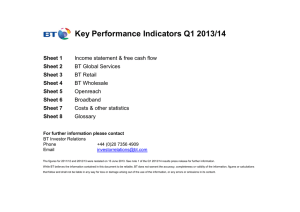

Key Performance Indicators Q2 2013/14

advertisement

Key Performance Indicators Q2 2013/14

Sheet 1

Income statement & free cash flow

Sheet 2

BT Global Services

Sheet 3

BT Retail

Sheet 4

BT Wholesale

Sheet 5

Openreach

Sheet 6

Broadband

Sheet 7

Costs & other statistics

Sheet 8

Glossary

For further information please contact

BT Investor Relations

Phone

+44 (0)20 7356 4909

Email

investorrelations@bt.com

The figures for 2011/12 and 2012/13 were restated on 13 June 2013. See note 1 of the Q2 2013/14 results press release for further information.

While BT believes the information contained in this document to be reliable, BT does not warrant the accuracy, completeness or validity of the information, figures or calculations

that follow and shall not be liable in any way for loss or damage arising out of the use of the information, or any errors or omissions in its content.

1. Group income statement

2012/13

Q1

YoY

Change

%

2013/14

Q1

2012/13

Q2

YoY

Change

%

2013/14

Q2

2012/13

Q3

2012/13

Q4

2012/13

Full Year

1,731

1,794

678

1,270

17

(986)

4,504

(2.0)

0.2

(5.9)

(2.0)

58.8

(3.2)

(1.2)

1,696

1,797

638

1,245

27

(954)

4,449

1,757

1,808

616

1,283

18

(989)

4,493

(3.6)

1.9

1.3

(0.9)

(22.2)

(3.4)

(0.0)

1,694

1,843

624

1,271

14

(955)

4,491

1,748

1,810

645

1,286

21

(983)

4,527

1,934

1,887

669

1,276

41

(992)

4,815

7,170

7,299

2,608

5,115

97

(3,950)

18,339

£m unless otherwise stated

1

Revenue

BT Global Services

BT Retail

BT Wholesale

Openreach

Other

Eliminations

Total

Underlying revenue excluding transit

(1.1)

(0.5)

1

EBITDA

BT Global Services

BT Retail

BT Wholesale

Openreach

Other

Total

171

493

163

633

(8)

1,452

6.4

0.6

(3.7)

(4.4)

(100.0)

(0.8)

182

496

157

605

0

1,440

182

495

143

664

4

1,488

10.4

(13.3)

11.2

(3.3)

(25.0)

(3.6)

201

429

159

642

3

1,434

215

500

153

662

9

1,539

264

537

161

683

19

1,664

832

2,025

620

2,642

24

6,143

Depreciation and amortisation

(723)

(3.6)

(697)

(722)

(6.2)

(677)

(706)

(692)

(2,843)

729

1.9

743

766

(1.2)

757

833

972

3,300

(169)

(13.6)

(146)

(169)

(12.4)

(148)

(167)

(148)

(653)

(2)

2

0

0

0

9

4.9

595

599

1.7

609

666

824

2,656

(87)

(59)

(146)

(14)

(29)

(43)

(52)

(58)

(110)

(55)

(28)

(83)

(153)

(32)

(185)

(224)

(117)

(341)

Operating profit

1

Net finance expense

1

Share of post tax profits/losses of associates & joint ventures

7

Profit before tax1

567

Specific items

Net interest on pensions

Total specific items

(2)

(28)

(30)

Reported profit before tax

537

(16.4)

449

556

(10.3)

499

583

639

2,315

(129)

7

22.8%

4.7

(135)

32

22.6%

(136)

108

22.7%

0.0

(136)

250

22.3%

(151)

18

22.7%

(181)

97

22.0%

(597)

230

22.5%

415

(16.6)

346

528

16.1

613

450

555

1,948

5.6

5.3

7,788

5.4

(17.0)

5.9

4.4

7,839

5.9

6.7

3.0

7,839

1.7

16.4

13.3

6.0

7.8

3.4

7,864

6.5

5.7

7,865

8.2

7.1

6.5

7,838

26.3

24.9

9.5

7,832

1,488

(619)

(129)

(181)

(249)

6

316

162

0

(90)

388

0

388

43.6

1,434

(634)

