Learn more about the MVA

advertisement

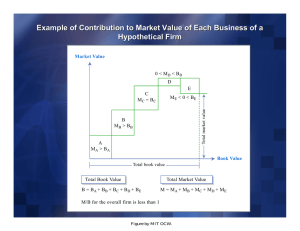

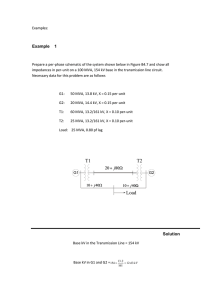

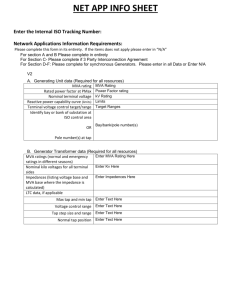

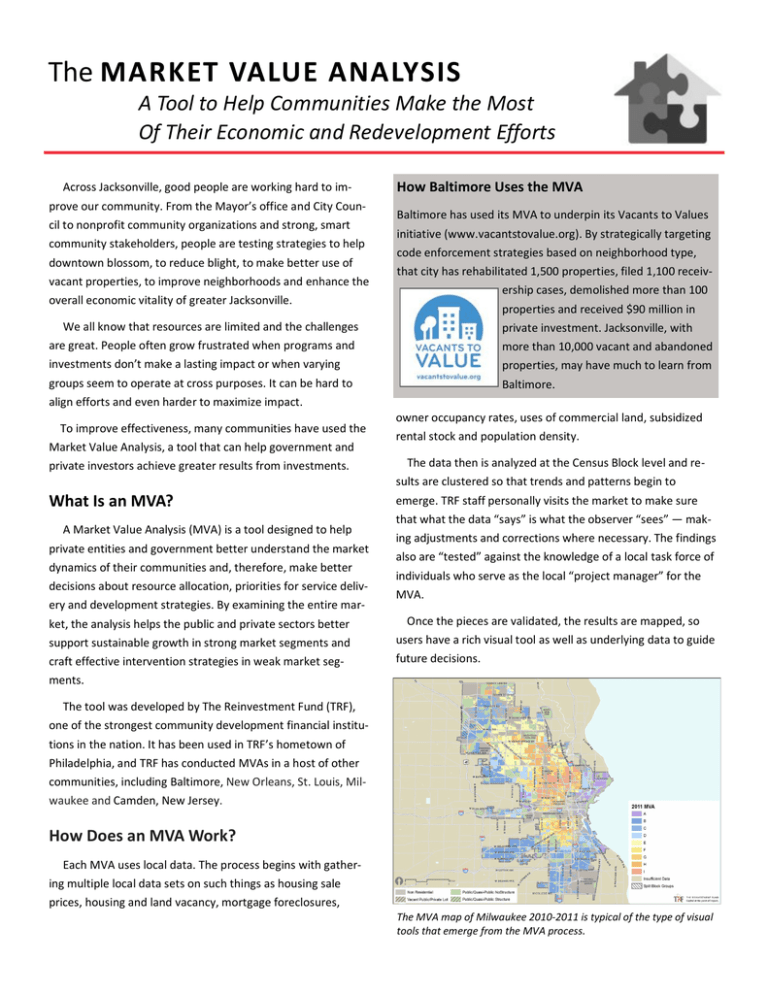

The MARKET VALUE ANALYSIS A Tool to Help Communities Make the Most Of Their Economic and Redevelopment Efforts Across Jacksonville, good people are working hard to improve our community. From the Mayor’s office and City Council to nonprofit community organizations and strong, smart community stakeholders, people are testing strategies to help downtown blossom, to reduce blight, to make better use of vacant properties, to improve neighborhoods and enhance the overall economic vitality of greater Jacksonville. How Baltimore Uses the MVA Baltimore has used its MVA to underpin its Vacants to Values initiative (www.vacantstovalue.org). By strategically targeting code enforcement strategies based on neighborhood type, that city has rehabilitated 1,500 properties, filed 1,100 receivership cases, demolished more than 100 properties and received $90 million in We all know that resources are limited and the challenges are great. People often grow frustrated when programs and investments don’t make a lasting impact or when varying groups seem to operate at cross purposes. It can be hard to align efforts and even harder to maximize impact. To improve effectiveness, many communities have used the Market Value Analysis, a tool that can help government and private investors achieve greater results from investments. What Is an MVA? A Market Value Analysis (MVA) is a tool designed to help private entities and government better understand the market dynamics of their communities and, therefore, make better decisions about resource allocation, priorities for service delivery and development strategies. By examining the entire market, the analysis helps the public and private sectors better support sustainable growth in strong market segments and craft effective intervention strategies in weak market segments. private investment. Jacksonville, with more than 10,000 vacant and abandoned properties, may have much to learn from Baltimore. owner occupancy rates, uses of commercial land, subsidized rental stock and population density. The data then is analyzed at the Census Block level and results are clustered so that trends and patterns begin to emerge. TRF staff personally visits the market to make sure that what the data “says” is what the observer “sees” — making adjustments and corrections where necessary. The findings also are “tested” against the knowledge of a local task force of individuals who serve as the local “project manager” for the MVA. Once the pieces are validated, the results are mapped, so users have a rich visual tool as well as underlying data to guide future decisions. The tool was developed by The Reinvestment Fund (TRF), one of the strongest community development financial institutions in the nation. It has been used in TRF’s hometown of Philadelphia, and TRF has conducted MVAs in a host of other communities, including Baltimore, New Orleans, St. Louis, Milwaukee and Camden, New Jersey. How Does an MVA Work? Each MVA uses local data. The process begins with gathering multiple local data sets on such things as housing sale prices, housing and land vacancy, mortgage foreclosures, The MVA map of Milwaukee 2010-2011 is typical of the type of visual tools that emerge from the MVA process. Values Surrounding the MVA Jacksonville’s MVA Underlying the MVA is the perspective that all parts of a city matter — weak neighborhoods, strong neighborhoods and neighborhoods in between — and all are “customers” of the city’s programs, resources and services. Moreover, public resources are scarce and cannot be singularly relied upon. Thus, locating and building on local strength is fundamental. Thanks to the support of a group of local investors, TRF will conduct a Market Value Analysis of Duval County in late 2014early 2015. Scarce public resources should be used to prepare a market for an infusion of private capital; public resources should be invested in a way that leverages private capital. To do this well, decisions to invest and/or deploy government dollars or programs should be based on objectively gathered data and sound quantitative and qualitative analysis — what is known as “evidence-based decision-making.” These values, along with the high quality of the research and data, have earned TRF and the MVA support from a diverse set of institutions. The Board of Governors of the Federal Reserve System have shared the MVA approach widely and TRF has worked directly with Federal Reserve Banks in Richmond, Boston, St. Louis and Cleveland. In addition, TRF has worked in partnership with municipalities, private foundations and community organizations to develop and support local MVAs. The Tool, Not the Solution As a tool, the MVA is valuable only to the extent that it is used. Thus it is important that information about the MVA — and access to the results once it is completed — are widely shared and easily accessible. To assist that, the MVA process deliberately involves repre- The Jessie Ball duPont Fund is serving as the local contact for The Reinvestment Fund during the course of the Market Value Analysis. To learn more, or inquire about the project, contact: Mark Constantine Senior Vice President Jessie Ball duPont Fund One Independent Drive Suite 1400 Jacksonville, FL 32202 904-353-0890 mconstantine@dupontfund.org In September 2014, representatives of TRF will visit Jacksonville for a series of meetings to explain the MVA and outline the research process. The Federal Reserve Bank of Atlanta’s Jacksonville office will convene local bankers and nonbank investors as well as for profit and nonprofit developers, and the Jessie Ball duPont Fund will convene a group of community stakeholders. Work on the MVA is scheduled to begin in October and, assuming good access to data and no surprises in the research phase, the draft MVA should be completed by spring 2015. Consistent with TRF’s processes, a local task force will be appointed to follow the research process and assist in vetting the findings. The task force also will recommend strategies to deploy the MVA upon its completion. sentatives of government, the investment community, developers and planners and philanthropy. By participating on the task force, individuals can actively encourage use of the MVA as part of the evidence-based decision making that will guide the city’s future. To Learn More The Reinvestment Fund — www.trfund.com Putting Data to Work: Data-Driven Approaches to Strengthening Neighborhoods A publication of the Board of Governors of the Federal Reserve System, December 2011 http://www.federalreserve.gov/communitydev/files/datadriven-publication-20111212.pdf Great Neighborhoods Great City: Strategies for the 2010s Report by Paul C. Brophy for the Goldseker Foundation http://www.goldsekerfoundation.org/ uploaded_files/0000/0023/great_cities_2012.pdf Market Value Analysis: Understanding Where and How to Invest Limited Resources Bridges, published quarterly by the Community Affairs Department of the Federal Reserve Bank of St. Louis http://www.trfund.com/wp-content/uploads/2013/06/ StLouisFRB.pdf