The Banking System and the Money Supply ECONOMICS: Principles and Applications 3e

advertisement

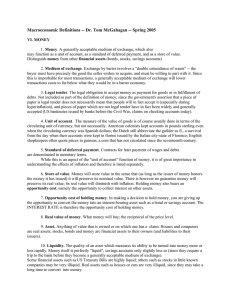

The Banking System and the Money Supply Slides by: John & Pamela Hall ECONOMICS: Principles and Applications 3e HALL & LIEBERMAN © 2005 Thomson Business and Professional Publishing What Counts as Money • Money has several useful functions – Provides a unit of account • Standardized way of measuring value of things that are traded – Serves as store of value • One of several ways in which households can hold their wealth • Yet credit cards are not considered money, even though you can use them to buy things • Why is this? – A more formal definition of money helps to answer questions like this • Money is an asset that is widely accepted as a means of payment – Only assets—things of value that people own—can be considered as money » This is why credit limit on your credit card, or your ability to go into a bank and borrow funds, is not considered money – Only things that are widely acceptable as a means of payment are regarded as money » Other assets—such as stocks and bonds or even gold bars—cannot generally be used to pay for goods and services » They fail the acceptability test 2 Measuring the Money Supply • Amount of money in circulation can affect macroeconomy • Money Supply – Total amount of money held by the public • In practice, measuring money supply is not as straightforward as it might seem • Governments have decided best way to deal with them is to have different measures of the money supply – In effect, alternative ways of defining what is and what is not money – Each measure includes a selection of assets that are widely acceptable as a means of payment and are relatively liquid • An asset is considered liquid if it can be converted to cash quickly and at little cost – An illiquid asset can be converted to cash only after a delay, or at considerable cost 3 Assets and Their Liquidity • Most liquid asset is cash in the hands of the public • Next in line are asset categories of about equal liquidity – Demand deposits • Checking accounts held by households and business firms at commercial banks – Other checkable deposits • Catchall category for several types of checking accounts that work very much like demand deposits – Travelers checks • Specially printed checks that you can buy from banks or other private companies, like American Express – Savings-type accounts • At banks and other financial institutions • Are less liquid than checking-type accounts, since they do not allow you to write checks • Next on the list are deposits in retail money market mutual funds – Time deposits (sometimes called certificates of deposit, or CDs) • Require you to keep your money in the bank for a specified period of time (usually six months or longer) – Impose an interest penalty if you withdraw early 4 Figure 1: Monetary Assets and Their Liquidity (July 14, 2003) 5 M1 And M2 • Standard measure of money stock is M1 – Sum of the first four assets in our list • M1 = cash in the hands of the public + demand deposits + other checking account deposits + travelers checks – When economists or government officials speak about “money supply,” they usually mean M1 • Another common measure of money supply, M2, adds some other types of assets to M1 – M2 = M1 + savings-type accounts + retail MMMF balances + small denomination time deposits • Other official measures of money supply besides M1 and M2 that add in assets that are less liquid than those in M2 – M1 and M2 have been most popular, and most commonly watched, definitions 6 M1 And M2 • Important to understand that M1 and M2 money stock measures exclude many things that people use regularly as a means of payment • Technological advances—now and in the future—will continue trend toward new and more varied ways to make payments • We will assume money supply consists of just two components – Cash in the hands of the public and demand deposits • Our definition of the money supply corresponds closely to liquid assets that our national monetary authority—the Federal Reserve—can control 7 The Banking System: Financial Intermediaries • What are banks? – Financial intermediaries—business firms that specialize in • Assembling loanable funds from households and firms whose revenues exceed their expenditures • Channeling those funds to households and firms (and sometimes the government) whose expenditures exceed revenues • An intermediary helps to solve problems by combining a large number of small savers’ funds into custom-designed packages – Then lending them to larger borrowers • Intermediaries must earn a profit for providing brokering services – By charging a higher interest rate on funds they lend than rate they pay to depositors 8 The Banking System: Financial Intermediaries • United States boasts a wide variety of financial intermediaries, including – – – – – – Commercial banks Savings and loan associations Mutual savings banks Credit unions Insurance companies Some government agencies • There are four types of depository institutions – – – – Savings and Loan associations Mutual savings banks Credit unions Commercial banks 9 Commercial Banks • A commercial bank (or just “bank” for short) is a private corporation that provides services to the public – Owned by its stockholders • For our purposes, most important service is to provide checking accounts – Enables bank’s customers to pay bills and make purchases without holding large amounts of cash that could be lost or stolen • Banks provide checking account services in order to earn a profit 10 A Bank’s Balance Sheet • A balance sheet is a two-column list that provides information about financial condition of a bank at a particular