Name:_______________________________ Student #:____________________________ Section #:

advertisement

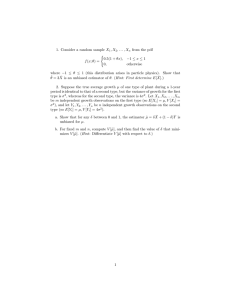

Name:_______________________________ Student #:____________________________ Section #: ____________________________ BUEC 333 MIDTERM There is a formula sheet attached at the end of the exam and some blank pages for your rough work. Use the bubble sheet to record your answers for the multiple choice questions and write your answers to the short answer questions in the space provided. Multiple Choice (1 points each) 1.) Suppose that on any given trading day, a stock’s price can increase, decrease, or remain unchanged. Likewise, on any given day, the weather can be sunny or cloudy. You have the following information about the joint distribution of weather and stock price changes. It is sunny today. What is the probability of a price increase? Sunny Cloudy Decrease 3/20 1/10 Unchanged 3/10 1/5 Increase 1/10 a) 1/4 b) 3/10 c) 3/16 d) 3/20 e) none of the above 2.) If the covariance between two random variables X and Y is zero then a) X and Y are independent b) Knowing the value of X provides no information about the value of Y c) E(X) = E(Y) = 0 d) a and b are true e) none of the above 3.) The value of X1 is an unbiased estimator of the sample mean. Now consider the estimator (X1 + X2). Is this another unbiased estimator of the population mean? a) Yes b) No c) Depends on the value of X1 d) Depends on the value of (X1 + X2) e) none of the above 4.) Suppose you have a random sample of 20 observations from a normal distribution with mean = 10 and variance = 2. The sample mean (x-bar) is 8 and the sample variance is 3. The sampling distribution of x-bar has a) mean 8 and variance 3 b) mean 8 and variance 0.3 c) mean 10 and variance 0.2 d) mean 10 and variance 0.1 e) none of the above 1 5.) The law of large numbers says that: a) the sample mean is a biased estimator of the population mean in small samples b) the sampling distribution of the sample mean approaches a normal distribution as the sample size approaches infinity c) the behaviour of large populations is well approximated by the average d) the sample mean is an unbiased estimator of the population mean in large samples e) none of the above 6.) The power of a test is the probability that you: a) reject the null when it is true b) fail to reject the null when it is false c) reject the null when it is false d) fail to reject the null when it is true e) none of the above 7.) Which of the following is not a linear regression model: a) Yi X i X i2 i b) Yi 0 1 X i 2 i c) log( Yi ) 0 1 log( X i ) i d) Yi 0 1 log( X i ) i e) all of the above 8.) In the linear regression model, the least squares estimator a) minimizes the sum of squared residuals b) is unbiased c) is most efficient among the class of linear estimators d) maximizes the value of R2 e) all of the above 9.) In the linear regression model, the degrees of freedom a) is equal to the number of observations (n) minus k minus 1 b) affects the precision of the coefficient estimates c) does not affect the value of the coefficient estimates d) all of the above e) none of the above 10.) In the Capital Asset Pricing Model (CAPM), a) R2 is meaningless b) β is greater than one c) α is less than zero d) β measures the sensitivity of the expected return of a portfolio to specific risk e) β measures the sensitivity of the expected return of a portfolio to systematic risk 2 Short Answer (10 points each – show your work!) 1.) Consider the case of a uniformly distributed random variable where each outcome (1, 2, 3, 4) has an equal chance of occurring. a) What is the population mean and variance of this random variable? b) Suppose that a random number generator provides the following sequence of numbers, 2-1-4-1. What is the mean and variance of this sample? c) What is the sampling distribution of the sample mean calculated above? Provide a verbal interpretation of the sampling distribution of the sample mean. d) Compute the value of the t-statistic for testing the null hypothesis that μ = 2.5. e) The critical value for a t distribution with 3 degrees of freedom and a 0.20 level of significance in the presence of a two-sided alternative is equal to 1.638. Can you reject the null hypothesis that μ = 2.5 at the 20% level of significance? What about at the 10% level of significance? a) f(1) = 0.25, f(2) = 0.25, f(3) = 0.25, f(4) = 0.25 µx = 1 * (0.25) + 2 * (0.25) + 3 * (0.25) + 4 * (0.25) µx = 0.25 + 0.50 + 0.75 + 1.00 = 2.50 Outcome Pr[X = x] Xi – E(X) = Xi – 2.50 [Xi – E(X)]2 Pr[Xi] * [Xi – E(X)]2 X=1 0.25 -1.50 2.25 0.5625 X=2 0.25 -0.50 0.25 0.0625 X=3 0.25 0.50 0.25 0.0625 X=4 0.25 1.50 2.25 0.5625 Var(X) = 0.5625 + 0.0625 + 0.0625 + 0.5625 Var(X) = 1.25 1 n (2 1 4 1) Xi 2 n i 1 4 b) X s2 1 n (2 2) 2 (1 2) 2 (4 2) 2 (1 2) 2 2 X X i n 1 i 1 3 (0) 2 (1) 2 (2) 2 (1) 2 0 1 4 1 6 s 2 3 3 3 2 c) The mean is equal to the population mean of 2.50. The sampling variance is equal to the population variance divided by the number of observations or 1.25/4 = 0.3125. This represents the set of possible values that the statistic might take, and the probabilities associated with each of them. It measures uncertainty over the possible value that the statistic might take in repeated samples from the same population. d) T 2.00 2.50 0.50 0.7071 ~ t 2/ 4 2/2 3 e) In this case, you will fail to reject the null that μ = 2.5 at the 20% level of significance. And as the critical value will only increase with the level of significance, we will fail to reject at the 10% level as well. 3 2.) Suppose that on any given day, the