Proceedings of 5th Annual American Business Research Conference

advertisement

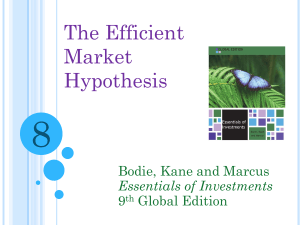

Proceedings of 5th Annual American Business Research Conference 6 - 7 June, 2013, Sheraton LaGuardia East Hotel, NY, USA, ISBN: 978-1-922069-24-5 The Efficient-Market Hypothesis and Its Validity in the French Stock Exchange Sabrina Khemiri and Houda HAFSA The aims of the paper are to test the validity of the Efficient-Market Hypothesis in the French Stock Exchange and to show whether the findings are sensitive to the frequency of data and the choice of proxies for the market. A certain number of tests have been carried out such as unit root test, ARIMA model, autocorrelation and normality test. The results of the tests for most part support the validity of EMH in the French stock market. However, normality and autocorrelation test show inconsistencies with EMH. This difference of findings means that despite the fact that EMH seems to hold, the French stock market is not perfectly efficient and present some inconsistencies. Concerning the impact of the data frequency factor, the ARIMA model shows that there is a slight difference in the results. Indeed, daily data appears to be more consistent with EMH concept that weekly data. However, the differences are not substantial to lead to a global conclusion. In all other test, no significant differences have been found between daily and weekly data. On the other side, the choice of the proxy has been found to influence substantially the results; in most cases, CAC 40 index has shown more consistencies with EMH than broader indices. Keywords: Efficient Market Hypothesis, Autocorrelation, Unit Root test, ARIMA Model, normality test. Introduction The main aim of the current study is to explore and test the validity of the Efficient-Market Hypothesis (EMH) in the French Stock Exchange between the 21st October 2005 and the 28th February 2011. During this 11 years period, the French Stock Exchange as well as others stock markets collapsed twice: in 2003 and 2009. Prior to the 1960‟s, EMH was missing in financial literature. The conventional wisdom was to believe that using advanced trading strategies and tools could possibly generate abnormal positive returns. Nonetheless with Eugene Fama‟s studies in 1965, theories in favour of information efficiency started to emerge. The information efficiency of the market could not permit to beat the market. The efficient market hypothesis (EMH) has become the central proposition of finance and one of the well-studied hypotheses in all the social sciences, yet, surprisingly; there is still no consensus, even among financial economists, as to whether the EMH holds. The collapse of the financial crisis in 2008 questioned the validity of the efficient-market hypothesis. The interest of the current research is to give a critical overview of all the issues in financial literature regarding the market efficiency and its validity in the market. The emerging of behavioural finance theory gives criticism of the EMH (Shiller, 2000). Indeed, empirical studies in the field showed that some markets are more efficient than others (Abrosimova and Linowski, 2002; Babaker, 2004; Lo and MacKinlay, 1988). Nonetheless, many active equity funds reject the EMH and try to outperform the market such as the hedge funds. Within a context of crisis and particularly a confidence crisis on the system, it is important to know if the EMH theory still held in the financial market. __________________________________________________________ Sabrina Khemiri, Ecole de Management Leonard DeVinci, France. Houda HAFSA, 1 Proceedings of 5th Annual American Business Research Conference 6 - 7 June, 2013, Sheraton LaGuardia East Hotel, NY, USA, ISBN: 978-1-922069-24-5 Indeed, because of the recent issues over the world financial market, the financial world started to put in doubt the validity of the EMH theory. It has been shown that at some period of time, financial market showed inefficiency. Therefore, it is interesting to see if EMH‟s validity depends on the time period and hence the environment of the financial market. In addition to this, the French Stock Market as the German one showed some resistance features to the global financial crisis started in 2008. All this arguments combined together give to the French Stock Market real interests to investigate. The current article lends empirical support to the question of validity of the EMH within the French stock exchange market. In order to analyse the problem, the papers follows a logical approach by focusing, first, on the review of the literature and theories concerning the theoretical concept of the EMH and its criticism. Then, section 3 presents the data sampling. Section 4 presents the different method used to test the EMH validity. In section 5 we present and analysis the results and findings and conclude the study 2. The EMH validity: Literature Review Fama (1965) was the first to conceptualise the EMH theory in financial literature. Nonetheless, prior to the World War II some publications already doubted the postulate of the market behaviour as Kirman (2009) stressed. Besides, even before Fama‟s studies, others researchers such as Cowles & Jones (1937) showed that returns in the market were developing randomly and thus chances to generate profit or loss were equal. The operational efficiency theory is the first of those basic theories. This theory evaluates the efficiency of transaction process in the market and particularly if they were absent. As an example, if you asked a broker to buy shares in a particular stock because the price is low at that time and you were expecting the price to rise, but due to the fact that the transaction process was slow and you missed that chance in acquiring the shares. The second theory is the pricing efficiency which assumes that pricing is supposed to be efficient. Thus, the trading is reputed to be fair and both parties are satisfied from the deal. However, this is not always the case in the market. Nonetheless, this implies that the market does not make systematic mistakes1. Finally, the third basic theory is the allocation efficiency and general welfare. It implies that the market is efficient to fulfil its purposes which are to allocate and raise capital in the market. The market also ensures that the general trading welfare for all parties is respected. This includes “the use of both pricing and operational efficiency theory” as Griffiths (2010) stressed. These three theories were the foundations that Fama (1965) used to formulate the EMH. Its hypotheses do not contradict the other three but it provides a useful scale against which markets can be judged. Indeed, Eugene Fama introduced 3 main forms of information efficiency: Firstly, the weak form efficiency of the EMH states that the current share price takes into account all historical information. Therefore, it is not relevant to predict future price based from past information and the several technical analysis of the past data and market information (bar charts, points, figure charts, moving averages, “oscillators”...) should not permit to yield abnormal returns on a constant basis. Some researchers such as Saad et al (1998) and Granger and Morgenstern (2007) agree in the existence of a “soft version” of the weak form efficiency. This one implies that there are some short term inefficiencies that investors could exploit to make abnormal returns. Nonetheless, as short term these inefficiencies would quickly disappear and therefore it is still not possible to beat constantly the market over a long term period. 1 Systematic errors will allow price prediction. 2 Proceedings of 5th Annual American Business Research Conference 6 - 7 June, 2013, Sheraton LaGuardia East Hotel, NY, USA, ISBN: 978-1-922069-24-5 Secondly, the semi-strong form efficiency assumes that the current price integrates all publicly available information of the market. Thus, it is not possible to generate abnormal returns based on public information because the price on the market already reacts to this information. This form does not imply internal informations which are not public (Bodie et al, 2009). Since the semi-strong form efficiency is focused on fundamental information and not only on technical information, event studies are the most suitable type of methodologies to test its validity. Finally, the strong form efficiency suggests that all information available both public and private already accounts in the share price. This supposes that is not possible to trade based on some information since the information efficiency over the market is too quick. The key postulate of the EMH implies that no superior returns on a constant basis are possible to achieve since all financial market are “informational efficient”. According to that, the market will tend to perform at its average return level. Therefore, theoretically there is no chance for investors to consistently beat the market. This concept annuls the need for active portfolio trading on which people rely to make above average return over the financial markets (Brealey and Myers, 2003; Bodie et al, 2009). Since its development, the EMH has become one of the main market financial principles. Both academics and professionals for the most part started to admit the validity of the EMH over the market. The increase in financial markets regulation after the great depression is one of the main reasons of the EMH‟s success. Indeed, the development of new information and communication technologies allowed information efficiency and reduced the possibility of making arbitrage profits in the market. Despite the number of its advocates, the EMH has received several criticisms from behavioural finance‟s defender. Shiller (2000) defended that financial markets are subject to the effects of “irrational exuberance”. This suggests that the market is overreacting about publicly available information. Thus, profits are not at the market average but are rather driven by investors‟ feelings (fear and greed). Following the same idea, Kahneman and Tyersky (1973) suggested a theory of overconfidence in the financial markets showing that stock prices become predictable due to behavioural factors. Both rejected then the EMH theory. Considering that investors are rational wealth maximizing decision maker, their role is important in the market since they try to exploit all anomalies until they disappear by using the psychology of choice. The two main psychological concepts for investors in the market are the invariance and the dominance. In one hand, the invariance psychology states that framing should not affect the choice we are making in the market. On the other hand, the dominance psychology implies that a superior investment should not always be selected over an inferior investment. Von Neuman et al. investigated these psychological problems for the construction of mathematical models of game theory. Concerning the use of technical analysis, several criticisms started to rise in the 1990s‟ with the technology development. Lo et al. (2000) argued that many technical instruments were useful to generate excess profits to investors. For instance, Lo et al (2000) showed that technical figures such as “head and shoulders” technique have often proved to predict stock price‟s trend and hence allowed abnormal returns. It is important to note that these evidences are inconsistent with the EMH. In addition to this, some studies showed that several behavioural effects had significant impact in the financial markets such as the day of the week effects. Keim (1983), Haugen and Lakonishok (1988) stressed the existence of a January effect on stock prices. Indeed, they argued that in the first half of January many stocks seem to follow a rising pattern. Again, these observations are not consistent with the EMH and put in doubt its validity. Although that several criticism demonstrates the invalidity of the Fama‟s hypotheses in the stock market, the EMH remains accredited by professionals and academics. The examples of inefficiencies can be interpreted as the result of the presence of transaction costs or only short term anomalies that are rather exceptions than regular occurrences. 