U.S. Private and Natural Gas Royalties: Estimates and Policy Consideration Timothy Fitzgerald

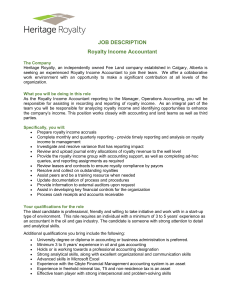

advertisement