Talking Point Schroders Five Themes for 2015

advertisement

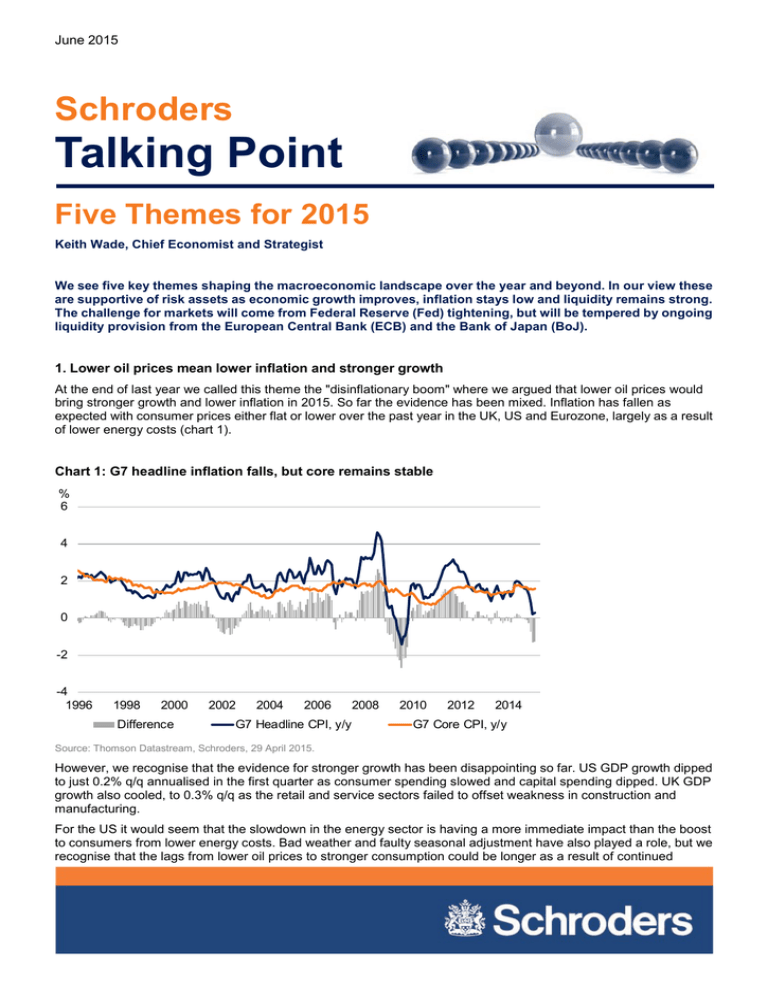

June 2015 Schroders Talking Point Five Themes for 2015 Keith Wade, Chief Economist and Strategist We see five key themes shaping the macroeconomic landscape over the year and beyond. In our view these are supportive of risk assets as economic growth improves, inflation stays low and liquidity remains strong. The challenge for markets will come from Federal Reserve (Fed) tightening, but will be tempered by ongoing liquidity provision from the European Central Bank (ECB) and the Bank of Japan (BoJ). 1. Lower oil prices mean lower inflation and stronger growth At the end of last year we called this theme the "disinflationary boom" where we argued that lower oil prices would bring stronger growth and lower inflation in 2015. So far the evidence has been mixed. Inflation has fallen as expected with consumer prices either flat or lower over the past year in the UK, US and Eurozone, largely as a result of lower energy costs (chart 1). Chart 1: G7 headline inflation falls, but core remains stable % 6 4 2 0 -2 -4 1996 1998 2000 Difference 2002 2004 2006 G7 Headline CPI, y/y 2008 2010 2012 2014 G7 Core CPI, y/y Source: Thomson Datastream, Schroders, 29 April 2015. However, we recognise that the evidence for stronger growth has been disappointing so far. US GDP growth dipped to just 0.2% q/q annualised in the first quarter as consumer spending slowed and capital spending dipped. UK GDP growth also cooled, to 0.3% q/q as the retail and service sectors failed to offset weakness in construction and manufacturing. For the US it would seem that the slowdown in the energy sector is having a more immediate impact than the boost to consumers from lower energy costs. Bad weather and faulty seasonal adjustment have also played a role, but we recognise that the lags from lower oil prices to stronger consumption could be longer as a result of continued SchrodersTalking Point Page 2 consumer caution post the financial crisis. Nonetheless, with the fundamentals still in place (improving real income and wealth), consumption in the US should pick up again. More encouragingly, retail sales volumes in the Eurozone are accelerating with the latest figures showing a gain of 6% y/y in the region and it is likely that the Euro region will outpace both US and UK GDP. 2. Oil and currency are rebalancing the world economy We still see a desynchronised monetary cycle where central bank policy diverges this year and we believe that a recovery in the Eurozone and Japan would have further to run than in the US or UK given respective deflationary pressures. However, we are seeing more convergence in growth this year as the US has slowed whilst Europe and, to some extent, Japan have picked up. Part of the story here is to do with oil as lower energy costs have been supporting growth across the developed world (which is primarily an oil importing economy) and Europe and Japan have taken less of a hit from energy industry cutbacks, compared to the US. Another part of the story is to do with currency with the stronger US dollar/weaker euro and yen acting to skew growth away from the US towards Eurozone and Japan. The swing in the trade-weighted euro has been dramatic over the past year, from overvalued to cheap (chart 2). Chart 2: Trade-weighted exchange rates: euro winning the currency war 4 Expensive 3 2 1 0 -1 -2 Cheap -3 EUR Upper quartile JPY Lower quartile GBP USD Current TW exchange rate (10yr z-score) Last year Source: Thomson Datastream, Schroders, 28 April 2015. 