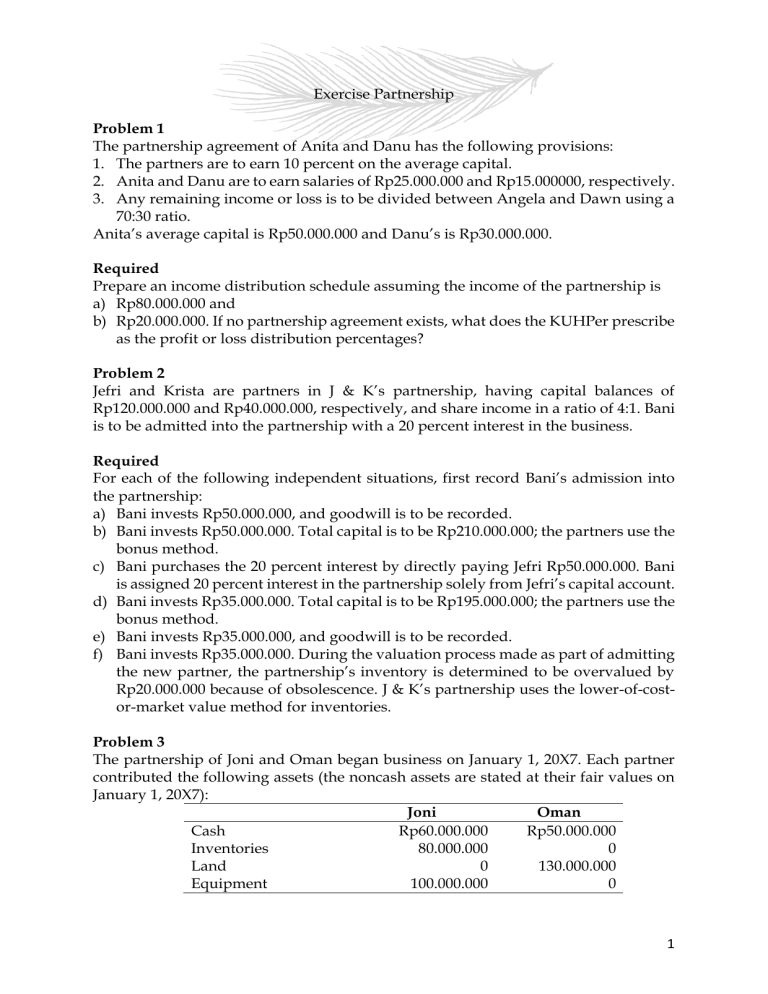

Exercise Partnership Problem 1 The partnership agreement of Anita and Danu has the following provisions: 1. The partners are to earn 10 percent on the average capital. 2. Anita and Danu are to earn salaries of Rp25.000.000 and Rp15.000000, respectively. 3. Any remaining income or loss is to be divided between Angela and Dawn using a 70:30 ratio. Anita’s average capital is Rp50.000.000 and Danu’s is Rp30.000.000. Required Prepare an income distribution schedule assuming the income of the partnership is a) Rp80.000.000 and b) Rp20.000.000. If no partnership agreement exists, what does the KUHPer prescribe as the profit or loss distribution percentages? Problem 2 Jefri and Krista are partners in J & K’s partnership, having capital balances of Rp120.000.000 and Rp40.000.000, respectively, and share income in a ratio of 4:1. Bani is to be admitted into the partnership with a 20 percent interest in the business. Required For each of the following independent situations, first record Bani’s admission into the partnership: a) Bani invests Rp50.000.000, and goodwill is to be recorded. b) Bani invests Rp50.000.000. Total capital is to be Rp210.000.000; the partners use the bonus method. c) Bani purchases the 20 percent interest by directly paying Jefri Rp50.000.000. Bani is assigned 20 percent interest in the partnership solely from Jefri’s capital account. d) Bani invests Rp35.000.000. Total capital is to be Rp195.000.000; the partners use the bonus method. e) Bani invests Rp35.000.000, and goodwill is to be recorded. f) Bani invests Rp35.000.000. During the valuation process made as part of admitting the new partner, the partnership’s inventory is determined to be overvalued by Rp20.000.000 because of obsolescence. J & K’s partnership uses the lower-of-costor-market value method for inventories. Problem 3 The partnership of Joni and Oman began business on January 1, 20X7. Each partner contributed the following assets (the noncash assets are stated at their fair values on January 1, 20X7): Joni Oman Cash Rp60.000.000 Rp50.000.000 Inventories 80.000.000 0 Land 0 130.000.000 Equipment 100.000.000 0 1 The land was subject to a Rp50.000.000 mortgage, which the partnership assumed on January 1, 20X7. The equipment was subject to an installment note payable that had an unpaid principal amount of Rp20.000.000 on January 1, 20X7. The partnership also assumed this note payable. Joni and Oman agreed to share partnership income and losses in the following manner: Interests on beginning capital balances Salaries Remainder Joni 3% Rp12.000.000 60% Oman 3% Rp12.000.000 40% During 20X7, the following events occurred: 1. Inventory was acquired at a cost of Rp30.000.000. At December 31, 20X7, the partnership owed Rp6.000.000 to its suppliers. 2. Principal of Rp5.000.000 was paid on the mortgage. Interest expense incurred on the mortgage was Rp2.000.000, all of which was paid by December 31, 20X7. 3. Principal of Rp3.500.000 was paid on the installment note. Interest expense incurred on the installment note was Rp2.000.000, all of which was paid by December 31, 20X7. 4. Sales on account amounted to Rp155.000.000. At December 31, 20X7, customers owed the partnership Rp21.000.000. 5. Selling and general expenses, excluding depreciation, amounted to Rp34.000.000. At December 31, 20X7, the partnership owed Rp6.200.000 of accrued expenses. Depreciation expense was Rp6.000.000. 6. Each partner withdrew Rp200.000 each week in anticipation of partnership profits. 7. The partnership’s inventory at December 31, 20X7, was Rp20.000.000. 8. The partners allocated the net income for 20X7 and closed the accounts. Additional Information On January 1, 20X8, the partnership decided to admit Hilda to the partnership. On that date, Hilda invested Rp99.800.000 of cash into the partnership for a 20 percent capital interest. Total partnership capital after Hill was admitted totaled Rp450.000.000. Required a. Prepare journal entries to record the formation of the partnership on January 1, 20X7, and to record the events that occurred during 20X7. b. Prepare the income statement for the Join-Oman Partnership for the year ended December 31, 20X7. c. Prepare a balance sheet for the Joni-Oman Partnership at December 31, 20X7. d. Prepare the journal entry for the admission of Hilda on January 1, 20X8. 2