(71)

(91)

(72)

44

610

19

0

(72)

557

0

557

1,539

(586)

(210)

(168)

217

15

807

157

0

(96)

868

0

868

1,664

(572)

(140)

(104)

553

(100)

1,301

79

(202)

(147)

1,031

(325)

706

6,143

(2,438)

(692)

(624)

(81)

(8)

2,300

560

(202)

(366)

2,292

(325)

1,967

9,037

(10.7)

8,074

8,140

7,797

7,797

Tax - excluding tax on specific items

Tax on specific items

Tax rate

Net income

EPS1 (p)

Reported EPS (p)

Dividend per share (p)

Average number of shares in issue (m)

Group free cash flow

EBITDA1

Capital expenditure2

Interest

Tax (excluding cash tax benefit of pension deficit payments)

Change in working capital

Other

Normalised free cash flow 3

Cash tax benefit of pension deficit payments

Purchases of telecoms licences

Specific items

Reported free cash flow

Gross pension deficit payment

Free cash flow (post pension deficit payments)

1,452

(661)

(213)

(171)

(602)

71

(124)

162

0

(33)

5

0

5

(51.6)

n/m

1,440

(600)

(222)

(31)

(716)

69

(60)

20

0

(134)

(174)

0

(174)

Net debt

9,142

(11.9)

8,058

1

(9.2)

4.2

n/m

before specific items

2

before purchases of telecommunications licences

3

before specific items, purchases of telecommunications licences, pension deficit payments and the cash tax benefit of pension deficit payments

n/m = not meaningful

2.4

(45.0)

93.0

43.6

2011/12

2. BT Global Services

2012/13

2013/14

Q1

Q1

Q2

Q3

Q4

FY

Q1

Q2

Q3

Q4

FY

Q2

853

961

854

915

3,583

652

648

644

662

2,606

229

218

210

217

874

172

188

187

202

749

1,906

2,015

1,895

1,996

7,812

115

111

110

121

457

800

-6.2%

552

-15.3%

205

-10.5%

174

1.2%

1,731

-9.2%

111

-3.5%

816

-15.1%

533

-17.7%

215

-1.4%

193

2.7%

1,757

-12.8%

105

-5.4%

795

-6.9%

552

-14.3%

204

-2.9%

197

5.3%

1,748

-7.8%

105

-4.5%

878

-4.0%

619

-6.5%

217

0.0%

220

8.9%

1,934

-3.1%

104

-14.0%

3,289

-8.2%

2,256

-13.4%

841

-3.8%

784

4.7%

7,170

-8.2%

425

-7.0%

745

-6.9%

559

1.3%

204

-0.5%

188

8.0%

1,696

-2.0%

102

-8.1%

739

-9.4%

546

2.4%

210

-2.3%

199

3.1%

1,694

-3.6%

99

-5.7%

189

210

196

240

835

171

-9.5%

182

-13.3%

215

9.7%

264

10.0%

832

-0.4%

182

6.4%

201

10.4%

16

24

29

65

134

15

-6.3%

30

25.0%

58

100.0%

104

60.0%

207

54.5%

31

106.7%

51

70.0%

117

155

139

149

560

128

9.4%

125

-19.4%

121

-12.9%

150

0.7%

524

-6.4%

111

-13.3%

120

-4.0%

(9)

(4)

186

218

391

(263)

n/m

(119)

n/m

140

-24.7%

454

108.3%

212

-45.8%

(280)

-6.5%

74

n/m

1,134

-28.4%

1,264

-11.8%

1,921

17.3%

1,954

-3.6%

6,273

-6.1%

1,686

48.7%

1,504

19.0%

Financial

Revenue (£m)

UK

YoY % change

Continental Europe

YoY % change

US & Canada

YoY % change

AsiaPac, Latam & MEA

YoY % change

Total

YoY % change

- of which transit

YoY % change

EBITDA (£m)

YoY % change

Operating profit (£m)

YoY % change

Capex (£m)

YoY % change

Operating free cash flow (£m)

YoY % change

Operational

Order intake (£m)

