T Fund Your IRA The Cost of Fed Policy Because Money Matters.

advertisement

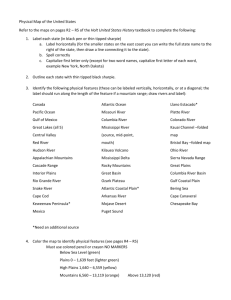

SECOND QUARTER 2016 Fund Your IRA At the time of this writing the deadline for 2015 IRA contributions is fast approaching, which is the same as your tax filing date (e.g. Postmarked April 18, 2016). Taxpayers can contribute up to $5,500 to a Traditional or Roth IRA ($6,500 if age 50 or over) if they meet certain eligibility requirements. Once you reach age 70½ however, you are no longer eligible to contribute to traditional IRAs, but you might be able to make a Roth contribution. Now is also the time to consider funding 2016 contributions. The power of compounding cannot be overstated. Take, for example, a 35 year old individual that contributes $5,500 for 2015. That single contribution could grow to nearly $59,000 over 35 years using a 7% compounded rate of return. Each situation is unique, but the common underlying theme is the power of contributing early and taking advantage of the tax-deferred compounding power of IRAs. In fact, many parents contribute to their child’s IRA as a bonus for working, which can be a very effective tool financially as well as instilling a firm work ethic at a young age. Because Money Matters. The Cost of Fed Policy T he past 10 years have been very positive for equity investors and borrowers, but not for savers. Since 2006, the S&P 500 benchmark has appreciated more than 60% and more than 200% if you measure from the market low in 2008. Unfortunately, the low interest rate environment driven by the Federal Reserve in response to the mortgage crisis has punished savers. The lost potential income to investors from near zero – yielding savings and money market accounts over that period is measured in billions of dollars if compared to the norm. Steve Soden President & CEO There is no question that “As always, if an income the aggressive search for yield investment seems too good to has pushed many investors into be true, it probably is. ” more risk than they normally would be comfortable taking. Faced with a shortfall in cash flow, many have had to invade their principal to meet life expenses. The basic goal of the low artificially depressed interest rate environment was (Continued on page 3) US 3-Month Treasury Bills 2006 - 2016 Interest Rate % 6.0 5.0 4.0 3.0 2.0 1.0 0.0 -1.0 2006 2007 2008 2009 Source: Bloomberg greatplainstrust.com 2010 2011 2012 2013 2014 2015 2016 Employee Spotlight Laurie Marchio, VP, Director of Operations How long have you been employed at Great Plains, and what are your responsibilities? I have been with Great Plains 20 years and I am the Director of Operations. Prior to working at GPTC, I worked in Operations at Kornitzer Capital Management for 4 years. What do you like most about your job? Enjoying Birthday Bagel Day with my co-workers. I also like the challenge of my day to day projects. What keeps you busy outside of Great Plains? My three children ages 9, 13, and 16. I’m coaching two of my children in track. Also, I’m currently busy redecorating my home. What is your favorite KC team to cheer for? Bishop Miege High School Girls Varsity Soccer. What are you currently watching on Tv? House of Cards Season 1 on Netflix. It’s eye opening to what might actually be going on behind closed doors in politics.. What is one item on your bucket list? I want to attend the Kentucky Derby. Hopefully, I can bet on the winning horse! What is your favorite restaurant in Kansas City? Q39 in Westport. Their bbq is fantastic! I give it two thumbs up! Welcome to GPTC - William Lenker Great Plains Trust of South Dakota has hired a new regional account executive, William Lenker. “We’re excited to welcome Bill to the team, and know his talent and experience will help us further our presence in South Dakota.” said Steve Soden, president of Great Plains. Lenker joined the company earlier this year following 20 years of experience in institutional retirement and trust management at Wells Fargo Bank. At Great Plains he will be responsible for managing and developing existing clients as well as pursuing new relationships throughout the state. 2 Great Plains Trust and Asset Management Lenker earned his Bachelor of Science in business administration from the University of South Dakota in Vermillion, SD. He has his Certified Retirement Services Professional (CRSP) designation from the American Bankers Association. Lenker is active in both charitable and civic organizations in Sioux Falls including the Boy Scouts of America and United Way. Bill and his wife Stacey, together with their two children, are lifelong residents of the Sioux Falls area. Fed Policy (continued from page 1) to stimulate and drive dollars into “riskier assets” such as stocks and create a “wealth effect” that would spread through the economy. That wealth effect was anticipated to produce further stimulus. The economic growth however during the post financial crisis recovery has been mired in the 2% to 2.5% range motivating the Fed to keep rates depressed. Stocks have been helped as these low rates have led to “cheap money” and the fueling of topline growth via debt throughout many industries. This in turn has driven the increases in stock prices, although volatile at times. The Fed is on record as committing to normalize interest rates. The trend will take time and even when the Fed gets back on the path to normalization, it probably will be several years before savers see significant rewards. As always, if an income investment seems too good to be true, it probably is. These are tough times for income alternatives but the risk/reward equation always has to be evaluated carefully. It makes sense to