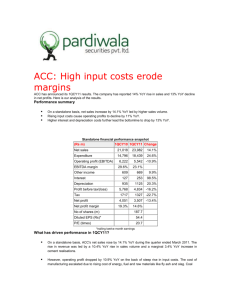

Key Performance Indicators Q2 2015/16

advertisement

Key Performance Indicators Q2 2015/16

For the quarter ended 30 September 2015. Published 29 October 2015

Sheet 1

Sheet 2

Sheet 3

Sheet 4

Sheet 5

Sheet 6

Sheet 7

Sheet 8

Sheet 9

Income statement & free cash flow

BT Global Services

BT Business

BT Consumer

BT Wholesale

Openreach

Broadband

Costs & other statistics

Glossary

For further information please contact:

BT Investor Relations

Phone

+44 (0)20 7356 4909

Email

ir@bt.com

Web

www.bt.com/ir

While BT believes the information contained in this document to be reliable, BT does not warrant the accuracy, completeness or validity of the information, figures or calculations

that follow and shall not be liable in any way for loss or damage arising out of the use of the information, or any errors or omissions in its content.

1. Group income statement

2014/15

Q1

£m unless otherwise stated

YoY

Change

2015/16

Q1

2014/15

Q2

%

YoY

Change

2015/16

Q2

2014/15

Q3

2014/15

Q4

2014/15

Full Year

1,559

781

1,127

520

1,267

19

(892)

4,381

99

1,694

789

1,083

532

1,255

20

(898)

4,475

141

1,789

805

1,100

571

1,266

18

(910)

4,639

129

6,779

3,145

4,285

2,157

5,011

73

(3,599)

17,851

555

2.0%

-1.0%

-1.3%

-0.4%

(4.4)

1.2

(10.2)

1.6

3.3

n/m

(0.6)

216

261

202

127

648

(12)

1,442

261

266

251

136

651

2

1,567

347

277

317

174

698

6

1,819

1,047

1,041

1,031

561

2,600

(9)

6,271

%

1

Revenue

BT Global Services

BT Business

BT Consumer

BT Wholesale

Openreach

Other

Eliminations

Total

- of which transit

1,647

762

1,046

525

1,245

19

(890)

4,354

144

Underlying revenue2 excl. transit (YoY % change)

0.5%

EBITDA1

BT Global Services

BT Business

BT Consumer

BT Wholesale

Openreach

Other

Total

213

240

238

126

624

(6)

1,435

Depreciation and amortisation1

Operating profit1

1

Net finance expense

Share of post tax profits/losses of associates & joint ventures 1

1,543

749

1,074

530

1,249

16

(883)

4,278

109

1,649

789

1,056

529

1,245

16

(901)

4,383

141

0.0%

0.2%

(10.8)

0.0

6.7

11.1

2.4

n/m

1.0

190

240

254

140

639

(14)

1,449

226

258

225

125

627

(11)

1,450

(652)

(3.7)

(628)

(618)

0.8

(623)

(618)

(650)

(2,538)

783

4.9

821

832

(1.6)

819

949

1,169

3,733

(145)

(9.0)

(132)

(143)

(21.7)

(112)

(134)

(138)

(560)

5

1

(1)

(1)

(1)

(1)

694

690

706

814

1,030

3,172

(7)

(55)

(62)

(54)

(73)

(127)

(8)

(56)

(64)

(48)

(72)

(120)

(114)

(74)

(188)

(235)

(292)

(527)

0

Profit before tax1

638

Specific items

Net interest on pensions

Total specific items

(19)

(73)

(92)

Reported profit before tax

Tax - excluding tax on specific items

Tax on specific items

Tax rate

Net income

EPS1 (p)

Reported EPS (p)

Dividend per share (p)

Average number of shares in issue (m)

(6.3)

(1.7)

2.7

1.0

0.3

(15.8)

(0.8)

(1.7)

8.8

(5.5)

(1.0)

6.7

(1.7)

1.8

18.8

(1.0)

0.0

2.3

546

15.8

632

563

14.0

642

694

842

2,645

(127)

22

19.9%

3.9

(132)

11

19.0%

(137)

20

19.9%

(5.8)

(129)

12

18.3%

(162)

26

19.9%

(205)

53

19.9%

(631)

121

19.9%

441

15.9

511

446

17.7

525

558

690

2,135

6.5

5.6

7,856

3.1

8.9

6.7

6.1

8,330

6.9

5.6

3.9

8,027

0.0

12.5

12.8

6.9

6.3

4.4

8,339

8.0

6.9

8,122

10.0

8.4

8.5

8,221

31.5

26.5

12.4

8,056

n/m

1,449

(626)

(183)

(88)

(446)

106

69

0

(52)

123

(625)

(502)

1,450

(521)

(87)

(136)

(173)

533

19

0

(75)

477

0

477

22.6

1,442

(595)

(65)

(91)

(122)

569

46

0

(30)

