Change Control Notification in accordance ... Ofcom’s Regulatory Financial Reporting Final Statement published on

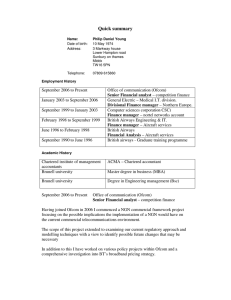

advertisement