3 Proceedings of 5th Annual American Business Research Conference 6 - 7 June, 2013, Sheraton LaGuardia East Hotel, NY, USA, ISBN: 978-1-922069-24-5 Many empirical studies have been undertaken to test the validity of the EMH. The most prominent investigations on EMH validity were conducted by Fama (1991), Seppi (1992), Malkiel (1995) and Seiler and Rom (1997). However, prior to the 1990s‟ an interesting study was held by Osborne (1959) in which the researcher provided statistical evidences that actual stock prices were not changing randomly as supposed. Although that this finding was found inconsistent with EMH, the natural logarithm of the stock prices showed evidence of randomness. In 1997, Huber explored and tested the Austrian stock market for the weak form efficiency. He found that Austrian stock prices were not developing randomly but rather following a certain pattern and therefore rejected the validity of EMH on this particular market. On the contrary, Al Loughani and Chappell (1997) showed that the EMH was valid in the UK stock market. A similar conclusion was obtained by Groenewold (1997) studies in the New Zealand equity market. The difference of the results is also due to difference in market development. Indeed, if we compare the British and the Russian financial markets, the United Kingdom stock market is found to be more efficient than the emerging market. The difference could be explained by the availability of information for investors. According to this, Abrosimova and Linowski (2002) rejected the validity of the EMH in the Russian equity market using daily prices. Nonetheless, it depends on the country tested. Indeed, Kvedaras and Basdevant (2004) proved that Baltic countries tended to show some evidence of efficiency even though they are emerging countries. Despite the fact that developed countries are more likely to show evidences of EMH, Lo and MacKinlay (1988) proved the contrary by demonstrating the US stock market inefficiency in the period from 1960‟s to 1980‟s based on the investigation of more than a thousand public companies listed on the NYSE. Babaker (2004) found an interesting result regarding the validity of EMH over the time. Indeed, at some point of time a particular market can be found efficient whereas it could not be at another point of time. It is important to note that the findings depend on the type of statistical test used on the study. Another interesting point is that differences of results could also be explained by the frequency of data (daily, weekly, monthly observations). In fact, the frequency of data could affect the result of a test. Abrosimova and Linowski (2002) argued that EMH can be either accepted or rejected depending on the choice of frequency of data. Based on this, it is important for the validity of a study to test the EMH using data of different frequency. Therefore to fully accept the validity of the EMH, the market needs to be found efficient regardless to the data frequency. Through the reading of the literature review, it is important to stress that testing the validity and drawing general conclusions on information efficiency over a market is more complex than it appears. Indeed, as shown, the result of such a study could be biased by: the methodology employed, the data frequency, the specificity of the tested market (developed/emerging countries, economic environment...), so it is essential to take into account all this factors in this study to obtain relevant and reliable results. Then, the study will test the validity of EMH theory in the French Stock Market according to the following assumptions: - Hypothesis 1 : The French Stock Market is information efficient regardless to the methodology employed - Hypothesis 2: The French Stock Market is information efficient regardless the frequency of data selected - Hypothesis 3: The French Stock Market is information efficient regardless its stage of development 4 Proceedings of 5th Annual American Business Research Conference 6 - 7 June, 2013, Sheraton LaGuardia East Hotel, NY, USA, ISBN: 978-1-922069-24-5 3. Data sampling We will test the validity of the EMH on the French Stock Exchange. The sample data includes historical prices of three French stock market indexes: CAC 40, SBF120, and SBF250 (CAC all tradable). The point for investing simultaneously three indexes is to test whether the validity of the EMH depends on size of the companies selected. The period considered for the investigation goes from 21/11/2005 to 28/02/2011. Data are downloaded from YAHOO! Finance The analyses were conducted independently on daily and weekly prices, as a truly efficient market should pass tests of efficiency at different frequency. The features of daily and weekly prices of the French equity indexes are shown in Table 1. Table 1: Descriptive Statistics of French Equity Indexes Daily Prices CAC 40 Weekly Prices SBF 120 3 281.3 5 3 278.6 6 4 507.1 0 1 823.0 8 SBF 250 3 197.1 7 3 190.3 8 4 395.3 4 1 780.0 9 4 441.8 9 4 427.0 4 6 168.1 5 2 534.4 5 SBF 120 3 275.3 4 3 254.9 5 4 507.1 0 1 834.3 5 SBF 250 3 189.1 9 3 159.3 7 4 337.9 4 1 817.2 7 CAC 40 Mean 4 442.64 Median 4 426.19 Maximum 6 168.29 Minimum 2 519.29 Standard Deviation 928.21 656.72 637.89 953.40 660.60 634.06 Variance 861 574. 92 431 277 .90 406 905 .06 874 969 .23 436 386 .99 402 037 .59 0.04 - 0.12* - 0.11 0.03 - 0.10 - 0.07 Kurtosis - 1.22*** - 0.96*** - 0.95*** - 1.22*** - 0.95*** - 0.95*** Jarque Bera 1 001.07 *** 884.17** * 878.54** * 204.90** * 180.23** * 179.13** * 110.84 78.28 75.14 276 276 276 Skewness Confidence 49.58 35.08 34.07 Level (95%) N° of 1 349 1 349 1 349 observations *, ** and *** indicates significance at 10%, 5 and 1% level respectively From Table 1 we notice that weekly and daily data are not identical but rather influenced by the data frequency. However what is the confidence interval within the true values (μ) lie? Due to the 95% confidence level displayed, we can affirm that the confidence interval for μ is given by: CAC 40 SBF 120 SBF 250 Weekly Data 4 442.64 ± 49.58 3 281.35 ± 35.08 3 197.17 ± 34.07 Daily Data 4 441.89 ± 110.84 3 275.34 ± 78.28 3 189.19 ± 75.14 5 Proceedings of 5th Annual American Business Research Conference 6 - 7 June, 2013, Sheraton LaGuardia East Hotel, NY, USA, ISBN: 978-1-922069-24-5 In other words, this means that we are each time 95% certain that the true value of µ lies in this range. However, in order to accept these values (x) as the real mean (μ), the one-tail „t‟ tests are used according to the following hypotheses: H0: μ = x H1: μ ≠ x Table 2: Mean T-test T-test (daily prices) T-test (Weekly prices) CAC 40 175.79*** 78.89*** SBF 120 183.52*** 82.37*** SBF 250 184.09*** 83.56*** *, ** and *** indicates significance at 10%, 5 and 1% level respectively Table 2 shows that all mean t-test are significant (since t-test > t-table) at 1% level meaning that there is significant evidence that the real mean values are different from the estimated values. The dispersion of the mean is measured by standard deviation. Thus, it represents the risk involved within each sample. The data shows that the CAC 40 index is the riskiest index of the French Stock Exchange. On the contrary, the SBF 250 index appears to be the less risky. This hierarchy of risk is highly due to the volume of transaction in each index. Indeed, the CAC 40 index is the more liquid index whereas the SBF 120 and the SBF 250 globally are more stable. These levels of risk give a good indication of investment behaviors. Indeed, a risk-averse investor will invest more in the SBF 250. On the contrary, a risk-seeking investor will have a highest investment level in CAC 40 and SBF 120. 