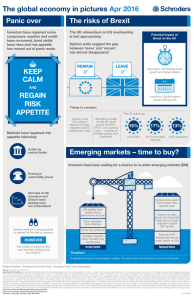

The global economy in pictures Feb 2016

advertisement

The global economy in pictures Feb 2016 Time to hit the panic button? We believe some of the gloom and concerns about the world economy have been overplayed. It is not time to hit the panic button, just yet IN CASE OF PANIC FALLING OIL PRICES A fall in oil prices led global equity markets down, especially in emerging markets BREAK GLASS However, we believe that lower oil prices generally lead to strong growth, albeit with an 18-month lag UK sterling slides DEPRECIATION IN ASIA US RECESSION RISK Whether the yuan continues to depreciate remains unknown Fears about US growth have been driving risk assets lower However, the Bank of Japan’s introduction of negative interest rates can be seen as a response to the sharp appreciation However, we believe: • Oil prices should boost consumer spending • Government spending will add 0.5% to US GDP in 2016 • Federal Reserve is unlikely to raise rates in March Concern over China UK sterling experienced its largest two-month fall against the US dollar since the height of global financial crisis in 2008 While much of the nervousness in global markets is stemming from China, we believe China is seeing some stabilisation Extent and speed of the depreciation in sterling has surprised... Will authorities continue with the existing policy of gradual depreciation or pursue a more aggressive one-off depreciation? ...although the direction of travel has not One-off devaluation Gradual depreciation Investors now place a greater probability on rates falling rather than rising in 2016 Move in sterling can be justified by recent moves in interest rate differentials (versus the US) Schroders’ view Given that the Brexit risk is becoming more prominent, and that opinion polls have been narrowing, we believe there’s further downside risk to sterling • Large deflationary shock to global economy • After a large enough devaluation, fears concerning further currency weakness should dissipate • This would provide no end point, volatility and global deflationary pressures remain heightened • Currency could depreciate more than necessary, leading to a vicious circle of global deflation Both options would adversely affect the rest of the world. For China in particular, a one-off, large devaluation would be preferable Source: Schroders as at February 2016. Important Information: Any security(s) mentioned above is for illustrative purpose only, not a recommendation to invest or divest. This document is intended to be for information purposes only and it is not intended as promotional material in any respect. The material is not intended to provide, and should not be relied on for investment advice or recommendation. Opinions stated are matters of judgment, which may change. Information herein is believed to be reliable, but Schroder Investment Management (Hong Kong) Limited does not warrant its completeness or accuracy. Investment involves risks. Past performance and any forecasts are not necessarily a guide to future or likely performance. You should remember that the value of investments can go down as well as up and is not guaranteed. Exchange rate changes may cause the value of the overseas investments to rise or fall. For risks associated with investment in securities in emerging and less developed markets, please refer to the relevant offering document. The information contained in this document is provided for information purpose only and does not constitute any solicitation and offering of investment products. Potential investors should be aware that such investments involve market risk and should be regarded as long-term investments. Derivatives carry a high degree of risk and should only be considered by sophisticated investors. The fund is authorized by the SFC but such authorization does not imply official approval or recommendation. Schroder does not provide any securities or investment products for offer, solicitation or trading within The People’s Republic of China (PRC). Should illegitimacy arise thereof, contents of this document shall not be construed as an offer or solicitation or trading for such securities or products. All items mentioned herein are sold through financial products issued by commercial bankers in the PRC under regulations by the China Banking Regulatory Commission (CBRC). Investors should read the relevant documents clearly before invest in the mentioned funds. Please consult the relevant commercial bankers in the PRC and/or professional consultants if necessary. This material including the website has not been reviewed by the SFC. Issued by Schroder Investment Management (Hong Kong) Limited. Schroder Investment Management (Hong Kong) Limited Level 33, Two Pacific Place, 88 Queensway, Hong Kong Telephone +852 2521 1633 Fax +852 2530 9095 0216/CNEN