Feature

advertisement

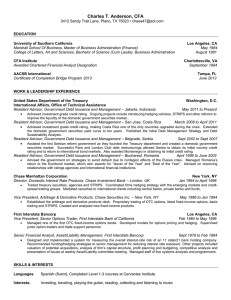

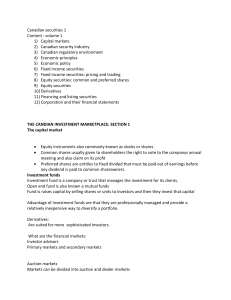

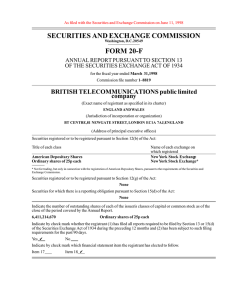

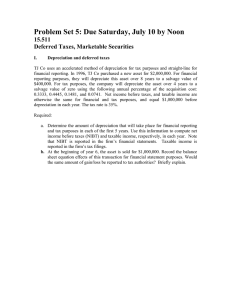

Feature G u n P i e r o C i g i i ' i i f i C o u n s e l j at the E u r o p e a n Bank for ReconsEruction a n d D e v e l o p m e n t , E m a i h cignagi^ebrd.com major ^hortcomfngs in [he Legislation - 5 « stockeKchangeinrhecounttyr Some stare chart 1 0 - i s 4 k c k of provisions concerning investment funds we re created to accumulate has attained good quality standards, while in theprotection of mjnorjiy shareholders, and reinvest hard currency for the state Central A s i a a n d i n the Balkans much work the d isclo&u re of qual i hed share lioldi ng a n d strategic s e c t o r s - o i l a n d g a s industry and needs to he done. collective iJivestmenr schemes. W h i l e there mineral resources - but these funds are appear lo be no professional accouncingftrms not permitted to issue securities for public enough. Ihe legal foundationsof sound in the couHEryn there are Lws regulating distribution, I h e E B R D assessment revealed financial systems require good laws supported accounting ajid bookkeeping activiiiea, a framework in urgent need of reform in all by institutions able to ensure their etffclivene^. akhough accounting standatH^ lack specifjciiy sections under consideration - see chart 11 Several transition countries have refotmedj or and there is no owrseeing body. below - the only exception being 'Accounting are considering reforming, the Scope of their and Auditing' where the country achieved market regulators. It is too early toaases^ T h e regulation of collective investment scheiises is not yet contemplated by lawr medium compliance, having provided for some Siniilarlyn anti-money Ijimderiiig legislation regulation in the 1996 Law'on Accounting in and rules addtessing Financial instruments lurkmenistan'. legislation in Central a n d Eastetn Europe But drafting good legislation isju^t not whether this trend is heading in the right direction but it is likely t o he here wh^re the future challenges of securities markets lie. and investment service providers arc almost non-existenc- • Tiblt 2 loiiinued ifi^r the page CONCLUSIONS T h e situation Is similar in TurbiftfnubJH, A s an international iinancial institution where the Ministry of Economy a n d Finance with a m a n d a t e to assist the countries of 1 In order ro elintinare rhe probJein of iinenferccability of derivarive&caiirtact& i s m charge ol securities issuance and olFering, C e n t r a ! and Eastern Europe a n d the C.iS under Ru&&ian Law bed^use of the'gambling change of control transactions^ securities in their transition to market economies, provtsiom' ineludcd rnclie Russian CLVU niarketand brokerage and dealing activities. t h e EBRLJ attaches great importance to the C^ade, on 26Janiijry 2007 the federal law'On Tlje 1993 Law on Securities and Stock modernisation of the financial instirutionS jmendment [u Jc( 1062of Pdrr II Hxchangesoutlines the main principles of and markets in the region. Liquid capital ot'rhe Civil Code of the Russijn Fcderjcion' privatesecuriries issuance and circulation matkels foslet savings and investment which, WAK enacted. However, Jtvhis moment in time, j n d a d d r e s s e s basic provisions on stock in t u r n , drives development a n d g t o w t h of the thcliw does not seem to H>[veih< ptobJrm ejtchangcoperations, but this is true only on private sectors- complciely ^nd it isdijhcult to predict how it papet as there appears to be no functioning The E B R D assessment shows that will be Implemented. BANK SHARE SECURITY Hague v Nam Tai Elettfonks Inc and others [2006] All ER (0) 280 (Nov) (Privy Council) W h e t h e r a c o m p a n y w h i c h is t h e subject of share security could power to redeem any of its shares held by j u d g m e n t debtt>rs ^ f t h e a m e n d a n d exercise powers u n d e r its a t t i c l e s to prohibit a b a n k company, N T E gave T A notice of a resolution ro r e d e e m N T E from perfecting its security. s h a r e s r e g i s r e r e d i n T A ' s n a m e to satisfy t h e d e b t - N T E p u r p o r t e d ro cancel t h e r e d e e m e d s h a r e s a n d t o treat t h e r e d e m p t i o n price as Background set oEt against the debt. I A charged its s h a t e s i n N T S to a b a n k Jti s u p p o r t of a g u a r a n t e e TA h a d given to cbe b a n k in relation ro the r e p a y m e n t of Conclusion advances m a d e by t h e b a n k t o TAL* a s u b s i d i a r y of N T E . O n t h e R e d e m p t i o n h a d been m a d e for the p u r p o s e s of a set-offagainsc s a m e d d y , a g o v e r n m e n t agency o b t a i n e d a.Judgment against T A a j u d g m e n t debt. Since s u c h a r e d e m p t i o n a g a i n s t an insolvent in t h e B V ! H i g h C o u r t , c o m p a n y was impossible, t h e articles could n o t b e used in t h i s T A L subsequently def^uhcd on its p a y m e n t s t o the bank. "ITie b a n k called T A on its g u a r a n t e e . N T K then took an a s s i g n m e n t way. Alteration t o t h e atticles was etfective only against a solvent of t h e j u d g m e n t debt. Thereafter N T E presented a w i n d i n g u p s h a r e b o l d e r - a t l e a s t i f t h e a h a r e s w e r e n o t subject t o a p r i o r petition against T A . Both t h e b a n k a n d N T K were therefore charge which left no equity against which set-off could o p e r a t e . creditots of T A , T h e bank held security over TA's shares in N T E . N T E was u n s e c u t e d . N T E a l c e r e d i t s articles ofassociation t o create a special February 2007 Rectification was che natural remedy - the shares had been wrongfully cancelled a n d should be given back, fhe b a n k was entitled to perfect its security^ ^ Butleiwofths Jaufnal of internalfanai Banking and Financial law