585

0

585

1,567

(568)

(183)

(70)

162

908

15

0

4

927

0

927

1,819

(792)

(98)

(76)

414

1,267

53

0

(3)

1,317

(876)

441

6,271

(2,411)

(573)

(415)

(42)

2,830

106

0

(154)

2,782

(876)

1,906

(17.8)

5,819

7,063

(16.2)

5,919

6,202

5,119

5,119

Group free cash flow

EBITDA1

Capital expenditure3

Interest

Tax (excluding cash tax benefit of pension deficit payments)

Change in working capital & other

Normalised free cash flow4

Cash tax benefit of pension deficit payments

Purchases of telecoms licences

Specific items

Reported free cash flow

Gross pension deficit payment

Free cash flow (post pension deficit payments)

1,435

(530)

(205)

(133)

(445)

122

19

0

(80)

61

0

61

Net debt

7,079

1

before specific items

2

excludes specific items, foreign exchange movements and the effect of acquisitions and disposals

3

before purchases of telecommunications licences

4

18.1

(10.7)

(13.1)

n/m

before specific items, purchases of telecommunications licences, pension deficit payments and the cash tax benefit of pension deficit payments

n/m = not meaningful

14.2

(25.3)

6.8

22.6

2013/14

2. BT Global Services

2014/15

2015/16

Q1

Q1

Q2

Q3

Q4

FY

Q1

Q2

Q3

Q4

FY

Q2

766

-6.9%

559

1.3%

239

-1.2%

188

8.0%

1,752

-2.2%

8

-11.1%

102

-8.1%

756

-9.2%

546

2.4%

242

-3.2%

199

3.1%

1,743

-3.6%

7

-12.5%

99

-5.7%

832

2.2%

552

0.0%

243

3.0%

220

11.7%

1,847

2.7%

8

-20.0%

93

-11.4%

883

-2.4%

587

-5.2%

222

-10.8%

235

6.8%

1,927

-3.3%

8

0.0%

90

-13.5%

3,237

-4.1%

2,244

-0.5%

946

-3.2%

842

7.4%

7,269

-1.7%

31

-11.4%

384

-9.6%

731

-4.6%

521

-6.8%

208

-13.0%

187

-0.5%

1,647

-6.0%

8

0.0%

88

-13.7%

703

-7.0%

511

-6.4%

224

-7.4%

211

6.0%

1,649

-5.4%

6

-14.3%

88

-11.1%

683

-17.9%

549

-0.5%

231

-4.9%

231

5.0%

1,694

-8.3%

7

-12.5%

93

0.0%

760

-13.9%

544

-7.3%

239

7.7%

246

4.7%

1,789

-7.2%

8

0.0%

84

-6.7%

2,877

-11.1%

2,125

-5.3%

902

-4.7%

875

3.9%

6,779

-6.7%

29

-6.5%

353

-8.1%

643

-12.0%

475

-8.8%

221

6.3%

204

9.1%

1,543

-6.3%

7

-12.5%

72

-18.2%

647

-8.0%

510

-0.2%

211

-5.8%

191

-9.5%

1,559

-5.5%

8

33.3%

71

-19.3%

-3.4%

-4.9%

3.8%

0.6%

-1.0%

-1.5%

-1.1%

-6.6%

-6.3%

-4.0%

-3.8%

-2.4%

210

6.6%

222

6.2%

290

17.9%

319

7.0%

1,041

9.6%

213

1.4%

226

1.8%

261

-10.0%

347

8.8%

1,047

0.6%

190

-10.8%

216

-4.4%

57

50.0%

70

27.3%

136

56.3%

162

19.1%

425

34.5%

73

28.1%

102

45.7%

134

-1.5%

219

35.2%

528

24.2%

63

-13.7%

86

-15.7%

116

-10.1%

125

-1.6%

143

17.2%

132

-15.9%

516

-3.6%

106

-8.6%

116

-7.2%

121

-15.4%

125

-5.3%

468

-9.3%

86

-18.9%

107

-7.8%

(262)

8.3%

91

-191.9%

111

-33.9%

559

14.8%

499

58.9%

(337)

28.6%

35

-61.5%

52

-53.2%

599

7.2%

349

-30.1%

(292)

-13.4%

113

222.9%

1,702

47.2%

1,518

18.7%

1,509

-22.1%

2,234

13.1%

6,963

9.7%

1,058

-37.8%

1,307

-13.9%

2,051

35.9%

2,042

-8.6%

6,458

-7.3%

1,201

13.5%

1,784

36.5%

Financial

Revenue (£m)

UK

YoY % change

Continental Europe

YoY % change

US & Canada

YoY % change

AsiaPac, Latam & MEA

YoY % change

Total

YoY % change

- of which internal

YoY % change

- of which transit

YoY % change

Underlying revenue excluding transit (YoY % change)

EBITDA (£m)

YoY % change

Operating profit (£m)