4. Tests of the EMH validity The literature review pointed that the method of testing affects the results of the study. Therefore, it is crucial to use several tests in order to compare the findings. 4.1 Unit Root Test The theory of EMH implies that stock prices are developed randomly and have an equal probability to rise and fail. Econometrics concept argues that a stochastic process2 admit a unit roots. Therefore a unit root test need to be run to verify the validity of the weak form of the EMH. The most common test to check the existence of a unit root test within the data sample is the Augmented Dickey Fuller (ADF). Enowbi et al. (2008) and Vulic (2009) among others has strongly recommended the ADF test to investigate the validity of the EMH. 2 Stochastic processes are processes which follow a random trend. 6 Proceedings of 5th Annual American Business Research Conference 6 - 7 June, 2013, Sheraton LaGuardia East Hotel, NY, USA, ISBN: 978-1-922069-24-5 The ADF test is a linear regression of the dependent variable on its past values and is given by Where : Yt indicates the observation at time t , T is the trend , ɛt represents the error or “shock” at time t and ΔYt is the first difference operator of the variable Y at time t The test implies the following hypotheses: H0: |φ| = 1 (β = 0) H1: |φ| < 1 (β ≠ 0) The null hypothesis supports the existence of a unit root I(1) and that the data sample is nonstationary3. At the contrary, the alternative hypothesis stresses that data are stationary and therefore inconvenient with the concept of random walk. The hypotheses are tested using the t-statistic test to show which hypothesis is accepted. The weak form efficiency implies that all the past information is integrated in the current stock price. According to this, the linear regression model representing the current stock price based on past prices should show a coefficient equals to one. The number of lags to select in the regression model is important. In order to select the appropriate number of lags, the Schwarz Information Criterion (SIC) is used. The SIC is a useful tool model selection invented by Schwarz (1978) and largely used in many empirical studies. This tool suggests that the number maximums of lags to consider are 22 and 15 respectively for daily and weekly data. Table 3 below displays the output of the unit root tests. Table 3: Unit Root Tests Critical Value Daily Weekly CAC 40 SBF 120 SBF 250 CAC 40 SBF 120 SBF 250 ADF 1.811622 1.869254 1.833023 1.920017 1.839397 1.743278 Probability 0.6988 0.6699 0.6882 0.6413 0.6829 0.7293 1% 3.964867 3.964867 3.964867 3.991780 3.991780 3.991780 5% 3.413150 3.413150 3.413150 3.426251 3.426251 3.426251 10% 3.128588 3.128588 3.128588 3.136336 3.136336 3.136336 Table 3 shows that all ADF test statistics are greater than all the critical values (10%, 5% and even 1%). This observation leads to accept the null hypothesis of the unit root test. Besides, the fact that probability values stands all above 0.5 strengthen the acceptance of the null hypothesis. Indeed, there is some significance evidence that data imply the existence of a 3 Non-stationary referred to statistical properties of random variables remaining unchanged with time. On the contrary, stationary implies that statistical properties change with time 7 Proceedings of 5th Annual American Business Research Conference 6 - 7 June, 2013, Sheraton LaGuardia East Hotel, NY, USA, ISBN: 978-1-922069-24-5 unit root. According to this, data for all samples appear to be non-stationary and therefore are consistent with the EMH. 4.2 ARIMA Model The EMH has also shown to imply a random walk process with draft. This concept will be tested using an Autoregressive Integrated Moving Average Model (ARIMA Model). In the autoregressive process of order p each observation is generated by a weighted average of past observations going back p periods, together with a random disturbance in the current period. This process is denoted as AR (p) and its equation is given by: Yt c 1Y t 1 2Y t 2 .... pY t p t Where the ∅ may be positive or negative, however they have to obey the stationarity conditions. The coefficients of the model are obtained by using the OLS (ordinary least squares) methods. The model‟s residuals have to show evidence of white noise to be consistent with EMH. Asiri (2008) strongly recommended the choice of ARIMA Model to test the validity of EMH. In addition to the unit root tests the autoregressive model was used to test the random walk process according to the following regression equation: Pit = + βAR(1) + εit This test goes further than the precedent unit root test since the ARIMA model, it indicates to what extent the beta coefficient is different from 1. The results are displayed in the Table 4: Table 4: ARIMA Model (1,0,0) Variable CAC 40 Daily SBF 120 SBF 250 CAC 40 Weekly SBF 120 SBF 250 AR(1) AR(1) AR(1) AR(1) AR(1) AR(1) Std. Error Tstatistic Probability 4290.832 758.1141 5.659876 0.0000 0.997678 0.001872 532.9539 0.0000 3336.260 504.4574 6.613562 0.0000 0.997564 0.001865 534.9447 0.0000 3254.377 493.5878 6.593309 0.0000 0.997601 0.001849 539.5788 0.0000 4239.195 816.2036 5.193796 0.0000 0.989668 0.008811 112.3217 0.0000 3312.737 532.1205 6.225540 0.0000 0.989047 0.008812 112.2373 0.0000 3266.679 512.3621 6.375724 0.0000 0.989326 0.008564 115.5249 0.0000 Coefficient 8 Proceedings of 5th Annual American Business Research Conference 6 - 7 June, 2013, Sheraton LaGuardia East Hotel, NY, USA, ISBN: 978-1-922069-24-5 We can see from table 4 that all the beta coefficients appear to be greater than the critical value for all significance level. Therefore, there is some significant evidence that all beta coefficients are statistically significant. Nonetheless, there is a slight difference between samples depending on the frequency of data. Indeed, beta coefficients for daily data appear to be closer to one than those in weekly data. In others words, daily data seem to more consistent to the concept of random walk process. However, the difference is not enough substantial to generalise the observation. In addition to this, it is necessary to test whether the residuals of ARIMA model are white noise, an essential requirement to be consistent with EMH. The residuals are obtained by estimating the difference between the actual and fitted values of the model. This test is implemented by using the Auto-Correlation Function (ACF), Partial Auto-Correlation Function (PACF) and the Bow-Pierce Q statistic. H0: k = 0 (coefficients are null which imply absence of autocorrelation) H1: k ≠ 0 (coefficients are non-null which imply existence of autocorrelation) In order to accept the null hypothesis, the probability value estimated for autocorrelation should be inferior to p-value of 0.05. Tables 5 and 6 display the results of the residuals‟ analysis. Table 5: ACF and PACF of ARIMA (1,0,0) model‟s residuals (Daily data) Daily CAC 40 L a g 1 2 3 4 A C 0 . 