YoY % change

1,584

1,433

1,638

2,028

6,683

2011/12

3. BT Retail

2012/13

2013/14

Q1

Q1

Q2

Q3

Q4

FY

Q1

Q2

Q3

Q4

FY

Q2

UK consumer calls & lines

UK consumer broadband & TV

UK consumer other

UK consumer (incl. Northern Ireland)

YoY % change

708

246

18

972

697

253

22

972

700

256

22

978

692

269

17

978

2,797

1,024

79

3,900

661

276

16

953

-2.0%

642

281

17

940

-3.3%

637

288

21

946

-3.3%

650

305

19

974

-0.4%

2,590

1,150

73

3,813

-2.2%

626

300

18

944

-0.9%

633

330

17

980

4.3%

Business calls & lines

Business broadband

Business IT services

Business other

Business

YoY % change

287

81

105

102

575

277

81

113

99

570

277

81

99

112

569

267

82

122

104

575

1,108

325

439

417

2,289

259

80

99

103

541

-5.9%

262

80

108

102

552

-3.2%

254

84

107

106

551

-3.2%

255

79

134

105

573

-0.3%

1,030

323

448

416

2,217

-3.1%

253

82

108

102

545

0.7%

249

85

116

100

550

-0.4%

BT Conferencing

Enterprises other

Enterprises

YoY % change

77

99

176

81

111

192

84

105

189

85

109

194

327

424

751

83

94

177

0.6%

82

106

188

-2.1%

82

104

186

-1.6%

84

114

198

2.1%

331

418

749

-0.3%

85

105

190

7.3%

80

113

193

2.7%

Ireland (ex Transit)

Transit

Ireland

YoY % change

167

10

177

176

11

187

170

12

182

175

12

187

688

45

733

164

13

177

0.0%

164

13

177

-5.3%

171

14

185

1.6%

188

10

198

5.9%

687

50

737

0.5%

171

10

181

2.3%

174

7

181

2.3%

(48)

1,852

(49)

1,872

(50)

1,868

(54)

1,880

(201)

7,472

122

124

127

137

510

(54)

1,794

-3.1%

130

6.6%

(49)

1,808

-3.4%

134

8.1%

(58)

1,810

-3.1%

134

5.5%

(56)

1,887

0.4%

158

15.3%

(217)

7,299

-2.3%

556

9.0%

(63)

1,797

0.2%

136

4.6%

(61)

1,843

1.9%

140

4.5%

471

472

483

511

1,937

493

4.7%

495

4.9%

500

3.5%

537

5.1%

2,025

4.5%

496

0.6%

429

-13.3%

347

348

359

379

1,433

370

6.6%

369

6.0%

372

3.6%

417

10.0%

1,528

6.6%

385

4.1%

323

-12.5%

Capex (£m)

YoY % change

102

117

115

134

468

103

1.0%

105

-10.3%

85

-26.1%

99

-26.1%

392

-16.2%

92

-10.7%

91

-13.3%

Operating free cash flow (£m)

YoY % change

310

370

305

468

1,453

248

-20.0%

334

-9.7%

471

54.4%

523

11.8%

1,576

8.5%

260

4.8%

254

-24.0%

9.77

-10.8%

9.72

-9.7%

9.63

-13.7%

9.69

-8.6%

38.81

-10.7%

9.07

-7.2%

8.84

-9.1%

8.78

-8.8%

8.71

-10.1%

35.40

-8.8%

8.07

-11.0%

7.83

-11.4%

330

5.1%

335

5.7%

337

4.7%

343

5.2%

350

6.1%

355

6.0%

359

6.5%

365

6.4%

370

5.7%

377

6.2%

10,671

-128

10,550

-121

10,457

-93

10,321

-136

10,184

-137

10,053

-131

9,931

-122

9,824

-107

9,727

-97

9,715

-34

598

23

639

41

679

39

707

28

728

21

749

21

770

21

810

40

833

23

903

70

Financial

Revenue (£m)

Other (incl. eliminations)1

Total

YoY % change

- of which internal

YoY % change

EBITDA (£m)

YoY % change

Operating profit (£m)

YoY % change

Operational2

Call minutes (bn)

YoY % change

Consumer ARPU (£)

YoY % change

Active consumer lines ('000)

QoQ movement ('000)

TV customers ('000)

QoQ movement ('000)

1

Includes elimination of consumer revenue in Northern Ireland, which is included in both Consumer and Ireland above