YoY % change

Capex (£m)

YoY % change

Operating free cash flow (£m)

YoY % change

Operational

Order intake (£m)1

YoY % change

1

Historic order book restated in Q1 2014/15 following review of Conferencing order book to fully align with BT Global Services methodology

2013/14

3. BT Business

2014/15

2015/16

Q1

Q1

Q2

Q3

Q4

FY

Q1

Q2

Q3

Q4

FY

Q2

250

-1.2%

192

2.1%

129

15.2%

149

4.2%

10

-23.1%

55

-16.7%

785

1.3%

101

1.0%

246

-4.3%

199

1.5%

137

14.2%

151

5.6%

7

-46.2%

59

-13.2%

799

0.3%

105

6.1%

251

0.0%

198

0.0%

133

9.9%

157

4.0%

12

-14.3%

57

-14.9%

808

0.7%

103

1.0%

247

-2.4%

199

1.5%

145

-4.0%

167

0.6%

9

-10.0%

54

-22.9%

821

-3.0%

106

-13.1%

994

-2.0%

788

1.3%

544

7.9%

624

3.5%

38

-24.0%

225

-17.0%

3,213

-0.2%

415

-1.9%

239

-4.4%

192

0.0%

126

-2.3%

142

-4.7%

10

0.0%

53

-3.6%

762

-2.9%

88

-12.9%

237

-3.7%

202

1.5%

138

0.7%

146

-3.3%

10

42.9%

56

-5.1%

789

-1.3%

103

-1.9%

239

-4.8%

201

1.5%

133

0.0%

152

-3.2%

10

-16.7%

54

-5.3%

789

-2.4%

99

-3.9%

226

-8.5%

208

4.5%

144

-0.7%

169

1.2%

10

11.1%

48

-11.1%

805

-1.9%

109

2.8%

941

-5.3%

803

1.9%

541

-0.6%

609

-2.4%

40

5.3%

211

-6.2%

3,145

-2.1%

399

-3.9%

225

-5.9%

198

3.1%

130

3.2%

142

0.0%

10

0.0%

44

-17.0%

749

-1.7%

93

5.7%

234

-1.3%

209

3.5%

132

-4.3%

159

8.9%

10

0.0%

37

-33.9%

781

-1.0%

88

-14.6%

Underlying revenue excluding transit (YoY % change)

0.4%

-0.5%

-0.3%

-2.7%

-0.8%

-2.6%

-0.9%

-1.4%

-1.1%

-1.4%

-0.5%

-0.1%

EBITDA (£m)

YoY % change

236

7.3%

247

8.8%

257

7.5%

262

3.1%

1,002

6.6%

240

1.7%

258

4.5%

266

3.5%

277

5.7%

1,041

3.9%

240

0.0%

261

1.2%

183

13.0%

197

16.6%

206

15.1%

219

11.2%

805

13.9%

197

7.7%

213

8.1%

218

5.8%

233

6.4%

861

7.0%

190

-3.6%

212

-0.5%

33

-21.4%

29

-31.0%

32

6.7%

33

17.9%

127

-10.6%

24

-27.3%

32

10.3%

42

31.3%

89

169.7%

187

47.2%

35

45.8%

37

15.6%

109

-9.9%

217

31.5%

218

-14.5%

255

-7.3%

799

-2.1%

190

74.3%

231

6.5%

224

2.8%

229

-10.2%

874

9.4%

116

-38.9%

215

-6.9%

471

8.8%

473

-33.2%

499

-8.4%

655

26.9%

2,098

-4.7%

484

2.8%

463

-2.1%

515

3.2%

611

-6.7%

2,073

-1.2%

457

-5.6%

538

16.2%

Financial

Revenue (£m)

SME & Corporate voice

YoY % change

SME & Corporate data & networking

YoY % change

IT services

YoY % change

Ireland Business (ex Transit)

YoY % change

Transit

YoY % change

Other (incl. eliminations)

YoY % change

Total

YoY % change

- of which internal

YoY % change

Operating profit (£m)

YoY % change

Capex (£m)

YoY % change

Operating free cash flow (£m)

YoY % change

Operational

Order intake (£m)

YoY % change

2013/14

4. BT Consumer

2014/15

2015/16

Q1

Q1

Q2

Q3

Q4

FY

Q1

Q2

Q3

Q4

FY

Q2

Revenue (£m)

Calls & lines

YoY % change

Broadband & TV

YoY % change

Other (incl. eliminations)

