Describe the difference between selective and general sales taxes.

advertisement

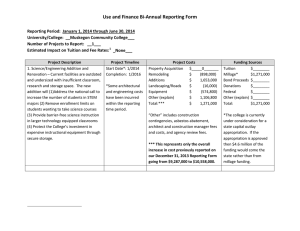

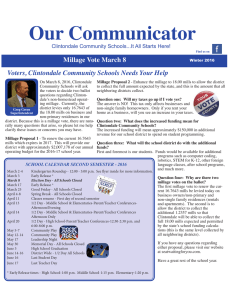

Describe the difference between selective and general sales taxes. • General sales tax applies the same tax rate to the purchase of all items. • Selective sales taxes apply a higher tax rate to the purchase of specific items. Explain what effect inaccurate assessments have on millage. • Inaccurate assessments cause the millage rate to be higher for all property tax payers. • It particularly hurts those taxpayers whose assessments are high because they also have to deal with the higher millage rates. Define progressive taxation and give one example of it. • Progressive taxation is when the tax rate that is charged increases as the person’s ability to pay the tax increases. • This means they not only pay more in taxes because they earn more, but also because their bill is calculated using a higher percentage rate. • Example: Federal Income Tax Define regressive taxation and give one example of it. • Any tax that is calculated without taking a person’s abiltiy to pay the tax into consideration. In other words, the tax bill is calculated on something other than the person’s income. • This hurts poorer taxpayers. • Examples: Property taxes; Sales taxes; $52 Emergency Medical Services tax; $10 Occupational Privilege Tax Define proportional taxation and give one example of it. • Any taxation system that charges each person the same percentage of their income • Pennsylvania income tax is an example. All Pennsylvanians pay 3.07% of their income. Describe the difference between estate and inheritance taxes. • Estate: Paid if an estate is worth over five million dollars at the time of a person’s death. Tax bill is based on the total value of the entire estate. Paid to the federal government. • Inheritance: Paid by an individual for the value of the specific items they inherit. Tax bill is based on the value of the specifc item(s) a person inherits. Define and/or give examples of both tangible and intangible personal property. • Tangible Personal Property: things whose value can be seen and touched; cars, boats, jewelry • Intangible Personal Property: things whose value is understood, but cannot actually be seen or touched; bank accounts; investments like stocks or bonds Give one example of an entitlement program and explain how they affect our deficit. • Examples include: Social Security, Medicare, and Medicaid • Because the existing rules for these programs guarantee payments for anyone who meets the eligibility requirements (citizenship; age and/or income), Congress does not get to decide how much is spent each year. Explain the difference between deficit and debt. • Deficit: the amount by which expenditures exceeds revenue for a given year; the shortfall of funds for current spending • Debt: the accumulated amount of money owed; If deficits occur for many years, the debt will the the sum total of those deficits. Explain the difference between market value and assessed value. • Market Value is what a piece of property is actually worth if it were to be bought or sold. • Assessed Value is what a county decides the property is worth for calculating your property tax bill. Describe the difference between real and personal property. • Real property: Real estate (land and the buildings that are on that land) • Personal: Any other property a person owns. This can be money and investments (intangible property) or actual possessions (tangible property) Bucks County Market Value to Assessed Value: $250,000 x .11 = $27,500 Millage: .017 $27,500 x .017 = $467.50 Montgomery County Market Value to Assessed Value: $125,000 x .58 = $72,500 Millage: .013 $72,500 x .013 = $942.50