Proceedings of 23rd International Business Research Conference

advertisement

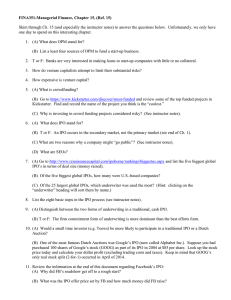

Proceedings of 23rd International Business Research Conference 18 - 20 November, 2013, Marriott Hotel, Melbourne, Australia, ISBN: 978-1-922069-36-8 Exit via IPOs: An Insight into the Listing Requirements of the Emerging Growth Enterprise Market of China Hai Long As listing requirements are different across listing markets, the emerging Growth Enterprise Market of China launched in 2009, has strict entry requirements for financial factors. This study aims to examine the impact of these determinants on the IPO probability in the listing market. Adopting a sample of the initial 243 IPOs in the market over 2009 to 2011 period, this paper develops a regression model to investigate the relationships between these factors and find that the net profit and its growth rate determine the IPO volume substantially. In addition, this study adopts a probit model to test the affection of the four factors on IPO likelihood. The findings are: 1) the fundraising amount as one of the most significant IPO determinants is positively associated to IPO probability on the market; 2) the net profit as a fundamental IPO determinant is positively associated to IPO probability as well, which confirmes the fact that the GEMC is a profit-preferred listing venue; 3) the net assets determine IPO probability but not IPO volume of the issuers. JEL Codes: G15, G24 * Mr. Hai Long, PhD Candidate, School of Business, Edith Cowan University, Australia, Email: soholonghai@163.com, Ph:0410317703.