Includes Northern Ireland

3

Excludes 22k lines relating to a small acquisition

2

3

2011/12

4. BT Wholesale

2012/13

2013/14

Q1

Q1

Q2

Q3

Q4

FY

Q1

Q2

Q3

Q4

FY

Q2

199

197

199

196

791

230

232

232

217

911

73

75

70

64

282

35

43

42

43

163

187

165

162

157

671

35

25

29

36

125

759

737

734

713

2,943

195

-2.0%

228

-0.9%

62

-15.1%

49

40.0%

119

-36.4%

25

-28.6%

678

-10.7%

197

0.0%

204

-12.1%

58

-22.7%

48

11.6%

86

-47.9%

23

-8.0%

616

-16.4%

208

4.5%

210

-9.5%

55

-21.4%

48

14.3%

95

-41.4%

29

0.0%

645

-12.1%

232

18.4%

206

-5.1%

54

-15.6%

56

30.2%

94

-40.1%

27

-25.0%

669

-6.2%

832

5.2%

848

-6.9%

229

-18.8%

201

23.3%

394

-41.3%

104

-16.8%

2,608

-11.4%

239

22.6%

188

-17.5%

52

-16.1%

55

12.2%

80

-32.8%

24

-4.0%

638

-5.9%

232

17.8%

183

-10.3%

51

-12.1%

59

22.9%

77

-10.5%

22

-4.3%

624

1.3%

EBITDA (£m)

YoY % change

172

171

168

156

667

163

-5.2%

143

-16.4%

153

-8.9%

161

3.2%

620

-7.0%

157

-3.7%

159

11.2%

Operating profit (£m)

YoY % change

106

109

105

88

408

99

-6.6%

81

-25.7%

89

-15.2%

97

10.2%

366

-10.3%

93

-6.1%

97

19.8%

74

89

82

91

336

72

-2.7%

57

-36.0%

52

-36.6%

52

-42.9%

233

-30.7%

64

-11.1%

63

10.5%

(16)

88

10

177

259

(8)

-50.0%

63

-28.4%

115

n/m

178

0.6%

348

34.4%

(31)

287.5%

154

144.4%

71

116

344

217

748

501

605.6%

308

165.5%

416

20.9%

806

271.4%

2,031

171.5%

509

1.6%

409

32.8%

Financial

Revenue (£m)

Managed solutions

YoY % change

Calls & lines

YoY % change

Broadband

YoY % change

IP services

YoY % change

Transit

YoY % change

Other

YoY % change

Total

YoY % change

Capex (£m)

YoY % change

Operating free cash flow (£m)

YoY % change

Operational

Order intake (£m)

YoY % change

2011/12

5. Openreach

2012/13

2013/14

Q1

Q1

Q2

Q3

Q4

FY

Q1

Q2

Q3

Q4

FY

Q2

661

656

648

642

2,607

290

306

313

311

1,220

171

182

194

203

750

9

13

18

28

68

138

137

140

127

542

1,269

1,294

1,313

1,311

5,187

887

890

902

885

3,564

611

-7.6%

289

-0.3%

208

21.6%

33

266.7%

129

-6.5%

1,270

0.1%

855

-3.6%

595

-9.3%

295

-3.6%

217

19.2%

40

207.7%

136

-0.7%

1,283

-0.9%

850

-4.5%

592

-8.6%

297

-5.1%

214

10.3%

53

194.4%

130

-7.1%

1,286

-2.1%

839

-7.0%

582

-9.3%

292

-6.1%

222

9.4%

60

114.3%

120

-5.5%

1,276

-2.7%

824

-6.9%

2,380

-8.7%

1,173

-3.9%

861

14.8%

186

173.5%

515

-5.0%

5,115

-1.4%

3,368

-5.5%

548

-10.3%

286

-1.0%

219

5.3%

71

115.2%

121

-6.2%

1,245

-2.0%

806

-5.7%

540

-9.2%

298

1.0%

224

3.2%

86

115.0%

123

-9.6%

1,271

-0.9%

816

-4.0%

EBITDA (£m)

YoY % change

617

648

672

681

2,618

633

2.6%

664

2.5%

662

-1.5%

683

0.3%

2,642

0.9%

605

-4.4%

642

-3.3%

Operating profit (£m)

