Chap011 - revised

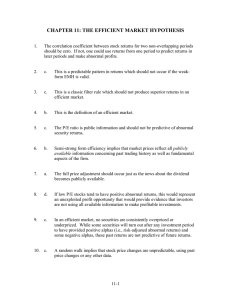

advertisement

The Efficient Market Hypothesis CHAPTER 11 Efficient Market Hypothesis (EMH) • Do security prices reflect information ? • Why look at market efficiency? – Implications for business and corporate finance – Implications for investment Figure 11.1 Cumulative Abnormal Returns Before Takeover Attempts: Target Companies Figure 11.2 Stock Price Reaction to CNBC Reports EMH and Competition • Stock prices fully and accurately reflect publicly available information • Once information becomes available, market participants analyze it • Competition assures prices reflect information The market price is more informative (accurate) than individual value estimates V = the true fundamental value, P = the market price, vi = value estimate of trader i; vi = V + ei, where E(ei) = 0, Di = trader i’s desired position in the security; Di = a(vi – P), where a is a constant. From ∑ Di = ∑ a(vi – P) = 0 (i.e., zero net supply), we have ∑ a(vi – P) = 0 → a∑(vi – P) = 0 → ∑(vi – P) = 0 → ∑vi – ∑P = 0 → ∑vi = ∑P = N * P → P = (1/N) ∑vi P = (1/N) ∑vi = (1/N) ∑(V + ei) = V + eM, where eM = (1/N) ∑ei ≈ 0. Versions of the EMH • Weak • Semi-strong • Strong Types of Stock Analysis • Technical Analysis - using prices and volume information to predict future prices – Weak form efficiency & technical analysis • Fundamental Analysis - using economic and accounting information to predict stock prices – Semi strong form efficiency & fundamental analysis Active or Passive Management • Active Management – Security analysis – Timing • Passive Management – Buy and Hold – Index Funds Market Efficiency & Portfolio Management Even if the market is efficient a role exists for portfolio management: • Appropriate risk level • Tax considerations • Other considerations Event Studies • Empirical financial research that enables an observer to assess the impact of a particular event on a firm’s stock price • Abnormal return due to the event is estimated as the difference between the stock’s actual return and a proxy for the stock’s return in the absence of the event How Tests Are Structured • Returns are adjusted to determine if they are abnormal Market Model approach a. rt = at + brmt + et (Expected Return) b. Excess Return = (Actual - Expected) et = rt - (a + brMt) Are Markets Efficient • Magnitude Issue • Selection Bias Issue • Lucky Event Issue Weak-Form Tests • Returns over the Short Horizon – Momentum • Returns over Long Horizons Predictors of Broad Market Returns • Fama and French – Aggregate returns are higher with higher dividend ratios • Campbell and Shiller – Earnings yield can predict market returns • Keim and Stambaugh – Bond spreads can predict market returns Semistrong Tests: Anomalies • • • • • P/E Effect Small Firm Effect (January Effect) Neglected Firm Effect and Liquidity Effects Book-to-Market Ratios Post-Earnings Announcement Price Drift Figure 11.3 Average Annual Return for 10 SizeBased Portfolios, 1926 – 2006 Figure 11.4 Average Return as a Function of BookTo-Market Ratio, 1926–2006 Figure 11.5 Cumulative Abnormal Returns in Response to Earnings Announcements Strong-Form Tests: Inside Information • The ability of insiders to trade profitability in their own stock has been documented in studies by Jaffe, Seyhun, Givoly, and Palmon • SEC requires all insiders to register their trading activity Interpreting the Evidence • Risk Premiums or market inefficiencies— disagreement here – Fama and French argue that these effects can be explained as manifestations of risk stocks with higher betas – Lakonishok, Shleifer, and Vishney argue that these effects are evidence of inefficient markets Interpreting the Evidence Continued • Anomalies or Data Mining • The noisy market hypothesis • Fundamental indexing Stock Market Analysts • Do Analysts Add Value – Mixed evidence – Ambiguity in results Mutual Fund Performance • Some evidence of persistent positive and negative performance • Potential measurement error for benchmark returns – Style changes – May be risk premiums • Hot hands phenomenon Figure 11.7 Estimates of Individual Mutual Fund Alphas, 1972 - 1991 Table 11.1 Performance of Mutual Funds Based on Three-Index Model Figure 11.8 Persistence of Mutual Fund Performance Table 11.2 Two-Way Table of Managers Classified by Risk-Adjusted Returns over Successive Intervals