Texas timber market: A Look at 2014

advertisement

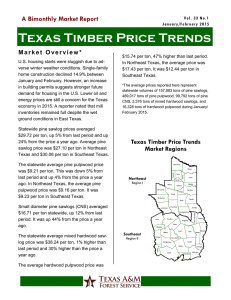

Texas timber market: A Look at 2014 Market overview The economy and the housing market in Texas have outperformed the rest of the U.S. in recent years. In Texas, single-family building permits rose from a monthly average of 7,197 in 2013 to 7,933 in 2014 with values above 8,600 permits for the months of April through July, 2014 (Figure 1). Timber prices are generally tied to the housing market. Timber prices have improved in Texas over the past two years thereby improving the outlook for tree growers in East Texas. However, the recent sharp decline in oil prices is a concern and could have a negative impact on the housing market and overall Texas economy in 2015. Building permit (no.) $/Ton 20 10,000 8,000 6,000 4,000 2,000 0 18 P ine 16 H a rdwo o d 14 12 10 8 6 Sep-14 Figure 1. Texas single-family building permits. Nov-14 Jul-14 May-14 Mar-14 Jan-14 Nov-13 Sep-13 Jul-13 Mar-13 May-13 Jan-13 Nov-12 4 2 0 N/D '12 J/F '13 M /A M /J '13 '13 J/A '13 S/O N/D J/F '13 '13 '14 M /A M /J '14 '14 J/A '14 S/O N/D '14 '14 Figure 2. Texas pulpwood stumpage price trends. A closer look According to Texas Timber Price Trend (TTPT) data, average annual stumpage prices of all five major timber products (pine sawlog, chip-n-saw, pulpwood; hardwood sawlog, pulpwood) increased from 2013 to 2014. In particular, the price for pine pulpwood timber rose 26 percent from an average price of $6.92 per ton in 2013 to $8.71 per ton in 2014. Hardwood pulpwood prices rose more sharply than pine pulpwood prices, especially in the latter half of 2014. For example, the hardwood pulpwood price of $15.79 for the September─October period was 94 percent higher than the average price of $8.13 for the January─February period (Figure 2). Pine pulpwood price was up 13 percent during this period. Reporters for TTPT have suggested a number of factors that may have contributed to the higher hardwood stumpage prices observed in the second half of 2014. Excessive wet weather may have limited access to hardwood logging sites, thereby diminishing supply of hardwood timber. Additionally, a reduced logging force including fewer log trucks may have been a factor restricting supply of hardwood timber. Given that hardwood timber products are generally hauled over a longer average distance than pine, fewer trucks would potentially have a greater impact on hardwood timber supply. Finally, a greater demand for hardwood mats and skids used for pipeline construction may have increased demand for hardwood sawlogs. In summary, over the long term, timber stumpage prices should continue to improve as long as the demand for softwood lumber and structural panel continues to increase in Texas. The recent increase in the average price of hardwood timber products would appear to be in part a supply-driven phenomenon. Should weather conditions improve in 2015 and hardwood logging sites become more readily accessible, one may expect average hardwood timber prices to retreat some from the recent spike. For questions about the information presented in this report, please contact Omkar Joshi or Chris Edgar by phone at 979/458-6630 or by email at ojoshi@tfs.tamu.edu and cedgar@tfs.tamu.edu.