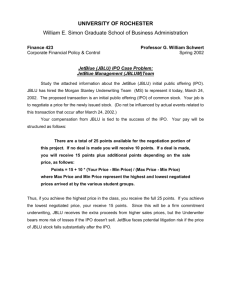

IPO Summary Statistics

advertisement

“The New Game Plan For An IPO” Brett White Cooley Godward May 19, 2001 Why Go Public 1. Growth Capital at Best Available Valuation 2. Currency for Future Acquisitions 3. Liquidity for Management and Other Shareholders 4. Validation of the Company Why Not Go Public 1. Lose Ability to be Quick, Silent and Nimble 2. Big Drain on Management Time 3. Open Kimono to Competitors 4. Employee Recruitment and Retention More Difficult Why Not Go Public (continued) 5. High Administrative Cost 6. Attracts Lawsuits of all Sorts 7. Can Cause Complacency; Lack of Focus Can You Go Public? It’s a tough market out there Maturity of the company Revenue and profitability expectations IPO Pricings By Quarter 144 144 133 140 136 133 120 # of IPO Pricings 102 100 80 68 56 60 40 24 20 0 1Q 2Q 3Q 1999 4Q 1Q 2Q 3Q 2000 4Q 1Q 2001 IPO Pricing By Industry 2000 Telecommunications (87) Other (non-technology) (122) Computer Software & Services Energy (12) (78) Computer Hardware (21) Electronics (41) Biotechnology (50) IPO Pricing By Industry 1Q 2001 Energy (6) Other (non-technology) (8) Drugs (3) Computer Hardware (1) Electronics & Miscellaneous Technology (1) Computer Software & Services (2) Pre-IPO Planning 1. Legal Due Diligence Review 2. Review Capitalization Issues a. Stock split (want to get into the “range”) b. Authorized Capital c. Automatic conversion of preferred stock d. Rule 701 compliance Pre-IPO Planning (continued) 3. Board of Directors Makeup a. Nasdaq listing requires three independent members for audit committee b. Underwriters may require other changes c. Audit and Compensation Committees 4. Accounting Issues a. Revenue recognition (SAB 101) b. Cheap stock review c. Option Repricings Pre-IPO Planning (continued) 5. Delaware Reincorporation 6. Employee Stock Matters 7. Anything Else that Requires Stockholder Approval 8. Publicity Choosing An Underwriter 1. How interested are they? 2. Transaction experience 3. Industry capability 4. Distribution knowledge 5. After deal research and support 6. Preliminary valuations The IPO Process 1. Once you have chosen an Underwriter, you are now “in registration” and in the “quiet period” 2. Initial Organization Meeting a. Review the schedule b. Discuss offering terms c. Review legal issues d. Accounting issues e. Publicity issues; industry conferences f. Directed shares The IPO Process (continued) 3. Company Diligence Sessions and Drafting a. Management must be involved heavily b. During this time, Underwriters conduct their customer and legal due diligence The IPO Process (continued) 4. File Registration Statement a. Generally 4-6 weeks after Org. Meeting b. You are now in the “waiting period” 5. Address Other Items a. Nasdaq Listing b. Stockholder Approvals The IPO Process (continued) 6. Obtain SEC comments (30 days after filing) and respond (usually one week or so) 7. Road Show (2-2½ weeks; respond to further SEC Comments) 8. Pricing the deal and going “effective” SEC Hot Issues 1. Cheap Stock 2. Gun-Jumping 3. Revenue Recognition 4. Directed Shares 5. Stock Option Repricings What Happens After IPO? 1. Ongoing Reporting 2. Dancing with Wolves - Analysts