YoY % change

266

296

318

322

1,202

275

3.4%

307

3.7%

304

-4.4%

328

1.9%

1,214

1.0%

236

-14.2%

287

-6.5%

Capex (£m)

YoY % change

253

251

292

279

1,075

286

13.0%

278

10.8%

287

-1.7%

293

5.0%

1,144

6.4%

280

-2.1%

268

-3.6%

Operating free cash flow (£m)

YoY % change

256

431

385

442

1,514

289

12.9%

328

-23.9%

448

16.4%

410

-7.2%

1,475

-2.6%

269

-6.9%

311

-5.2%

Internal physical lines ('000)

14,976

14,663

14,428

14,128

13,866

13,628

13,405

13,214

13,034

12,932

External physical lines ('000)

5,273

5,294

5,209

5,192

5,192

5,130

5,127

5,088

4,988

4,838

Fully unbundled physical lines (MPF) ('000)

4,583

4,885

5,240

5,631

5,848

6,110

6,384

6,702

6,995

7,239

24,832

18

24,843

11

24,877

34

24,950

74

24,906

-44

24,869

-38

24,917

48

25,004

88

25,017

12

25,009

-8

Financial

Revenue (£m)

WLR

YoY % change

LLU

YoY % change

Ethernet

YoY % change

Fibre broadband

YoY % change

Other

YoY % change

Total

YoY % change

- of which internal

YoY % change

Operational

Total physical lines ('000)

QoQ movement ('000)

6. Broadband

Q1

2011/12

Q2

Q3

Q4

Q1

2012/13

Q2

Q3

Q4

2013/14

Q1

Q2

000s

Retail

Total Broadband

Net adds in quarter

Retail share of DSL + fibre net adds

Retail share of DSL + fibre installed base

5,832

5,998

6,144

6,280

6,365

6,446

6,569

6,704

6,799

6,961

141

166

146

136

85

81

122

136

95

156

1

56%

37%

64%

37%

56%

37%

45%

37%

54%

38%

54%

38%

50%

38%

48%

38%

50%

38%

93%

39%

1

8,962

Wholesale

Total BT Wholesale Broadband

8,391

8,510

8,551

8,543

8,577

8,591

8,653

8,770

8,860

Net adds in quarter

279

119

41

(8)

34

14

62

117

90

101

External Wholesale

2,559

138

2,512

(47)

2,407

(105)

2,263

(144)

2,212

(51)

2,144

(67)

2,084

(60)

2,066

(19)

2,061

(5)

2,000

(60)

Full LLU (MPF)

4,583

4,885

5,240

5,631

5,848

6,110

6,384

6,702

6,995

7,239

Shared LLU (SMPF) + external fibre on WLR lines

2,996

2,836

2,700

2,622

2,528

2,401

2,308

2,158

1,963

1,786

Total

Net adds in quarter

7,579

(29)

7,722

142

7,941

219

8,253

312

8,376

123

8,511

135

8,693

182

8,859

167

8,958

99

9,025

67

15,969

16,232

16,491

16,795

16,952

17,102

17,345

17,629

17,818

17,987

250

261

260

304

157

150

243

284

189

168

Net adds in quarter

Openreach

External broadband volumes

Group

Total DSL + fibre

Net adds in quarter

1

Excludes 6k lines relating to a small acquisition

2011/12

7. Costs & other statistics

2012/13

2013/14

Q1

Q1

Q2

Q3

Q4

FY

Q1

Q2

Q3

Q4

FY

Q2

Direct labour costs before leaver costs

Indirect labour costs

Leaver costs

Gross labour costs

Capitalised labour

Net labour costs

1,195

242

28

1,465

(241)

1,224

1,220

232

29

1,481

(242)

1,239

1,199

230

11

1,440

(247)

1,193

1,204

210

29

1,443

(257)

1,186

4,818

914

97

5,829

(987)

4,842

1,193

221

23

1,437

(237)

1,200

1,182

214

16

1,412

(243)

1,169

1,165

205

12

1,382

(241)

1,141

1,187

205

7

1,399

(245)

1,154

4,727

845

58

5,630

(966)

4,664

1,181

210

6

1,397

(238)

1,159

1,173

216

4

1,393

(245)