work with investment professionals on the investment risk you are willing to take. As the famous old quote goes, “I am more concerned with the return of my money than the return on my money.” Wills vs Living Trusts Educational Trusts for Generations There is often confusion between a Last Will and Testament “Will” and a Revocable Living Trust “Trust”. However, there are important differences between the two documents even though both can direct how assets pass to one’s beneficiaries at death. W Wills require Probate (the court supervised procedure ensuring the disposition of property in accordance with the Will) to be effective. Wills are often used alone in simpler plans whereby transfer on death “TOD” or beneficiary designations are implemented. These designations bypass the probate process and can be very useful as long as the overall plan is coordinated, because sometimes people forget to update designations and wind up with an outcome they did not foresee. An often overlooked but very effective vehicle for individuals to leave a legacy to future generations is to fund dynasty trusts for educational purposes. These trusts provide that funds can be segregated and protected and provide certain incentives to encourage or discourage certain behavior to reinforce family values or beliefs while maintaining core principles of the original grantor for generations. A Trust is often used as a way to avoid probate, maintain privacy, and provide for more complicated distribution patterns and estate tax planning. A Trust can also incorporate disability planning. However, because a Trust is typically more complicated than a Will, it is usually more expensive. A Will is often used where a simple distribution pattern is desired, or when contentious beneficiaries make court supervision beneficial. hile dynasty trusts are often used to provide creditor protection from the consequences of divorce or uncontrolled spending , they are also created to exclude assets from one’s estate, and this can become perpetual with each generation. Because of the irrevocable nature of dynasty trusts and potential generation skipping transfer tax issues, careful planning must be done and legal counsel consulted. However, a strategically planned dynasty trust can have a lasting impact for generations to come. Take the next step. Consider naming Great Plains Trust as your Corporate Trustee in your estate planning documents. Doing so eliminates many of the above-noted issues. As a Great Plains Trust client, you have access to a full range of investment professionals. For more Trust-related questions, please contact Jonathan Staton at 913-6471282 at Great Plains today. Because Money Matters. 3 COLLECTIVE FUND PERFORMANCE NET PERFORMANCE (3/31/2016) PENSION FUNDS YTD ANNUALIZED 1 YR. ANNUALIZED 3 YR. ANNUALIZED 5 YR. ANNUALIZED 10 YR. ANNUALIZED 15 YR. ANNUALIZED 20 YR. ANNUALIZED 25 YR. GPTC Large Cap Fund -2.19% -2.16% 12.86% 10.22% 7.20% N/A N/A N/A GPTC USA Global Fund 0.24% -1.21% 11.79% 9.84% 8.06% 6.49% 8.14% N/A 10.84% GPTC Equity Fund -7.76% -10.58% 1.28% 6.35% 6.08% 10.31% 11.39% GPTC Small Cap Fund -4.42% -10.78% 4.08% 5.94% 5.21% 8.73% 11.38% N/A GPTC Science & Technology -1.78% -3.13% 12.78% 11.54% 9.25% 7.99% N/A N/A GPTC Mid Cap Fund -1.63% -8.39% 7.71% 6.73% 6.10% N/A N/A N/A GPTC International Fund 1.26% -3.45% 3.15% 3.51% N/A N/A N/A N/A -15.30% -21.29% -3.50% 5.58% 5.35% 6.35% 7.10% 8.54% YTD ANNUALIZED 1 YR. ANNUALIZED 3 YR. ANNUALIZED 5 YR. ANNUALIZED 10 YR. ANNUALIZED 15 YR. ANNUALIZED 20 YR. ANNUALIZED 25 YR. GPTC Fixed Fund INDICES (3/31/2016) MARKET INDEX S&P 500 1.35% 1.78% 11.82% 11.58% 7.01% 5.99% 7.98% 9.28% Russell 1000 Growth 0.74% 2.52% 13.61% 12.38% 8.28% 6.03% 7.39% NA Russell 2000 Growth -4.68% -11.84% 7.91% 7.70% 6.00% 6.86% 5.76% NA Russell Mid Cap Growth 0.58% -4.75% 10.99% 10.00% 7.43% N/A N/A N/A Russell 3000 Growth Index 0.34% 1.34% 13.16% 12.00% 8.09% 6.09% N/A N/A Russell Global ex US -0.10% -7.37% 1.58% 1.28% N/A N/A N/A N/A BofA Merrill Lynch HY Master II 3.25% -3.99% 1.75% 4.71% 6.85% 7.16% 6.77% 8.31% Past performance is not indicative of future results. Investments are not insured by the FDIC, are not deposits or other obligations of Great Plains Trust, and are not guaranteed by Great Plains Trust. Investments are subject to risk, including possible loss of principal invested. Performance for the GPTC Pension Funds are net of the 1% annual fee and include the reinvestment of interest and dividends. CONTACT US When you work with Great Plains, you’re putting your wealth in the hands of real professionals, not just some algorithm. Real people who have built real wealth. Real businesses. Not just for our customers, but for ourselves. We know firsthand the hopes, fears, ambitions and challenges that individuals and small business owners in Kansas City and nationwide face. It’s what makes Great Plains the first name in wealth management. And it’s always on a first-name basis. CORPORATE HEADQUARTERS 7700 Shawnee Mission Parkway, Suite 101 Overland Park, KS 66202 P 913.831.7999 | TF 888.529.2776 | F 913.831.0007 info@greatplainstrust.com FLORIDA TRUST SERVICE OFFICE Sarasota, FL | 913.831.9221 ATLANTIC REGION TRUST SERVICE OFFICE Charlotte, NC | 704.552.3885 OUR MISSION STATEMENT To be a premier provider of investment and trust services to the business owner and high net worth/ income individual. We shall deliver responsive, reliable and informed service combined with a commitment to achieve superior long-term investment returns for our customers. We shall at all times deal honestly and respectfully with all clients and associates. GREAT PLAINS TRUST OF SOUTH DAKOTA Sioux Falls, SD | 605.271.5141 greatplainstrust.com