advertisement

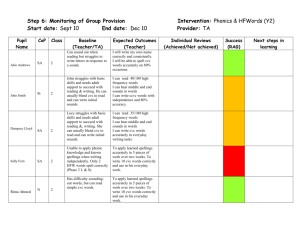

MIT OpenCourseWare tp://ocw.mit.edu ht ______________ 15.369 Corporate Entrepreneurship: Strategies for Technology-Based New Business Development Fall 2007 http://ocw.mit.edu/te___ rms. For information about citing these materials or our Terms of Use, visit: ________________ Corporate Venture Capital Study Project Dr. Andrew Wang, NIST/ATP Dr. Val Livada, MIT Sloan Study Team Ian MacMillian Wharton School of Business Edward Roberts Sloan School of Management Val Livada Sloan School of Management Andrew Wang National Institute of Standards and Technology Objectives Create knowledge base of CVC best-practices Strategy and structure Management and process Outcomes and metrics Assess funding landscape for early-stage technology Assess interaction between large and small companies in the innovation ecosystem Primary source data Qualitative interviews Survey of CVCs 30 companies 48 CVC respondents Case study CVC and stakeholders Survey Respondents Air Products Applied Materials Ascension Health AstraZeneca BASF BD BlueCross Chevron Disney Dow Duchossois DuPont Eastman Easenergy Genzyme GlaxoSmithKline Honda IBM In-Q-Tel Kodak Lilly Michelin Microsoft Mitsubishi Pharma Motorola NEC Nokia Novartis Panasonic Philips SAP Siemens Silicon Valley Bank Southern California Gas Sun Takeda TELUS Texas Instruments Turner Broadcasting Tyco Unilever UPS Visa Survey Data CVC Organizations - Year Established 8 8 8 6 6 Number 4 5 4 3 3 3 2 2 2 1 1980 1985 1 1 0 1 1990 1995 Year 2000 2005 Survey Data CVC Organizational Form Independent Subsidiary Company 35% Type of Capitalization 38% 63% 65% No Discretionary Fund Yes Dedicated Fund Survey Data CVC Reporting Relationship - 1 2 10 5 12 2 3 2 3 0 2 10 0 5 10 Number of CVCs CEO Business Unit - Head CFO Business Unit - Strategy/Development CTO Business Unit - Finance Corporate - Strategy/Development Business Unit - R&D Corporate - Finance Other Corporate - R&D Survey Data CVC Reporting Relationship - 2 Company Organization Company Function 8% 21% 21% 29% 15% 65% 19% 23% Corporate Executive R&D Business Unit Strategy/Development Other Other Finance Survey Data CVC and Corporate Venturing Other CVC Units at Company 27% CVC Engage in Internal Venturing 31% CVC Invest in Spin-Outs 31% 69% 73% 69% No No No Yes Yes Yes Survey Data CVC Source of Capital Corporate Business Units External Investors 4% 17% 27% 73% 83% 96% No No No Yes Yes Yes Survey Data CVC Investment Philosophy 15% 21% 15% 50% Strategic Financial Strategic w/Financial Financial w/Strategic Survey Data CVC Strategic Aims Seek new directions Support existing businesses 6% 15% 8% Not important Not important 25% Somewhat important 38% 40% Very important 52% Very important Extremely important Provide window on new technology 15% 17% 31% 4% Not important Not important 27% Develop new products Somewhat important Very important Extremely important 31% Improve manufacturing processes 6% 10% Not important Somewhat important 33% 31% 38% Very important Extremely important 25% Extremely important Provide window on new markets Somewhat important 54% Somewhat important Very important Extremely important Not important 29% Somewhat important 65% Very important Extremely important Survey Data CVC Investments - Total Amount 2004-2006 Direct Investments Limited Partner Investments 10% 17% 6% 4% 40% 40% 17% 19% 13% 2% 21% 8% $0 $0 Less than $1M Less than $1M $1M to $3M $1M to $3M $3M to $5M $3M to $5M $5M to $10M $5M to $10M $10M to $20M $10M to $20M Over $20M Over $20M 4% Survey Data CVC Direct Investments - Total Number 2004-2006 4% 13% 15% 10% 23% 35% 0 1 to 3 4 to 6 7 to 15 16 to 30 More than 30 Survey Data 29 10 Number 20 30 CVC Organizations - Concept Stage Investments 2004-2006 8 4 1 0 1 0.0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 Share of Investments (2004-2006) - Concept Stage 0.9 1.0 Survey Data CVC Organizations - Non-U.S. Investments 2004-2006 10 9 6 5 5 4 3 1 0 Number 15 16 0.0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9 Share of Investments (2004-2006) - Outside of USA 1.0 Survey Data Senior Personnel - Sourcing 34 25 30 35 Temporary Assignment from Parent Company Number of CVCs 15 20 20 10 10 15 17 7 4 4 3 2 3 3 1 1 3 1 1 0 1 4 5 5 5 0 Number of CVCs 25 30 35 Hired from Outside Parent Company 