YoY % change

Total

YoY % change

- of which internal

YoY % change

626

-5.3%

300

8.7%

24

9.1%

950

-0.9%

12

20.0%

633

-1.4%

330

17.4%

24

-17.2%

987

3.7%

10

-9.1%

633

-0.6%

351

21.9%

30

7.1%

1,014

6.4%

13

18.2%

659

1.4%

377

23.6%

32

18.5%

1,068

8.8%

14

16.7%

2,551

-1.5%

1,358

18.1%

110

3.8%

4,019

4.5%

49

11.4%

641

2.4%

377

25.7%

28

16.7%

1,046

10.1%

14

16.7%

641

1.3%

387

17.3%

28

16.7%

1,056

7.0%

15

50.0%

648

2.4%

403

14.8%

32

6.7%

1,083

6.8%

16

23.1%

657

-0.3%

414

9.8%

29

-9.4%

1,100

3.0%

17

21.4%

2,587

1.4%

1,581

16.4%

117

6.4%

4,285

6.6%

62

26.5%

644

0.5%

405

7.4%

25

-10.7%

1,074

2.7%

15

7.1%

650

1.4%

452

16.8%

25

-10.7%

1,127

6.7%

16

6.7%

EBITDA (£m)

YoY % change

231

-6.1%

158

-33.6%

175

-23.2%

269

5.1%

833

-13.9%

238

3.0%

225

42.4%

251

43.4%

317

17.8%

1,031

23.8%

254

6.7%

202

-10.2%

Operating profit (£m)

YoY % change

176

-4.3%

105

-40.0%

120

-27.7%

213

9.2%

614

-14.7%

183

4.0%

171

62.9%

201

67.5%

258

21.1%

813

32.4%

204

11.5%

144

-15.8%

Capex (£m)

YoY % change

56

-5.1%

60

-1.6%

48

-9.4%

47

-30.9%

211

-12.4%

39

-30.4%

52

-13.3%

47

-2.1%

69

46.8%

207

-1.9%

52

33.3%

56

7.7%

Operating free cash flow (£m)

YoY % change

146

46.0%

11

-92.5%

99

-47.9%

216

-0.9%

472

-27.9%

227

55.5%

105

n/m

274

176.8%

207

-4.2%

813

72.2%

211

-7.0%

53

-49.5%

370

5.7%

377

6.2%

383

6.7%

391

7.1%

398

7.6%

404

7.2%

410

7.0%

415

6.1%

419

5.3%

427

5.7%

Financial

Operational

Consumer ARPU (£)

YoY % change

Total consumer lines ('000)

QoQ movement ('000)

10,070

-130

10,027

-65

2

9,957

-70

9,908

-49

9,839

-69

9,754

-85

9,694

-60

9,633

-61

9,574

-59

9,522

-52

Active consumer lines ('000)

QoQ movement ('000)

9,727

-97

9,715

-34

2

9,675

-40

9,650

-25

9,599

-51

9,534

-65

9,493

-41

9,447

-46

9,400

-47

9,360

-40

833

23

903

70

956

53

1,002

46

1,007

40

1,045

38

1,090

45

1,142

52

1,202

60

1,308

106

TV customers ('000)

QoQ movement ('000)

1

Excludes 7k lines relating to accounts transferred from BT Consumer to BT Business

2

Excludes 22k lines relating to a small acquisition

3

Base adjusted to remove 35k inactive customers

1

3

2013/14

5. BT Wholesale

2014/15

2015/16

Q1

Q1

Q2

Q3

Q4

FY

Q1

Q2

Q3

Q4

FY

Q2

239

22.6%

188

-17.5%

52

-16.1%

55

12.2%

80

-32.8%

24

-4.0%

638

-5.9%

232

17.8%

183

-10.3%

51

-12.1%

59

22.9%

77

-10.5%

22

-4.3%

624

1.3%

199

-4.3%

181

-13.8%

47

-14.5%

66

37.5%

68

-28.4%

28

-3.4%

589

-8.7%

219

-5.6%

157

-23.8%

45

-16.7%

77

37.5%

50

-46.8%

23

-14.8%

571

-14.6%

889

6.9%

709

-16.4%

195

-14.8%

257

27.9%

275

-30.2%

97

-6.7%

2,422

-7.1%

190

-20.5%

144

-23.4%

44

-15.4%

78

41.8%

46

-42.5%

23

-4.2%

525

-17.7%

195

-15.9%

131

-28.4%

41

-19.6%

95

61.0%

43

-44.2%

24

9.1%

529

-15.2%

197

-1.0%

134

-26.0%

39

-17.0%

96

45.5%

38

-44.1%

28

0.0%

532

-9.7%

206

-5.9%

175

11.5%

38

-15.6%

96

24.7%

35

-30.0%

21

-8.7%

571

0.0%

788

-11.4%

584

-17.6%

162

-16.9%

365

42.0%

162

-41.1%

96

-1.0%

2,157

-10.9%

198

4.2%

141

-2.1%

35

-20.5%

103

32.1%

27

-41.3%

26

13.0%

530

1.0%

197

1.0%

131

0.0%

36

-12.2%

116

22.1%

18

-58.1%

22

-8.3%

520

-1.7%

Underlying revenue excluding transit (YoY % change)

-0.2%

3.2%

-5.3%

-9.4%

-3.0%

-14.4%

-11.2%

-5.2%

2.9%

-7.1%

5.0%

3.3%

EBITDA (£m)