0 8 3 0 . 0 2 3 0 . 0 4 2 0 . 0 6 0 P A C 0 . 0 8 3 0 . 0 3 1 0 . 0 4 7 0 . 0 5 3 Q S t a t 9 . 3 9 3 9 1 0 . 1 3 2 1 2 . 5 0 7 1 7 . 4 5 P r o b . 0 . 0 0 1 0 . 0 0 2 0 . 0 0 1 A C 0 . 0 5 3 0 . 0 4 3 0 . 0 3 1 0 . 0 6 5 SBF 120 Q S P t A a C t 3 0 . . 7 0 3 5 6 3 5 6 0 . . 2 0 3 4 1 6 7 7 0 . . 5 0 4 3 9 6 2 0 1 . 3 0 . 6 3 0 0 P r o b . 0 . 0 1 3 0 . 0 2 3 0 . 0 0 4 A C 0 . 0 4 6 0 . 0 4 7 0 . 0 2 9 0 . 0 6 8 SBF 250 Q S P t A a C t 2 0 . . 8 0 2 4 3 6 6 5 0 . . 7 0 5 4 7 9 9 6 0 . . 9 0 3 3 0 4 2 0 1 . 3 0 . 6 2 3 7 P r o b . 0 . 0 1 6 0 . 0 3 1 0 . 0 0 4 9 Proceedings of 5th Annual American Business Research Conference 6 - 7 June, 2013, Sheraton LaGuardia East Hotel, NY, USA, ISBN: 978-1-922069-24-5 4 6 0 . 0 5 9 0 . 0 1 0 0 . 0 5 2 0 . 0 1 8 7 0 . 0 1 2 0 . 0 1 1 9 0 . 0 3 4 0 . 0 5 5 1 0 0 . 0 0 4 1 1 0 . 0 0 1 0 . 0 2 7 0 . 0 4 5 0 . 0 0 3 0 . 0 0 2 1 2 0 . 0 4 9 0 . 0 4 4 0 . 0 0 9 0 . 0 0 9 0 . 0 0 . 0 2 5 0 . 0 0 9 0 . 0 5 8 1 3 1 4 1 5 2 2 . 1 0 1 2 2 . 2 3 5 2 2 . 4 1 4 2 3 . 9 5 5 2 8 . 0 0 3 2 8 . 0 2 4 2 8 . 0 2 4 3 1 . 2 8 9 3 1 . 3 9 7 3 1 . 5 1 2 3 2 . 9 7 0 . 0 0 0 0 . 0 1 0 0 . 0 2 1 0 . 0 6 3 0 . 0 1 3 0 . 0 1 3 0 . 0 0 0 0 . 0 1 5 0 . 0 0 1 0 . 0 2 5 0 . 0 2 0 0 . 0 0 2 0 . 0 0 9 0 . 0 1 0 0 . 0 0 1 0 . 0 3 3 0 . 0 3 3 0 . 0 0 2 0 . 0 2 5 0 . 0 3 0 0 . 0 0 . 0 3 3 0 . 0 2 8 0 . 0 0 . 0 0 0 0 . 0 0 0 0 . 0 0 1 0 . 0 0 1 0 . 0 0 3 0 . 0 0 0 . 0 6 7 0 . 0 1 1 0 . 0 1 0 1 9 . 3 1 9 1 9 . 4 7 0 1 9 . 6 0 1 1 9 . 7 4 3 2 0 . 3 3 9 2 1 . 1 5 6 2 1 . 2 6 6 2 2 . 7 5 5 2 3 . 5 9 4 2 4 . 7 9 9 2 6 . 5 2 0 . 0 1 1 0 . 0 1 6 0 . 0 6 6 0 . 0 1 2 0 . 0 1 5 0 . 0 0 0 0 . 0 0 9 0 . 0 1 9 0 . 0 2 6 0 . 0 0 6 0 . 0 2 2 0 . 0 0 4 0 . 0 1 9 0 . 0 5 0 0 . 0 4 9 0 . 0 2 3 0 . 0 2 0 0 . 0 2 9 0 . 0 0 . 0 2 8 0 . 0 2 8 0 . 0 0 . 0 0 1 0 . 0 0 2 0 . 0 0 3 0 . 0 0 6 0 . 0 0 9 0 . 0 1 2 0 . 0 2 5 0 . 0 2 0 . 0 6 8 0 . 0 1 1 0 . 0 1 2 1 9 . 5 9 8 1 9 . 7 4 9 1 9 . 9 3 5 2 0 . 0 8 5 2 0 . 4 2 0 2 1 . 3 3 7 2 1 . 3 7 8 2 4 . 7 8 4 2 5 . 3 5 3 2 6 . 5 3 3 2 7 . 6 0 . 0 0 1 0 . 0 0 1 0 . 0 0 3 0 . 0 0 5 0 . 0 0 9 0 . 0 1 1 0 . 0 1 9 0 . 0 1 0 0 . 0 1 3 0 . 0 1 4 0 . 0 1 10 Proceedings of 5th Annual American Business Research Conference 6 - 7 June, 2013, Sheraton LaGuardia East Hotel, NY, USA, ISBN: 978-1-922069-24-5 3 3 3 2 5 8 3 3 5 3 3 0 4 2 2 9 2 3 6 1 6 Table 6: ACF and PACF of ARIMA (1,0,0) model‟s residuals (Weekly data) Weekly L a g 1 A C 0 . 1 2 0 4 0 . 0 9 2 0 . 0 3 8 0 . 0 0 8 5 0 . 0 5 6 2 3 6 7 8 0 . 0 6 2 0 . 1 4 0 0 . 1 2 9 CAC 40 Q S P t A a C t 4 0 . . 0 1 3 2 0 0 4 6 0 . . 3 0 7 7 6 8 8 6 0 . . 7 0 7 1 8 9 8 6 0 . . 7 0 9 2 9 2 0 7 0 . . 6 0 9 5 0 9 6 8 0 . . 7 0 6 7 4 8 3 1 0 4 . . 1 3 4 5 0 1 0 1 . 9 0 . 9 1 6 1 P r o b . 0 . 0 1 2 0 . 0 3 4 0 . 0 7 9 * 0 . 1 0 4 * 0 . 1 1 9 * 0 . 0 2 6 0 . 0 0 8 A C 0 . 1 2 0 0 . 0 9 7 0 . 0 4 2 0 . 0 0 0 0 . 0 7 2 0 . 0 6 3 0 . 1 2 9 0 . 1 3 7 SBF 120 Q S P t A a C t 4 0 . . 0 1 3 2 2 0 0 6 0 . . 6 0 7 8 8 4 0 7 0 . . 1 0 7 2 4 2 1 7 0 . . 1 0 7 1 4 5 1 8 0 . . 6 0 2 7 6 7 1 9 0 . . 7 0 5 8 2 2 4 1 0 4 . . 1 4 3 6 1 7 0 1 . 9 1 . 0 8 7 4 P r o b . 0 . 0 1 0 0 . 0 2 8 0 . 0 6 7 * 0 . 0 7 1 * 0 . 0 8 3 * 0 . 0 2 5 0 . 0 0 6 A C 0 . 0 7 1 0 . 0 0 6 0 . 0 5 4 0 . 0 4 7 0 . 0 4 9 0 . 0 6 1 0 . 0 4 9 0 . 1 0 5 SBF 250 Q S P t A a C t 1 0 . . 4 0 0 7 6 1 6 1 0 . . 4 0 1 1 8 2 4 2 0 . . 2 0 4 5 0 3 9 2 0 . . 8 0 5 5 6 5 3 3 0 . . 5 0 3 4 8 1 2 4 0 . . 6 0 0 5 5 3 1 5 0 . . 2 0 7 4 6 7 3 0 8 . . 1 4 0 4 4 4 P r o b . 0 . 2 3 4 * 0 . 3 2 6 * 0 . 4 1 4 * 0 . 4 7 2 * 0 . 4 6 6 * 0 . 5 0 9 * 0 . 2 9 5 11 Proceedings of 5th Annual American Business Research Conference 6 - 7 June, 2013, Sheraton LaGuardia East Hotel, NY, USA, ISBN: 978-1-922069-24-5 9 1 2 0 . 1 1 7 0 . 0 3 1 0 . 0 4 9 0 . 1 0 2 0 . 0 6 8 0 . 0 8 4 0 . 0 5 1 0 . 0 9 7 1 3 0 . 1 4 2 0 . 1 3 5 1 4 0 . 0 8 3 0 . 1 1 1 1 5 0 . 0 9 4 0 . 1 4 4 9 1 0 1 1 2 3 . 0 3 6 2 3 . 3 1 1 2 4 . 0 0 4 2 7 . 0 2 6 3 2 . 9 0 1 3 4 . 8 9 4 3 7 . 5 0 6 8 0 . 0 0 5 0 . 0 9 6 0 . 0 1 4 0 . 0 4 6 0 . 0 9 9 0 . 0 4 4 0 . 0 6 9 0 . 0 4 6 0 . 0 9 2 0 . 0 0 1 0 . 1 4 3 0 . 1 3 2 0 . 0 0 1 0 . 0 4 5 0 . 0 7 2 0 . 0 0 1 0 . 1 0 2 0 . 1 3 7 0 . 0 0 3 0 . 0 0 6 0 . 0 0 8 2 2 . 4 7 0 2 2 . 5 2 4 2 3 . 1 3 1 2 5 . 9 5 8 3 1 . 8 9 5 3 2 . 4 8 8 3 5 . 5 2 7 0 . 0 1 0 0 . 0 0 6 0 . 1 5 1 0 . 0 1 7 0 . 0 0 5 0 . 1 5 6 0 . 0 4 1 0 . 0 0 7 0 . 0 7 2 0 . 0 5 3 0 . 0 0 1 0 . 0 7 5 0 . 1 2 2 0 . 0 0 2 0 . 0 2 1 0 . 0 4 1 0 . 0 0 1 0 . 1 2 7 0 . 1 2 7 0 . 0 0 4 0 . 0 0 7 7 * 8 . 4 5 3 8 1 5 . 0 1 4 1 5 . 1 0 2 1 6 . 6 0 5 1 8 . 2 3 2 1 8 . 3 5 6 2 3 . 0 6 8 0 . 3 9 0 * 0 . 0 9 1 * 0 . 1 2 8 * 0 . 1 2 0 * 0 . 1 0 9 * 0 . 1 4 4 * 0 . 0 5 9 * As shown on Table 5, all the probability fort daily data appear to be smaller than the critical p-value of 0.05 leading to accept the null hypothesis. Therefore, the lacks of autocorrelation in the residuals imply the existence of with noise in the model‟s error terms. Thus, the three stock indexes for daily data frequency are found to be consistent with the EMH. On the contrary, weekly data show inconsistence with EMH. Indeed, in the weekly samples, some evidences of significant autocorrelation were found. In particular, from lag 4 to 6, all three indexes imply significant autocorrelation coefficients. By taking this into account, residuals for weekly data should not be considered as white noise since price does not develop randomly. The SBF 250 is the index showing the more inconsistencies with EMH. Both these observations, for daily and weekly data lead to an interesting finding. Indeed, it suggests that the results of testing the validity of EMH depend on the selected frequency of data. In others words, the EMH tends to hold for higher frequency data and there are more inconsistencies for lower frequency data. In addition to this, the validity of EMH seems also 12 Proceedings of 5th Annual American Business Research Conference 6 - 7 June, 2013, Sheraton LaGuardia East Hotel, NY, USA, ISBN: 978-1-922069-24-5 to depend on the proxy taken to represent the stock market. Indeed, the CAC 40 index is showing more consistencies with EMH than the broader indexes (SBF 120 and SBF 250). 