– Unit 7 - Accounting for a Corporation Lesson Plan Course Title

advertisement

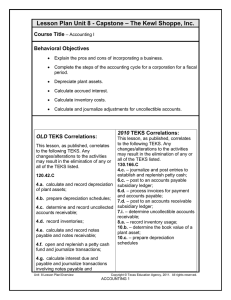

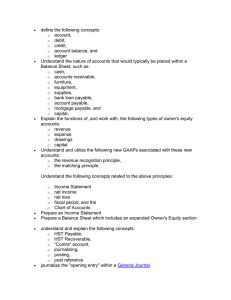

Lesson Plan – Unit 7 - Accounting for a Corporation Course Title – Accounting I Behavioral Objectives Research characteristics of a corporation. Analyze differences between a merchandising and manufacturing business. Record transactions related to discounts and returns and allowances for both purchases and sales. Identify terms related to a corporation and specialized transactions for a corporation. Open, replenish and prove petty cash funds. Journalize correcting entries. Calculate and record adjustments to uncollectible accounts as well as write-off uncollectible accounts. Record buying a long-term asset; calculate depreciation expense, prepare long-term asset records and record the disposal of a plant asset. Calculate inventory using the periodic and perpetual method. Calculate inventory using first-out inventory costing, last-out inventory costing and weighted-average inventory costing. Estimate inventory cost. Calculate interest on interest-bearing notes and non-interest bearing notes. Record discounted notes and other types of note transactions. Record adjustments for accrued revenue and expense. Calculate and record dividend distribution for a corporation. Calculate net income or loss and income tax for a corporation. Complete all phases of the accounting cycle for a corporation. Follow accounting procedures for the forming and dissolving a business. OLD TEKS Correlations: 2010 TEKS Correlations: This lesson, as published, correlates to the following TEKS. Any changes/alterations to the activities may result in the elimination of any or all of the TEKS listed. 120.42.C 2.b. analyze transactions relating to purchase and sale of merchandise; 2.c. record transactions in special journals; 4.a. calculate and record depreciation of plant assets; This lesson, as published, correlates to the following TEKS. Any changes/alterations to the activities may result in the elimination of any or all of the TEKS listed. 130.166.C 4.c. – journalize and post entries to establish and replenish petty cash; 5. – The student performs accounting functions specific for a merchandising business. The student is expected to explain the nature of special journals Unit 7 – Intro Lesson/Overview Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING 1 4.b. prepare depreciation schedules; 4.c. determine and record uncollected accounts receivable; 4.d. record inventories; 4.e. calculate and record notes payable and notes receivable; 4.f. open and replenish a petty cash fund and journalize transactions; 4.g. calculate interest due and payable and journalize transactions involving notes payable and receivable; 4.h. calculate interest due and payable and journalize transactions involving uncollecte3d accounts; 5.a. compare the various forms of business organizations; 5.b. list advantages and disadvantages of each form of business organization; 5.c. identify the various accounting functions involved with each form of business organization; 7.a. follow oral and written instructions; 7.b. develop time management skills by setting priorities for completing work as scheduled; 7.c. make decisions using appropriate accounting concepts 7.e. perform accounting procedures using manual and automated methods. and recording transactions in special journals. 6.e. – prepare an accounts payable schedule; 7.h. – prepare an accounts receivable schedule; 7.i. – determine uncollectible accounts receivable; 10.a. – process notes payable and receivable; 10.b. – determine the book value of a plant asset; 10.c. – prepare depreciation schedules TAKS Correlation: READING Objective 1: The student will demonstrate a basic understanding of culturally diverse written texts. MATH Objective 10: The student will demonstrate an understanding of the mathematical processes and tools used in problem solving. Unit Overview: Introduce students to specialized accounting procedures for a corporation, Unit 7 – Intro Lesson/Overview Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING 1 including recording purchases discounts and purchases returns and allowances recording sales discounts and sales returns and allowances calculating and recording depreciation on long-term assets preparing depreciation schedules determining and recording uncollected accounts receivable recording inventories using various methods calculating and recording various types of notes payable and notes receivable opening and replenishing a petty cash fund and journalizing related transactions calculating interest due and payable and journalizing transactions related to notes payable and receivable calculating bad debts expense and journalizing transactions related to uncollected accounts Unit 7 – Intro Lesson/Overview Copyright © Texas Education Agency, 2011. All rights reserved. ACCOUNTING 1