YoY % change

157

-3.7%

159

11.2%

146

-4.6%

152

-5.6%

614

-1.0%

126

-19.7%

125

-21.4%

136

-6.8%

174

14.5%

561

-8.6%

140

11.1%

127

1.6%

Operating profit (£m)

YoY % change

93

-6.1%

97

19.8%

86

-3.4%

93

-4.1%

369

0.8%

67

-28.0%

70

-27.8%

79

-8.1%

121

30.1%

337

-8.7%

82

22.4%

72

2.9%

Capex (£m)

YoY % change

64

-11.1%

63

10.5%

61

17.3%

56

7.7%

244

4.7%

53

-17.2%

53

-15.9%

49

-19.7%

55

-1.8%

210

-13.9%

44

-17.0%

46

-13.2%

Operating free cash flow (£m)

YoY % change

(31)

287.5%

154

144.4%

30

-73.9%

219

23.0%

372

6.9%

11

-135.5%

60

-61.0%

114

280.0%

93

-57.5%

278

-25.3%

117

963.6%

63

5.0%

509

1.6%

409

32.8%

467

12.3%

525

-34.9%

1,910

-6.0%

264

-48.1%

249

-39.1%

439

-6.0%

956

82.1%

1,908

-0.1%

351

33.0%

349

40.2%

Financial

Revenue (£m)

Managed solutions

YoY % change

Calls, lines & circuits

YoY % change

Broadband

YoY % change

IP services

YoY % change

Transit

YoY % change

Other

YoY % change

Total

YoY % change

Operational

Order intake (£m)

YoY % change

2013/14

6. Openreach

2014/15

2015/16

Q1

Q1

Q2

Q3

Q4

FY

Q1

Q2

Q3

Q4

FY

Q2

548

-10.3%

286

-1.0%

219

5.3%

71

115.2%

121

-6.2%

1,245

-2.0%

806

-5.7%

540

-9.2%

298

1.0%

224

3.2%

86

115.0%

123

-9.6%

1,271

-0.9%

816

-4.0%

532

-10.1%

304

2.4%

225

5.1%

91

71.7%

122

-6.2%

1,274

-0.9%

814

-3.0%

524

-10.0%

300

2.7%

229

3.2%

98

63.3%

120

0.0%

1,271

-0.4%

803

-2.5%

2,144

-9.9%

1,188

1.3%

897

4.2%

346

86.0%

486

-5.6%

5,061

-1.1%

3,239

-3.8%

509

-7.1%

296

3.5%

222

1.4%

104

46.5%

114

-5.8%

1,245

0.0%

769

-4.6%

497

-8.0%

294

-1.3%

218

-2.7%

119

38.4%

117

-4.9%

1,245

-2.0%

764

-6.4%

497

-6.6%

298

-2.0%

224

-0.4%

124

36.3%

112

-8.2%

1,255

-1.5%

764

-6.1%

493

-5.9%

292

-2.7%

227

-0.9%

140

42.9%

114

-5.0%

1,266

-0.4%

767

-4.5%

1,996

-6.9%

1,180

-0.7%

891

-0.7%

487

40.8%

457

-6.0%

5,011

-1.0%

3,064

-5.4%

483

-5.1%

298

0.7%

220

-0.9%

148

42.3%

100

-12.3%

1,249

0.3%

755

-1.8%

480

-3.4%

297

1.0%

227

4.1%

164

37.8%

99

-15.4%

1,267

1.8%

766

0.3%

605

-4.4%

642

-3.3%

660

-0.3%

694

1.6%

2,601

-1.6%

624

3.1%

627

-2.3%

651

-1.4%

698

0.6%

2,600

0.0%

639

2.4%

648

3.3%

236

-14.2%

287

-6.5%

315

3.6%

357

8.8%

1,195

-1.6%

275

16.5%

292

1.7%

319

1.3%

366

2.5%

1,252

4.8%

304

10.5%

318

8.9%

Capex (£m)

YoY % change

280

-2.1%

268

-3.6%

249

-13.2%

252

-14.0%

1,049

-8.3%

258

-7.9%

246

-8.2%

300

20.5%

278

10.3%

1,082

3.1%

402

55.8%

348

41.5%

Operating free cash flow (£m)

YoY % change

269

-6.9%

311

-5.2%

452

0.9%

460

12.2%

1,492

1.2%

298

10.8%

339

9.0%

471

4.2%

394

-14.3%

1,502

0.7%

270

-9.4%

329

-2.9%

Internal physical lines ('000)

13,034

12,932

12,808

12,697

12,572

12,428

12,340

12,243

12,143

12,085

External physical lines ('000)

4,988

4,838

4,688

4,544

4,515

4,506

4,514

4,472

4,464

4,420

Fully unbundled physical lines (MPF) ('000)

