Financial Accounting Basics: Chapter 7 Presentation

Chapter 7

Accounting

Chapter

7

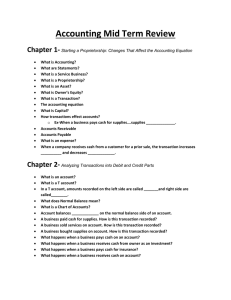

Financial Accounting financial reports accounting period accounting cycle accounting equation account accounts receivable accounts payable double-entry accounting

T account debit credit (accounting) journal general ledger posting trial balance financial statements income statement cost of merchandise sold net income balance sheet statement of cash flows

Chapter

7

Financial Accounting

Chapter

7

Financial Accounting

The Accounting System

Who might be interested in your business’s finances?

Potential buyers

Government agencies

Banks or other financial institutions

Employees and consumers

Chapter

7

Financial Accounting

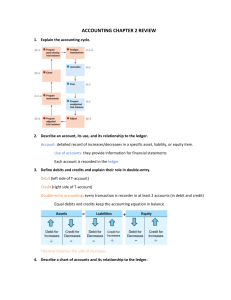

Establishing Accounts

Rules of Debit and Credit

An asset account increases on the debit side and decreases on the credit side.

Liability accounts and owner’s equity accounts increase on the credit side and decrease on the debit side.

Chapter

7

Financial Accounting

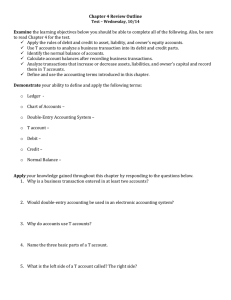

Using the Five Steps

1

2

Collect and verify source documents

Analyze each transaction

First Five Steps of the

Accounting Cycle

5

3

Journalize each transaction

4

Post to the general ledger

Prepare a trial balance

Chapter

7

Financial Accounting

Computerized Accounting

Computerized posting is faster and eliminates accounting errors.

Even for an automated system, you still need to collect and keep your source documents.

Financial Accounting

Chapter

7

Section 2 Financial Statements for a Business

How is it possible for a business to have made a profit during the most recent accounting period but not have enough money to pay its employees this week?

A business may show a profit for the most recent accounting period but still have more cash outflows than inflows during the time period.

Chapter

7

Financial Accounting

Profit Motive

Profit

Profit is the incentive for entrepreneurs to risk their own money.

Profits are needed to buy more goods and make improvements at a company.

Net income on an income statement is really net profit before taxes.

Chapter

7

Financial Accounting