4.3 Autocorrelation A necessary (but not sufficient) condition for the martingale hypothesis to hold is that the time series has no autocorrelation, also known as serial correlation, of any order. The Auto Correlation Function approach (ACF) is used to determine if future returns can be predicted based on past returns. In order to get significant test results, the sample size is critical. According to Fama‟s study, ACF is influenced by large observations. On the contrary a small sample would not be sufficient to draw correct inferences. This methodology recommended by Brooks (2008), aims to test whether the random process is valid. The Box-Pierce Q-statistic is used to determine the existence of serial correlation in the stock index return: m Q T k2 k 1 Where T represents the sample size and τ²k is the chi-squared value at k degrees of freedom For this test, returns rather than prices are used as some of the statistical tests a stationary variable (Bodie et al.,2009). A Q-statistic above its critical value will reject the validity of EMH and therefore accept the hypothesis of autocorrelation‟s evidence. All previous tests were implemented on the price index. In order to draw global conclusion on the validity of EMH on the French Stock Market, it is also necessary to test the correlation of returns‟ variations. Indeed, an either positive or negative autocorrelation for arithmetic returns would be inconsistent with EMH. In order to determine the existence autocorrelation for returns, the ACF is once more implemented based on a chart analysis. The upper and lower limits in the autocorrelation test were estimating using the following formulas: Upper limit= 2 (T - k ) Where T represents the number of observations and k is correlation coefficient at lag k Lower Limit = - Upper Limit 13 Proceedings of 5th Annual American Business Research Conference 6 - 7 June, 2013, Sheraton LaGuardia East Hotel, NY, USA, ISBN: 978-1-922069-24-5 Figure 1: Autocorrelation correlogram for CAC 40 (Daily data) CAC 40 Autocorrelation correlogram (Daily data) Correlation Upper limit Lower limit Table 7: Autocorrelation Table for CAC 40 (Daily data) Lag Autocorrelation Function (ACF) Upper Lower Correlation limit limit Correlation² 1 -0.0768 0.0545 -0.0545 0.0059 2 -0.0562 0.0545 -0.0545 0.0032 3 -0.0585 0.0545 -0.0545 0.0034 4 0.0825 0.0546 -0.0546 0.0068 5 -0.0750 0.0546 -0.0546 0.0056 6 -0.0132 0.0546 -0.0546 0.0002 7 0.0227 0.0546 -0.0546 0.0005 8 0.0380 0.0546 -0.0546 0,0014 9 -0.0860 0.0547 -0.0547 0.0074 10 -0.0002 0.0547 -0.0547 0.0000 0.034 Q statistic 3.236 Figure 1 demonstrates that the CAC 40 index for daily data seems to be inconsistent with EMH since almost all correlation coefficients lies outside the limits. Besides, this is confirmed by the low value of Q-statistic estimated in Table 7. Similar observations have been noticed for SBF120 and SBF 250. 14 Proceedings of 5th Annual American Business Research Conference 6 - 7 June, 2013, Sheraton LaGuardia East Hotel, NY, USA, ISBN: 978-1-922069-24-5 Figure 2: Autocorrelation correlogram for SBF 120 (Daily data) SBF 120 Autocorrelation correlogram (Daily data) Correlation Upper limit Lower limit Table 8: Autocorrelation Table for SBF 120 (Daily data) Lag Autocorrelation Function (ACF) Upper Lower Correlation limit limit Correlation² 1 -0.0485 0.0545 -0.0545 0.0023 2 -0.0771 0.0545 -0.0545 0.0059 3 -0.0471 0.0545 -0.0545 0.0022 4 0.0882 0.0546 -0.0546 0.0078 5 -0.0871 0.0546 -0.0546 0.0076 6 -0.0137 0.0546 -0.0546 0.0002 7 0.0029 0.0546 -0.0546 0.0000 8 0.0156 0.0546 -0.0546 0.0002 9 -0.0559 0.0547 -0.0547 0.0031 10 0.0327 0.0547 -0.0547 0.0011 0.031 Q statistic 2.868 The Box-Pierce Q statistic is even found to be weaker for boarder index which allow rejection of the EMH validity. This finding is confirmed with the results from SBF 250. Figure 3: Autocorrelation correlogram for SBF 250 (Daily data) 15 Proceedings of 5th Annual American Business Research Conference 6 - 7 June, 2013, Sheraton LaGuardia East Hotel, NY, USA, ISBN: 978-1-922069-24-5 SBF 250 Autocorrelation correlogram (Daily data) Correlation Upper limit Lower limit Table 9: Autocorrelation Table for SBF 250 (Daily data) Lag Autocorrelation Function (ACF) Upper Lower Correlation limit limit Correlation² 1 2 -0.0433 -0.0790 0.0545 0.0545 -0.0545 -0.0545 0.0019 0.0062 3 4 -0.0455 0.0901 0.0545 0.0546 -0.0545 -0.0546 0.0021 0.0081 5 6 -0.0880 -0.0138 0.0546 0.0546 -0.0546 -0.0546 0.0077 0.0002 7 8 0.0019 0.0155 0.0546 0.0546 -0.0546 -0.0546 0.0000 0.0002 9 10 -0.0518 0.0333 0.0547 0.0547 -0.0547 -0.0547 0.0027 0.0011 Q statistic 0.030 2.847 Autocorrelation test shows inconsistencies of all three daily data stocks. Nonetheless, in order to understand whether the frequency of data is impacting the degree of autocorrelation, the weekly data of the same stocks is also tested. Figure 4: Autocorrelation correlogram for CAC 40 (Weekly data) CAC 40 Autocorrelation correlogram (Weekly data) Correlation Upper limit Lower limit Table 10: Autocorrelation Table for CAC 40 (Weekly data) Autocorrelation Function (ACF) 16 Proceedings of 5th Annual American Business Research Conference 6 - 7 June, 2013, Sheraton LaGuardia East Hotel, NY, USA, ISBN: 978-1-922069-24-5 Lag 1 2 3 4 5 6 7 8 9 10 Correlation -0.1562 0.0689 -0.0816 -0.0253 0.0647 0.0719 -0.1524 0.1363 -0.1502 -0.0301 Upper limit 0.1208 0.1211 0.1212 0.1215 0.1217 0.1220 0.1221 0.1224 0.1226 0.1229 Lower limit -0.1208 -0.1211 -0.1212 -0.1215 -0.1217 -0.1220 -0.1221 -0.1224 -0.1226 -0.1229 Q statistic Correlation² 0.0244 0.0047 0.0067 0.0006 0.0042 0.0052 0.0232 0.0186 0.0226 0.0009 0.111 10.438 As a comparison, the CAC 40 on the weekly sample appears to imply less significant autocorrelations evidence since most of points lie inside the limits. In addition, the Box-Pierce Q statistic is stronger than the previous one. However, the presence of autocorrelations evidences at lags 1st, 7th/ 9th still invalidates the EMH. Figure 5: Autocorrelation correlogram for SBF 120 (Weekly data) SBF 120 Autocorrelation