length of time spent waiting to board the gondola at Whistler Mountain can be short, medium, or long. Likewise, on any given day, there can be fresh snow on the mountain or not. You have the following information about the joint distribution of snowfall and waiting times: Fresh Snow No Fresh Snow Short Wait 1/20 1/5 Medium Wait 1/10 3/10 Long Wait 5/20 a) What is the joint probability that there is no fresh snow and the wait time is long? b) If a short wait is one minute, a medium wait is ten minutes, and a long wait is twenty minutes, what is the expected waiting time on any given day? c) There is NO fresh snow today. What is the probability of a long wait? d) Explain the difference between your answer to part a) and your answer to part c). e) Are wait times and weather independent? Explain. a) Pr(no fresh snow, long wait) = 1 – 1/20 – 1/10 – 5/20 – 1/5 – 3/10 Pr(no fresh snow, long wait) = 20/20 – 1/20 – 2/20 – 5/20 – 4/20 – 6/20 = 2/20 b) Pr(short wait) = 1/20 + 1/5 = 1/20 + 4/20 = 5/20 Pr(medium wait) = 1/10 + 3/10 = 2/20 + 6/20 = 8/20 Pr(long wait) = 5/20 + 2/20 = 7/20 E(waiting time) = 5/20 * 1 minute + 8/20 * 10 minutes + 7/20 * 20 minutes E(waiting time) = 5/20 minutes + 80/20 minutes + 140/20 minutes = 11.25 minutes c) Pr(long wait|no fresh snow) = Pr(no fresh snow, long wait)/Pr(no fresh snow) Pr(no fresh snow) = 1/5 + 3/10 + 2/20 = 4/20 + 6/20 + 2/20 = 12/20 Pr(long wait|no fresh snow) =(2/20)/(12/20) = 2/12 = 1/6 d) Inherently, the answer in part a is the joint probability of both events happening simultaneously. The answer in part c is the conditional probability that you will experience a long wait given that there is no fresh snow today. The fundamental difference is that the conditional probability is based on more information, that is, we already know that there is no fresh snow. e) For independence, we require that Pr(long wait|no fresh snow) = Pr(long wait). Clearly, this is not the case as 1/6 does not equal 2/20 and so we conclude that wait times and weather are not independent. 4 3.) Suppose we have a linear regression model with two independent variables and a constant: Yi = β0 + β1X1i + β2X2i + εi Verbally, explain the steps necessary to derive the least squares estimator, providing as much intuition as possible for each step. The least squares estimator seeks to minimize the sum of the squared residuals from the estimating equation. 1.) Thus, we first have to define our residual as the difference between that which is observed and that which is predicted by the regression. In this way, the residual is best thought of as a prediction error, that is, something we would like to make as small as possible. 2.) Next, we need to define a minimization problem. Because our residuals will likely be both positive and negative, simply considering their sum is unsatisfactory as these will tend to cancel one another out. Additionally, minimizing the sum of residuals does not generally yield a unique answer. A better way forward is to minimize the sum of the squared “prediction errors” which will definitely yield a unique answer and which will penalize us for making big errors. 3.) We must take the derivatives of the sum of squared residuals with respect to the beta-hats and set them equal to zero. These first order conditions establish the values of beta-hat for which the sum of squared residuals “bottoms out” and is, thus, minimized. 4.) Finally, we must solve for the values of the beta-hats which are consistent with these first order conditions, thus, yielding our least squares estimators. 5 4.) Suppose that in a random sample of 100 SFU graduates, you estimate the following regression equation: Yi 0 1 X 1i 2 X 2i 3 X 3i i Yi = Hourly wage (in dollars) at first full-time job X1i = Cumulative GPA at graduation X2i = Number of years to complete SFU degree X3i = Usual number of hours worked off-campus per week while a student You estimate the model in EViews and obtain the following: ˆ0 10 ˆ1 5 ˆ2 1 ˆ3 0.2 R 2 0.3 a) Interpret the estimates ˆ and ˆ . 0 1 b) Compute the predicted wage of a graduate with a GPA of 3.0, who completes their degree in 5 years, and who worked 10 hours per week off-campus. c) What is the value of this student’s residual if their hourly wage is $25? What does the value of this student’s residual tell you (that is, interpret its value)? d.) If a student from the same graduating class had a GPA of 4.0 and took only four years to complete their degree, how many hours per week do you predict they would need to have worked as a student in order to make that same $25 hourly wage? e.) Are there any important variables missing from the regression above? If so, name one which it should be easy for you and/or the university to collect data on. a) The estimated value of the intercept tells us that when the value of all our explanatory variables (GPA, years at SFU, hours worked) are all zero, then the hourly wage will be $10. Since such an observation cannot occur (in particular, no graduate of SFU can do so in zero years), the constant is of no intrinsic interest to us. On the other hand, achieving one more grade point and holding years at SFU and hours worked constant is associated with an additional $5 for a graduate’s hourly wage. Yˆi 10 5 X 1i 1X 2i 0.2 X 3i b) Yˆi 10 15 5 2 $18 c) ei Yi Yˆi $25 $18 $7 This suggests that this particular student makes $7 more than the regression model predicts, given their GPA, years at SFU, and hours worked as a student. Yˆi 10 5 X 1i 1X 2i 0.2 X 3i 25 10 20 4 0.2 X 3i d) 0.2 X 26 25 1 3i X 3i 5 e) One obvious observable missing variable would be a student’s major. 6