6,995

7,239

7,585

7,846

8,013

8,180

8,371

8,587

8,688

8,798

25,017

12

25,009

-8

25,081

72

25,087

6

25,099

12

25,114

15

25,225

111

25,302

76

25,295

-6

25,303

7

Financial

Revenue (£m)

WLR

YoY % change

LLU

YoY % change

Ethernet

YoY % change

Fibre broadband

YoY % change

Other

YoY % change

Total

YoY % change

- of which internal

YoY % change

EBITDA (£m)

YoY % change

Operating profit (£m)

YoY % change

Operational

Total physical lines ('000)

QoQ movement ('000)

7. Broadband

Q1

2013/14

Q2

Q3

Q4

Q1

7,111

150

7,281

170

7,385

104

60%

39%

79%

39%

2014/15

Q2

2015/16

Q1

Q3

Q4

Q2

7,473

88

7,592

119

7,713

121

7,796

83

7,879

82

64%

40%

48%

40%

46%

40%

49%

40%

56%

40%

51%

40%

000s

Total retail broadband

Total retail broadband

Net adds in quarter

Total retail share of DSL + fibre net adds

Total retail share of DSL + fibre installed base

Of which:

Total retail fibre base

Net adds in quarter

6,799

95

6,961

156

50%

38%

93%

39%

1,433

197

1,628

195

1,856

228

2,105

249

2,332

226

2,535

203

2,744

209

3,010

266

3,226

217

3,438

212

2,061

-5

2,000

-60

1,886

-114

1,872

-14

1,866

-5

1,859

-8

1,873

14

1,831

-42

1,842

11

1,847

5

8,860

6,995

1,963

17,818

189

8,962

7,239

1,786

17,986

168

8,997

7,585

1,656

18,238

252

9,153

7,846

1,455

18,455

217

9,252

8,013

1,353

18,618

163

9,332

8,180

1,288

18,800

182

9,465

8,371

1,222

19,058

258

9,544

8,586

1,175

19,306

248

9,639

8,688

1,128

19,455

149

9,726

8,798

1,091

19,615

160

1,676

265

1,992

316

2,330

339

2,677

347

3,019

341

3,363

344

3,738

375

4,193

455

4,582

389

4,997

415

1

1

Wholesale

BT Wholesale external broadband

Net adds in quarter

Openreach2

Internal DSL & fibre broadband (sold to other BT lines of business)

Full LLU (MPF)

Shared LLU (SMPF) + external fibre on WLR lines

Total DSL + fibre

Net adds in quarter

Of which:

Openreach fibre base

Net adds in quarter

1

Excludes 6k lines relating to a small acquisition

2

Includes Northern Ireland

2013/14

8. Costs & other statistics

2014/15

2015/16

Q1

Q1

Q2

Q3

Q4

FY

Q1

Q2

Q3

Q4

FY

Direct labour costs before leaver costs

Indirect labour costs

Leaver costs

Gross labour costs

Capitalised labour

Net labour costs

1,181

210

6

1,397

(238)

1,159

1,173

216

4

1,393

(245)

1,148

1,158

217

1,375

(260)

1,115

1,177

205

4

1,386

(253)

1,133

4,689

848

14

5,551

(996)

4,555

1,177

200

2

1,379

(261)

1,118

1,154

190

1

1,345

(260)

1,085

1,121

200

1

1,322

(273)

1,049

1,093

184

4

1,281

(349)

932

4,545

774

8

5,327

(1,143)

4,184

1,142

184

16

1,342

(290)

1,052

1,141

186

20

1,347

(291)

