PROPERTY TAXES THE MOST VOLATILE POLITICAL ISSUE FACING STATE AND LOCAL GOVERNMENTS TODAY

advertisement

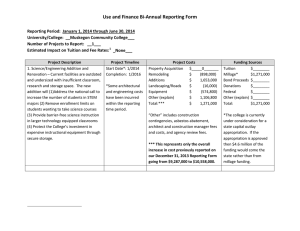

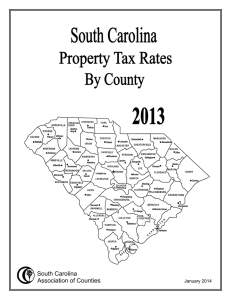

PROPERTY TAXES THE MOST VOLATILE POLITICAL ISSUE FACING STATE AND LOCAL GOVERNMENTS TODAY PROPERTY TAXES 1. What is the Property Tax? PROPERTY TAXES 1. A What is the Property Tax? tax on the value of property (usually real estate) that a person owns PROPERTY TAXES 2. What are property taxes made up of? PROPERTY TAXES 2. What are property taxes made up of? 3 parts – County Tax (Courts and justice system) Municipality Tax (Township or Boro) – police and local services School Tax – education PROPERTY TAXES SO 3 DIFFERENT GROUPS GOT THEIR HANDS IN MY POCKETS!!! WHERE IS MY VOTER REGISTRATION FORM AND WHAT LINE DO I MARK FOR THE LIBERTARIAN PARTY!!! ADVANTAGES OF PROPERTY TAXES 1. An even and stable flow of income for local governments 2. They protect continuity of basic services like police, fire, schools, streets, parks, etc. Makes the local municipality more independent and gives them greater control over their own affairs ADVANTAGES OF PROPERTY TAXES Alternatives are cutting programs or raising other taxes at the state level DISADVANTAGES OF PROPERTY TAXES 1. They are regressive. 2. It is a tax on an unproductive item and value of real estate is not always a key element in a person’s income 3. It impacts harshly on the elderly and on those who have no children in the school system DISADVANTAGES OF PROPERTY TAXES 4. The system is based on an assessment process that is out of date and/or corrupt (tax exemptions given out like candy). 5. Other revenue options exist PROPERTY TAXES – SO HOW DOES THIS WHOLE PROPERTY TAX PROCESS WORK??? OKAY PROPERTY TAXES Who sets the tax? The individual taxing authority – what? PROPERTY TAXES Who sets the tax? The County Board of Commissioners The Township / Borough Supervisors The School Board PROPERTY TAXES How do they decide what the tax is? 1st – Set the Budget 2nd – Calculate (Assess) the value of all real property in the municipality 3rd - Divide = that equals the tax rate of property called the MILLAGE RATE PROPERTY TAXES Who sets the value of real property in the county? The county tax assessor does a property assessment PROPERTY TAXES How do they assess the value of my property? It starts with MARKET VALUE – what a willing buyer would pay and a willing seller would accept PROPERTY TAXES How do they assess the value of my property? Then they apply the Uniform Assessment Ratio to the market value Montco = 100% of 1996 value Bucks = about 5% of value or the 1973 value of your land PROPERTY TAXES How do they assess the value of my property? For example – in Montco – a house valued at $500,000 in today’s market would be assessed at the 1996 value or about $300,000 but in Bucks it would be assessed at 5% of the current market value PROPERTY TAXES How do they assess the value of my property? This math calculation gives the assessed value of the property PROPERTY TAXES This is where it gets easy! Now you apply the millage rate to the assessed value and that gets you the Property Tax Due PROPERTY TAXES What??? Example A house assessed at $100,000 in NPSD would be set this way $100,000 X millage rate of 22.7049 Careful – this is a little bit different than doing a percent PROPERTY TAXES What??? 1 mill = 1/1000 or 1 mill = .001 – so you have to move the decimal place 3 spots to the left $100,000 X 22.7049 = the property tax due $100,000 X .0227049 = Property tax due PROPERTY TAXES Where do I find out information about my property assessment and the millage rates for my property taxes? The Montgomery County Board of Assessments http://boa.montcopa.org/boa/site/default .asp