. Here the brokers place orders on behalf of clients through a special window on trading terminal. After finalisation of allocation, brokers are advised to inform the allottees. Successful allottees submit the application form and the amount payable through the broker to the clearing house. Subsequently the share certificates would be delivered to the investors by crediting the depositories account in the name of investor. The major advantage of the method is investors need not to park their funds until allotment. Book Building Most commonly used method now-a-days. In this case the issuer company does not directly issue shares to the public but invites bids from public. Therefore this method is also called as “Price Discovery Through book Building Process”. In this method the bids are collected from investors at various prices which are above or equal to the floor price. The offer price is determined after the bid closing date. In this case the issuer company advertises about the issue in the national newspaper. The advertisement will have the information about floor price, price band and cap price. Floor price is the minimum price of the issue and cap price is the maximum price, and the spread between these two prices are called as price band. Here the cap price must not be more than 120 percent of the floor price. The book shall remain open minimum for three days. The price band can be revised also and in that case the bidding process can be extended to three more days subject to total bidding period not exceeding ten days. The actual discovered issue price can be any price between the price bands. www.VipinMKS.com Page 3 Professor Vipin 2015 Commodity Market Commodity A reasonably homogeneous good or material, bought and sold freely as an article of commerce. Commodities include agricultural products, fuels, and metals and are traded in bulk on a commodity exchange or spot market. Commodity Market Multi Commodity Exchange of India is a de-mutualized online commodity exchange of India promoted by Financial Technologies (I) Ltd, SBI, Fidelity International, NSE, NABARD, HDFC Bk, SBI Life Insurance Co., Union Bank of India, Canara Bank, Bank of India, Bank of Baroda and Corporation Bank. Commodity vs Stock Market www.VipinMKS.com Page 4