1,056

Payments to telecommunications operators

Property and energy costs

Network operating and IT costs

Programme rights charges

Other costs

Operating costs before depreciation and specific items

646

246

164

794

3,009

639

251

149

50

820

3,057

620

258

142

76

851

3,062

567

204

136

77

926

3,043

2,472

959

591

203

3,391

12,171

530

244

159

78

790

2,919

552

241

153

83

819

2,933

550

238

153

84

834

2,908

512

245

140

85

906

2,820

2,144

968

605

330

3,349

11,580

496

245

136

86

814

2,829

533

241

163

135

811

2,939

Depreciation and amortisation

Total operating costs before specific items

Specific items

Total operating costs

697

3,706

84

3,790

677

3,734

52

3,786

670

3,732

46

3,778

651

3,694

94

3,788

2,695

14,866

276

15,142

652

3,571

44

3,615

618

3,551

112

3,663

618

3,526

48

3,574

650

3,470

177

3,647

2,538

14,118

381

14,499

628

3,457

89

3,546

623

3,562

84

3,646

116

33

56

64

280

47

596

125

29

60

63

268

50

595

143

32

48

61

249

48

581

132

33

47

56

252

54

574

516

127

211

244

1,049

199

2,346

106

24

39

53

258

36

516

116

32

52

53

246

34

533

121

42

47

49

300

40

599

125

89

69

55

278

62

678

468

187

207

210

1,082

172

2,326

86

35

52

44

402

39

658

107

37

56

46

348

35

629

9,957

-70

3,878

-100

13,835

-170

9,908

-49

3,784

-94

13,693

-142

9,839

-69

3,695

-89

13,534

-159

9,754

-85

3,626

-70

13,380

-155

9,694

-60

3,544

-82

13,238

-141

9,633

-61

3,503

-75

13,136

-137

9,574

-59

3,428

-75

13,002

-134

9,522

-52

3,379

-49

12,901

-101

7.79

-11.3%

7.59

-12.9%

7.13

-11.6%

7.00

-10.6%

6.92

-11.2%

6.80

-10.4%

6.28

-11.9%

6.19

-11.6%

Q2

Operating costs (£m)

Capital expenditure (£m)

Capital expenditure by line of business

BT Global Services

BT Business

BT Consumer

BT Wholesale

Openreach

Other

Total

Other Stats

Lines sold through BT lines of business

Total consumer lines (as sheet 4)

QoQ movement

Business/Corporate lines

QoQ movement

Total

QoQ movement

10,070

-130

4,071

-101

14,141

-231

Call minutes across BT lines of business (bn)

YoY % change

8.07

-11.0%

1

Excludes 7k lines relating to accounts transferred from BT Consumer to BT Business

2

Excludes 22k lines relating to a small acquisition

3

Excludes 34k lines relating to reporting adjustment

1

1

10,027

-65

3,978

-93

14,005

-158

7.83

-11.4%

2

2

31.28

-11.6%

3

3

27.85

-11.0%

9. Glossary

BT Global Services

Revenue

Geographic split of revenue is based on the country of origin from which the customer is invoiced. Reported growth rates are not adjusted for the effect of foreign exchange movements.

Underlying revenue excluding transit

Operational

Order intake

The YoY change in underlying revenue excluding transit. Underlying revenue excludes specific items, foreign exchange movements and the effect of acquisitions and disposals

Orders for all business types including new business, renewals and extensions. Where a renewal or extension overlaps with a previous contract value reported as Order intake, only the

incremental increase is included. Also includes all orders for BT Global Services's Conferencing and Security units.

BT Business

Revenue

SME & Corporate voice

SME & Corporate data & networking

IT services

Ireland Business (ex Transit)

Revenue from calls, lines, mobile and VoIP services. Calls revenue is local and national geographic calls, international direct dial, fixed to mobile, other non-geographic calls and revenue from call

packages sold to SMEs and mid-tier corporates in the UK under both the BT and Plusnet brands. Lines revenue is rentals and connections revenue from analogue and digital lines sold to SMEs

and mid-tier corporates in the UK under both the BT and Plusnet brands.

Revenue from broadband, analogue and digital private circuits, and ICT and managed network services sold to SMEs and mid-tier corporates in the UK under both the BT and Plusnet brands.

Internal

Revenue from five specialist IT services units in BT Business - BT Engage IT, BT iNet, BT Business Direct, BT Expedite & Fresca and BT Tikit

In Northern Ireland, includes revenue from SMEs and the public sector, plus internal charges related to usage of the network in Northern Ireland. In Republic of Ireland, includes revenue from

the corporate sector, the public sector and from wholesale network services.

Ireland revenues from the carriage of telecoms traffic across BT's network where neither the originating nor the terminating network is owned or controlled by BT (including the pass through of

mobile terminating traffic)

Mainly revenue from certain units previously reported within BT Enterprises: BT Directories, BT Redcare, BT Payphones and BT Fleet, as well as Inbound and Select Services revenue. Also

includes revenue from audio, video and web conferencing and collaboration services for business customers in the UK.

Contains IT services & managed networks revenue from BT Global Services; and internal charges from Ireland to other parts of BT relating to usage of the network in Northern Ireland.

Underlying revenue excluding transit

The YoY change in underlying revenue excluding transit. Underlying revenue excludes specific items, foreign exchange movements and the effect of acquisitions and disposals

Transit

Other (incl. eliminations)

Operational

Order intake

BT Consumer

Revenue

Calls & lines

Broadband & TV

Other (incl. eliminations)

Internal

Operational

Consumer ARPU

Total consumer lines

Active consumer lines

TV customers

Orders for calls & lines, broadband, IT services and conferencing services sold by BT Business in the UK and Ireland. Includes all connections, installations and one-off charges, plus all recurring

charges for the term of the contract. Excludes orders for volume products such as calls & lines and broadband ordered directly through our outbound sales desks.

All measures include consumers in Northern Ireland, and Plusnet's consumer business

Calls revenue is local and national geographic calls, international direct dial, fixed to mobile, other non-geographic calls and revenue from call packages sold to consumers in the UK. Lines

revenue is rentals, connections and calling features revenue for analogue and digital lines sold to consumers in the UK. Also includes revenue from BT Mobile plans.