correlogram (Weekly data) Correlation Upper limit Lower limit Table 11: Autocorrelation Table for SBF 120 (Weekly data) Lag 1 Autocorrelation Function (ACF) Upper Lower Correlation limit limit Correlation² -0.1608 0.1208 -0.1208 0.0259 2 3 0.0755 -0.0867 0.1211 0.1212 -0.1211 -0.1212 0.0057 0.0075 4 5 -0.0180 0.0888 0.1215 0.1217 -0.1215 -0.1217 0.0003 0.0079 6 7 0.0693 -0.1508 0.1220 0.1221 -0.1220 -0.1221 0.0048 0.0228 8 9 0.1418 -0.1372 0.1224 0.1226 -0.1224 -0.1226 0.0201 0.0188 10 -0.0084 0.1229 -0.1229 0.0001 0.114 Q statistic 10.701 17 Proceedings of 5th Annual American Business Research Conference 6 - 7 June, 2013, Sheraton LaGuardia East Hotel, NY, USA, ISBN: 978-1-922069-24-5 Despite few variations, the autocorrelation correlogram for weekly data between CAC 40 and SBF 120 index appears to be stable with significant spikes at the same lags. Figure 6: Autocorrelation correlogram for SBF 250 (Weekly data) SBF 250 Autocorrelation correlogram (Weekly data) Correlation Upper limit Lower limit Table 12: Autocorrelation Table for SBF 250 (Weekly data) Lag 1 Autocorrelation Function (ACF) Upper Lower Correlation limit limit Correlation² -0.0593 0.1208 -0.1208 0.0035 2 3 -0.0539 0.0429 0.1210 0.1213 -0.1210 -0.1213 0.0029 0.0018 4 5 0.0154 -0.0428 0.1215 0.1217 -0.1215 -0.1217 0.0002 0.0018 6 7 0.0691 -0.0143 0.1220 0.1222 -0.1220 -0.1222 0.0048 0.0002 8 9 0.0467 0.0039 0.1224 0.1226 -0.1224 -0.1226 0.0022 0.0000 10 -0.2267 0.1228 -0.1228 0.0514 0.069 Q statistic 6.478 The weekly SBF 250 sample appears to see some consistencies with the EMH since all the correlations except one are insignificant. However, the only point lying outside the limits shows strong negative autocorrelation evidence. Hence, it is not possible to consider this sample as consistent with EMH. 18 Proceedings of 5th Annual American Business Research Conference 6 - 7 June, 2013, Sheraton LaGuardia East Hotel, NY, USA, ISBN: 978-1-922069-24-5 To sum up, autocorrelation test reject the validity of EMH for all stocks and for both data frequency. However, daily data seem to imply more significant autocorrelation evidences than weekly data and thus should be more rejected. Nonetheless, this finding appears to be inconsistent with previous analysis based on unit roots and ARIMA model. Therefore, the differences of finding tend to prove that the choice of methodological tools highly impact the results. Indeed, the EMH could be validated by one test whereas another one would reject it. This explains why some previous studies presented in the literature review were found to be incompatible. 4.4 Normality test EMH implies the normality of distribution of stock returns. This suggests that stock prices have an equal probability to rise up or to go down. The normality distribution of index prices is tested with the Jarque-Bera statistic ( in Table 1) From Table 1, we can see that all samples show an abnormal Skewness value which is significant only for SBF120 index for daily frequency. For a normal distribution shape, the Kurtosis value should be 3. We can see, from table 1, that all samples show an significant abnormal negative Kurtosis value. Therefore, there is significant evidence of an abnormal Kurtosis in these samples and the distributions are nonnormal. Finally, the JB joint test of normality shows that all JB statistics are significant (JB > 5.69). which confirms that the normality hypothesis is rejected for all samples at 1% significance level. 5. Discussion and conclusion The objective of the current study was to test the validity of the EMH in the French stock market. The results of the tests displayed demonstrate that unit root tests and ARIMA model supported the validity of EMH. On the contrary, autocorrelation tests and normality tests rejected the validity of EMH for the French equity indices. The differences in the findings could be explained by the choice of different methodological tools and set of data used. The objective of using daily and weekly data was to investigate upon the impact of the data frequency on the tests results. In fact, the results of the unit root tests, autocorrelation tests and normality tests demonstrate that there were no significant differences in findings between daily and weekly data. Indeed, both daily and weekly data implied the same findings with the same method. This observation appears to be inconsistent with the findings of Abrosimova and Linowski (2002) who argued that the choice of data frequency is determinant for the results. The only result that was quite consistent with this finding was obtained on the ARIMA model. Indeed, the model showed that daily data tend to be more consistent with EMH that weekly data. Finally, the last objective of the study was to explore whether the results using to assess the validity of EMH are dependent on the choice of methods employed and the proxies for the 19 Proceedings of 5th Annual American Business Research Conference 6 - 7 June, 2013, Sheraton LaGuardia East Hotel, NY, USA, ISBN: 978-1-922069-24-5 stock market. The fact that three indices were testes allows the comparison of results. It appears that the choice of methods had an impact on the testing results. The EMH was generally supported by the unit root test and the ARIMA model whereas the autocorrelation and normality test rejected it. However, the results did not show significant differences between all three indices. The only exception was the ARIMA model that shows that autocorrelation in residuals was inexistent in CAC 40 weekly index whereas it was present in SBF 120 and particularly SBF 250 weekly index. According to this, there are few evidences in favor of a higher EMH validity in more developed market. The findings obtained stress that further investigations in the study is necessary since some tests support the validity of EMH in the French Stock market while others reject it. According to this, the first recommendation to make would be to analyse every individual stock traded in the market rather than aggregate indices. Indeed, in real life investors do not always invest in market portfolios but also in selected stocks. Therefore, it would be better to test the validity of EMH for individual stocks. Secondly, another recommendation to give on this study would be to test the semi-strong and strong forms of EMH in the French stock market. The first one could be tested using event studies as suggested Bodie and al.