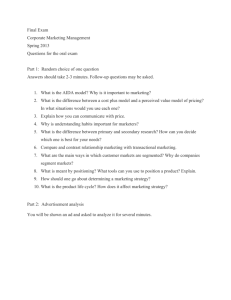

P L O :

advertisement