Revenue from broadband sold to consumers in the UK. Includes BT Infinity, BT TV and retail and wholesale BT Sport.

Mainly sales of telephones and other equipment, BT Wi-fi direct revenue from the sale of wi-fi vouchers to customers, and wi-fi revenue from corporate customers.

Mainly BT Wi-fi revenue from services sold by BT Global Services on certain contracts; services and applications sold by Plusnet to BT Global Services.

12 month rolling consumer revenue, less mobile POLOs, less BT Sport revenue from: satellite customers paying for the channels, our wholesale deals and from commercial premises. This is

divided by the average number of primary lines.

Total number of UK consumer analogue lines and ISDN channels (WLR)

The number of UK consumer lines over which BT is the call provider

Total number of customers, with either a BT Vision or a YouView box, that are registered & enabled on the BT TV platform to receive video on demand. Includes YouView TV from Plusnet

BT Wholesale

Revenue

Managed solutions

Calls, lines & circuits

Broadband

IP services

Transit

Other

Underlying revenue excluding transit

Operational

Order intake

Managed network services, white label managed services and wholesale calls sold to external communications providers (CPs) in the UK. Includes managed broadband network service

contracts.

Direct and indirect conveyance, wholesale and international direct dial calls (not sold as part of a managed service), interconnect circuits, private circuits and partial private circuits

IPStream Connect, Datastream and Wholesale Broadband Connect revenue from sales to external CP customers including that not deemed managed solutions. Excludes managed broadband

network service contracts.

Voice over IP services (including IP Exchange), Fixed Wholesale Ethernet and other wholesale data revenue including MPLS products such as SHDS & IP Clear

UK revenues from the carriage of telecoms traffic across BT's network where neither the originating nor the terminating network is owned or controlled by BT (includes the pass through of

mobile terminating traffic)

Media & Broadcast revenue and equipment sales

The YoY change in underlying revenue excluding transit. Underlying revenue excludes specific items, foreign exchange movements and the effect of acquisitions and disposals

Orders for all business types including new business, renewals and extensions.

Openreach

Revenue

WLR

LLU

Ethernet

Fibre broadband

Other

Internal

Operational

Internal physical lines

External physical lines

Fully unbundled physical lines (MPF)

Internal and external WLR connection and rental revenue

Internal and external SMPF and MPF connection and rental revenue, co-location connection and rental revenue, copper port build, tie cables and TAMs

Internal and external Ethernet connection and rental revenue

Internal and external Fibre connection and rental revenue

Primarily revenue from service-based activity and some legacy connectivity products

Primarily rental and connection revenue related to WLR, SMPF, Ethernet and fibre supplied to the customer-facing BT lines of business

Lines provided by Openreach to other BT lines of business - including Plusnet and physical lines operated by BT Consumer and BT Business in Northern Ireland (includes analogue lines and ISDN

lines provided over copper (WLR), but excludes non-equivalent traded products and ISDN30)

Lines provided by Openreach to other CPs (includes analogue and ISDN lines provided over copper (WLR), but excludes full LLU (MPF) and ISDN30)

MPF lines provided by Openreach to other CPs

Broadband

Total retail broadband

Total retail broadband

Total retail fibre base

Wholesale

BT Wholesale external broadband

Openreach

Internal DSL & fibre broadband

(sold to other BT lines of business)

Full LLU (MPF)

Shared LLU (SMPF) + external fibre on WLR lines

Total DSL + fibre

Openreach fibre base

BT's total retail broadband base (including retail fibre) - BT Consumer (including Plusnet and Northern Ireland), BT Business and broadband lines sold by Global Services

BT's total retail fibre base - BT Consumer (including Pusnet and Northern Ireland) and BT Business. Included within retail broadband numbers

Total broadband lines sold by BT Wholesale to external CP customers

Total broadband (including fibre) lines sold via BT lines of business. Calculated as the sum of 'Total retail broadband' base + 'BT Wholesale external broadband' base

MPF lines provided by Openreach to other external CPs

SMPF lines provided by Openreach to other external CPs - includes fibre provided by Openreach to other CPs on WLR lines

Total number of broadband lines sold by Openreach both internally and externally. Includes fibre. Calculated as the total of the 3 rows above

Total fibre lines sold by Opnreach, both internally to BT lines of business and externally to other CPs. Included within the 'Total DSL + fibre' number

Costs & other statistics

Total consumer lines (as sheet 4)

Business/Corporate lines

Call minutes

Total number of UK consumer analogue lines and ISDN channels (WLR) sold by BT Consumer. Includes consumers in Northern Ireland and Plusnet.

Total lines (analogue lines and ISDN channels (WLR)) sold by BT Global Services, BT Business and BT Wholesale

Includes BT Consumer (including Northern Ireland), BT Business (including Northern Ireland) and BT Global Services non-geographic and geographic call minutes - local, national and

international call minutes, fixed to mobile, 0800, 0870 and 0845