Proceedings of 7th Annual American Business Research Conference

advertisement

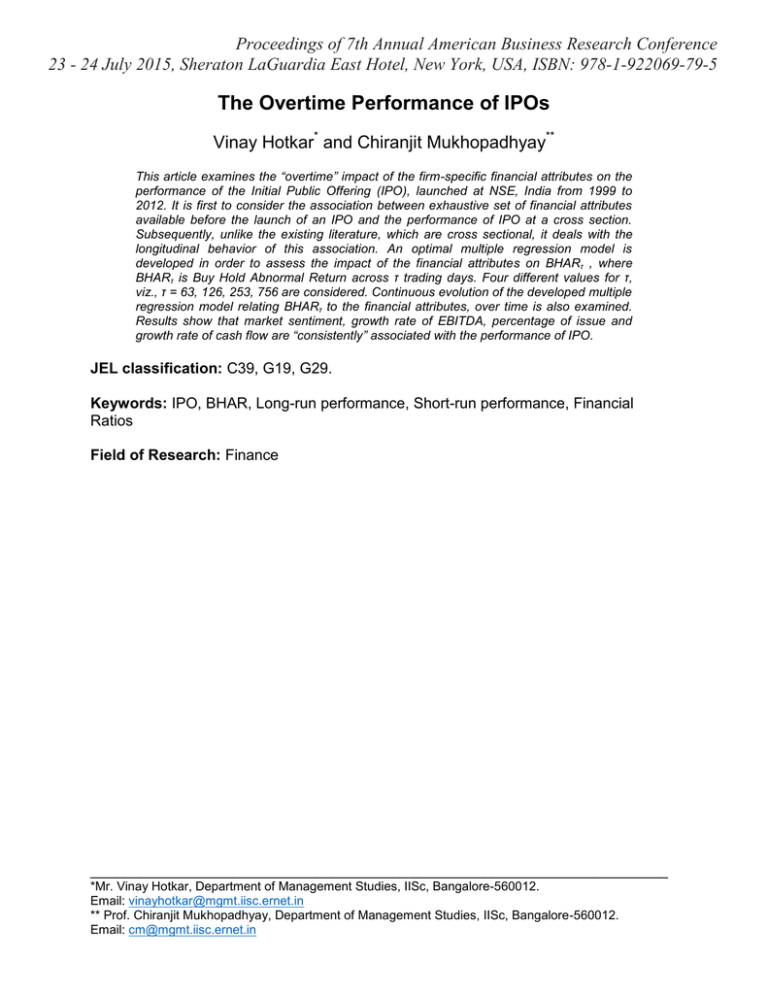

Proceedings of 7th Annual American Business Research Conference 23 - 24 July 2015, Sheraton LaGuardia East Hotel, New York, USA, ISBN: 978-1-922069-79-5 The Overtime Performance of IPOs Vinay Hotkar* and Chiranjit Mukhopadhyay** This article examines the “overtime” impact of the firm-specific financial attributes on the performance of the Initial Public Offering (IPO), launched at NSE, India from 1999 to 2012. It is first to consider the association between exhaustive set of financial attributes available before the launch of an IPO and the performance of IPO at a cross section. Subsequently, unlike the existing literature, which are cross sectional, it deals with the longitudinal behavior of this association. An optimal multiple regression model is developed in order to assess the impact of the financial attributes on BHARτ , where BHARτ is Buy Hold Abnormal Return across τ trading days. Four different values for τ, viz., τ = 63, 126, 253, 756 are considered. Continuous evolution of the developed multiple regression model relating BHARτ to the financial attributes, over time is also examined. Results show that market sentiment, growth rate of EBITDA, percentage of issue and growth rate of cash flow are “consistently” associated with the performance of IPO. JEL classification: C39, G19, G29. Keywords: IPO, BHAR, Long-run performance, Short-run performance, Financial Ratios Field of Research: Finance _____________________________________________________________________ *Mr. Vinay Hotkar, Department of Management Studies, IISc, Bangalore-560012. Email: vinayhotkar@mgmt.iisc.ernet.in ** Prof. Chiranjit Mukhopadhyay, Department of Management Studies, IISc, Bangalore-560012. Email: cm@mgmt.iisc.ernet.in