(2009). However, the strong form is difficult to test since access to private or internal information is almost impossible. In addition to this, others investigations could also implement “Runs tests” to assess the validity of EHM. Indeed, these additional tools give the advantage to test the speed of the market to react to new information. As a summary of the study findings, the research stresses that is hard to beat the market since EMH imply that stock prices follow a random walk with a positive drift. In other words, it is not possible to predict future stock prices based on past information. However, EMH accepts that anomalies are possible. According to this, we can distinguish 2 types of anomalies in the market: one that is consistent and the other one inconsistent. This argument is widely accepted by EMH critics. Indeed, critics are continuously looking for anomalies in the market in order to develop a trading strategy that can beat the market. However, if a trading strategy is found to be effective, people would start replicate this strategy until it become ineffective. EMH does not reject that looking for a trading strategy to beat the market is useless. Nonetheless, EMH argues that is time and resources consuming to look for small anomalies that will disappear very quickly. EMH supports that market is efficient most of the time but ignores behavioural finance. Indeed, investors are people with emotions and therefore do not always act rationally which leads to anomalies and exceptional events as bubble. The EMH considers that an overpriced asset will be sold in the market whereas an underpriced asset will be bought by investors. These stock movements will bring the prices of both assets to its equilibrium. However, arbitrages are possible in the market during the time required to be back to the equilibrium. Bubble started because of overconfidence of the market. 20 Proceedings of 5th Annual American Business Research Conference 6 - 7 June, 2013, Sheraton LaGuardia East Hotel, NY, USA, ISBN: 978-1-922069-24-5 According to EMH, since prices are following a normal distribution, crisis should never happen or rarely as once every thousand years. However, two crises have burst only the last 10 years: the internet bubble in 2000, the Sub-primes crisis in 2008. Such evidences tend to reject the normality of stock prices distribution in the market such as shown by normality tests. These crises should not have happened twice within the last ten years but it did which give doubts on the validity of EMH. Nonetheless, these events are yet considered as exceptional and therefore, the French stock market tends globally to validate EMH. As a conclusion, the study shows that EMH is valid within the French Stock Market, even though it is not perfectly efficient. 21 Proceedings of 5th Annual American Business Research Conference 6 - 7 June, 2013, Sheraton LaGuardia East Hotel, NY, USA, ISBN: 978-1-922069-24-5 References Abrosimova, N. and Linowski, D. (2002), „Testing weak-form of the Russian stock market‟, Paper presented in the EFA Berlin Meetings, 20 February. Al-Loughani, N. and Chappell, D. (1997), “On the validity of the weak form efficient market hypothesis applied to the London stock exchange”, Applied Financial Economics, 7, pp. 173-6. Babaker, M. (2004), “Some empirical investigations about the efficiency of Arab stock markets”, paper presented at the Gulf Stock Exchange Role on the Support and Activation of the Economic Development Potentials in the GCC Countries Conference, Muscat, Oman, 2-3 October. Bajo, E. and Petracci, B. (2006), „Do what insiders do: Abnormal performances after the release of insiders' relevant transactions‟, Studies in Economics and Finance, 23, 2, pp. 94 – 118. Brealey, R. and Myers, S. (2003), Principals of Corporate Finance, New York: McGraw Hill. Bodie, Z., Kane, A. and Marcus, A. (2009) Investments, New York: McGraw Hill Professional. Fama, E. F. (1965), „The Behaviour of Stock Market Prices,‟ Journal of Business, 38, pp. 34-105. Fama, E.F. (1991), “Efficient capital markets II”, Journal of Finance, pp. 1575-617. Granger, C. and Morgenstern, O. (2007), „Spectral Analysis Of New York Stock Market Prices‟, Kyklos, 16, 1, pp. 1–27. Griffith, H. (2010) London South Bank University, Lecture notes and hand-outs Groenewold, N. (1997), “Share market efficiency: tests using daily data for Australia and New Zealand”, Applied Financial Economics, 7, pp. 645-57. Haugen, R. and Lakonishok, J. (1988), The Incredible January Effect, Homewood: Dow JonesIrwin. Huber, P. (1997), “Stock market returns in thin markets: evidence from the Vienna Stock Exchange”, Applied Financial Economies, 7, pp. 493-8. Kahneman, D. and Tversky, A. (1973), „On the Psychology of Prediction‟, Psychological Review, 80, pp. 237-251. Keim, D. (1983), „Size-Related Anomalies and Stock Return Seasonality: Further Empirical Evidence‟, Journal of Financial Economics, 12, pp. 13-32. Kirman, A. (2009), „Economic Theory and the Crisis‟, Voxeu, 14,11. Kvedaras, V. and Basdevant, O. (2004), „Testing the efficiency of emerging capital markets: the case of the Baltic States‟, Journal of Probability and Statistical Science, 2, 1, pp. 111-38. 22 Proceedings of 5th Annual American Business Research Conference 6 - 7 June, 2013, Sheraton LaGuardia East Hotel, NY, USA, ISBN: 978-1-922069-24-5 Lo, A.W. and MacKinlay, A.C. (1988) “Stock market prices do not follow random walks: evidence from a simple specification test”, The Review of Financial Studies, 1, 1, pp. 41-66. Lo, A., Mamaysky, H. and Wang, J. (2000), „Foundations of Technical Analysis: Computational Algorithms, Statistical Inference, and Empirical Implementation‟, Journal of Finance, 55, pp. 17051765. Malkiel, B. (1995), “Return from investing in equity mutual funds 1991 to 1991”, Journal of Finance, 50, 2, pp. 549-72. Osborne, M. (1959), „Brownian motion in the stock market‟, Operation Research, 7, pp. 145-73. Saad, E., Prokhorov, D. and Wunsch, D. (1998), „Comparative Study of Stock Trend Prediction Using Time Delay, Recurrent and Probabilistic Neural Networks‟, IEEE Transactions on Neural Networks, 9, 6, pp. 1456–1470. Seiler, M.J. and Rom, W. (1997), “A historical analysis of market efficiency: do historical returns follow a random walk?”, Journal of Financial and Strategic Decisions, 10, 2,pp. 49-57. Seppi, D. (1992), “Block trading and information revelation around quarterly earnings announcements”, Review of Financial Studies, 5, pp. 281-306. Shiller, R. (2000), Irrational Exuberance, Princeton: Princeton University Press. 23