1,148

Payments to telecommunications operators

Property and energy costs

Network operating and IT costs

Other costs

Operating costs before depreciation and specific items

825

273

170

868

3,360

786

270

163

971

3,429

800

270

144

873

3,280

742

253

153

960

3,294

3,153

1,066

630

3,672

13,363

697

261

156

738

3,052

653

259

156

768

3,005

651

253

137

806

2,988

676

249

138

934

3,151

2,677

1,022

587

3,246

12,196

646

246

164

794

3,009

639

251

149

870

3,057

Depreciation and amortisation

Total operating costs before specific items

Specific items

Total operating costs

739

4,099

66

4,165

753

4,182

(343)

3,839

734

4,014

26

4,040

746

4,040

14

4,054

2,972

16,335

(237)

16,098

723

3,775

2

3,777

722

3,727

50

3,777

706

3,694

(87)

3,607

692

3,843

151

3,994

2,843

15,039

116

15,155

697

3,706

84

3,790

677

3,734

52

3,786

117

102

74

253

36

582

155

117

89

251

40

652

139

115

82

292

37

665

149

134

91

279

42

695

560

468

336

1,075

155

2,594

128

103

72

286

33

622

125

105

57

278

31

596

121

85

52

287

27

572

150

99

52

293

54

648

524

392

233

1,144

145

2,438

111

92

64

280

49

596

120

91

63

268

53

595

11,563

11,323

11,138

10,919

10,717

10,534

10,361

10,207

10,070

-239

-240

-185

-219

-202

-183

-173

-154

-137

4,827

4,722

4,636

4,551

4,437

4,340

4,262

4,165

4,071

Operating costs (£m)

Capital expenditure (£m)

Capital expenditure by line of business

BT Global Services

BT Retail

BT Wholesale

Openreach

Other

Total

Lines ('000)

Lines sold through BT lines of business

Consumer

QoQ movement

Business/Corporate

1

10,027

1

3,978

-65

QoQ movement

-90

-105

-86

-85

-114

-97

-78

-97

-94

-93

Total

QoQ movement

16,390

-329

16,045

-345

15,774

-271

15,470

-304

15,154

-316

14,874

-280

14,623

-251

14,372

-251

14,141

-231

14,005

-158

1

2

From 1 April 2013, a small number of accounts were transferred from BT Consumer to BT Business. Excluding this, in Q1 2013/14 actual Consumer line loss was 130k and actual Business/Corporate line loss was 101k.

Excludes 22k lines relating to a small acquisition

2

2

8. Glossary

Global Services

Revenue

Geographic analysis of revenue is on the basis of the country in which the contract or services are supplied, and the revenue is earned. Reported growth rates are not

adjusted for the effect of foreign exchange movements.

Retail

Revenue

UK consumer calls & lines

Calls revenue is local and national geographic calls, international direct dial, fixed to mobile, other non-geographic calls and revenue from call packages sold to

consumers in the UK by BT Consumer (including Plusnet) and BT Ireland. Lines revenue is rentals, connections and calling features revenue for analogue and digital

lines sold to consumers in the UK by BT Consumer (including Plusnet) and BT Ireland.

UK consumer broadband & TV

UK consumer other

Business calls & lines

Revenue from broadband sold to consumers in the UK by BT Consumer (including Plusnet) and BT Ireland. Includes BT Infinity, BT TV and BT Sport.

Mainly telephones and equipment sold by BT Consumer

Calls revenue is local and national geographic calls, international direct dial, fixed to mobile, other non-geographic calls and revenue from call packages sold to SMEs

in the UK by BT Business and Plusnet. Lines revenue is rentals, connections and calling features revenue for analogue and digital lines sold to SMEs in the UK by BT

Business and Plusnet.

Business broadband

Business IT services

Business other

BT Conferencing

Enterprises other

Ireland (ex Transit)

Revenue from broadband sold to SMEs in the UK by BT Business and Plusnet. Includes mobility revenue.

