Thomas Jefferson University

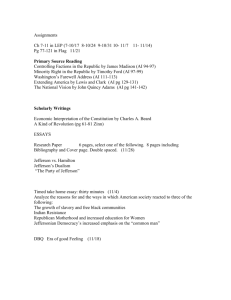

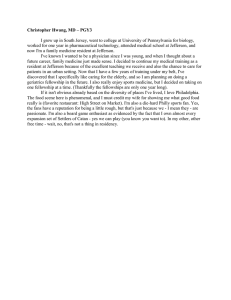

advertisement