Lat22 Puter Corporation acquired a 90% interest in Surry Corporation in... interests business combination. The pooling was correctly recorded by Puter...

advertisement

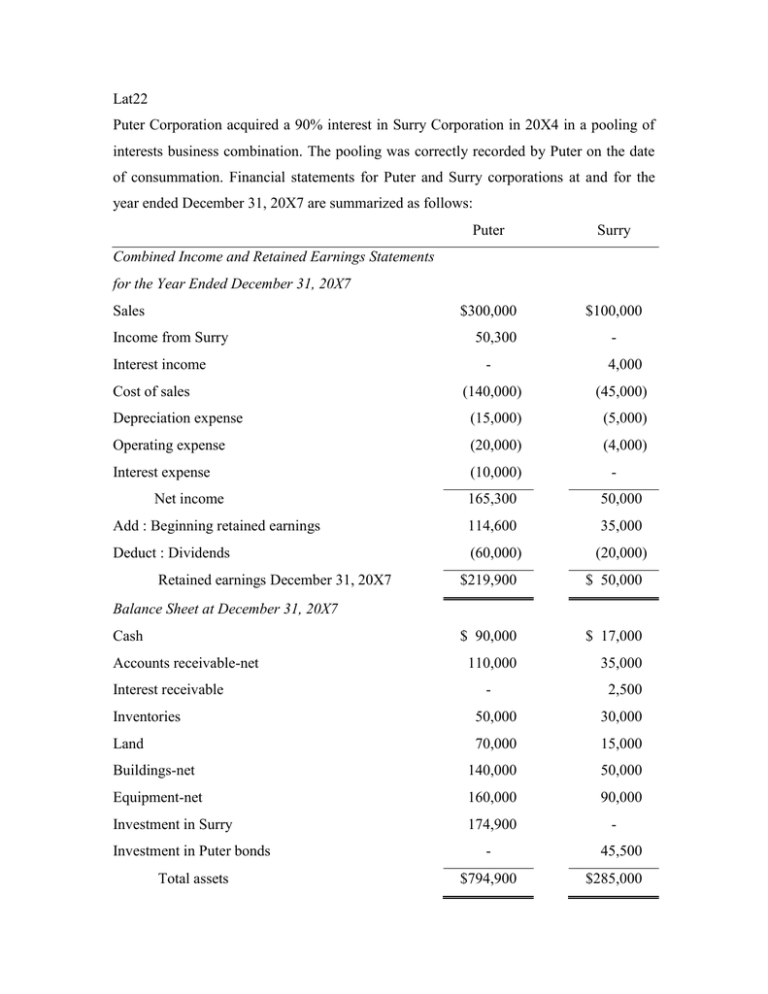

Lat22 Puter Corporation acquired a 90% interest in Surry Corporation in 20X4 in a pooling of interests business combination. The pooling was correctly recorded by Puter on the date of consummation. Financial statements for Puter and Surry corporations at and for the year ended December 31, 20X7 are summarized as follows: Puter Surry $300,000 $100,000 Combined Income and Retained Earnings Statements for the Year Ended December 31, 20X7 Sales Income from Surry Interest income 50,300 - - 4,000 (140,000) (45,000) Depreciation expense (15,000) (5,000) Operating expense (20,000) (4,000) Interest expense (10,000) Cost of sales Net income - 165,300 50,000 Add : Beginning retained earnings 114,600 35,000 Deduct : Dividends (60,000) (20,000) Retained earnings December 31, 20X7 $219,900 $ 50,000 $ 90,000 $ 17,000 110,000 35,000 - 2,500 Balance Sheet at December 31, 20X7 Cash Accounts receivable-net Interest receivable Inventories 50,000 30,000 Land 70,000 15,000 Buildings-net 140,000 50,000 Equipment-net 160,000 90,000 Investment in Surry 174,900 Investment in Puter bonds - Total assets $794,900 45,500 $285,000 Accounts payable $120,000 150,000 5,000 42,000 10% bonds payable 100,000 $210,000 Capital stock, $10 par 300,000 100,000 50,000 35,000 219,900 65,000 $794,900 $285,000 Interest payable Additional paid-in capital Retained earnings Total equities Additional Information 1. Surry purchased inventory items from Puter during 20X6 and 20X7 as follows: Sales Cost of sales Gross Profit Unsold December 31 20X6 $30,000 $20,000 $10,000 $15,000 20X7 40,000 25,000 15,000 16,000 2. Puter paid Surry $20,000 on January 5, 20X6 for equipment that had a book value of $12,000 on Surry’s books and a four-year remaining useful life. Straight-line depreciation is used. 3. Surry paid $44,000 for $50,000 par of Puter’s 10% bonds on July 1, 20X7. Puter issued the bonds at par in 20X1 and the bonds mature on July 1, 20X9. Interest payment dates are January 1 and July 1. Straight-line amortization is used. 4. Puter uses the equity method to account for its interest in Surry. Required : Prepare consolidated working papers for Puter Corporation and Subsidiary at and for the year ended December 31, 20X7.