Revenue from three specialist IT units in BT Business - BT Engage IT, BT iNet and BT Business Direct

Mainly ICT and managed network services revenue outside of the three specialist IT units

Revenue from audio, video and web conferencing and collaboration services for business customers in the UK and around the world

Revenue from BT Directories, BT Expedite & Fresca, BT Redcare, BT Payphones, BT Wi-fi, BT Tikit (from January 2013) and BT Fleet

In Northern Ireland, includes revenue from consumers, SMEs, and the public sector. In Republic of Ireland, includes revenue from the corporate sector, the public

sector and from wholesale network services.

Ireland Transit

Ireland revenues from the carriage of telecoms traffic across BT's network where neither the originating nor the terminating network is owned or controlled by BT

(including the pass through of mobile terminating traffic)

Internal

BT Conferencing revenue from BT Global Services; BT Business' IT services & managed networks revenue from BT Global Services; and other internal revenue in

BT Enterprises and BT Ireland

Operational

Call minutes

Consumer ARPU

Active consumer lines

TV customers

Includes BT Retail (including Northern Ireland) and BT Global Services non-geographic and geographic call minutes - local, national and international call minutes,

fixed to mobile, 0800, 0870 and 0845

12 month rolling consumer revenue, less mobile POLOs, less BT Sport revenue from: satellite customers paying for the channels, our wholesale deals and from

commercial premises. This is divided by the average number of primary lines (including Northern Ireland).

The number of UK consumer lines over which BT is the call provider (including Plusnet and Northern Ireland)

Total number of customers, with either a BT Vision or a YouView box, that are registered & enabled on the BT TV platform to receive video on demand (including

Northern Ireland)

Wholesale

Revenue

Managed solutions

Managed network services, white label managed services and wholesale calls sold to external communications providers (CPs) in the UK. Includes managed

broadband network service contracts.

Calls & lines

Direct and indirect conveyance, wholesale and international direct dial calls (not sold as part of a managed service), interconnect circuits, private circuits and partial

private circuits

Broadband

IPStream Connect and Wholesale Broadband Connect revenue from sales to external CP customers including that not deemed managed solutions. Excludes

managed broadband network service contracts.

IP services

Voice over IP services (including IP Exchange), Fixed Wholesale Ethernet and other wholesale data revenue including MPLS products such as SHDS & IP Clear

Transit

UK revenues from the carriage of telecoms traffic across BT's network where neither the originating nor the terminating network is owned or controlled by BT

(includes the pass through of mobile terminating traffic)

Other

Media & Broadcast revenue and equipment sales

Openreach

Revenue

WLR

Internal and external WLR connection and rental revenue

LLU

Internal and external SMPF and MPF connection and rental revenue, co-location connection and rental revenue, copper port build, tie cables and TAMs

Ethernet

Internal and external Ethernet connection and rental revenue

Fibre broadband

Internal and external Fibre connection and rental revenue

Other

Primarily revenue from service-based activity and some legacy connectivity products

Internal

Primarily rental and connection revenue related to WLR, SMPF, Ethernet and fibre supplied to the customer-facing BT lines of business

Operational

Internal physical lines

Lines provided by Openreach to other BT lines of business - including Plusnet and physical lines operated by BT Retail in Northern Ireland (includes analogue lines

and ISDN lines provided over copper (WLR), but excludes non-equivalent traded products and ISDN30)

External physical lines

Lines provided by Openreach to other CPs (includes analogue and ISDN lines provided over copper (WLR), but excludes full LLU and ISDN30)

Fully unbundled physical lines (MPF)

MPF lines provided by Openreach to other CPs

Broadband

Total broadband base (retail)

BT's total retail broadband base - BT Consumer (including BT Infinity), BT Business, Plusnet, Northern Ireland and broadband lines sold by Global Services

Total BT Wholesale Broadband

External broadband volumes: full LLU (MPF)

External broadband volumes: shared LLU (SMPF)

+ external fibre on WLR lines

Total physical and fibre broadband lines sold by BT Wholesale both internally and externally to CP customers

MPF lines provided by Openreach to other CPs

SMPF lines provided by Openreach to other CPs - includes Generic Ethernet Access (fibre) provided by Openreach to other CPs on WLR lines

Costs & other stats

Consumer lines

Business/Corporate lines

Total lines (analogue lines and ISDN channels (WLR)) sold by BT Retail, including Northern Ireland and Plusnet

Total lines (analogue lines and ISDN channels (WLR)) sold by BT Business, BT Global Services and BT Wholesale