3. Fed to tighten as US economy normalises Although US growth slowed in the first quarter, we still expect the Fed to raise interest rates this year with the first move coming in September. Dollar strength has helped tighten monetary conditions for the Fed, but we still see labour market developments underpinning the need to move away from emergency monetary policy. For example, using the Atlanta Fed jobs calculator it is likely that the unemployment rate will fall below 5% in 12 months’ time given the current rate of participation and job growth. Should participation fall further, as is likely given demographics, then unemployment will fall faster for any given rate of job growth. Whilst this may not immediately translate into higher inflation, there is evidence that wages and employment costs are picking up, and most estimates suggest that the equilibrium rate of unemployment lies between 5% – 5.5%. Combine a more normal labour market with a banking system that is beginning to function again in terms of providing credit to the real economy, and there seems to be little reason for the Fed to maintain interest rates at emergency levels. We do not see the need for rates to rise as much as in previous cycles given the headwinds on activity, but after the first move in September we would look for the Fed funds rate to be at 2.5% by the fourth quarter of 2016 – a hike of 25 basis points at each subsequent meeting. SchrodersTalking Point Page 3 4. Emerging markets: pockets of strength The broader pattern of recovery in the developed world has not fully extended to the emerging markets where activity remains subdued. The latest Purchasing Managers Indices (PMIs) confirm that the divergence persists (chart 3). Underpinning this has been the weakness of commodity prices and downturn in China where growth moderated to 7% in the first quarter on the official measure, although it was probably considerably weaker based on other indicators such as rail freight and electricity consumption. Chart 3: Emerging markets still lagging developed economy recovery Balance 65 60 55 50 45 40 35 30 25 2006 2007 2008 2009 2010 2011 Developed Market PMI 2012 2013 2014 2015 Emerging Market PMI Source: Thomson Datastream, Schroders, 28 April 2015. On this basis, an upturn in China is needed to help support a broader emerging markets recovery. We do not think there would be a hard landing as the authorities would not allow such a move given the social disruption which would follow. However, the headwinds facing China in terms of overcapacity and the need to reform state-owned enterprises (SOEs) and the banking system, mean there is little prospect of growth accelerating soon. The situation is helped by easier monetary policy from the People's Bank of China (PBoC) and China should benefit from stronger demand elsewhere. However, these measures will cushion the downturn rather than trigger an acceleration, especially given the ongoing strength of the US dollar, which has helped push the Chinese yuan to the top of its historical range in trade-weighted terms. Nonetheless, there are pockets of strength to be found in the emerging world with the energy importers well placed to benefit from lower oil prices. The more manufacturing-orientated countries in Asia in particular stand to benefit from better growth in Europe and the US. With a Fed rate rise in prospect we would be focused on those economies with strong balance sheets and low external financing requirements. We would also favour economies like India which have seen a significant improvement in their current account and have been able to attract strong capital inflows since the “taper tantrum” of 2013. 