point in time – In one column, bank’s assets are listed • Everything of value that it owns – On the other side, the bank’s liabilities are listed • Amounts bank owes • Bond – A promise to pay back borrowed funds, issued by a corporation or government agency • Loan – An agreement to pay back borrowed funds, signed by a household or noncorporate business • Next come two categories that might seem curious – “Vault cash” – “Account with the Federal Reserve” • Why does the bank hold them? 11 A Bank’s Balance Sheet • Explanations for vault cash and accounts with Federal Reserve – On any given day, some of the bank’s customers might want to withdraw more cash than other customers are depositing – Banks are required by law to hold reserves • Sum of cash in vault and accounts with Federal Reserve • Required reserve ratio tells banks the fraction of their checking accounts that they must hold as required reserves – Set by Federal Reserve • Net worth = Total assets – Total liabilities – Include net worth on liabilities side of balance sheet because it is, in a sense, what bank would owe to its owners if it went out of business • A balance sheet always balances 12 The Federal Reserve System • Every large nation controls its money supply with a central bank – A nation’s principal monetary authority – Most developed countries established central banks long ago • England’s central bank—Bank of England—was created in 1694 • France established Banque de France in 1800 • United States established Federal Reserve System in 1913 • U.S. waited such a long time to establish a central authority because of – Suspicion of central authority that has always been part of U.S. politics and culture – Large size and extreme diversity of our country – Fear that a powerful central bank might be dominated by the interests of one region to the detriment of others 13 The Federal Reserve System • Our central bank is different in form from its European counterparts • One major difference is indicated in the very name of the institution – Does not have the word “central” or “bank” anywhere in its title • Another difference is the way the system is organized • Another interesting feature of Federal Reserve System is its peculiar status within government – Strictly speaking, it is not even a part of any branch of government – Both President and Congress exert some influence on Fed through their appointments of key officials 14 Figure 2: The Geography of the Federal Reserve System 15 Figure 3: The Structure of the Federal Reserve System 16 The Structure of the Fed • Board of Governors – Consists of seven members who are appointed by President and confirmed by Senate for a 14-year term – In order to keep any President or Congress from having too much influence over Fed • Four-year term of the chair is not coterminous with four-year term of the President • Each of 12 Federal Reserve Banks is supervised by nine directors – Three of whom are appointed by Board of Governors – Other six are elected by private commercial banks—the official stockholders of the system – Directors of each Federal Reserve Bank choose a president of that bank, who manages its day-to-day operations • Only about 3,500 of the 8,000 or so commercial banks in United States are members of Federal Reserve System – But they include all national banks and state banks – All of the largest banks in United States are nationally chartered banks and therefore member banks as well 17 The Federal Open Market Committee • Federal Open Market Committee (FOMC) – A committee of Federal Reserve officials that establishes U.S. monetary policy • Most economists regard FOMC as most important part of Fed • Consists of all 7 governors of Fed, along with 5 of the 12 district bank presidents • Not even President of United States knows details behind the decisions, or what FOMC actually discussed at its meeting, until summary of meeting is finally released – Committee exerts control over nation’s money supply by buying and selling bonds in public (“open”) bond market 18 The Functions of the Federal Reserve • Federal Reserve, as overseer of the nation’s monetary system, has a variety of important responsibilities including – Supervising and regulating banks – Acting as a “bank for banks” – Issuing paper currency – Check clearing – Controlling money supply 19 The Fed and the Money Supply • Suppose Fed wants to change nation’s money supply – It buys or sells government bonds to bond dealers, banks, or other financial institutions • Actions are called open market operations • We’ll make two special assumptions to keep our analysis of open market operations simple for now – Households and business are satisfied holding the amount of cash they are currently holding • Any additional funds they might acquire are deposited in their checking accounts • Any decrease in their funds comes from their checking accounts – Banks never hold reserves in excess of those legally required by law 20 How the Fed Increases the Money Supply • To increase money supply, Fed will buy government bonds – Called an open market purchase • Suppose Fed buys $1,000 bond from Lehman Brothers, which deposits the total into its checking account – Two important things have happened • Fed has injected reserve into banking system • Money supply has increased – Demand deposits have increased by $1,000 and demand deposits are part of money supply – Lehman Brothers’ bank now has excess reserves » Reserves in excess of required reserves » If required reserve ratio is 10% bank has excess reserves of $900 to lend » Demand deposits increase each time a bank lends out excess reserves 21 The Demand Deposit Multiplier • How much will demand deposits increase in total? – Each bank creates