0 .1 .2 .3 .4 .5 .6 .7 .8 .9 1 Share of Outside Hires 0 .1 .2 .3 .4 .5 .6 .7 .8 .9 Share of Temporary Assignments 1 Survey Data Senior Personnel - Expected Job Tenure 2% 11% 53% 34% 1 to 2 years 2 to 3 years 3 to 5 years 5 years or more Survey Data Senior Personnel - Compensation Salary Bonus 2% 15% 85% 98% No No Yes Yes Bonus similar to Carried Interest 13% Carried Interest 21% 88% 79% No No Yes Yes Survey Data CVC Investment Sponsor - R&D or Business Unit 20% 31% 18% 31% Not important Somewhat important Very important Extremely important Survey Data Investment Sourcing Angel Investors Other CVCs 7% 2% Independent VCs 4% 6% 4% 20% 26% 51% 52% 39% 38% 50% Not important Not important Not important Somewhat important Somewhat important Somewhat important Very important Very important Very important Extremely important Extremely important Extremely important Direct Company Solicitation 24% 15% Parent Company Business Units 9% 30% 30% 28% 33% 32% Not important Not important Somewhat important Somewhat important Very important Very important Extremely important Extremely important Survey Data Due Diligence - Utilize Personnel from Parent Company 2% 11% 23% 64% Not at all Small extent Moderate extent Large extent Survey Data CVC Representation on Portfolio Company Board Voting Board Member Non-Voting Board Observer 7% 7% 18% 25% 45% 47% 29% 23% Never Never Sometimes Sometimes Frequently Frequently Always Always Survey Data Communication with Portfolio Companies Attendance at Board Meetings Written Reports from Management 17% 29% No Yes 83% Phone Calls with Technical Management 31% Yes 71% Phone Calls with Business Management 19% No No Yes 69% No Yes 81% Regular Site Visits 35% Feedback from Parent Company Groups No Yes 65% Other 8% No Yes 92% 44% No 56% Yes Survey Data Provide Support to Portfolio Companies Scientific Support 22% 4% 18% Engineering Support Management Support 7% 14% 11% 20% 31% 41% 38% 56% 39% Not at all Not at all Not at all Small extent Small extent Small extent Moderate extent Moderate extent Moderate extent Large extent Large extent Large extent Marketing Support Other Commercialization Support 3% 16% 11% 27% 39% 33% 40% 30% Not at all Not at all Small extent Small extent Moderate extent Moderate extent Large extent Large extent Survey Data Provide Access for Portfolio Companies Access to Customers 14% Access to Suppliers 18% Access to Partners 7% 11% 34% 41% 27% 45% 59% 43% Not at all Not at all Not at all Small extent Small extent Small extent Moderate extent Moderate extent Moderate extent Large extent Large extent Large extent Survey Data New Collaborations with Portfolio Companies From CVC Direct Investments 2004-2006 2% 4% 13% 18% 20% 42% 0 1 to 3 4 to 6 7 to 15 16 to 30 More than 30 Survey Data Types of Collaboration with Portfolio Companies R&D Collaboration 26% Manufacturing Collaboration Licensing Collaboration 19% 45% 55% 74% 81% No No No Yes Yes Yes Sales Collaboration Other Collaboration 27% 45% 55% 73% No No Yes Yes Survey Data Perceptions of CVC Value Contribution - Key Stakeholders Senior Management 2% Technical Operations 4% 15% Not at all 41% 41% 24% 24% Not at all Small extent Small extent Moderate extent Moderate extent Large extent Large extent 47% Business Operations 22% Other 2% 11% 30% Not at all 11% Not at all Small extent Small extent 56% Moderate extent Large extent 46% 22% Moderate extent Large extent Survey Data CVC Performance Metrics - 1 CVC Activity Metrics CVC Output Metrics 13% 17% 24% 30% 15% 35% 28% 37% Not at all Not at all Small extent Small extent Moderate extent Moderate extent Large extent Large extent Survey Data CVC Performance Metrics - 2 Overall Financial Performance of CVC Portfolio 9% Specific Company Performance in CVC Portfolio 20% CVC Value Contribution to Parent Company 7% 9% 13% 24% 47% 48% 38% 31% 33% 22% Not at all Not at all Not at all Small extent Small extent Small extent Moderate extent Moderate extent Moderate extent Large extent Large extent Large extent Survey Data CVC Trends Past Funding 2004-2006 9% 5% Future Investment 2007-2009 9% 16% 24% 14% 57% 24% 43% Increased significantly Increase significantly Increased moderately Increase moderately Stayed about the same Stay about the same Decreased moderately Decrease moderately Decreased significantly Decrease significantly