5. Liquidity: the search for yield continues Last year as the Fed brought an end to quantitative easing (QE), the prospect of a subsequent increase in interest rates raised fears over liquidity in markets, particularly in emerging markets. This remains a concern, but the search for yield has been given fresh impetus by the start of ECB QE and continued money printing by the BoJ. In our previous themes we emphasised the potential impact on markets like the NASDAQ, but the effects now seem broader. Interest rates in the Eurozone have now reached extraordinarily low levels with the German yield curve below zero out to five years maturity, for example. As we have argued before, this is intensifying the search for yield and helping to drive down peripheral yields in the region (with the exception of Greece), the rest of Europe and beyond. The spread between Treasuries and Bunds remains attractive (at its widest since 1989, see chart 4) and is a key element in driving the euro weaker. In this respect, action by the ECB is helping to anchor global bond yields and SchrodersTalking Point Page 4 should help temper some of the concerns the Fed has over higher market volatility and a repeat of the 2013 experience when they tighten policy. Chart 4: Overspill from ECB QE drives search for yield % 10 8 6 4 2 0 -2 90 92 96 98 00 02 94 10 year Treasury – Bund Spread German 10Y Government bond yield 04 06 08 12 14 10 US 10Y Government bond yield Source: Thomson Datastream, Schroders, 28 April 2015. More generally, liquidity will continue to drive flows into real estate and equities across Europe as well as keeping the currency weak. There has been some speculation that the ECB will soon begin to taper and close its QE programme given the dramatic results so far. ECB President Mario Draghi has kicked such concerns into touch, however, that does not preclude an active debate, especially as Eurozone activity revives and inflation picks up next year. In our forecast we assume the ECB continues asset purchases through to September 2016. Although risk premiums in bond and currency markets are in danger of disappearing, the search for yield has further to run. Important Information Any security(s) mentioned above is for illustrative purpose only, not a recommendation to invest or divest. This document is intended to be for information purposes only and it is not intended as promotional material in any respect. The views and opinions contained herein are those of the author(s), and do not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. The material is not intended to provide, and should not be relied on for investment advice or recommendation. Opinions stated are matters of judgment, which may change. Information herein is believed to be reliable, but Schroder Investment Management (Hong Kong) Limited does not warrant its completeness or accuracy. Investment involves risks. Past performance and any forecasts are not necessarily a guide to future or likely performance. You should remember that the value of investments can go down as well as up and is not guaranteed. Exchange rate changes may cause the value of the overseas investments to rise or fall. For risks associated with investment in securities in emerging and less developed markets, please refer to the relevant offering document. The information contained in this document is provided for information purpose only and does not constitute any solicitation and offering of investment products. Potential investors should be aware that such investments involve market risk and should be regarded as long-term investments. Derivatives carry a high degree of risk and should only be considered by sophisticated investors. This material, including the website, has not been reviewed by the SFC. Issued by Schroder Investment Management (Hong Kong) Limited. Schroder Investment Management (Hong Kong) Limited Level 33, Two Pacific Place, 88 Queensway, Hong Kong Telephone +852 2521 1633 Fax +852 2530 9095