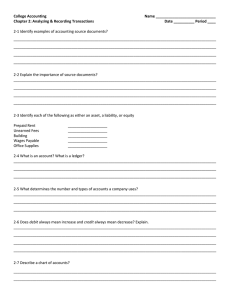

Transactions That Affect Assets, Liabilities, and Owner Making Accounting Relevant

advertisement

Transactions That Affect Assets, Liabilities, and Owner’s Equity Making Accounting Relevant Accounting and finance professionals are key to every business operation. How might the work performed by the accountant affect the day-to-day decisions made by the business owner? Section 1 Accounts and the Double-Entry Accounting System What You’ll Learn How to use T accounts. Why you need a ledger. The rules of debit and credit. Section 1 Accounts and the Double-Entry Accounting System (cont'd.) Why It’s Important The rules of debit and credit are the basis for entering transactions into the records of a business. Key Terms ledger chart of accounts double-entry accounting T account debit credit normal balance Section 1 Accounts and the Double-Entry Accounting System (cont'd.) The Chart of Accounts A list of all the accounts and their assigned account numbers. Roadrunner Delivery Service 155 Gateway Blvd. Sacramento, CA 94230 CHART OF ACCOUNTS ASSETS LIABILITIES OWNER’S EQUITY REVENUE EXPENSES 101 105 110 115 120 125 201 205 Cash in Bank Accounts Receivable--City News Accounts Receivable--Green Company Computer Equipment Office Equipment Delivery Equipment Accounts Payable--Beacon Advertising Accounts Payable--North Shore Auto 301 302 303 401 501 505 510 515 Maria Sanchez, Capital Maria Sanchez, Withdrawals Income Summary Delivery Revenue Advertising Expense Maintenance Expense Rent Expense Utilities Expense Section 1 Accounts and the Double-Entry Accounting System (cont'd.) Double-Entry Accounting • A system of recordkeeping • Each business transaction affects at least two accounts. Section 1 Accounts and the Double-Entry Accounting System (cont'd.) T Accounts • Shows the dollar increase or decrease in an account that is caused by a transaction. Account Name Left Side Right Side Debit Side Credit Side Debit Credit Section 1 Accounts and the Double-Entry Accounting System (cont'd.) The Rules of Debit and Credit Different for the different accounts - asset, a liability, or an owner’s capital account. Normal balance is always on the side used to record increases to the account. Section 1 Accounts and the Double-Entry Accounting System (cont'd.) Rules for Asset Accounts Assets Debit + (1) Increase Side (3) Normal Balance Credit – (2) Decrease Side Section 1 Accounts and the Double-Entry Accounting System (cont'd.) Rules for Liability and Owner’s Capital Accounts Liabilities Debit Debit – – Credit + (2) Decrease (1) Increase Side Side (3) Normal Balance Owner’s Equity Debit Credit Credit – ++ (2) Decrease (1) (1)Increase Increase Side Side Side (3) (3)Normal Normal Balance Balance