less in demand deposits than the bank before – In each round, a bank lent 90% of deposit it received • Whatever the injection of reserves, demand deposits will increase by a factor of 10, so we can write – ΔDD = 10 x reserve injection • Demand deposit multiplier is number by which we must multiply injection of reserves to get total change in demand deposits • Size of demand deposit multiplier depends on value of required reserve ratio set by Fed 22 The Demand Deposit Multiplier • For any value of required reserve ratio (RRR), formula for demand deposit multiplier is 1/RRR • Using general formula for demand deposit multiplier, can restate what happens when Fed injects reserves into banking system as follows – ΔDD = (1 / RRR) x ΔReserves • Since we’ve been assuming that the amount of cash in the hands of the public (the other component of the money supply) does not change, we can also write – ΔMoney Supply = (1 / RRR) x ΔReserves 23 The Fed’s Influence on the Banking System as a Whole • Can also look at what happened to total demand deposits and money supply from another perspective – Where did additional $1,000 in reserves end up? – In the end, additional $1,000 in reserves will be distributed among different banks in system as required reserves • After an injection of reserves, demand deposit multiplier stops working—and the money supply stops increasing—only when all reserves injected are being held by banks as required reserves • In the end, total reserves in system have increased by $1,000 – Amount of open market purchase 24 How the Fed Decreases the Money Supply • Just as Fed can increase money supply by purchasing government bonds – Can also decrease money supply by selling government bonds • An open market sale • Process of calling in loans will involve many banks – Each time a bank calls in a loan, demand deposits are destroyed – Total decline in demand deposits will be a multiple of initial withdrawal of reserves – Keeping in mind that a withdrawal of reserves is a negative change in reserves • Can still use our demand deposit multiplier—1/(RRR)—and our general formula • ΔDD = (1/RRR) x ΔReserves 25 Some Important Provisos About the Demand Deposit Multiplier • Although process of money creation and destruction as we’ve described it illustrates the basic ideas, formula for demand deposit multiplier—1/RRR—is oversimplified – In reality, multiplier is likely to be smaller than formula suggests, for two reasons • We’ve assumed that as money supply changes, public does not change its holdings of cash • We’ve assumed that banks will always lend out all of their excess reserves 26 Other Tools for Controlling the Money Supply • While other tools can affect the money supply, open market operations have two advantages over them – Precision and secrecy – This is why open market operations remain Fed’s primary means of changing money supply • Fed’s ability to conduct its policies in secret—and its independent status in general—is controversial – In recent years, because Fed has been so successful in guiding economy, controversy has largely subsided 27 Other Tools for Controlling the Money Supply • There are two other tools Fed can use to increase or decrease money supply – Changes in required reserve ratio – Changes in discount rate • Changes in either required reserve ratio or discount rate could set off the process of deposit creation or deposit destruction in much the same way outlined in this chapter – In reality, neither of these policy tools is used very often • Why are these other tools used so seldom? – Partly because they can have unpredictable effects 28 Using the Theory: Bank Failures and Banking Panics • A bank failure occurs when a bank cannot meet its obligations to those who have claims on the bank – Includes those who have lent money to the bank, as well as those who deposited their money there • Historically, many bank failures have occurred when depositors began to worry about a bank’s financial health • Run on the bank – An attempt by many of a bank’s depositors to withdraw their funds • Ironically, a bank can fail even if it is in good financial health, with more than enough assets to cover its liabilities – Just because people think bank is in trouble • Banking panic occurs when many banks fail simultaneously 29 Using the Theory: Bank Failures and Banking Panics • Banking panics can cause serious problems for the nation – Hardship suffered by people who lose their accounts when their bank fails – Even when banks do not fail, withdrawal of cash decreases banking system’s reserves • Money supply can decrease suddenly and severely, causing a serious recession • Banking panic of 1907 convinced Congress to establish Federal Reserve System – But creation of Fed did not, in itself, solve problem • Great Depression is a good example of this problem – Officials of Federal Reserve System, not quite grasping seriousness of the problem, stood by and let it happen 30 Using the Theory: Bank Failures and Banking Panics • For five-year period ending in May 2003, a total of 26 banks failed—an average of about 6 per year – Why the dramatic improvement? • Federal Reserve learned an important lesson from Great Depression – It now stands ready to inject reserves into system more quickly in a crisis • In 1933 Congress created Federal Deposit Insurance Corporation (FDIC) to reimburse those who lose their deposits • FDIC has had a major impact on the psychology of banking public • FDIC protection for bank accounts has not been costless • To many observers, experience of late 1980s and early 1990s was a reminder of the need for a sound insurance system and close monitoring of banking system 31 Figure 4: Bank Failures in the United States, 1921-1999 32