Example of Contribution to Market Value of Each Business of... Hypothetical Firm

advertisement

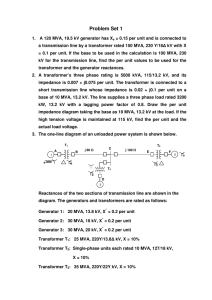

Example of Contribution to Market Value of Each Business of a a Hypothetical Firm Firm Market Value 0 < MD < BD D E C MC = BC Total market value ME < 0 < BE B MB > BB A MA > BA Book Value Total book value Total Book Value Total Market Value B = BA + BB + BC + BD + BE M = MA + MB + MC + MD + ME M/B for the overall firm is less than 1 Figure by MIT OCW. Selecting the Best Strategy for a Business Unit: Unit: Evaluation of Alternative Strategic Thrust Options For each business unit, characterize the strategic options in terms of market share thrust as: - Build (aggressively, gradually, or selectively) - Maintain (aggressively or selectively) - Harvest - Divest Project the equity cash flow associated with each strategic option, & compute the corresponding M/B ratio. M represents the present value of cash flow and B the existing book value of the equity base. Summarize the M/B values for the different strategic options, for all of the business units of the firm. Business unit Build Hold 1 2 3 4 5 6 1.0 2.1 0.8 0.3 2.2 0.5 1.6 1.5 1.2 0.5 2.5 0.7 Harvest Divest 1.4 0.9 1.4 0.7 1.8 0.6 1.2 1.8 1.1 0.8 1.9 0.5 Green values represent the M/B ratios under the optimum strategy for each business unit. Select, for each business unit, that alternative that takes into account the optimum economic performance, as well as that host of additional impacts that the business positioning might have on the overall competitive standing of the firm. Figure by MIT OCW. Principles for Resource Allocation 1. The principle of zero-based resource allocation A zero-based resource allocation process evaluates the use of all resources, sunk as well as incremental, to assure that they are contributing to value creation. 2. The principle of funding strategies, not projects A business strategy can be regarded as a bundle of projects. The resource allocation process should concentrate on the value created by this entire bundle, rather than looking at individual projects in isolation. Principles for Resource Allocation (cont’d.) d.) 3. The principle of no capital rationing rationing The assumptions imbedded in most processes of resource allocation is that capital is scarce but free. Exactly the opposite is true: capital is plentifully available, but is expensive. 4. The principle of zero tolerance for bad growth This principle makes the redeployment of resources from unprofitable or bad-growth businesses to value creating ones. It helps to minimize bad growth, and maximize good growth. Value Concentration in Typical Portfolio Percent of Company’s Total Value Creation from Each Business 60% 40% 12 businesses produce capital losses, offsetting 115% of value created 20% 0% -20% Five more businesses add another 115% to total value creation -40% 100% of total company value creation comes from two businesses -60% 0% 20% 40% 60% Percent of Equity Invested in Each Business 80% 100% Who creates value? The 200 companies with the biggest market caps are listed below by MVA rank in a field of 1,000 large-cap companies. MVA RANK1 1998 19972 19932 What market value added means to you MVA, in effect, shows the difference between the capital investors have put into a company and the money they can take out. Company3 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 2 1 3 5 4 8 7 11 6 10 9 14 18 12 13 26 49 20 42 19 16 15 33 5 2 12 4 24 9 11 16 3 5 7 1 27 77 26 1000 39 15 35 32 48 13 28 24 25 26 27 17 32 39 21 10 * 319 17 28 29 38 93 14 8 Home Depot AT&T 30 31 45 Bellsouth General Electric Coca-Cola Microsoft Merck Intel Procter & Gamble Exxon Pfizer Philip Morris Bristol-Myers Squibb Johnson & Johnson Wal-Mart Stores Eli Lilly Cisco Systems Gillette IBM Bell Atlantic Walt Disney SBC Communications Du Pont Hewlett-Packard Abbott Laboratories Schering-Plough Pepsico Lucent Technologies American International Group American Home Products Market value added ($ millions) $195,830 $158,247 $143,740 $107,418 $90,010 $88,706 $85,557 $83,835 $82,412 $81,312 $71,433 $69,678 $67,204 $50,422 $50,209 $49,101 $48,414 $46,869 $45,136 $42,631 $42,615 $42,443 $41,143 $40,743 $39,767 $39,697 $38,920 $35,818 $35,214 $34,189 Wealth Predictor EVA is after-tax net operating profit minus cost of capital. A growing EVA is good sign that a stock will soar. Economic value added ($ millions) $1,917 $2,615 $2,781 $1,921 $4,821 $587 $(412) $1,077 $3,524 $1,802 $1,320 $920 $199 $1,472 $518 $(1,561) $1,429 $(968) $2,234 $975 $152 $1,200 $960 $(218) $146 $(834) $503 $462 $(2,892) $448 Capital Return on ($ millions) capital The Real Story Does the return on capital exceed the cost of capital? If so, then the company is using investor's money wisely. Cost of capital $59,251 $10,957 $8,676 $23,112 $21,436 $24,419 $88,122 $15,220 $43,146 $14,627 $19,803 $33,890 $13,049 $5,221 $9,724 $66,420 $51,343 $32,707 $41,259 $42,077 $26,507 $10,639 $4,970 17.3% 36.3% 52.9% 23.2% 42.7% 15.2% 9.4% 19.9% 20.2% 25.3% 20.2% 13.5% 14.3% 50.9% 18.8% 10.5% 13.4% 9.0% 16.2% 13.8% 15.6% 23.2% 36.0% 13.8% 12.1% 14.2% 14.5% 15.1% 12.8% 9.9% 12.1% 11.9% 12.5% 12.9% 10.5% 12.8% 14.3% 12.0% 12.8% 9.6% 12.0% 9.3% 11.1% 15.0% 10.9% 14.0% $18,507 $25,057 $36,590 $19,462 11.5% 12.9% 9.9% 13.8% 12.5% 12.3% 12.3% 11.1% $9,583 $70,408 16.8% 5.6% 10.8% 9.9% $35,860 10.8% 9.4% TH E TO P W EA LTH C R EATO R S Figure by MIT OCW. Adapted from: Fortune, November 9, 1998.